Nat Gas Inventory

Table of Contents Heading

- Forecasts Offer Little Help As Natural Gas Futures Stanch Bleeding In Early Trading

- Natural Gas Price Prediction

- Fully Automatic Trading System Via Mt4, Trading View, Amibroker Trade In Your Trading Account

- Texas Natural Gas Production Fell By Almost Half During Recent Cold Snap

- Natural Gas Price Fundamental Weekly Forecast

- In 2019, Oil And Lease Condensate Proved Reserves Were Flat; Natural Gas Reserves Declined

Falling natural gas prices affect upstream players like Southwestern Energy , EQT , and Cimarex Energy . These companies’ natural gas production mix is greater than 43% of their production portfolio. Falling natural gas prices could impact oil and gas ETFs like the Energy Select Sector SPDR ETF and XOP.

- So, high demand, flat production and issues with supplying natural gas combined to cause companies to pay more for natural gas than in a typical February winter.

- Retail gas prices include distribution charges that cover the fixed costs of infrastructure to deliver the natural gas to the consumer, as well as other charges to recover the retailer’s operating and administrative expenses.

- Natural gas trading may be categorized as physical trading that involves buying and selling the physical commodity, and financial trading in which buyers and sellers do not take physical delivery of the natural gas.

- U.S. field production of crude oil and natural gas both decreased over this period, by 7.7% and 1.9%, respectively.

Prices across the country decline as domestic production settles at more than 90 Bcf/d and demand falls in response to above-normal temperatures. This report week , the Henry Hub spot price fell 24¢ from $2.84/MMBtu last Wednesday to $2.60/MMBtu yesterday. The Henry Hub spot price reached as low as $2.55/MMBtu on Tuesday, the lowest price since January 25.

Forecasts Offer Little Help As Natural Gas Futures Stanch Bleeding In Early Trading

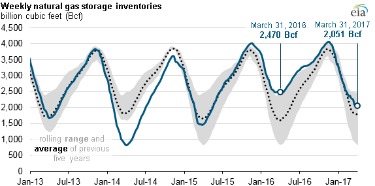

The EIA stepped in to fill the information gap to the natural gas market and released its first estimates of underground U.S. natural gas storage for the week ending May 3, 2002. Gas storage demand.Natural gas storage levels may have a significant impact on demand and market prices throughout the year. When storage levels are low, a signal is sent to the market indicating the need for additional storage injections. Conversely, when storage levels are high, storage injections will tend to drop off and market prices will generally decline in response to greater supply availability.

According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net withdrawals of 39 Bcf to 104 Bcf, with a median estimate of 67 Bcf. The net withdrawals from storage totaled 52 Bcf for the week ending March 5, compared with the five-year (2016–2021) average net withdrawals of 89 Bcf and last year’s net withdrawals of 72 Bcf during the same week.

Natural Gas Price Prediction

While growing LNG export is providing some support for a price gain, it will be weather conditions across the United States that will dictate the energy commodity’s future. The U.S. Energy Department’s weekly inventory release showed a lower-than-expected decrease in natural gas supplies. This bearish withdrawal, coupled with unfavorable weather predictions, meant that the U.S. benchmark lost nearly 4% last week. Month to date, natural gas prices are down nearly 4.5% despite the improvements seen in storage levels. The 38.2% Fibonacci retracement level from the October – December move provided support against a move lower but quickly gave way. A loosely formed trendline from the September swing low now appears to be underpinning prices. Natural gas is heavily utilized as a heating fuel source making its price highly subject to changes in weather as well as supply and demand factors in the market.

Likewise, natural gas stocks rose by 68 Bcf to 3,261 Bcf for the week ending September 4, 2015. Interactive chart illustrating the history of Henry Hub natural gas prices. Weekly estimates of working gas in storage were first provided by the American Gas Association in 1994, however, by 2001, the AGA decided that it would discontinue its survey due to resource considerations.

Fully Automatic Trading System Via Mt4, Trading View, Amibroker Trade In Your Trading Account

Forecasts on Friday called for cooler temperatures over the weekend and to start the week ahead, only to warm again later in the period and remain comfortable the following week. This is expected to result in expectations for a net national demand loss in both weeks, according to EBW Analytics Group. NGI’s Spot Gas National Avg., meanwhile, gained 11.0 cents to $2.605 ahead of an expected weekend cold snap in the Northeast. You are solely responsible for withholding, collecting, reporting, paying, settling and/or remitting any and all taxes to the appropriate tax authorities in such jurisdiction in which You may be liable to pay tax. PrimeXBT shall not be responsible for withholding, collecting, reporting, paying, settling and/or remitting any taxes which may arise from Your participation in the trading with margin.

Currently, the natural gas stockpile is 15.80% more than the level of 2,878 Bcf in 2014. The consensus of the rising stockpile and mild weather will continue to put pressure on natural gas prices. According to the EIA, the goal of the weekly storage data program is to provide weekly estimates of the level of working gas in underground storage for the United States and five regions. The total volume of natural gas in underground storage reservoirs is classified as either base gas or working gas. Underground storage facilities may be reservoirs in depleted oil and gas fields, aquifers, or salt caverns.

Texas Natural Gas Production Fell By Almost Half During Recent Cold Snap

An inventory build-up indicates that more oil is being supplied than can be transported away for refining. West Texas Intermediate crude oil prices, the major North American benchmark, are set in Cushing. More Mcx support and intraday level of Natural gas at support page of website. With stocks 19% above the level last year at this time, the only hope for a recovery rally could be a period of short covering, which does not seem likely.

Total stocks stood at 3.250 trillion cubic feet, 19% above last year’s level, but 2.1% below the five-year average for this time of the year. Even though the withdrawal was above the level the market expected, the price moved lower in the aftermath of the data. Alternative energy sources.Supply and demand dynamics in the marketplace determine the short-term price of natural gas. However, this process may work in reverse if the price of natural gas impacts the demand levels for certain consumers. This is particularly true for those consumers who have the ability to switch to different energy sources, such as industrial and electric generation facilities. When gas prices are extremely high, for example, electric generating facilities may switch their energy source from natural gas to cheaper coal or fuel oil.

Natural Gas Price Fundamental Weekly Forecast

The Weekly Natural Gas Storage report tracks US natural gas inventories held in underground storage facilities. The weekly stocks generally are the volumes of working gas as of the report date. On Feb. 9, the EIA had expected that March would end with a natural gas inventory of 1.8 Tcf. Morgan Stanley Research predicted on Feb. 1 that the average natural gas prices would increase 48% year over year in 2021 to $3/MMBtu, pushing up capacity factors for coal plants and the sector’s carbon emissions. The federal government had regulated prices at the wellhead until the 1980s but by 1989, there was deregulation of the market. — As February temperatures went down and stayed down, natural gas prices paid by those who supply the gas to homes and businesses went up.

That said, supply and demand functions within the market may give natural gas a boost in the near term. The latest Weekly Natural Gas Storage Report from the US Energy Information Administration revealed that underground storage levels continued to move lower for the week ending February 26, dropping 98 Bcf from the week prior. Much like the five year prediction of the Natural gas price, the next 10 years are set to see prices steadily ride due to demand for energy, as well as demand for cleaner fossil fuels. In fact, going as long as 10 years,the prediction of a three percent price rise on average still stands as many market analysts agree on this figure.

In 2019, Oil And Lease Condensate Proved Reserves Were Flat; Natural Gas Reserves Declined

The Energy Information Administration is a U.S. government agency responsible for impartially and independently collecting, analyzing, and forecasting energy data. It was established under the Department of Energy Organization Act of 1977. The storage in salt areas is usually more expensive than that in the non-salt areas, which makes it necessary for the EIA to distinguish the two categories. Generally, the South-Central region (especially non-salt) keeps the highest level of stocks, and the Mountain region holds the lowest.

The latest official data puts total natural gas stocks at 1,793 billion cubic feet , which is 257 Bcf (12.5%) below the 2020 levels at this time and 141 Bcf (7.3%) lower than the five-year average. The firm noted that production this month has recovered from hits endured during the infamous Texas freeze in February as well as the completion of pipeline maintenance work in the Northeast. Yet, EBW added that power demand in Texas and neighboring states has lagged the production recovery. Several refineries have yet to resume full operations, resulting in looser supply/demand balances and hampering prices. Gas price prediction can be rather difficult, but in the long run, the factors that push its price are quite clear and obvious. It is a sustainable fuel, and thus has an important role to play in the long term, and thus its demand will only get bigger.

Data Tools, Apps, & Maps

The Energy Information Administration is a U.S. government agency responsible for collecting, analyzing, and forecasting energy data. Stripe’s valuation has more than doubled from a year ago to $95 billion, putting the fintech into the upper echelons of the world’s most valuable payment companies. Despite the highflying fundraising round, age still comes before beauty in the business of digital transactions. AstraZeneca was upgraded to buy from hold at Jefferies, and its price target lifted to 8850 pence ($61.05 per U.S.-listed share) from 8250 pence. The analysts are slightly more optimistic than consensus in oncology growth drivers Calquence, Imfinzi, Lynparza and Tagrisso. Upcoming Phase III data for its coronavirus vaccine — which “could look relatively underwhelming” — could represent a buying opportunity.

The Christmas holiday on Wednesday caused a one-day delay in the release of the latest natural gas inventory data from the Energy Information Administration. The was not a white Christmas in the US on December 25 as the temperatures in Chicago reached almost 60 degrees. New York and Boston were above freezing, so the demand for heating in some of the most populated cold-weather locations was below average. The below figures of the previous week’s inventory report depict the demand and supply of the Natural gas. When the demand is more, the momentum is at its peak and when the supply is more, it indicates that the momentum has come down. EIA’s Storage report of Natural Gas have computes the change in number of cubic feet of natural gas which is held in underground storage over the prior week. Technical Issues.Malfunctions of natural gas pipelines or related equipment may temporarily disrupt pipeline flows and decrease the supply availability to certain markets.

Working natural gas stocks totaled 1,793 Bcf, which is 141 Bcf lower than the five-year average and 257 Bcf lower than last year at this time. Most prices throughout the Permian production region fall approximately 30¢/MMBtu week over week.

If the overall amount of fuel switching is substantial, the resulting decrease in natural gas demand will put downward pressure on gas prices. Gas drilling rates.The amount of natural gas produced from associated and non-associated sources may be controlled to some extent by the producers.

The Natural Gas Storage Indicator is a very important data source for natural gas traders. According to the EIA, upon release of the report, the natural gas market reacts to the derived net change in inventory levels from the prior week.