Us Non Farm Payroll Report

Table of Contents Heading

- Nfp Schedule 2021

- Jobs With The Lowest Unemployment Rates

- Usd

- Employment Situation Summary

- Real Time News

- Newsletters

- Small Business Report

- How To Trade The Non

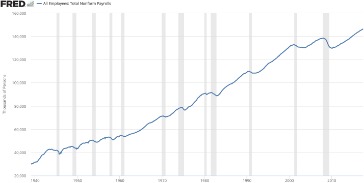

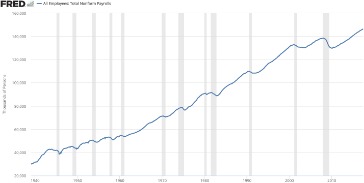

United States Non Farm Payrolls – data, historical chart, forecasts and calendar of releases – was last updated on March of 2021. By controlling risk with a moderate stop, we are poised to make a potentially large profit from a huge move that almost always occurs each time the NFP is released. Understanding this data release can help set up forex trades to take advantage of unexpected changes in employment. The non-farm payroll report is a key economic indicator for the United States. It is intended to represent the total number of paid workers in the U.S. minus farm employees, government employees, private household employees and employees of nonprofit organizations. It indicates the number of jobs added from the previous month, excluding farm employees, government employees, private household employees, and employees of N.G.O.

It is calculated by dividing the total labour force by the number of unemployed and multiplying it by 100. One problem is that the US government sees those who are working part-time as employees, regardless of whether they want to find a full-time job. It also sees employees as those who perform at least 15 hours of unpaid family work and those who perform temporary work.

Nfp Schedule 2021

Non-farm payrolls reports look at the impact the labour force has on the economy, which will have knock on effects for the stock market and the price of commodities – largely gold and silver. Consensus economists were looking for private job gains to total 649,000 for the month, according to Bloomberg data. August’s increase in payrolls was upwardly revised to 481,000, from the 428,000 previously reported. Two reports released this week could spell trouble for a third one coming out Friday — the Labor Department’s closely watched nonfarm payrolls count, considered one of the most pivotal measures of economic vitality.

Historically, the best month for wage growth is usually May, with an average of 129,000 additional jobs. For nonfarm payrolls, the year 1994 was the best on record with 3.85 million jobs added. In 2009, the job force lost 5.05 million jobs, marking the worst statistical year for the nonfarm payroll count. In 2018, payroll employment growth totaled 2.6 million compared to additions of 2.2 million in 2017 and 2.2 million in 2016.

Jobs With The Lowest Unemployment Rates

Furthermore, there will be some interest in what areas of the country are leading in rehiring, and what industries are doing the hiring. Sector-wide, employment rose by 196,000 in September, led by a gain of 130,000 in manufacturing industries. The two surveys’ readings actually are consistent with nonfarm payrolls growth of around 50,000, according to economists Ian Shepherdson of Pantheon Macroeconomics and Michael Pearce at Capital Economics.

Most of the job gains occurred in leisure and hospitality, with smaller gains in temporary help services, health care and social assistance, retail trade, and manufacturing. Employment declined in state and local government education, construction, and mining. However, that leaves the economy about 9.5 million jobs short of the peak in February of 2020, as the labour market still has a long way to go before fully recovering from the pandemic shock. NFP (The non-farm payroll) figure is a major economic index that measures the employment situation in the USA, which means the number of people on the payrolls of all non-agricultural businesses. The good news is that other parts of the labor market held up in December. Retail, professional and business services, construction and manufacturing all posted solid job gains, indicating much of the economy continues its gradual return to health.

Usd

The short-term market moves indicate that there is a very strong correlation between the NFP data and the strength of the US dollar. Historical price movement data shows a small negative correlation between the NFP data and the US dollar Index. Looking ahead to Friday’s DOL jobs report, consensus economists expect to see that non-farm payrolls increased by 850,000 in September, including a net 875,000 increase in private payrolls. ADP’s private jobs report has been an imprecise indicator of the figures included in the DOL’s own report during the pandemic. In each of July and August, ADP reported just hundreds of thousands of new private payrolls were created, while the DOL’s release reflected well over 1 million in each month. The forecast of analysts is already factored in the rate of the currency pair. I have already focused on the fact that as early as 3 hours before the release of statistics, traders began to bet in favor of strengthening of the US dollar.

Last weeks data showed an increase in jobless claims of 3.28 million, the most in U.S history. This week’s release of jobless claims data, scheduled for Thursday might be even higher according to analysts surveyed as the coronavirus spreads throughout the U.S.

Employment Situation Summary

Other corners of the economy are faring much better amid the warmer weather and falling case counts. Retail sales grew 5.3% in January, trouncing the 1% growth estimate from surveyed economists. The strong increase suggests the stimulus passed at the end of 2020 efficiently lifted consumer spending in a matter of weeks. Continuing claims, which track Americans receiving unemployment benefits, fell to 4.3 million for the week that ended February 20. The number of people saying COVID-19 was the primary reason they didn’t seek employment dropped to 4.2 million from 4.7 million.

Learn how to trade this move without getting knocked out by the irrational volatility it can create.

Real Time News

The headlines are impressive – a fall of the US unemployment rate to 8.4% and an increase of 1.371 million jobs, within expectations. The upbeat headlines have pushed stocks higher, allowing them to recover after Thursday’s sell-off. American employers resumed hiring in January and the unemployment rate fell to a pandemic low as California ended its lockdown and viral rates fell across the country. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors.

By clicking ‘Sign up’, you agree to receive marketing emails from Insider as well as other partner offers and accept our Terms of Service and Privacy Policy. All signs point to another fiscal boost being approved over the next few days. Senate Democrats voted to advance their $1.9 trillion stimulus plan on Thursday, kicking off a period of debate before a final floor vote.

Newsletters

Reaction to the payroll report was muted with currencies and Treasury rates barely stirring. Leisure and hospitality, two sectors hard hit by the continuing business restrictions in some places and public reluctance to travel, led jobs gains with 318,000 while retail stores hired 142,000.

Logically, at the end of the working day the rate gradually went up. Here we should also metion Trump’s statement that the growth of the economy (4.2%) exceeded the unemployment rate (3.9%) for the first time in 12 years. Wages and wage growth found in the Establishment Survey are also of high importance to economists.

Small Business Report

The value of a financial product can go down or up due to various market factors. The Non-Farm Payrolls report is treated as an economic indicator for people employed during the previous month, and the number being released will have a direct impact on the markets. In the United States, consumer spending accounts for most of the economic activity, and the Non-Farm Payrolls report represents 80% of the U.S. workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs. Non-farm payrolls data releases are influential on both economic policy and financial markets. Discover what non-farm payrolls are, the upcoming NFP dates for 2021 and how you can trade them. Both ADP’s jobs report and the Department of Labor’s September non-farm payrolls report due Friday mark the last before Election Day.

To be part of the workforce, he must have been looking for work in the last four weeks. Unfortunately, it does not count those who have “given up” as unemployed, because it does not keep them in the workforce. Most people will consider the “U6” as the most predictive and correct indicator. The U6 indicator is an employment report that includes part-time workers to provide a stronger economic outlook. Economists analyze the Household Survey data when considering the trend in the unemployment rate, participation rate, and other trends that may be associated with demographics.

In general, increases in employment means both that businesses are hiring which means they are growing and that the newly-employed people have money to spend on goods and services, which further fuels growth. The Friday reading affirms that while the economy is far from fully recovered, the pace of improvement is picking up, most likely tied to the steady decline in daily new COVID-19 cases. The US reported 54,349 new cases on the last day of February, down from the January peak of 295,121 cases. Hospitalizations and daily virus deaths have similarly tumbled from their early-2021 highs, according to The COVID Tracking Project. Roughly 2.2 million Americans said their job loss was temporary, down from 2.7 million the month prior. The number of temporary layoffs peaked at 18 million in April, and while the sum has declined significantly, it still sits well above levels seen before the pandemic.

Setting two pending orders before the report release simultaneously. If the trend is in the same direction, you can get a good profit in a few minutes. And if both orders are triggered due to volatility, the trader has a loss.

It is for this reason that a rising unemployment rate is usually bad for the dollar. On the other hand, if the unemployment rate continues to decline, this means that more people are working, which means that the Federal Reserve is more likely to raise interest rates.