Treasury Auction Results

Table of Contents Heading

- Property Auctioned By The Internal Revenue Service (irs)

- Quarterly Refunding Archives

- Savings Bonds

- Financial Sanctions

- Announcements And Results By Auction Year

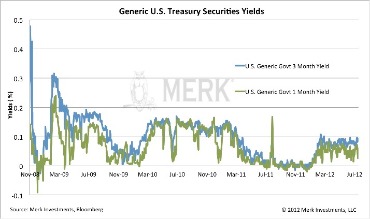

- What Does This Mean For Future Interest Rates?

- Department Of The Treasury

- Budget, Financial Reporting, Planning And Performance

- Bid To Cover

Noncompetitive results will be available approximately 15 minutes before the competitive auction close. You can access these results by selecting the year and then selecting the security.

After the auction results, the 10y future sold of quickly as the pricing was soft (tailed by 1.7bp), bid to cover was soft and bidder allocation data was mixed . The US Treasury provides a lot of information with the results of each auction but most of it is not needed for a quick analysis of the strength of the auction. Below is a screenshot of the official results for the 10y auction on 8th February 2017, highlighting the key elements we look for.

Property Auctioned By The Internal Revenue Service (irs)

Meanwhile, the 30-year bond yield TMUBMUSD30Y, 2.381%slipped 3.9 basis points to 2.265%. Since last month’s ill-fated Treasury sale, long-term government bond yields have looked to carve out a new range, but at a much higher plateau than at the end of 2020. The turbulence has sparked renewed debate about potential plumbing problems in the deep well of the U.S. government bond market, a linchpin of global finance. Yields, or the return on investments, are tied to certain interest rates. Yields go down when there is a lot of demand for Treasury products. If yields go up because of a lack of buying — in order to attract more buyers — interest rates for purchasing a home would also go up.

On issue day, the Treasury delivers securities to bidders who were successfully awarded securities. In exchange, Treasury charges the accounts of those bidders for payment of the securities. The final price, discount rate, and yield is released to the public within two hours of the auction. Yield fluctuations should be monitored closely as an indicator of the government debt situation. Investors compare the average rate at auction to the rate at previous auctions of the same security. Here we see the reaction to the 7y auction on 26th January 2017.

Quarterly Refunding Archives

Intraday Data provided by FACTSET and subject to terms of use. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. an analogous compliance monitoring programme to a designated investment business. If the auction average price is above the snap, that’s “overbidding”.

The cost of medical care services increased 0.5% and are up 3.0% year over year. I agree that higher U.S. inflation seems likely, but 2.27% over the next 10 years might be about right. At the best, this TIPS is fairly priced versus a nominal U.S. All submitted bids are consolidated in TAAPS where they are reviewed and processed to assure compliance under the Treasury’s Uniform Offering Circular .

Savings Bonds

Did buyers in the auction pay more or less than the prevailing market price? Ie The difference between the average price at which a bond sold at auction, and the market price of that bond just before the auction bidding deadline (the “snap price”). This is a statistic that we calculate for some government bond auctions where a government doesn’t sell all of the new bonds being issued and instead retains some of the bonds for themselves. The most high profile example of an issuer that does this regularly is Germany. This is explained fully in another article – Real Bid to Covers in Government Bond Auctions. Each quarter, Treasury debt managers meet with primary dealers that trade with the Federal Reserve Bank of New York in the U.S. government securities market. The weaker-than-expected core inflation numbers give the Federal Reserve a lot of leeway to continue easy money policies, but those policies were going to continue anyway, no matter what this report said.

However, there are cases where an issuer may be unable to attract bids for the full amount of bonds that they wanted to issue. In these cases, the bid to cover may be reported as a figure below 1.0 as the calculation may be modified to reflect the number of bonds the issuer intended to sell, rather than what they actually sold. The real bid to cover can also be below 1.0 – again, see our separate article.

Financial Sanctions

Notes mature in two to ten years and are currently offered in 2-, 3-, 5-, 7-, and 10-year maturities. Treasury notes (T-notes) make a coupon payment every six months. Cash management bills are occasionally offered in order to meet short-term financial needs. CMB maturities are set on an issue-by-issue basis and typically run from 1-day to approximately 1-year . Bids are submitted through Treasury Direct or through the Treasury Automated Auction Processing System .

Treasury releases a variety of documents and data relating to Treasury borrowing and debt management policy each quarter. For TIPS. February’s inflation report means that principal balances for all TIPS will increase 0.55% in April, following a 0.43% increase in March. This is welcome news for TIPS investors, but keep in mind that in this case, non-seasonal adjusted inflation was slightly outpacing adjusted inflation, and eventually those numbers will balance out over a year.

Announcements And Results By Auction Year

The highest accepted rate (3.000%) is known as the stop-out rate. When this occurs, each bidder at this rate is awarded a percentage of their total bid amount. The allocation percentage is calculated by dividing the remaining competitive offering by the total amount bid at the stop-out rate. Non-competitive bids are generally submitted by small investors and individuals.

- A much smaller volume of securities is purchased by individual investors who buy them directly from the Treasury Department through TreasuryDirect.

- The New York Fed provides a wide range of payment services for financial institutions and the U.S. government.

- The U.S. Government currently auctions several Treasury securities to finance the public debt including bills, notes, bonds, Treasury Inflation Protected Securities , and Floating Rate Notes .

- In general, an auction that traded through by a significant margin is seen as positive.

- To ensure that the secondary market for Treasury securities remains competitive, bidders are restricted to receiving no more than 35 percent of the total amount of securities available to the public.

- This program enhanced the liquidity of Treasury benchmark securities, which promoted overall market liquidity and helped reduce the government’s interest cost over time.

The Weekly Economic Index provides an informative signal of the state of the U.S. economy based on high-frequency data reported daily or weekly. The Center for Microeconomic Data offers wide-ranging data and analysis on the finances and economic expectations of U.S. households. Our model produces a “nowcast” of GDP growth, incorporating a wide range of macroeconomic data as it becomes available. Treasury marketable securities Noncompetitive Results, Competitive Results, and Announcements and Results by Auction Year. Marvin Loh, senior global market strategist at State Street, said yields could “certainly push higher if some of the market functioning issues crop up,” in an interview.

What Does This Mean For Future Interest Rates?

If the average price is below the snap, that’s “underbidding”. To access interest rate data in the legacy XML format and the corresponding XSD schema, click here. Our highest priority continues to be the health and well-being of everyone who attends our appointment-only inspections and auctions. As we navigate the evolving impact of coronavirus on our communities, please follow CDC and State Guidelines for the prevention of COVID-19 before attending any of our appointment-only inspections. Property seized/forfeited due to violations of federal laws enforced by the U.S. Department of Homeland Security, auctioned by the Treasury Executive Office for Asset Forfeiture . Try Treasury Hunt to search for matured bonds and held interest payments.

Between 1973 and 1976, the auction process gradually replaced all other means of issuing notes and bonds. Treasury department holds regular auctions to sell T-bills, notes and bonds—all known as treasurys. Direct Bidders – any non-primary dealer financial institution bidding directly on the auction for bonds that will be held on their own account. Requires access to TAAPS (application / terminal providing direct access to the auction). This can include pension funds, hedge funds, insurers, banks, governments and individuals.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Your ability to comment is currently suspended due to negative user reports. Sunny Oh is a MarketWatch fixed-income reporter based in New York.

Therefore, TAAPS works its way down the list of competitive bids and accepts the total amount submitted at the lowest possible bid yields until the full offering amount has been awarded. Once the auction is completed, TAAPS will process all the bids received and determine the auctions’ winning price. It does this first by subtracting the non-competitive bids from the public offering amount to determine the amount of securities available to the competitive bidders. For example, in an $11 billion auction, if $1 billion in non-competitive bids is received then $10 billion in securities will be awarded to competitive bidders. Currently, the Treasury auctions a variety of securities including bills, notes, bonds, TIPS, and FRNs. Treasuries with the New York Fed—are the largest group of buyers at auction.

All bidders receive the same rate at the highest accepted bid. The US Treasury includes a partial breakdown of who bought bonds in the auction, split into three categories. Traders look at this information to get a feel for whether real demand or dealer demand was the main driver in the auction. The official results page present the data in dollar amounts but for quick interpretation it’s easier to look at it as a percentage of the total – most newswires will do this for you.

These securities are bought by primary government securities dealers, investment funds, foreign accounts, individual investors, and other investor classifications. The New York Fed provides a wide range of payment services for financial institutions and the U.S. government. The New York Fed offers the Central Banking Seminar and several specialized courses for central bankers and financial supervisors. The New York Fed has been working with tri-party repo market participants to make changes to improve the resiliency of the market to financial stress. Specifically, the intense appetite for shorting bonds has made it difficult to source one of the more popular 10-year Treasury notes. As a result, the cost to borrow money for a short period, in return for lending out the benchmark debt security, turned negative last week, meaning investors have begun to pay interest to temporarily own the bonds.

Because the marginal buyer of the bond was only willing to pay a much lower price than the average. InTouch Fixed Income has a multi-year database covering all European, UK & US issuance which we leverage in analyzing auctions for our clients. Some issuers or maturities often see high overbidding in auction, whilst other bonds typically have softer pricing.