Weekly Oil Inventories

Table of Contents Heading

- Related Products

- Stocks (million Barrels)

- Teco 2030 To Set Up Giga Factory For Production Of Hydrogen

- Subscribe To Our Newsletter

- Weekly Fuels Watch Report

- Subscribe To The Fred Newsletter

- European Oil Storage: Turning The Tanks

- Futures Prices (dollars Per Gallon*)

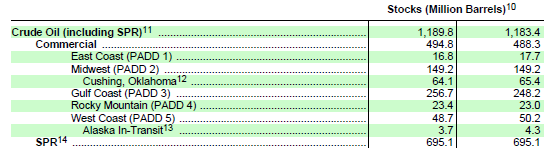

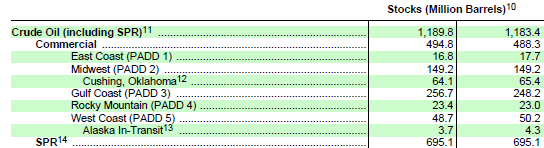

Increases in gasoline and distillate inventories added to bearish sentiment, as gauges of demand for both fuels declined in a bad sign for the near-term consumption outlook. Oil inventories provide insight into the balance of supply and demand in the oil market, and of course influence oil prices. The relationship between supply and demand is one of the fundamental concepts of economics, and it is no more clear than comparing how the ebb and flow of crude oil inventories affect the commodity market. U.S. commercial crude oil inventories, excluding the Strategic Petroleum Reserve, were at 492.4 million barrels, which was 13% above the five-year seasonal average . However, it marked the third consecutive week that total inventories were below 500 MMbbl, which had not happened since COVID-19 lockdown measures began to be implemented in late March/early April. The year-over-year difference of 69.8 MMbbl of inventory equates to three and half days’ worth of domestic demand. While these weekly releases provide essential data points for understanding current U.S. oil supplies, traders must also pay attention to international politics and policy.

In its March Short-Term Energy Outlook, the US EIA forecast Brent crude oil prices will average $61/bbl in 2021 and $58.5/bbl in 2022, compared to previous forecasts of $53/bbl and $55/bbl, respectively, in last month’s outlook. At 469.0 million bbl, US crude oil inventories are 2% above the 5-year average for this time of year, the EIA report indicated. US crude oil inventories for the week ended Feb. 5, excluding the Strategic Petroleum Reserve, decreased by 6.6 million bbl from the previous week, according to data from the US Energy Information Administration. API reported an increase of 4.174 million barrels of crude oil inventories for the previous week ending Nov. 13, while the U.S. Instead of reaching equilibrium, oil supply and demand change rapidly in unison with prices.

Over that same period in 2018, stocks declined by only 5.0 MMbbl with four weeks of inventory additions. In 2019, inventories decreased 15.6 MMbbl from the start of August to the third week of September, and also had four weekly builds.

Related Products

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. The Keystone XL pipeline is a proposed extension of the Keystone pipeline system that will transport oil from Canada to refineries in the United States. For other great articles about exploration, drilling, completions and production, subscribe to The American Oil & Gas Reporter.

The sustained OPEC+ production curtailment through April suggests that supply will remain constrained in the near term, even as demand continues to increase. As a result, EIA expects that further inventory withdrawals to meet rising crude oil demand will support crude oil prices through at least the end of April. In May, China’s crude oil imports jumped to the highest ever, at 11.34 million b/d.

Stocks (million Barrels)

Governments have introduced massive emergency fiscal plans to support workers and businesses. We are also seeing measures being taken to tackle the oil market crisis, with two major events taking place over the past week. Rystad Energy’s oil markets analyst, Louise Dickson, described the EIA’s latest stockpile data as an item of “relief”. Propane-propylene inventories decreased by 4.5 million bbl last week and are about 9% below the 5-year average for this time of year, EIA said.

On March 5 and 6, 2020, OPEC and Russia met in Vienna in an effort to iron out their differences. Despite ending on a hopeful note, the meeting did not produce results; Saudi Arabia and fellow OPEC members Iraq and the United Arab Emirates began reversing production cuts. On Sunday, oil producers in the OPEC+ group agreed to cut output by an initial 9.7 mb/d versus their agreed baseline, effective 1 May. Those present offered their support for the efforts of the OPEC+ countries to stabilise the oil market and, in some cases, discussed output cuts that would take place immediately or over time.

Since March 16, 2020, when COVID-19 concerns prompted the suspension of in-person data collection, BLS has transitioned to alternative methods for collecting all gasoline price data. After encountering problems during initial attempts at collection by telephone, economic assistants shifted to collecting data from websites, supplementing them with a third-party source. However, the outlets and specific prices in the sample remained unchanged; only the method of collection varied.

Teco 2030 To Set Up Giga Factory For Production Of Hydrogen

Food prices rose 10.6 percent last month, while non-food prices increased 0.4 percent, the same as in April. Of the non-food items, fuel costs dropped 22 percent in May compared with April’s 20.5 percent decrease. In December 2019, the average price for gasoline was $2.65, the highest December level since 2013. In addition to publishing the CPI for gasoline, BLS publishes average price data for gasoline. These data include average prices for gasoline , the three individual grades of gasoline, and diesel fuel. Producer prices for crude petroleum rose 35.9 percent in May 2020, before jumping 74.0 percent in June.

- That marks a sharp increase from the 15,000 forecasts earlier this year and raises the stakes for a sector already in turmoil before the coronavirus pandemic catapulted the country into recession.

- EIA’s most recentWorking and Net Available Shell Storage Capacity Reportwas released on May 29, 2020, with data as of March 31, 2020.

- In addition, the countries that had previously cut production beyond agreed amounts reversed those cuts.

One of the biggest intrigues of the upcoming EIA report is whether U.S. oil production has finally managed to grow from the 11 million barrels per day level. If EIA report confirms API data, it will signal that demand remains soft due to the negative impact of the second wave of the virus. The market is optimistic on Biden’s huge stimulus plan which includes $1,400 stimulus checks, but it remains to be seen whether the implementation of this plan will lead to a robust increase in domestic oil demand in the near term. “The poor gasoline demand figures compared to last year over the last couple of weeks have added further bearish sentiment into the market.

Subscribe To Our Newsletter

According to the China Hydrogen Alliance, a government-supported industry group that promotes the use of hydrogen, China built 38 new hydrogen refueling stations in 2019. This means that by the end of the year, China had a total of 66 hydrogen refueling facilities, 46 of which were operational. The government is targeting 300 hydrogen refueling stations across the country by 2025. Last week, China gave the go-ahead to plans for a massive $20-billion refinery and petrochemical complex in the Shandong province. The province of Shandong has had plans since 2018 to shut down 500,000 b/d of refining capacity by independent refiners.

Rocky Mountain/West Coast and Gulf Coast inventories decreased by 0.2 million barrels and 0.1 million barrels, respectively. Midwest and East Coast inventories increased by 0.2 million barrels and 0.1 million barrels, respectively. At the same time, high prices also encourage OPEC+ to relax production targets given current, very large amounts of spare crude oil production capacity, which is available to come online if OPEC+ member countries decide to increase production. To some degree, then, the more prices rise in the near term, the more future downward price pressures they bring. On Thursday, Wall Street fell on renewed fears of a pandemic resurgence and pessimistic economic forecasts from the US Federal Reserve.

Weekly Fuels Watch Report

Growing geopolitical tensions with Washington makes it tough for Chinese LNG importers to commit to more US LNG cargoes when US LNG is already facing challenges to bring LNG to Asia due to uneconomic arbitrage and oversupplied Asian markets. A period of punishing heat may envelop much of the US and potentially extend to parts of Canada and Alaska. The higher temperatures could swallow much of the contiguous US toward the end of June, arriving just in time for summer and potentially lingering for weeks. The above-average temperatures are part of a significant pattern change that would bring anomalous warmth to some parts of the nation that have seen a colder than average spring.

Looking at the natural gas market, EIA reported a storage build of 66 Bcf for the week ending Sept. 18, increasing total stocks to 3.68 trillion cubic feet. That was 504 Bcf (15.9%) higher than the same time in 2019, and 407 Bcf (12%) above the five-year historical average of 3.27 Tcf .

Subscribe To The Fred Newsletter

LNG exports averaged 7.9 Bcf/d in the first three months of 2020, before declining to 3.1 Bcf/d in July as the global market recalibrated after the COVID shutdown. EIA says crude oil imports were 5.1 MMbbl/d, down 45,000 bbl/d from the previous week.

After falling sharply during the early months of the pandemic, crude petroleum prices began advancing at the end of April 2020. Producer prices for crude petroleum partially recovered from April to June, and import prices recorded a similar recovery from April to July. The price upturn began with a supply decrease, with a positive shock to demand eventually contributing as well. Bureau of Labor Statistics measures crude oil prices and how these prices have changed over the course of the COVID-19 pandemic. Also, low prices impact the livelihood of millions of people employed along the oil industry’s extensive value chain, and they damage the economies of weaker producing countries where social stability is already fragile.

Inventories at Cushing, Oklahoma, the delivery point for WTI, fell by 1.7 million barrels. Gasoline and jet fuel consumption continues to fall while oil production continues flooding the market. As of June 19, U.S. net commercial crude oil inventories were at 62% of total available storage capacity. The majority of capacity and inventories are located in the Gulf Coast, a region which is also home to the majority of U.S. refining capacity and a key area for exporting crude oil.

Comprehensive data summaries, comparisons, analysis, and projections integrated across all energy sources. On the contrary, demand-side push keeps strengthening amid expectations of the economic recovery as covid vaccinations are on the hike. Also on the positive side are strong talks that the $1.9 COVID-19 stimulus from the US is about to hit the floor as soon as next month. API Weekly Crude Oil Stock dropped more than prior -3.5M during the week ended on February 12. WTI jumps to the highest in 13 months as upbeat API stockpiles join the demand-supply imbalance. Resilience is a program of Post Carbon Institute, a nonprofit organization dedicated to helping the world transition away from fossil fuels and build sustainable, resilient communities.

May’s fall was more significant than April’s 3.1 percent decline and slightly sharper than expected by economists. Oil production in Iraq’s semi-autonomous Kurdistan region has fallen 10 percent so far this year, as oil companies respond to shrinking cash flows by reducing capital expenditures and laying off staff. The contraction of Kurdistan’s oil sector follows two years of steady growth resulting from relatively high oil prices and a government commitment to make timely payments to companies. Now, however, the Kurdistan Regional Government has fallen behind on its invoices, and oil prices are so low that many fields can barely turn a profit. Global natural gas markets are facing the largest demand shock in recorded history. According to the International Energy Agency’s newGas 2020report, consumption of natural gas is expected to drop by twice the amount it did after the 2008 financial crisis. The pandemic and an exceptionally mild winter in the northern hemisphere are setting the stage for the historic demand shock.

In the Middle East, the Organization of Petroleum Exporting Countries , regularly meets to exercise control over production quotas and oil prices. Since OPEC controls 60% of the world’s oil, OPEC policy changes can heavily impact global oil supply and demand. The combination of falling demand, rising supply, and diminishing storage space caused such a pronounced crude petroleum price plunge that, on April 20, crude petroleum traded at a negative price in the intraday futures market. Producer prices for crude petroleum declined 34.0 percent in March and 48.8 percent in April. The March and April decreases were the two largest monthly declines since the index was first published in July 1991. The Import Price Index for crude petroleum declined 34.1 percent in March and 36.6 percent in April.

Futures Prices (dollars Per Gallon*)

In February, cases were reported throughout Europe and the United States, prompting the World Health Organization to declare a global emergency. On March 3, the United States followed suit by declaring a national emergency, a move that resulted in lockdowns across the country. The impact of containment measures in 187 countries and territories has been to bring mobility almost to a halt. Demand in April is estimated to be 29 mb/d lower than a year ago, down to a level last seen in 1995. The recovery in 2H20 will be gradual; in December demand will still be down 2.7 mb/d y-o-y.