Forex Shooting Star

Table of Contents Heading

- Best Forex Brokers For Ukraine

- Harami Pattern

- Points To Note On Shooting Star Candlestick Pattern & An Inverted Hammer

- How Do Traders Interpret A Dragonfly Doji Pattern?

- Example On How To Trade Shooting Star Candlestick In Forex

- Trading Psychology

- Trend Trading Tips By Victor Sperandeo

He has over 18 years of day trading experience in both the U.S. and Nikkei markets. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. When Al is not working on Tradingsim, he can be found spending time with family and friends. Put a stop loss right above the upper candlewick of the shooting star figure. There is a strong psychology factor behind the shooting star – exponentially growing bullish pressure, which quickly frazzles and ends up sending the price down. The price target for the shooting star is equal to the size of the pattern. If you are able to identify the presence of these signals, then you should short the security.

- This way, you will practice with virtual funds and equip yourself with an array of trading patterns and formations to apply when you start trading live.

- However, the only downside is that they will only show up on your Forex candlestick chart once in a while.

- If you want to take advantage of falling prices, you can do so via derivatives such as CFDs or spread bets.

- Whenever you decide to trade the reversal that was initiated by a shooting star, the stop loss should always be placed above the candle’s high.

- However, in recent years, I’ve completely abandonded the standard entries used with the shooting star candlestick pattern in favor of the confirmation entry discussed below.

And with that, we have confirmation of shooting star pullback set up. That is to say that the upper wick of this candle is very prominent in comparison to the lower wick. Additionally, the open and close of this formation occurs near the bottom of the range. And finally, the size of the body within the candle should be relatively small. If you examine the shooting star formation here, it’s quite evident that all of these characteristics have been met. First and foremost, we will need to spot a potential shooting star formation on the price chart.

Best Forex Brokers For Ukraine

As with any technical indicator, each one must be examined as an individual case. The nature of the trend, the market momentum, as well as the resistance areas are all important factors that should be examined. On balance, fewer of these patterns will lead to a prolonged change in trend direction in a major currency pair than won’t. A shooting star formation produced a bearish correction 54 percent of the time according to the historical data. Some currency pairs did produce stronger reactions, particularly USDJPY and AUDJPY. Eventually the new price-high attracts new sell orders and profit taking and the market fails to remain firmly within that higher price range. At this point the market starts to reverse or correct lower and eventually closes near the open.

There’s a chance that you will stop out with my method, and you will. Something that either works more often than it doesn’t or something that leads to big enough wins to erase the loses and then some. I think most of us had our questioned answered by the community or in the live trading room. I guess making the course easier to understand will lead to fewer support questions, questions in the live room, etc.

At some point, the sharp bearish price move began to subside, as the price action started to move higher. This upward price move is considered as a correction or pullback trading opportunity. The shooting star chart pattern that emerges at the termination of the upside correction has been magnified for easier viewing. These candlestick patterns are a must-learn when getting started in trading. Most seasoned traders consider the shooting star to be a powerful price formation due to its effectiveness and reliability. It is also is one of the most common candlestick patterns in the market. As this occurred in an uptrend the selling pressure is seen as a potential reversal sign.

Harami Pattern

Following the advance, a shooting star opens and then rises strongly during the day. This shows the same buying pressure seen over the last several periods. As the day progresses, though, the sellers step in and push the price back down to near the open, erasing the gains for the day.

What it signals is, that price action may have probably reached a low limit, while prices may begin to change their direction and rise. The appearance of the Hammer provides traders with the opportunity to enter into a long position, but this does not mean they should purchase at once. As with any other technical analysis tool, this should not be taken into consideration as a sole indicator. In addition, traders need to look for confirmation, that price action is reversing up. Usually this may be a green candle, which has a close price above the open price of the candle, preceding the Hammer candle.

However, please note that this is still one signal generated by one of hundreds of technical indicators. A shooting star pattern is found at the top of an uptrend, when the trend is losing its momentum. Join thousands of traders who choose a mobile-first broker for trading the markets. Look for complementary signals such as Support and Resistance levels for clues whether a reversal, continuation, or consolidation pattern is in play. Prices in the Shooting Star session will open higher on early buying, but very quickly, the Bears move in, sending prices lower. By the end of the trading session, the close comes at a level lower than the previous day’s closing. Since Bullish trends develop a series of higher highs and higher lows in prices identifying the last higher low is essential.

Points To Note On Shooting Star Candlestick Pattern & An Inverted Hammer

The shadows are at least two times longer than the body, small body, and very little lower shadow. This candle would have been more powerful if the closing price is below the opening price. The best shooting star strategy will address this issue and will show you how to catch a falling knife without cutting off our fingers.

It’s important to not only study the anatomy of the shooting star pattern, but also to realize the conditions under which it is most effective. With these conditions met, we should go back to the shooting star formation for further analysis. We want the shooting star pattern to have either touched or penetrated the upper line of the bearish channel. If you look closely at the shooting star formation once again, you will notice that the upper wick did in fact penetrate the upper line of the bearish channel plotted.

When trading the shooting star signal with resistance levels, I like to see the wick, at least, touch the resistance level . Just like price action signals, you need to qualify any support or resistance levels that you are relying on in order to make trading decisions. Those of you who have been reading my blog for a while probably already know that I don’t recommend trading naked price action patterns. Instead, I prefer to combine them with another trading system that is profitable on its own. Once price has moved in your favor a bit, you can move your stop loss to break even. This step is optional, but I do it myself and recommend it – especially when trading reversal patterns.

How Do Traders Interpret A Dragonfly Doji Pattern?

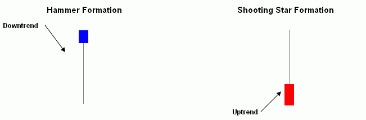

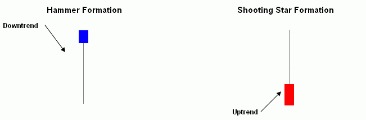

This shows that buyers lost control by the close of the day, and the sellers may be taking over. As always, verify these signals by checking other candles and indicators, and look for confirmations before you enter a trade based on a single pattern. A hammer takes place at the end of a downtrend, while a shooting star occurs at the end of an uptrend. The take-profit level depends on your trading style and risk management. In this particular example, we placed a profit-taking order at the previous resistance. Given that the market had pushed through this resistance line, it is likely to come back to test it in the context of support once it corrects lower. This resistance is also illustrated by the 23.6 Fibonacci Level.

As outlined above, a significant strength associated with the shooting star is its signal that a reversal may take place soon, as the uptrend is near its end. It is considered to be a potent formation due to its effectiveness and reliability. In our last lesson we learned about the Morning and Evening Star Candlestick Patterns. In today’s lesson we are going to wrap up our series on candlestick chart patterns with a look at the Inverted Hammer and the Shooting Star candlestick patterns. To some traders, this confirmation candle, plus the fact that the downward trendline resistance was broken, gave them a potential signal to go long.

Example On How To Trade Shooting Star Candlestick In Forex

When evaluating online brokers, always consult the broker’s website. Commodity.com makes no warranty that its content will be accurate, timely, useful, or reliable. Sellers pushed prices back to where they were at the open, but increasing prices shows that bulls are testing the power of the bears. We also review and explain several technical analysis tools to help you make the most of trading. The most popular blog posts are about gold, food prices, and pay gaps.

Both the green and red versions are considered to be shooting stars although the bearish candle is more powerful given that its close is located at the mere bottom of the candle. Again similar to a hammer, the shadow, or wick, should be twice as long as the body itself.

The Shooting Star forex strategy is made up of one reversal candlestick pattern and one exponential moving average for trend direction. This is a great reversal strategy used to trade short-term rallies found in a bearish market. The shooting star pattern is made up of one candlestick with a small body and little or no lower wick. The difference is that the shooting star occurs at the top of an uptrend. The inverted hammer, on the other hand, is a bullish chart pattern that can be found at the bottom of a downtrend and signals that the price is likely to trend upward. A shooting star candlestick pattern occurs when an asset’s market price is pushed up quite significantly, but then rejected and closed near the open price.

Trading Psychology

As always, be sure to backtest and demo trade any new techniques before adding them to your live trading repertoire. The farther back you have to go to find a candlestick of similar size the better. Sometimes an Inverted Hammer may form close to an ordinary Hammer, with this serving as a confirmation that a given support level is indeed strong. German solar car firm Sono Motors is exploring a U.S. stock market listing that may value the company at more than $1 billion, people close to the matter said.

The first scenario is when the market is exhibiting a clear uptrend, and the second scenario is when the market is correcting to the upside within a larger downtrend. This would mean that we would miss out on the opportunity to trade the shooting star set up in this case.

Trade Forex Trading

However, in recent years, I’ve completely abandonded the standard entries used with the shooting star candlestick pattern in favor of the confirmation entry discussed below. Larger candlesticks are more significant as far as what they can tell us about current market sentiment.

2- The candle has a long bullish body, with a short upper shadow compared to the body. The hammer candle suggests that trading action was strong during the period. As selling pushed the price lower, buyers managed to regain and push the price to close the period near the open. Remember to visit our Forex Trade Setups section after completing this tutorial, to see real time usage of these candlestick reversal patterns. A sell is confirmed when a candlestick closes below the neckline, this is the opening of the candlestick on the left side of this pattern. A buy is confirmed when a candlestick closes above the neckline, this is the opening of the candlestick on the left side of this pattern. At this point, it appears as though the longs are in complete control.

Trend Trading Tips By Victor Sperandeo

Sono Motors is developing an electric car that uses solar panels on its outside to power its batteries, but which can also be charged using a plug. The solar panels generate energy worth on average 112 kilometers a week.

The Shooting Star candle pattern is a reversal pattern where the trend can reverse from Bullish to Bearish. This final example of shooting star candlestick is found on the BCH/USD 15-minute chart. At USD163, bulls start to lose momentum, and this is reflected in the presence of a shooting star followed by a bearish candle.

Moreover, we will explain how you can trade it profitably and increase your odds of success. The content on this website is provided for informational purposes only and isn’t intended to constitute professional financial advice. Trading any financial instrument involves a significant risk of loss. Commodity.com is not liable for any damages arising out of the use of its contents.

With a strong trend, it is preferable to wait for at least one other confirmation. That confirmation should show us that the trend is turning, before a short position is entered. Looking at historical daily charts, we examined the five bars following every shooting star and obtained the following results. Traders holding short positions may have been forced to exit and buy back their positions. Likewise a price reaching new highs could initiate an abundance of buy side stop losses which would add to the volume of buyers.