Next Fed Rate Hike Meeting

Table of Contents Heading

- Federal Reserve Leaves Interest Rates And Asset Purchases Unchanged, Sees Growth Slowing

- The Fed Has Three Options Here’s The Difference Between Them, And Why Anything Could Happen

- Fed Sees Rates Near Zero Through 2023 To Boost Jobs, Prices

- What Time Are The Fomc Meeting Minutes Released?

- Fed Seen Holding Rates This Week With Hike Still On Horizon

- Federal Reserves Final Meeting Of 2020: Four Things To Watch

- Fomc fed Meeting Schedule (fomc Calendar

- Support Economy

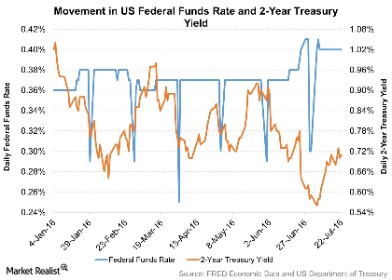

Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation. They also took note of the U.S. economy’s resilience through a summer of financial market turbulence and felt that global threats had “diminished.”

has recovered by some 15 percent in two months while China’s economy grew at 6.7 percent in the first quarter. After a volatile couple of months, stocks have rebounded and financial conditions have eased as expectations for China’s economy again improved. Moreover, temporary extra jobless benefits are running out and the political stalemate over a new round of stimulus threatens to set back the economy. Uncertainty could hang over government policies at least until the outcome of the presidential and congressional elections is clear. Republicans including President Donald Trump — who trails challenger Joe Biden in national polls — have proposed a smaller package of aid than Democrats have. In addition to slashing borrowing costs in March, the central bank has pumped trillions of dollars into the financial system through bond purchases and launched a slew of emergency lending facilities to keep businesses afloat.

Federal Reserve Leaves Interest Rates And Asset Purchases Unchanged, Sees Growth Slowing

The chairman spoke during a tumultuous day on Wall Street in which major averages fell amid a frenzy over the market’s most-shorted stocks. Investors on the social media network Reddit have banded to buy stocks that bigger Wal Street players have been betting against, setting up wild swings and sending the Dow industrials down sharply.

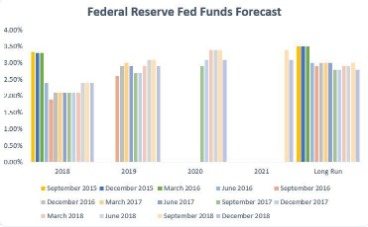

As a result, the strategist isn’t completely ruling out the possibility that the Fed revisits lifting the administered rates at the April FOMC meeting, although fed funds futures are not priced for such an action. While the $1.37 trillion cash pile is down from $1.66 trillion at the beginning of February, it’s still some ways from the Treasury’s end-March forecast of $800 billion. Out of the three scenarios, the worst case would result in the Fed holding rates near zero for a period that would be longer than the last one, which lasted seven years. In this scenario, the economy remains weak with high unemployment and low GDP. The economy would have to improve and force inflation to rise in a sustained fashion before the Fed would even think about rate hikes. Of course, a quick economic recovery would be the best case scenario for deposit rates, but even in that case, the Fed won’t be in a hurry to raise rates. Their new inflation framework will likely cause them to be slower in their rate hikes than they were in the last zero rate period.

The Fed Has Three Options Here’s The Difference Between Them, And Why Anything Could Happen

Should prices pop later in the spring, after the economy begins to recover and more relief payments go out to individuals, these Chicken Littles may feel vindicated. Despite his best efforts, Powell can’t quite get investors not to worry so much about inflation.

The Federal Open Market Committee holds eight scheduled meetings per year. During the meeting, the FOMC maintained its target for the fed funds rate at a range of 0% to 0.25. ET tomorrow with a statement, followed by Fed Chairman Jerome Powell’s press conference. Analysts aren’t expecting any rate moves, in spite of rising bond yields that some investors worry might be the first sign of inflation, and rising import prices in February might add to those concerns. Hint, it includes a confiscatory tax policy the likes of which the country has never seen and America’s wealth is about to flee the country at record levels. Just what’s needed when we are trying to recover from the pandemic and were finally on the right economic course. I think every American is going to suffer badly, but retirees in particular are going to be in imminent big trouble.

Fed Sees Rates Near Zero Through 2023 To Boost Jobs, Prices

Expect short-term interest rates, such as those for adjustable-rate loans, to remain at current levels for the next two to three years. Interest rates are at record lows in response to the COVID-19 pandemic. Since then, the yield is up about 60 basis points, leading some to speculate on the “dreaded i-word.” The inflation equation had many investors nervous the last few weeks, but that seems to be fading a bit. See more below on how the Fed’s dot plot may have changed since it was last published. The yield fell to just below 1.6% this morning but isn’t far off one-year highs. Going into the Fed meeting, we have a 10-year yield that’s risen six weeks in a row. Their meeting gets underway soon and we could have a bit of turbulence between now and tomorrow afternoon when Fed Chairman Jerome Powell addresses the media.

President Trump nominated him to replace Janet Yellen as the Fed chair. A vote to alter coverage would lead to both shopping for and promoting U.S. authorities’ securities on the open market to advertise the expansion of the financial system. FOMC is the department of the Federal Reserve Board that determines the path of financial coverage. The FOMC “FED” meets a number of instances 12 months to debate whether or not to take care of or change present coverage. The Fed also announced that it plans to keep buying Treasurys and mortgage-backed securities “at least at the current pace.” This continues the commitment of “unlimited QE” that the Fed first announced at its March 15th emergency meeting.

What Time Are The Fomc Meeting Minutes Released?

Your APR is a factor in how your minimum payment is calculated, so that could go up as well. Regardless of the effect in dollar terms, reducing your credit card debt is always a wise move. If you’re already a homeowner with a fixed-rate mortgage, you’re all good. “I thought it was wrong and harmful,” Kohn said of Dudley’s commentary. “The Fed needs to keep away from politics. They need to apply the best economic analysis possible to achieve legislative mandates.” “I’m much less certain than the market seems to be that we need a whole bunch of decreases here,” he said.

In my case, I am debt free except for my mortgage, and my mortgage interest rate is only 2.875%; however, 2.875% is a great rate of return right now, so I have made large extra principal payments in the last year. For readers who have higher interest debts, like credit card or other retail debt, the principle is the same; viz. paying off 5k in debt on a credit card with a 9% interest rate is like earning 10% on that 5k. With CD rates so low, it seems to make more sense to keep more of your “safe money” in liquid bank accounts, such as online savings accounts and/or high-yield reward checking accounts. Like CD rates, online savings account rates appear to be reaching a bottom. So it’s possible that an online savings account that currently has a 0.50% APY will be able to maintain this rate for the rest of this zero rate period. CD rate declines have been slowing in the last few months as seen in our Online CD Indexes (see online 1-year and 5-year averages.) If the economy does have a strong recovery this year, it’s possible that we may be at a bottom for CD rates.

Fed Seen Holding Rates This Week With Hike Still On Horizon

Expectations are that he will reiterate that the central bank will “act as appropriate” to sustain the expansion of the U.S. economy. Federal Open Market Committee members vote on where to set the rate.

Everyone is waiting pretty much on the edge of their seats to hear what, if anything, Powell might have to say about inflation. CME Group is the world’s leading and most diverse derivatives marketplace. Read about the surge in rates activity as bond yields rise sharply, SOFR futures topping $237B per day, updates on IBOR fallbacks, and more. The January jobs report that was released last Friday mostly confirmed that the winter surge of COVID cases did weigh on the job market.

- But a Fed spokesman quickly walked back the remarks, saying Williams was only speaking theoretically and not in a way that should be interpreted as policy intention.

- But if you’re all set to buy, don’t let modestly higher mortgage rates worry you.

- This is a very large Jumbo which requires a minimum deposit of $250k.

- As a result, many people have good reason to wonder about who makes these decisions about monetary policy and how they make them.

In response to Maloney, the Fed chair predicted that the future of the U.S. economy would remain murky. In congressional testimony on Nov. 4, Yellen called a December rate hike a “live possibility” if the economy stays on track.

Federal Reserves Final Meeting Of 2020: Four Things To Watch

The March and June meetings will include the summary of economic projections. In terms of how much, what we said is that we would like to see, because inflation has been running persistently below 2%, we would like to see it run moderately above 2% for some time. We use policy rules and formulas in everything we do, consult them constantly, but we don’t set policy by them. We don’t do that, and so we’re going to preserve an element of judgement. Again, we’ll seek inflation moderately above 2% for some time, and we’ll show what that means when we get inflation above 2%. The way to achieve credibility on that is to actually do it, and so that’s what we’re planning on doing. But “the velocity of the move in rates that we saw, or the rate of change in the move that we saw, spooked equity investors,” he said.

This guidance could help the economy by reducing the likelihood that investors will send borrowing costs higher before the Fed intends. Since March, the Fed has slashed its benchmark short-term rate, bought $2.1 trillion in Treasury and mortgage bonds to inject cash into markets and rolled out nine lending programs to try to keep credit flowing smoothly. In the statement, the Fed also credited its emergency lending programs for reviving the flow of credit to households and businesses, after markets had locked up in March when investors sold a range of securities to boost their cash holdings.

But with Fed officials sounding more dovish and concerned about global growth, the Fed as an issue has fallen into the background somewhat. The markets are still fearful trade wars will hurt growth, as could geopolitical uncertainties surrounding Brexit and the special counsel’s investigation into President Donald Trump. “You had this repricing with no new data, and the Federal Reserve officials are in the blackout period. The only new development was Brexit … and especially the increased probability there could be a hard Brexit,” said Jon Hill, BMO fixed income strategist. He said expectations for a March rate hike are just 12 percent, down from 20 percent early Monday.

Markets have already anticipated such an approach, seeing no chance of a rate increase at this week’s meeting on April of the Federal Open Market Committee , and are pricing in just a one in five chance of a move at the next meeting on June 14-15. Reuters polling of market participants sees two rate hikes this year. Whereas back in December the thought was that the Federal Reserve might tamp down long-term Treasury yields, the issue now lies with shorter-dated ones — 5-year rates. Yields on that maturity have become unmoored in recent weeks, surging amid speculation that the central bank will need to start a cycle of rate hikes perhaps a full year earlier than officials have indicated. That shift has roiled the outlook for a classic iteration of the reflation wager, a widening gap between 5- and 30-year yields, even as the narrative of a stimulus-fueled recovery has only gained momentum. As the 10-week stock market correction deepened, fears of slowing growth escalated and expectations for Fed rate hikes have fallen.

That’s kept bets on the widely watched spread to the 10-year rate in play, as well as versus other maturities, such as the 5- and 7-year. Without Fed pushback, he said, “there might be more pressure on the belly of the curve,” in which case the best steepeners would be the spreads between 2-year yields versus 5- and 7-year rates that have room to rise as traders price in tightening. The key takeaway is that the bet on a steeper curve isn’t kaput because yields are still generally seen as rising further. For example, it may mean ditching the wager if it’s grounded on the 5-year note, which reflects a medium-term view of the Fed’s path, in favor of one based on the 2-year, which still remains anchored in the market’s eyes.

Support Economy

These rising long-dated Treasury yields are already impacting brokered CD rates. This morning, the top rate at Fidelity for a non-callable brokered 5-year CD was 0.90%. This morning, the top rate at Fidelity for a non-callable brokered 10-year CD was 1.80%. The massive fiscal stimulus and a recovering economy may also result in rising inflation. The expectation of future rising inflation can be seen in the rising long-dated Treasury yields. The 10-year yield increased 7 bps to 1.55%, and the 30-year increased 11 bps to 2.37%. The short-dated Treasury yields with terms of two years and under fell between one and three bps.

That number will likely improve in February, with Covid cases falling dramatically. “We’re still a long way from our goals of maximum employment and inflation averaging 2% over time,” Powell said in an interview at The Wall Street Journal Jobs Summit on March 4. Covid-19 hospitalizations have fallen off a cliff, millions of Americans are getting vaccinated every day and consumers have kept spending thanks in part to the $900 billion relief package passed late last year. Economists believe that after a rough 2020, the economy will experience a boom in 2021 the likes of which has not been seen for years. “All of the economic fallout has been a function of how we’ve responded to the public health crisis,” he said. “Making a forecast about this year is really at its heart a forecast of how well the vaccine is going to penetrate into the population so we’re at a place where we don’t have to be so cautious about how we do our economic activity.”

He reiterated his pledge also that the market will get plenty of guidance before any tapering actually happens. Markets were watching, though, to see whether the statement would provide any clues on the future of the asset purchases, or quantitative easing. Since the beginning of the coronavirus crisis, the Fed expanded its holdings by more than $3 trillion, bringing its balance sheet to nearly $7.5 trillion. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. First, we provide paid placements to advertisers to present their offers. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site.