Import Of Goods And Services

Table of Contents Heading

- How Important Are Imports And Exports?

- Case I: Import Of Service For Consideration Whether Or Not In The Furtherance Of Business

- Example For Calculating Igst On Import Of Goods

- How Africa Will Benefit From Trading Through Imports And Exports

- That Time Julius Caesar Was Kidnapped And Insisted His Captors Increase Their Ransom

- What Are The Advantages Of Africa Importing Goods And Services?

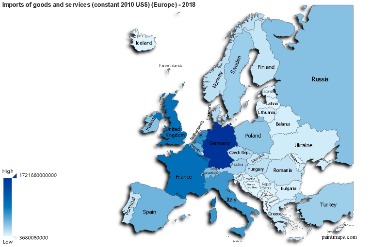

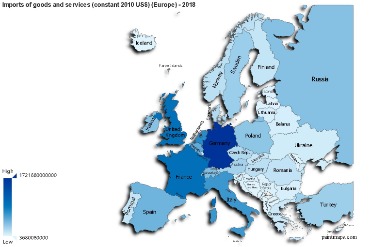

- Real Imports Of Goods And Services (impgsc

- More Under Goods And Services Tax

- How Importing Has Benefited Africa To Better Business Deals?

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. Looking for foreign sourcing to get their products at the cheapest price. An import of a good occurs when there is a change of ownership from a non-resident to a resident; this does not necessarily imply that the good in question physically crosses the frontier.

Whether export contract/purchase order already registered with STPI. No direction under Sub-regulation shall be given by the Reserve Bank and no approval under clause of that Sub-regulations shall be withheld by the Authorised Dealer, unless the exporter has been given a reasonable opportunity to make a representation in the matter.

How Important Are Imports And Exports?

Another method of increasing exports and decreasing imports is by devaluing the domestic currency. Governments devalue their currency with the aim of bringing down the prices of domestic goods and services, the ultimate goal being to increase net exports. The currency devaluation also makes purchasing from other countries more expensive, thus discouraging imports. Sometimes, countries ensure a regular flow of international trade, i.e., a high volume of both imports and exports, by entering into a trade agreement with another country. Such agreements are aimed at stimulating trade and supporting economic growth for both countries involved. Exports are goods and services that are produced domestically, but then sold to customers residing in other countries.

All the changes will get reflected in the Master Directions available on the RBI website along with the dates on which changes are made. Explanations of rules and regulations will be issued by way of Frequently Asked Questions after issue of the Master Directions in easy to understand language wherever necessary. The existing set of Master Circulars issued on various subjects will stand withdrawn with the issue of the Master Direction on the subject. It is pertinent to note that while service tax is applicable on import of services as per above, reverse charge tax liability arises only for transactions undertaken for a consideration. Under the current Service tax law, there is no mechanism to charge tax on services provided in the absence of any direct or indirect consideration.

Case I: Import Of Service For Consideration Whether Or Not In The Furtherance Of Business

Imports are the goods and services that are purchased from the rest of the world by a country’s residents, rather than buying domestically produced items. Imports lead to an outflow of funds from the country since import transactions involve payments to sellers residing in another country. Exhibit 19 shows goods that are seasonally adjusted for selected countries and world areas. Unlike the commodity-based adjustments discussed above, these adjustments are developed and applied directly at the country and world area levels. For total exports and imports, data users should refer to the commodity-based totals shown in the other exhibits.

In the case of a Public Sector Company or a Department/ Undertaking of the Government of India/ State Governments, approval from the Ministry of Finance, Government of India for advance remittance for import of services without bank guarantee for an amount exceeding USD 100,000 or its equivalent would be required. AD Category – I banks may frame their own internal guidelines to deal with such cases as per a suitable policy framed by the bank’s Board of Directors.

Experts state that Cuban buyers will need to develop close and reliable relationships with U.S. suppliers for product support, spare parts, maintenance, and training before U.S. exports in certain sectors can reach significant levels. That the Cuban government frequently makes decisions about trade and investment based on political factors rather than on economic rationale was widely cited as the single most important factor affecting the ability of U.S. and foreign companies to do business in Cuba.

- The Master Directions consolidate instructions on rules and regulations framed by the Reserve Bank under various Acts including banking issues and foreign exchange transactions.

- No direction under Sub-regulation shall be given by the Reserve Bank and no approval under clause of that Sub-regulations shall be withheld by the Authorised Dealer, unless the exporter has been given a reasonable opportunity to make a representation in the matter.

- Considering that in some cases, the goods acquired may require certain specific processing/ value-addition, the state of goods so acquired may be allowed transformation subject to the AD bank being satisfied with the documentary evidence and bonafides of the transaction.

- The seasonal adjustment procedure (X-13ARIMA-SEATS) is based on a model that estimates the monthly movements as percentages above or below the general level of series .

- If the tax on such import of services had been paid in full under the existing law, no tax shall be payable on such import under GST law.

Charges for end-user rights to use audiovisual content, such as film, television programming, and sound recordings, as well as outright sales of audiovisual originals, are included under audiovisual services, a component of personal, cultural, and recreational services. Transport – Consists of transactions associated with moving people and freight from one location to another and includes related supporting and auxiliary services. Transport covers all modes of transportation, including air, sea, rail, road, space, and pipeline. Postal and courier services and port services, which cover cargo handling, storage and warehousing, and other related transport services, are also included.

Example For Calculating Igst On Import Of Goods

One or two evenings a week, attend business events or meetings with partners for discussion. Discuss problems and/or chances for the future with prospects and/or business partners. After lunch, take time to reflect on what has and what should have happened. Receive the pro forma invoice, the exporter’s quote on the merchandise; negotiate if necessary.

U.S. exports may, however, be hindered by U.S. firms’ unwillingness to provide the long-term financing or barter arrangements that Cuba currently enjoys from some of its main trading partners. In the longer term, as Cuban purchasing power increases and Cuban GDP grows, opportunities will likely expand for increased U.S. exports in a wide variety of sectors. U.S. dairy exports to Cuba could resume following the removal of U.S. restrictions.

How Africa Will Benefit From Trading Through Imports And Exports

The efficiency of U.S. pork production and the short shipping distance would be competitive advantages for U.S. pork exports. Absent U.S. restrictions, however, these exports could resume and could eventually exceed 2005–11 levels.

Within the contours of the Regulations, Reserve Bank of India also issues directions to Authorised Persons under Section 11 of the Foreign Exchange Management Act , 1999. These directions lay down the modalities as to how the foreign exchange business has to be conducted by the Authorised Persons with their customers/constituents with a view to implementing the regulations framed. Further, under service tax, credit is available only for input services directly attributable to provision of service. Under GST, all input services as well as goods shall be eligible for ITC.

Over the past 34 years, the value for this indicator has fluctuated between $1,182,622,000 in 2015 and $141,350,000 in 1985. This means that goods are sold by the original importer before such goods enter the custom frontiers for clearance. Therefore, it is the third person who files custom declaration, that is the Bill of Entry, after the High Sea Sales are undertaken by the importer.

That Time Julius Caesar Was Kidnapped And Insisted His Captors Increase Their Ransom

This can also increase the technology and infrastructural development on the continent, which is much needed. More simpler and flexible rules of origin- This will allow African countries to use cheaper, better quality and more innovative inputs from other countries in their exports. It will thereby help African countries move up the value added ladder instead of exporting predominantly lower value raw materials. As such, they will not be subjected to custom duties when exporting their final products to the EU. The European Union allows free access to the EU market of half a billion people for the business community across Africa, the Caribbean and the Pacific. Imports open up room for new innovations and diversification for African countries as they are able to access new materials which help realize new production possibilities – With more imports Africans will have access to a variety of intermediate and capital goods.

The provisions present in Section 7 of the Central Goods and Services Tax Act, 2017, mentions that when services are imported with consideration, it will be deemed as a supply, regardless of whether it is utilised in the continuance or course of business. When services are imported without consideration, they will not be deemed as supply. Businesses, however, are not mandated to undertake any tests for service imports to be deemed as a supply.

What Are The Advantages Of Africa Importing Goods And Services?

Gold exports, nonmonetary – This addition is made for gold that is purchased by foreign official agencies from private dealers in the United States and held at the Federal Reserve Bank of New York. The Census data only include gold that leaves the U.S. customs territory. U.S. import coverage includes shipments of railcars and locomotives from Canada.

The port trust and custom authorities maintain two types of warehouses-Bonded and Duty paid. These warehouses are situated near the dock and are very useful to importers who do not have godown of their own to store the imported goods or who, for business reasons, do not wish to carry them to their own godowns. If the importer is not is a position to supply the detailed particulars of goods because of insufficiency of information supplied to him by the exporter, he has to prepare a statement called a bill of sight.

Exports increased $1.3 billion to $5.7 billion and imports decreased $0.5 billion to $6.6 billion. The deficit with Germany increased $1.5 billion to $7.2 billion in January. Exports decreased $0.2 billion to $4.7 billion and imports increased $1.3 billion to $12.0 billion. The deficit with Mexico increased $1.6 billion to $11.9 billion in January. Exports increased $0.1 billion to $20.7 billion and imports increased $1.6 billion to $32.6 billion. Imports of services decreased $0.3 billion to $39.0 billion in January. Exports of services decreased $0.3 billion to $56.3 billion in January.

Real Imports Of Goods And Services (impgsc

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy.

With this release of the FT-900, the Census Bureau, in coordination with the U.S. Department of Agriculture , has adopted the World Trade Organization’s internationally recognized definition of agricultural products as its standard definition for the statistical reporting of U.S. agricultural trade.

More Under Goods And Services Tax

v. Further, due caution may be exercised to ensure that remittance is not permitted for import of conflict diamonds . AD Category – I banks should, undertake the transaction based on their commercial judgment and after being satisfied about the bonafides of the transaction. The importer should be a recognised processor of rough diamonds and should have a good track record. There cannot be a fixed benchmark for valuation of services without consideration. Whatever valuation rules are brought to value such kind of transaction, it will be arbitrary and an attempt to value service which is subjective and different with different set of supplier and receiver.

According to the Customs Tariff Act 1962, goods can be removed from the custom station to warehouse without payment of duty. The importer can deposit the goods at the customs designated warehouses from the custom station with no payment of duty. Section 7 of the IGST act further provides that any supply of imported goods that takes place before such goods cross India’s customs frontiers are deemed as interstate supplies. Authorised dealers may enter into arrangements with international factoring companies of repute, preferably members of Factors Chain International, without approval of the Reserve Bank.

How Importing Has Benefited Africa To Better Business Deals?

The Import of service from HO or branch outside India in the course or furtherance of business will be subject to GST even if no payment was made to HO or Branch outside India. Ram Capital of London is an associate firm of Ram & Associates and thus is an establishment outside India. Ram & Associates is a taxable person importing capital management service without consideration. In this case John& Co provides design consultancy to both Ram Associates and also to its Managing Partner Mr Ram. Service to Ram & Associates was for furtherance of business as the design was made for the office but service to Mr Ram for designing his home was not for the furtherance of business but rather individual personal use. But still both these conditions satisfy the conditions of Sec 7 and hence are supply of service. There are few items which can be imported into India in certain conditions upto certain limit is exempt from custom duty.