New Residential Construction Report

Table of Contents Heading

- Top U S. Housing Market Indicators

- Nyc Construction Industry Remains Strong Despite The Effects Of Covid

- How Much Do Residential Construction Jobs Pay Per Year?

- Residential Skilled Multi Trade Construction Worker

- Browse All Economic Data

- Construction Project Manager

- 769 Residential Construction Jobs

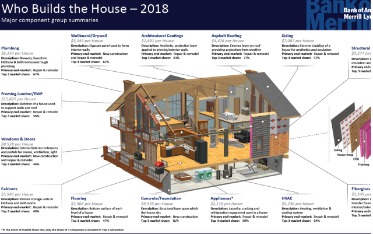

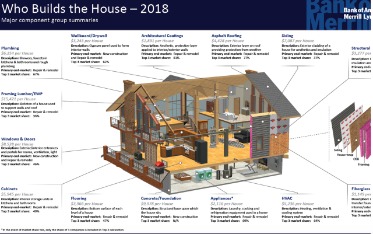

The same study found that regulatory costs from all levels of government account for 24.3% of the final price of a home in the U.S., consistent with 2011, when regulatory costs accounted for an estimated quarter of a home’s final price. 58% of builders as a major challenge in 2017, and 65% expect the same in 2018. Zoning restrictions and evolving government regulation of where and how homes can be built exacerbate the land shortage.

Large homebuilders enjoy economies of scale, with national purchasing power for materials and greater access to capital. Small homebuilders generally don’t grow beyond the 30-home annual building level because of the intensely local nature of real estate. Worker Shortages – As building activity increases, construction companies often struggle to find skilled workers to meet the rising demand. The challenge is particularly acute after periods of low construction activity and high turnover, conditions that can force construction workers to leave the industry. During the recession of the late 2000s, for example, many laid-off construction workers in the US sought employment as general laborers, landscapers, and truck drivers. Onsite Vandalizing – Damage by vandals and theft of construction equipment and supplies are costly for builders. High prices for construction materials, such as lumber, copper wire, and metals, as well as fuel, have led to increased theft from construction sites.

Top U S. Housing Market Indicators

Mixed-Use Developments – Construction of mixed-use developments that combine residential, office, and commercial spaces will likely increase as the population becomes more urbanized. Some city planners advocate for such projects because placing residents and workers closer to stores and restaurants can help reduce city traffic. Nonresidential construction firms may need to expand their building expertise through joint ventures or acquisitions to take advantage of mixed-use development demand. This means they help economists and investors see how the economy is faring. The subprime mortgage meltdown hit hurt consumers and businesses alike including the construction industry. Many companies in this industry were forced to shut down, leaving workers in the lurch.

For each time they fill in the soil, they do a density test for the compact soil until it arrive to a certain weight. It is important to test for the density of the compact soil as poor compaction can result in basement and pool cracks and leaks, slab cracks, pipe leakage and breaks, foundation erosion, under abutments erosion gullies and utility trench settling. Joint Ventures – As projects get bigger, on-time completion becomes more important to owners of construction firms. Costs for late completion, including penalties, rise disproportionately to actual construction costs.

Nyc Construction Industry Remains Strong Despite The Effects Of Covid

Census Bureau’s most recent press release and the methodology of its data compilation. At the start of the tumultuous year, skeptics wondered whether we ought to write off the city as we know it.

In conjunction with still very high initial claims in unemployment insurance and weak personal income growth, this month’s jobs report strongly suggests that the economy will be moving sideways as the year comes to an end. Except for single family and warehousing, most construction categories are seeing little gain in activity. Until a vaccine is available and being distributed, we’re likely to continue to see unsteady improvements in the economy and construction through the latter half of next year. The COVID-19 vaccine rollout will help the overall economic recovery, but the construction sector’s recovery will be limited by reduced demand for nonresidential buildings, budgetary issues at the state and local level, and limited public works projects. Besides the flux underway in the overall commercial property market, plans for several new supertall office towers were also unveiled in 2019. While their possibilities ranged from the somewhat plausible 350 Park Avenue to pie-in-the-sky Penn15, the duo of proposals unveiled by YIMBY this year highlight the continued growth in prospects between Hudson Yards and Midtown East. While overall development remained resilient in 2019, an avalanche of legislative changes have severely impacted the city’s commercial property market, particularly the hotel sector.

A number of garages did not list any square footage or listed just one square foot, so for statistical purposes we averaged such structures at 315 square feet apiece. If the fine folks at the Department of Buildings are reading this article, please encourage your applicants to adhere to stricter standards. While the 26 buildings proposed at 20 stories and higher is a paltry number compared to the group above, it is still a considerable figure in its own right. When grouped together, the resulting cluster would rival the skylines of most of the nation’s mid-sized cities. Notably, multifamily filings slightly outpaced the single- and two-family category, in a testament to the enduring appeal and desire for density in the city.

Yet another chart shows that dense residential development is the name of the game in the Bronx, Brooklyn, and Manhattan, which average 45, 37, and 43 units per residential proposal, respectively. The Bronx counts seven proposed dwellings with 100-plus units and 28 more with ten to 99 apartments. For Queens, the count is three and 16, explaining its significantly lower average. The case is most acutely pronounced in Staten Island, where of the 59 residential proposals, only one would include more than two units, though its 12 floors and 274 apartments would provide a welcome boost in density. The prior chart paints Brooklyn as the clear leader in multi-family residential filings, so it naturally leads in proposed apartment filings with 4,490 units on the drawing board.

How Much Do Residential Construction Jobs Pay Per Year?

Multifamily, For-Rent Apartments – High demand for apartments and condos has resulted in many traditionally single-family home builders also turning to multifamily construction. Many people are unable to afford to buy a home or can not qualify for a mortgage, creating stronger demand for rental properties. Builders such as Lennar and Toll Brothers, for example, are following the trend by breaking ground on apartment and condo communities. New single-family rental home communities are also gaining in popularity for home builders. Special-Purpose Housing Developments – The changing demographics of the US population suggest that demand for second homes and retirement communities will increase.

The most comprehensive store of information on construction projects in North America, with more private and early-stage projects than any other source. The Bronx overtook Queens for the second spot, with 9,321 units, up 25% from 2018’s total of 7,449.

According to Dietz, Canadian lumber accounts for one-third of all that used in constructing American homes. Shamrock Building Inspection Consultants LLC offers residential inspection options for buyers and sellers. Our experienced inspectors have a reputation as the best in the business, and they include the home owner or buyer every step of the way. You have %%pigeonMeterAvailable%% free %%pigeonCopyPage%% remaining this month. Get unlimited access and support reader-funded, independent data journalism. PPD Business, the economy-reporting arm of People’s Pundit Daily, is “making sense of current events.” We are a no-holds barred, news reporting pundit of, by, and for the people.

Residential Skilled Multi Trade Construction Worker

If you have set this checklist up to integrate with Webmerge through Zapier, this is the task to trigger the transfer of data. It is important to present an Earned Value Analysis to the client to be open and honest about the performance of the project. You should demonstrate to the client that you are aware of any challenges the weather may present to the project, or has presented to the project, and that you have a strategy to deal with this.

The next wave of the virus is accelerating and the prospects for additional federal stimulus are still very uncertain, so employment growth is expected to slow further in the months to come. Construction employment should remain somewhat resilient, however, due to the booming housing market. Looking into 2021, the hope for rapid deployment of a vaccine sets the table for a stronger economic recovery taking hold by the midpoint of the year. BEDFORD, MA – FEBRUARY 24, 2021 – In 2020, the COVID-19 pandemic raged on, pushing the U.S. economy into recession and constraining opportunity.

The larger scale and complexity of projects lead to more joint ventures among construction companies, which can pool their expertise and financial resources in bidding for contracts and in implementation. Need for Repairs and Retrofits – The inventory of homes in the US is aging. More than 65% of US owner-occupied homes were built before 1990, according to the National Association of Home Builders .

Browse All Economic Data

Before Redfin, Greg was a data journalist in the market research industry, writing about cultural trends, climate change, and politics. His dream home would be a viking hall in the mountains of Vermont, with a zipline back to Brooklyn. 1December throughout this report is a rolling three-month measure and includes October, November, and December for all new construction data.

- Of these, 19 structures would pack over half a million square feet and eight more would span over a million square feet.

- Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1,216,000.

- The March rate for units in buildings with five units or more was 357,000.

- This ratio provides an indication of the economic productivity of capital.

Units in multi-family dwellings start when workers break ground on the building. Each unit is considered a single start, though, so a 25-unit building counts as 25 different housing starts. This is what makes the New Residential Construction Report—commonly referred to as housing starts—a critical indicator of broader economic strength. Local construction officials issue building permits for new construction, additions, and alterations. Permits for additions authorize work that adds space to an existing structure. Alterations also are for work on existing buildings, but no new space is added. Examples of alterations include tenant fit ups, new roofs, and repairs to existing structures.

Construction Project Manager

Despite ongoing travel restrictions, the city continues to plan for future visitors. Over the course of 2020, permits were filed for 21 hotels across the city, with seven in Brooklyn, five in Queens, four each in Manhattan and the Bronx, and one in Staten Island. The highest room count belongs to the 33-story, 534-room hotel proposed at 32 West 48th Street just south of the Rockefeller Center in Midtown.

But the underlying need for new homes is still there, which should keep the building sector busy for some time to come. Both figures came in above analysts’ expectations, reflecting growth in the single-family sector.

It does not, however, mean that the economy has returned to pre-pandemic levels of activity and regained its full health. With today’s report, the economy has recovered only two-thirds of the output lost in the first half of the year. Moving forward, the economy still faces significant hurdles including the next wave of COVID-19, election uncertainty, and diminished hope in the near-term for additional federal stimulus. Expect economic growth to move sideways in the fourth quarter and into early next year. October’s unemployment rate also fell by a full percentage point to 6.9%. More recently, Wall Street rallied last week with the strongest stock market gains since April.

Private sector employment improved by 344,000, while the public sector shed 99,000 positions. Within the public sector, state and local governments cut 13,000 positions, while federal employment was down 86,000 reflecting the loss of temporary workers that had been hired for the 2020 Census. Hope for a better recovery, however, lies with the potential for an influx of federal stimulus funds directed to infrastructure. President Biden’s Build Back Better plan is said to include “a $2 trillion accelerated investment, with a plan to deploy those resources over his first term.” The last major spending program was in the wake of the Great Recession in 2009. Though the American Recovery Reinvestment Act of helped direct $100-$150 billion towards infrastructure, it did not provide consistent and significant upward momentum in public works starts. Private sector jobs increased by 465,000 in February, but government jobs continued to feel the squeeze from the loss of tax revenue and high cost of responding to the pandemic.

Beyond the actual filings, and more visually impressive, the supertall boom of the mid-2010s has finally reached its crescendo as the buildings resulting from said frenzy reached their peaks within the skyline. All of the major new residential supertalls along 57th Street topped-out in 2019, as did One Vanderbilt.

6 2.0 SITE SAFETY 2.1 SAFETY PRECAUTIONS General construction site signs The board that pinned up with the rules and regulations for the employees to follow. Safety Helmet Economic Safety Vest Safety helmet is to protect users’ head from falling objects. 3-Series Lace Up Safety Boots Safety boots is to protect the feet from sharp and dangerous objects. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. This data cannot be copied, sold, or distributed in any manner without the written permission of First Research.

In the following 4 chapters, you will quickly find the most important statistics relating to “U.S. residential construction “. NAHB serves the entire home building, development and remodeling industry. Tracking nationwide sales and inventory levels offers key insights about current market conditions and future housing demand. These reports can also serve as early indicators of economic shifts, often triggering changes in consumer behavior. The second is that the boroughs appear to maintain their density status quo. Developers in the intensely urban Bronx, Brooklyn, and Manhattan are sticking almost exclusively to multi-family structures.

In addition, many entries in the utility category are garages associated with existing or proposed dwellings. An encouraging sign is that multi-family proposals far outweigh the one-and two-family counterparts , meaning that dense residential structures remain the dominant development mode even when low-density outlying districts are taken into consideration. Speculative builders may launch construction on multi-level apartment buildings in urban areas, for example, anticipating a certain amount of demand for apartment space in a given city. If there is a drop in demand for such housing, construction companies naturally might pull back on plans to further build up and develop in cities. Salary shifts and job changes can directly affect the feasibility of seeking a new home. A construction official may issue a demolition permit for a residential or nonresidential structure. For demolitions that result in the loss of a dwelling unit , we report the number of dwellings lost.

Multi-family residential filings maintain a remarkably similar percentage to that of total filings. The submitted filings would create nearly 30 million square feet of new development that runs the gamut from single-car garages to multi-million-square-foot distribution centers. Nearly half of the footage is residential, just over one-third is commercial, and the rest is split between functions such as education and utilities. The proposals would supply nearly 10,000 new residential units, in buildings that range from numerous one- and two-story, single-unit properties to a 47-story skyscraper in Brooklyn. YIMBY’s 2020 New Building Report, covering 2019’s numbers, showed a substantial increase in applications, with 2019’s total filings reaching 36,467. This year, the numbers have dropped somewhat, with 2020’s submitted residential units totaling 30,036. The full report covering 1,774 new buildings and over 57 million square feet of new floor space is available in Excel format upon purchase of YIMBY’s Building Wire subscription.