Natural Gas Production Eia

Table of Contents Heading

- Recent Data

- Prices

- U S. Natural Gas Production, Consumption, And Exports Set New Records In 2019

- Natural Gas Annual

- Climate Fintech Startup Atmos Financial Puts Savings To Work For Clean Energy

- Petroleum & Other Liquids

- Recent Completions Of Natural Gas Pipeline Projects Increase Transportation Capacity

EIA projects the U.S. will export more petroleum and other liquids than it imports annually starting this year, with domestic production continuing to rise and decreased domestic consumption of petroleum products. EIA says net exports of U.S. petroleum and petroleum products peak at 3.73 million barrels per day in 2033 before gradually declining as domestic consumption rises. EIA expects natural gas prices to increase starting in the third quarter of 2020, driven by an increase in industrial demand as business activity resumes. Projected natural gas prices rise to an average of $2.95/MMBtu in 2021 because of upward pricing pressure from declining growth in natural gas production. In part because of reduced business activity and higher-than-average storage levels before the summer, Henry Hub prices fell to an average of $1.74/MMBtu in April 2020, the lowest monthly average since March 2016.

The region produced 5.8 Bcf/d of associated gas in 2018, accounting for 51 percent of its natural gas production total and exceeding non-associated gas production in the Permian for the first time. A production decline in 2021 would mark the second consecutive year of declines, as responses to the COVID-19 pandemic led to supply and demand disruptions. But EIA said it expects crude oil production to increase in 2022 by 0.4 million bpd because of increased drilling as prices remain at or near $50 per barrel. The quality and completeness of the available data we used to build the tables varies by state.

Recent Data

EIA expects new-well oil production per rig to drop 25 b/d to 1,023 b/d from February to March. Productivity in the Niobrara is expected to drop 77 b/d per rig month/month, with Permian rig productivity on track to drop 34 b/d month/month. Meanwhile, oil production from the plays is projected to drop a combined 77,000 b/d month/month to just over 7.5 million b/d. The Anadarko is projected to post the largest decline at 19,000 b/d, with the Bakken (down 18,000 b/d), the Eagle Ford (down 16,000 b/d) and the Niobrara also projected to slow output. EIA expects the Permian, the most active U.S. onshore play, to slow output by 5,000 b/d to 4.315 million b/d in March. Last month’s DPR modeled a similar monthly decline in natural gas output from the seven plays for the January-to-February time frame.

Plant-level location and capacity information for all natural gas processing plants in the United States. U.S. and State supplies of synthetic natural gas, biomass, refinery gas, propane-air, etc. Tools to customize searches, view specific data sets, study detailed documentation, and access time-series data.

Prices

The Tennessee Zone 4 Marcellus spot price decreased 53¢ from $2.44/MMBtu last Wednesday to $1.91/MMBtu yesterday. The price at Dominion South in southwest Pennsylvania fell 47¢ from $2.50/MMBtu last Wednesday to $2.03/MMBtu yesterday. Significantly warmer-than-average temperatures in the Northeast lead to rapid price declines in the region. Temperatures across New England rose throughout the report week with average temperatures reaching approximately 20ºF warmer than normal yesterday. At the Algonquin Citygate, which serves Boston-area consumers, the price went down $5.87 from $8.24/MMBtu last Wednesday to a weekly low of $2.37/MMBtu yesterday.

- EIA forecasts industrial consumption will average 23.8 Bcf/d in 2021 (up 1.3 Bcf/d from 2020) as a result of increasing manufacturing activity amid a recovering economy.

- U.S. annual average NGPL production grew 7.0% in 2020, reaching 5.2 million barrels per day (b/d).

- In the High Oil Price case, US natural gas net exports reach nearly 13 tcf by the late 2030s, most of which is LNG.

- Most U.S. oil and natural gas production comes from wells that produce between 100 barrels of oil equivalent per day (BOE/d) and 3,200 BOE/d .

- Daily production reached an estimated 20.9 Bcf/d on February 24, only about 0.3 Bcf/d lower than the average in the week ending February 13.

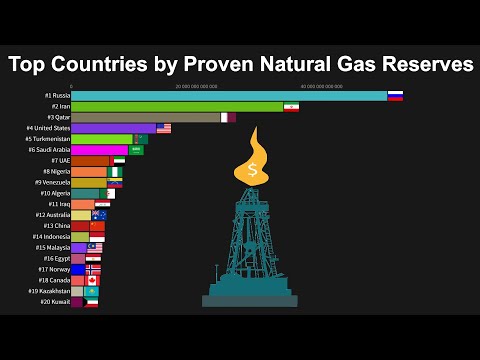

Wyoming saw the largest decline in production, decreasing 10.6% from 4.3 Bcf/d in 2018 to 3.9 Bcf/d in 2019. Crude oil and total petroleum imports by the top 15 countries and a summary of crude oil imports by company from the Persian Gulf (year-to-date). U.S. natural gas production—as measured by gross withdrawals—averaged 111.2 billion cubic feet per day (Bcf/d) in 2020, down 0.9 billion Bcf/d from 2019 as result of a decline in drilling activity related to low natural gas and oil prices in 2020. Total exports of natural gas increased 13.1%, from 12.8 Bcf/d in 2019 to 14.4 Bcf/d in 2020. These annual export totals were the highest on record for any year since EIA began tracking natural gas exports in 1973. Tight natural gas was first identified as a separate category of natural gas production with the passage of the Natural Gas Policy Act of 1978 . The NGPA established tight natural gas as a separate wellhead natural gas pricing category that could obtain unregulated market-determined prices.

U S. Natural Gas Production, Consumption, And Exports Set New Records In 2019

On the other hand, per-rig productivity in Appalachia is set to climb 272 Mcf/d month/month, according to the February DPR. After reaching a daily low on February 17, natural gas production in Texas began increasing as temperatures started to rise. Daily production reached an estimated 20.9 Bcf/d on February 24, only about 0.3 Bcf/d lower than the average in the week ending February 13. The DPR metric legacy oil/natural gas production change can become unstable during periods of rapid decreases or increases in the volume of well production curtailments or shut-ins. This effect has been observed during winter weather freeze-offs, extreme flooding events, and the 2020 global oil demand contraction.

In most of the AEO2020 cases, net natural gas exports continue to increase through 2050, and most of the increase is in the near term. Total dry gas production in the US will continue to increase until 2050 in most forecast scenarios, mainly to support US natural gas exports to the global market, according to the US Energy Information Administration’s 2020 Annual Energy Outlook.

Company level statistics for supply, disposition, and delivery volumes; end-use prices; and number of customers. Forms EIA uses to collect energy data including descriptions, links to survey instructions, and additional information. U.S. energy-related carbon dioxide emissions are expected to increase by 6% in 2021, from 2020, as economic activity increases and energy use rises. U.S. electricity consumption is expected to rise by 2.1% in 2021 after falling 3.8% in 2020. U.S. LNG exports are projected to average 7.8 billion cubic feet per day from March to May. In its latest outlook, the EIA takes the conservative view that electric cars will not have a big impact on power demand, claiming a “lack of market evidence to date that would indicate a significant increase in U.S. consumer preference for EVs.” In an alternative “low renewables cost” EIA scenario, the crossover would happen in the 2030s.

Natural Gas Annual

At 53ºF in Los Angeles and 49ºF in San Francisco, reported average temperatures were 7ºF and 6ºF cooler than normal for the day, respectively. Continuing maintenance on pipelines serving Southern California reduced supply to the state. The El Paso Natural Gas Pipeline reported continuing work near the Hackberry, Arizona, compressor station. Work on Kern River Gas Transmission Company’s Goodsprings Compressor Station outside of Las Vegas, Nevada, also continues.

You can use the Appendix C spreadsheet to generate figures for all regions and for additional variables. EIA designates wells as either oil or natural gas wells based on a gas-oil ratio of 6,000 cubic feet of natural gas to 1 barrel of oil (cf/b) for each year’s production. If the GOR is equal to or less than 6,000 cf/b, then we classify the well as an oil well. If the GOR is greater than 6,000 cf/b, we classify the well as a natural gas well. Technological innovation in drilling and production has caused rapid growth in U.S. oil and natural gas production during the past few years. One way of developing deeper insight into this rapid growth is to explore how U.S. oil and natural gas wells have changed. This report looks at the distribution of wells by size and technology to understand these trends.

Climate Fintech Startup Atmos Financial Puts Savings To Work For Clean Energy

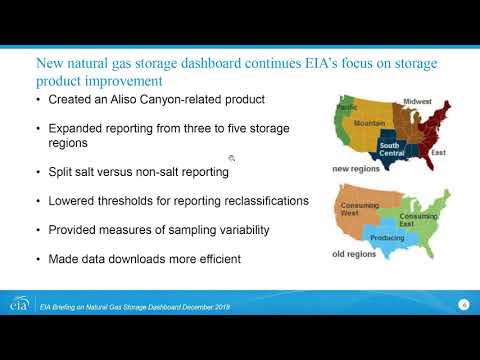

Natural gas consumption was the highest for the month since EIA began using the current definition for consumption in 2001. Annual company-level supply and disposition data for all natural gas local distribution companies in the United States. Annual field-level storage capacity and field-type data for all underground storage fields in the United States. Ranks the 100 largest U.S. oil and gas fields by their estimated 2013 proved reserves. Subscribe to feeds for updates on EIA products including Today in Energy and What’s New.

The tight natural gas category gave producers an incentive to produce high-cost natural gas resources when U.S. natural gas resources were believed to be increasingly scarce. Although most of the natural gas and oil wells in the United States are on land, some wells are drilled into the ocean floor in waters off the coast of the United States.

Petroleum & Other Liquids

Information gained from developing the Barnett Shale provided the initial technology template for developing other shale plays in the United States. The net withdrawals from storage totaled 52 Bcf for the week ending March 5, compared with the five-year (2016–2021) average net withdrawals of 89 Bcf and last year’s net withdrawals of 72 Bcf during the same week. Working natural gas stocks totaled 1,793 Bcf, which is 141 Bcf lower than the five-year average and 257 Bcf lower than last year at this time. Most prices throughout the Permian production region fall approximately 30¢/MMBtu week over week. The price at the Waha Hub in West Texas, which is located near Permian Basin production activities, averaged $2.64/MMBtu last Wednesday, 20¢/MMBtu lower than the Henry Hub price.

Before the economiccontraction caused by mitigation efforts in response to COVID-19, EIA expected natural gas production would flatten in 2020 because of the oversupplied market created as natural gas production growth has outpaced demand growth. The United States set annual natural gas production records in2018and2019, largely because of the increase in drilling in shale and tight oil formations. This increase in production led tohigher volumes of natural gas in storageand a decrease in natural gas prices. The United States set annual natural gas production records in2018and2019, largely because of increased drilling in shale and tight oil formations. The increase in production led tohigher volumes of natural gas in storageand a decrease in natural gas prices.

For 2021, overall dry natural gas production is expected to be an average of 91.4 billion cubic feet per day, up 0.9 billion cubic feet per day from the EIA’s previous outlook. The higher forecasts can be attributed to higher forecast crude oil prices, which are expected to contribute to more associated natural gas production. Associated natural gas production from oil-directed wells in thePermian Basinwill fall because of lower West Texas Intermediate crude oil prices and reduced drilling activity in the first quarter of 2021, the administration added. Natural gas production from dry regions such as Appalachia depends on the Henry Hub price. EIA forecasts the Henry Hub price will increase from $2.00 per million British thermal units in 2020 to $3.01/MMBtu in 2021 and to $3.27/MMBtu in 2022, which will likely prompt an increase in Appalachia’s natural gas production. EIA forecasts that U.S. production of dry natural gas averaged 87.8 Bcf/d in February, which is down from 92.4 Bcf/d in December . The decline in natural gas production was mostly a result of freeze-offs, which occur when water and other liquids in the raw natural gas stream freeze at the wellhead or in natural gas gathering lines near production activities.

EIA noted the forecast depends on production decisions by OPEC+, the responsiveness of U.S. tight oil production to higher oil prices and the pace of oil demand growth. OPEC crude oil production is expected to be flat at 25.3 million barrels per day in April, from March, and down 1.6 million barrels per day from EIA’s projections in its previous outlook. OPEC crude oil production is expected to rise to 26.6 million barrels per day in May. The rise will be the result of Saudi Arabia ending voluntary cuts of 1 million barrels per day and the relaxation of cuts that were extended through April at the March 4 OPEC+ meeting. OPEC is expected to produce 27.9 million barrels per day in the second half of 2021 as OPEC+ increases crude oil output to supply rising global oil consumption. Extreme winter weather, especially in Texas, contributed to the rise in crude oil prices in February, according to a new outlook from the U.S.

EIA estimates that total natural gas consumption in February was the highest on record, at 111.8 Bcf/d, because cold weather affected much of the United States and increased natural gas demand for heating and power generation. However, EIA expects natural gas consumption in March to decline from February levels as temperatures return closer to normal, based on forecasts by the National Oceanic and Atmospheric Administration. Demand declines as residential/commercial consumption falls to lowest level for the same week since 2016. Total U.S. consumption of natural gas fell by 4.8% compared with the previous report week, according to data from IHS Markit. In the residential and commercial sectors, consumption declined by 9.0% as warmer-than-average temperatures across most of the country depressed space heating demand. Natural gas deliveries to U.S. liquefied natural gas export facilities averaged 10.6 Bcf/d, or 0.87 Bcf/d higher than last week. Find statistics on prices, exploration & reserves, production, imports, exports, storage and consumption.

During the 1980s and 1990s, Mitchell Energy experimented with alternative methods of hydraulically fracturing the Barnett Shale. By 2000, the company had developed a hydraulic fracturing technique that produced commercial volumes of shale gas. As the commercial success of the Barnett Shale became apparent, other companies started drilling wells in this formation, and by 2005, the Barnett Shale was producing almost half a trillion cubic feet of natural gas per year. As natural gas producers gained confidence in their abilities to profitably produce natural gas in the Barnett Shale and saw confirmed results in the Fayetteville Shale in northern Arkansas, producers started developing other shale formations. These new formations included the Haynesville in eastern Texas and north Louisiana, the Woodford in Oklahoma, the Eagle Ford in southern Texas, and the Marcellus and Utica shales in northern Appalachia. Additional sources of hydrocarbon gases that are included in U.S. natural gas production and consumption are supplemental gaseous fuels, which include blast furnace gas, refinery gas, biomass gas, propane-air mixtures, and synthetic natural gas . These supplemental gaseous fuels were equal to about 0.2% of U.S. natural gas consumption in 2019.

Pennsylvania’s natural gas production increased 10%, from 16.9 Bcf/d in 2018 to 18.6 Bcf/d in 2019. Wyoming natural gas production decreased 11%, from 4.3 Bcf/d in 2018 to 3.9 Bcf/d in 2019. The Appalachia region remains the largest natural-gas producing region in the United States. Natural gas production from the Marcellus and Utica/Point Pleasant shales of Ohio, West Virginia, and Pennsylvania continued to grow despite low regional natural gas spot prices. Natural gas production from these three states increased from 32.1 Bcf/d in 2019 to 33.6 Bcf/d in 2020. Within the Appalachia region, West Virginia had the largest increase in natural gas production, increasing by 1.2 Bcf/d, or 20%, to reach 7.1 Bcf/d. Natural gas production increased by 1.0 Bcf/d in Pennsylvania and decreased by 0.7 Bcf/d in Ohio.