Ism Manufacturing Survey

Table of Contents Heading

- Caveats On The Use Of The Ism Manufacturing Index:

- Eyeing China? Consider These Economic Indicators

- Economic Indicators You Should Know For Investment

- Market Snapshot: Global Manufacturing Pmis

- Center For Supply Chain Management

- Recent Manufacturing Articles

- Caveats On The Use Of The Ism Non

We’re also a community of traders that support each other on our daily trading journey. USD dives once again on net negative economic updates, continued stimulus hopes, & optimism of a recovery from continued positive vaccine headlines. This is important because manufactured goods make up almost half of the total economy. If manufacturing sales slow, these corporate buyers will cut back on industrial orders. People in charge of buying stuff for their company are called purchasing managers. A sample of items they might order includes cables, packing boxes, and computers.

Please consider a donation to Econintersect to allow continuing output of quality and balanced financial and economic news and analysis. Sign Up NowGet this delivered to your inbox, and more info about our products and services. ISM shall not have any liability, duty, or obligation for or relating to the ISM ROB Content or other information contained herein, any errors, inaccuracies, omissions or delays in providing any ISM ROB Content, or for any actions taken in reliance thereon. In no event shall ISM be liable for any special, incidental, or consequential damages, arising out of the use of the ISM ROB. Report On Business®, PMI®, and NMI® are registered trademarks of Institute for Supply Management®. Institute for Supply Management® and ISM® are registered trademarks of Institute for Supply Management, Inc.

Caveats On The Use Of The Ism Manufacturing Index:

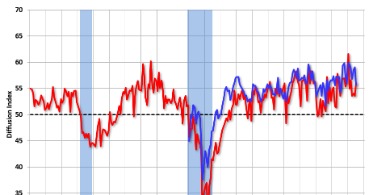

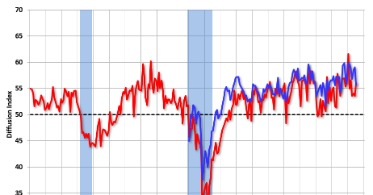

The activities include new orders, production, employment, supplier deliveries, inventories, customers’ inventories, commodity prices, order backlog, new export orders, and imports. An index of more than 50 indicates an expansion in the manufacturing segment of the economy in comparison with the previous month while a reading of 50 indicates no change and a reading below 50 suggests a contraction of the manufacturing sector.

The prices paid for services and goods by companies can be an indicator of inflation, which is a measure of how much prices increase in an economy. Higher prices could also be an indicator of a shortage in supply for particular goods. Inventory levels are tracked each month to show whether there’s a reported increase or decrease. For example, if a company experienced no sales growth, its inventory levels might have remained the same due to a lack of demand. New orders include new sales that were recorded for the month and whether businesses have seen increases or decreases in demand for their services versus prior months. For example, retailers might report a high demand for their services at year-end due to the holiday season. New orders help provide insight as to the demand for services by consumers and businesses and, ultimately, whether economic growth is increasing or decreasing.

Eyeing China? Consider These Economic Indicators

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. The Non-Manufacturing Index which is a weighted composite index for non-manufacturing data (similar to the Purchasing Managers’ Index ) was developed and first published in the January 2008 Non-Manufacturing ISM Report On Business. This was not available prior to that date because there was insufficient non-manufacturing historical data to develop a composite index. In January 1989, the Supplier Deliveries Index from the Report became a standard element of the DOC’s Bureau of Economic Analysis Index of Leading Economic Indicators. The origin of the Manufacturing ISM Report On Business can be traced back to 1923. The ISM, then known as the National Association of Purchasing Agents (N.A.P.A.), began to survey its members and share the results with them. Three years later, N.A.P.A. selected Edward T. Gushee, a purchaser from Detroit, Michigan, to supervise the organization’s survey group and expand the information they gathered.

- Economists also forecast lower unemployment rates each quarter compared with their December projections.

- Supply chains are improving their ability to produce despite continued pandemic-related pressures.

- The all-time high was 77.5% in July 1950; the all-time low, 29.4% in May 1980.

- The survey’s measure of prices paid hit its highest level in 10 months, suggesting some building up of inflation pressures at the factory level.

- The ISM®Prices Index registered 53.2 percent, 1.9 percentage points higher than the June reading of 51.3 percent, indicating raw materials prices increased for the second consecutive month.

- When looking at the relationships with the annual rate of change in the official data, the highest correlation is again achieved by the IHS Markit PMI at 0.84, followed by the Chicago ISM at 0.77.

- A survey of economists by the National Association for Business Economics showed increased optimism about the economy’s prospects this year.

Lower correlations are observed across the board with month-on-month changes due to the high volatility of the official data (see section ‘Comparing with official growth rates’ at the end of this report). The ISM Semiannual Report, released in May and December, provides insight into both the manufacturing and non-manufacturing sectors of the U.S. economy.

Economic Indicators You Should Know For Investment

The peak number of unemployed people for the Great Recession, as measured in the household survey portion of the monthly Employment Situation report, actually occurred in October 2009, four months after the official end of the recession, and was 15.4 million. Among the key components of the nonmanufacturing index, the business-activity index was 26.0 in April, down from 48.0 in March and is the lowest reading since the survey began in 1997. For April, 17 industries in the nonmanufacturing survey reported contraction. The Institute for Supply Management’s nonmanufacturing index dropped to a reading of 41.8 in April from 52.5 in the prior month. The April result is the first below the neutral 50 threshold since December 2009 and the lowest result since March 2009 during the Great Recession . Readings above 50 suggest expansion for the nonmanufacturing sector and historically, readings above 48.5 have suggested expansion of the overall economy. The April figure ends a run of 122 months of expansion for the sector and 128 months of growth for the economy.

This page provides the latest reported value for – United States ISM Purchasing Managers Index – plus previous releases, historical high and low, short-term forecast and long-term prediction, economic calendar, survey consensus and news. United States ISM Purchasing Managers Index – data, historical chart, forecasts and calendar of releases – was last updated on March of 2021. Customer inventories in October are still considered too low, with the index remaining below 50 at 36.7 percent versus 37.9 percent in the prior month and the lowest level since June 2010 (index results below 50 indicate customers’ inventories are too low; see second chart).

Market Snapshot: Global Manufacturing Pmis

Economists surveyed by Dow Jones and The Wall Street Journal had forecast the ISM index to total 58.9%. The Institute for Supply Management said its manufacturing index climbed to 60.8% from 58.7% in the prior month and matched a three-year high.

The index of new orders jumped to 31.8 from 27.1, and ISM’s production metric leaped to 33.2 from 27.5. The Institute for Supply Management’s US manufacturing survey ticked slightly higher in May, ending a four-month decline that placed the industry at its lowest levels since the financial crisis. Timothy R. Fiore is chair of the Institute for Supply Management’s Manufacturing Business Survey Committee, which polls procurement professionals every month on 10 economic indicators. In our exclusive Q&A, he says the only thing holding U.S. manufacturers back is their inability to keep up with demand. Flash Manufacturing PMI is an estimate of manufacturing for a country, based on about 85% of total PMI survey responses each month. Other analysts said they believed manufacturing would be able to overcome the supply chain issues.

Center For Supply Chain Management

He said these shortages could hold back the recovery in manufacturing output in coming months. Average commitment lead time for Capital Expenditures increased by four days in July to 136 days. Average lead time for Production Materials increased by three days to 66 days. Average lead time for Maintenance, Repair and Operating Supplies decreased by one day to 35 days. “General business climate continues to be subdued, driving highly conservative forecasting due to variability in the ongoing pandemic-driven conditions and economic response.” The employment barometer also climbed for the third month in a row — to 54.4% from 52.6% — despite higher absenteeism and a dearth of skilled labor. The index for new orders advanced 3.7 points to 64.8% while the production gauge increased 2.5 points to 63.2%.

And to add to the confusion, Markit’s index improved whilst the ISM index declined – go figure. The ISM improved but remained in expansion whilst the Markit PMI improved advanced further into expansion. We have incurred air-shipment and production interruptions due to shortages of raw materials and components.” “The two main issues affecting our business COVID-19 and the oil-price war. We are in daily discussions and meeting constantly, updating tracking logs to document high risk concerns.” Average commitment lead time for Capital Expenditures was unchanged in August at 136 days.

Recent Manufacturing Articles

/PRNewswire/ — Economic activity in the manufacturing sector contracted in April, and the overall economy contracted after 131 consecutive months of expansion, say the nation’s supply executives in the latest Manufacturing ISM®Report On Business®. To gain an insight into the track record of the manufacturing business surveys in terms of their ability to accurately anticipate actual official factory production data , we look at how the survey indicators correlate with both the three-month-on-three-month and annual rates of change in the official data. Survey respondents are asked whether activities in their organizations are increasing, decreasing, or stagnant.

Trends can go on for months, which is valuable for analysts who focus on making long-term economic forecasts. The ISM Non-Manufacturing Index is an economic index based on surveys of more than 400 non-manufacturing firms’ purchasing and supply executives. The ISM services survey is part of the ISM Report On Business—Manufacturing and Services . Meanwhile, for those concerned that the ISM may be signalling a global manufacturing downturn, a better insight into global trends is provided by our global PMI, which is based on responses to monthly questionnaires sent to purchasing managers in survey panels in over 40 countries, totalling around 13,500 companies. Coverage includes all major developed and emerging markets which collectively account for 98% of global manufacturing value added.

The October result was the first and only reading above the neutral 50 threshold since July 2019 . The Bureau of Labor Statistics’ Employment Situation report for November is due out on Friday, December 4th. Consensus expectations are for a gain of 495,000 nonfarm-payroll jobs including the addition of 45,000 jobs in manufacturing. The unemployment rate is expected to fall to 6.8 percent from 6.9 percent in October. The ISM survey is broadly diversified across industries based on the North American Industry Classification System , which is weighted by each industry’s share of U.S. gross domestic product . Survey responses are delineated into 17 industry sectors, such as chemical products, computer, and electronic products, and transportation equipment.

The data in the current report compares information from the previous report versus what current conditions are. All the ISM indexes are diffusion indexes and are indicators of month-to-month change. The percent response to the “Better,” “Same,” or “Worse” question is difficult to compare to prior periods; therefore, ISM diffuses the percentages for this purpose. A diffusion index indicates the degree to which the indicated change is dispersed or diffused throughout the sample population. Respondents to ISM surveys indicate each month whether particular activities (e.g., new orders) for their organizations have increased, decreased, or remained unchanged from the previous month. Business Confidence in the United States averaged 52.91 points from 1948 until 2021, reaching an all time high of 77.50 points in July of 1950 and a record low of 29.40 points in May of 1980.

Us Manufacturing Activity Rebounds In January

“The PMI® contracted in March after expanding marginally in January and February. Three of the big six industries expanded, with Food, Beverage & Tobacco Products expanding strongly. Only one of the PMI®’s 10 subindexes recorded expansion, down from four the previous month,” says Fiore. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting. The services PMI report provides an overall outlook for business activity in the United States. The PMI index is reported as a number—above 50 represents growth or expansion while below 50 represents a contraction. The report also shows the industries that experienced growth in business activity compared to the prior month while showing which industries contracted. Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change and the scope of change. A PMI®reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally declining.

“Our packaging business is starting to see signs of a slowdown in May after two strong months into COVID-19.” The outperformance of the IHS Markit data relative to the ISM is less obvious, though is likely a consequence of ISM only surveying large companies while the IHS Markit survey covers small, medium and large companies in the correct proportions, as defined by the official data. When looking at the relationships with the annual rate of change in the official data, the highest correlation is again achieved by the IHS Markit PMI at 0.84, followed by the Chicago ISM at 0.77. Most major financial media agencies cover the Report each month on the first and third business day of the month. Articles regularly appear in The Wall Street Journal, Financial Times, MarketWatch, MNI, Bloomberg and others. The Trading Economics Application Programming Interface provides direct access to our data.

Caveats On The Use Of The Ism Non

Average lead time for Maintenance, Repair and Operating Supplies increased by six days in March to 37 days. ,” says Fiore. A reading below 50 percent indicates faster deliveries, while a reading above 50 percent indicates slower deliveries. “COVID-19’s spread in the U.S. may start impacting our domestic business. As for Asian suppliers, they are starting to get back up to speed.” Monitoring the ISM Services PMI can help investors better understand the economic conditions within the U.S. Also, some service sectors may experience growth while others contract, which can be helpful when choosing which industry to invest in via equities or corporate bonds. The ISM Services PMI provides significant information about factors affecting total output, growth, and inflation.