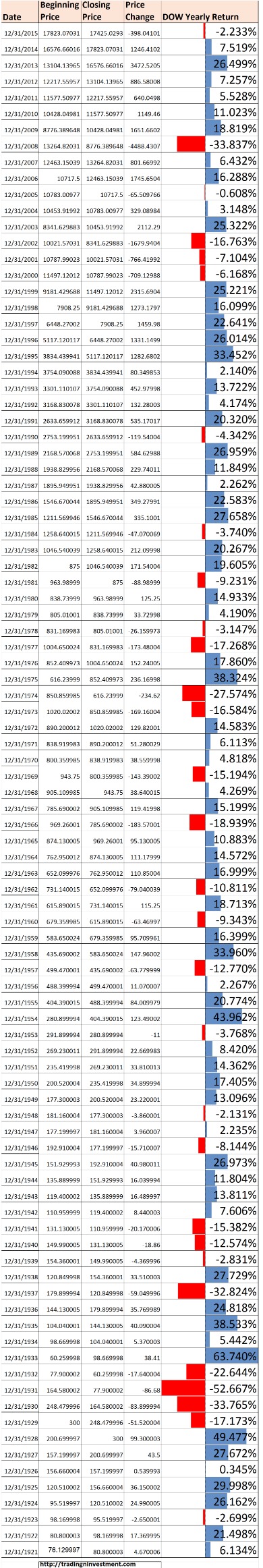

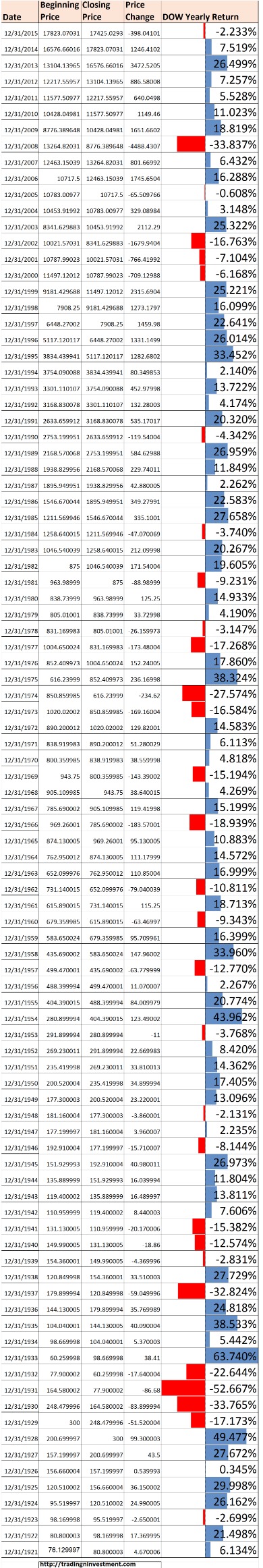

Dow Jones Index Year To Date

Table of Contents Heading

- Notes & Data Providers

- Issues With Market Representation

- ‘liquidity Jumping’: Stock Market Update For The Week Ahead

- Stock Market Crash

- Movers Djia

- Global Markets Leading Indicator Euro: Very Bullish Going Into 2021

- S&p 500 Up 0 1%; Dow Down 0.1%

- Dow Jones Indu Average Ndx (dow Jones Global Indexes:indu)

We’ve estimated Dow Jones performance and returns back to 1896. The Smart Investing & Trading Score from previous trading session is 100 and hence a deterioration of trend. Bespoke Investment Group provides some of the most original content and intuitive thinking on the Street. Along with running their Think B.I.G. finance blog, Bespoke provides timely investment ideas through its Bespoke Premium subscription service and also manages money for high net worth individuals. Another four stocks are up more than 10% YTD — Procter & Gamble , McDonald’s , Caterpillar , and UnitedHealth . Then you have Visa , Johnson & Johnson , and Amgen up on the year but only marginally.

The stock market historically performs similarly to the economy. Abear market(prices decrease 20% or more) occurs during a recession and abull market during an expansion.

It was also in 2008 that some of the largest ever recorded losses of the Dow Jones Index based on single-day points were registered. On September 29th of 2008, for instance, the Dow had a loss of 106.85 points, one of the largest single-day losses of all times. The best years in the history of the index still are 1915, when the index value increased by 81.66 percent in one year, and 1933, year when the index registered a growth of 63.74 percent. Using a calculation including dividend reinvestment, the Dow Jones returned 25.34% in 2019. Expert market commentary delivered right to your inbox, for free.

Notes & Data Providers

First calculated on May 26, 1896, the index is the second-oldest among the U.S. market indices . It was created by Charles Dow, the editor of The Wall Street Journal and the co-founder of Dow Jones & Company, and named after him and his business associate, statistician Edward Jones. The word industrial in the name of the index initially emphasized the heavy industry sector, but over time stocks from many other types of companies have been added to the DJIA. The value of the index is the sum of the stock prices of the companies included in the index, divided by a factor which is currently (as of September 2020) approximately 0.152. The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split. ), is a stock market index that measures the stock performance of 30 large companies listed on stock exchanges in the United States. At the time, investors had little access to truthful and unbiased information about company financials.

In July and August, the Dow rose as investors flocked to safe U.S. markets after turbulence rocked the European Union. This threatened U.S. businesses, the U.K.’s largest investors. The Dow suffered a market correction between August 2015 and April 19, 2016, leading to a 2016 downturn.

Issues With Market Representation

The kickoff to the Dow’s slide was thestock market crash of 1929, but the Great Depression had already started in Aug. 1929, when the economy contracted. The downturn reflected a 10-month recession, from July 1953 to May 1954, during the military demobilization following the Korean War. It closely followed the economic downturn of the recession, which started in April 1960. It lasted 10 months, until Feb. 1961 when President Kennedy used stimulus spending to end it. On Oct. 27, 1997, the Dow fell 554.26points for its biggest point loss ever at that time. The Dow peaked on Jan. 14, 2000, closing at 11,722.98, thanks to the boom in internet businesses. On Monday, Sept. 15, 2008, Lehman Brothers Holding, Inc. declared bankruptcy.

For now the quarterly chart suggests there is some upside potential. Note as well that each and every time the top of this giant channel is tested it results in a long and/or exceptionally aggressive decline. The decline back then was devastating, and it resulted in the Dow Jones falling to levels so low that even on a 100 year chart it was exceptional. The Dow Jones has a very long history so we can look at the longest timeframes. In order to understand long term trends you need to simplify things and set a few rules to determine trends.

Please scroll down to find the most up-to-date Dow Jones forecast for 2021. more quote information »MemoClick here to write a private note about this stock. You can calculate DJIA’s 1 month return from DJIA’s value today and DJIA’s value 30 days ago.

On February 19, 2008, Chevron Corporation and Bank of America replaced Altria Group and Honeywell. Chevron was previously a Dow component from July 18, 1930 to November 1, 1999. During Chevron’s absence, its split-adjusted price per share went from $44 to $85, while the price of petroleum rose from $24 to $100 per barrel. On November 1, 1999, Microsoft, Intel, SBC Communications, and Home Depot replaced Goodyear Tire, Sears Roebuck, Union Carbide, and Chevron Corporation. Intel and Microsoft became the first and second companies traded on the NASDAQ to be part of the Dow. A method of calculating a Dow Jones index that assumes all index components hit their high or low at the same time during the day.

‘liquidity Jumping’: Stock Market Update For The Week Ahead

A bull market had been running since March 11, 2009, when the Dow closed at 6,930.40. Until March 2020, it hadn’t fallen 20% since then, making it the longest-running bull market in U.S. history. However, the 2020 stock market crash and recession saw record-setting drops.

We wrote this update on August 23d, 20′, 5 months after the depth of the Corona crash. We wrote this update on April 27th, 20′, one month after the depth of the Corona crash.

Stock Market Crash

Note that we updated our articleThe Dow Jones Historical Chart On 100 Years with this up-to-date chart and related insights. As a next step we look at the Dow Jones charts in a top down approach. Please scroll down to find the most up-to-date Dow Jones forecast with post Corona crash charts. Register now to watch these stocks streaming on the ADVFN Monitor. Anyone investing in the US may find Dow Jones’s 10 years return important. It would be very easy to represent the return as a single number, however, there are multiple KPIs related to its performance. Enter a choice of fixed timeframes (e.g. 10 years, 20 years) and the tool will tell you summary statistics about returns over all those spans in our set.

The Wilshire 5000 Total Market Index was established by the Wilshire Associates in 1974, naming it for the approximate number of issues it included at the time. It was renamed the “Dow Jones Wilshire 5000” in April 2004, after Dow Jones & Company assumed responsibility for its calculation and maintenance.

Movers Djia

A crash is most often associated with an inflated stock market. An analysis of the historical data for the DJIA can help investors understand its all-time highs and downs. It would also be correct to say that AAPL and MSFT have especially been growth stocks leading the market higher.

Price-weighted indices derive their actual trading prices by the trading price of the underlying company shares times an individual stock factor. The 1990s brought on rapid advances in technology along with the introduction of the dot-com era. The markets contended with the 1990 oil price shock compounded with the effects of the early 1990s recession and a brief European situation surrounding Black Wednesday. The easiest way to invest indirectly in the Dow Jones Industrial Average is to buy an index fund which tracks its daily movement. Either a mutual fund or an exchange-traded fund can replicate, before fees and expenses, the performance of the index by holding the same stocks as the index, in the same proportions. Some ETFs use leverage or short strategies to magnify price movements. The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global.

Global Markets Leading Indicator Euro: Very Bullish Going Into 2021

For example, during September–October 2008, former component AIG’s reverse split-adjusted stock price collapsed from $22.76 on September 8 to $1.35 on October 27; contributing to a roughly 3,000-point drop in the index. Marked by global instability and the Great Depression, the 1930s contended with several consequential European and Asian outbreaks of war, leading up to catastrophic World War II in 1939. The United States experienced the Recession of 1937–1938, which temporarily brought economic recovery to a halt. The largest one-day percentage gain in the index happened in the depths of the 1930s bear market on March 15, 1933, when the Dow gained 15.34% to close at 62.10. However, as a whole throughout the Great Depression, the Dow posted some of its worst performances, for a negative return during most of the 1930s for new and old stock market investors. For the decade, the Dow Jones average was down from 248.48 points at the beginning of 1930, to a stable level of 150.24 points at the end of 1939, a loss of about 40%.

After a peak of 381.17 on September 3, 1929, the bottom of the 1929 crash came just 2 months later on November 13, 1929 at 195.35 intraday, closing slightly higher at 198.69. The Wall Street Crash of 1929 and the ensuing Great Depression over the next several years returned the average to its starting point, almost 90% below its peak. Overall for the 1920s decade, the Dow still ended with a healthy 131.7% gain, from 107.23 to 248.48 points at the end of 1929. In inflation-adjusted numbers, the high of 381.17 on September 3, 1929 was not surpassed until 1954.

For many viewers, content quality is extremely important when it comes to entertainment. The Disney brand, coupled with its powerful and unparalleled intellectual property , will likely be the magnet that draws viewers to its streaming service.

Continuous Follow Up On Our Dow Jones Forecast (free Forecasting Email Newsletter)

The Dow Jones Industrials Index is the most known and oldest stock market index. The Dow Jones historical chart on 100 years has a breathtaking chart pattern.

- This threatened U.S. businesses, the U.K.’s largest investors.

- However, it continued to rise in the short term such that, on February 8, 2013, the index surpassed the 16,000 level for the first time.

- The markets contended with the 1990 oil price shock compounded with the effects of the early 1990s recession and a brief European situation surrounding Black Wednesday.

- Investopedia requires writers to use primary sources to support their work.

- That correction was more than 16% lower than its all-time high set in May of the same year, putting the index into a correction but not a bear market.

- After a peak of 381.17 on September 3, 1929, the bottom of the 1929 crash came just 2 months later on November 13, 1929 at 195.35 intraday, closing slightly higher at 198.69.

Investors were encouraged by the progress made onTrump’s North American Free Trade Agreement renegotiation. On Aug. 27, 2018, the Dow ended a six-month correction (a decline of 10% or more) when it reached 26,049.64. This was 10% above its closing low of 25,533.20, reached on March 23. This was the longest correction since 1961, when a correction lasted for 223 sessions. The index breached 26,000 on January 17, then continued on to set 15 closing records in the rest of 2018. It hit two of them in the first few weeks in January, closing above 25,000 on January 4.

S&p 500 Up 0 1%; Dow Down 0.1%

Ranking second is the newly-added Dow stock salesforce.com , which is up 61% year-to-date and 9.5% above its 50-day moving average. On April 20, 2007, the index closed above 15,000 for the first time. The index reached an all-time high on October 9, 2007 at the 15,806.69 point level, right before the onset of the Great Recession and the related financial crisis of 2007–08.

If this happens on a 3 week consecutive weekly closing basis we will know for sure that the Dow Jones is on its way to 32k points in 2021. Based on the elements in this article we conclude that the likelihood of stock markets moving higher in 2021 and 2021 is high. This implies that we can reasonably expect decent returns in stock markets. As you can see on the chart above, the average return is not a result of a balanced change all the time.

It was followed by two more record-setting point drops on March 12 and March 16. The stock market crash included the three worst point drops in U.S. history. Intraday Data provided by FACTSET and subject to terms of use. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. While stocks were setting a major low the financial news became more depressing than ever. Just listening to the news reports one would think the crash had to become much worse.

The CRSP U.S. Total Market Index is a very similar comprehensive index of U.S. stocks supplied by the Center for Research in Security Prices. After Dow Jones and Wilshire split up, Dow Jones made their own total stock market index, called the Dow Jones U.S. Total Stock Market Index, similar to the Wilshire 5000. Since late 2007, the expansion of subprime lending difficulties into a wider financial crisis plunged the United States into a renewed bear market that accelerated beginning on September 15, 2008. On October 8, the Wilshire 5000 closed below 10,000 for the first time since 2003. The index continued trading downward towards a 13-year low, reaching a bottom of 6,858.43 points, on March 9, 2009, representing a loss of about $10.9 trillion in market capitalization from its highs in 2007. A study between the correlation of components of the Dow Jones Industrial Average compared with the movement of the index finds that the correlation is higher when the stocks are declining.

Dow Jones Indu Average Ndx (dow Jones Global Indexes:indu)

Right now, the Dow Jones Industrials Index is trading in its upper band of its long term rising channel. It does not trade at an extreme level though, it is some 25% to 30% below extreme levels. The one and only time that the Dow Jones index fell below its 100 year rising channel was in .