Interactive Brokers Account Minimum

Table of Contents Heading

- Best Brokers For Penny Stocks

- How We Make Money

- Interactive Brokers Forex Review

- Buying Mutual Funds

- Investment Research

- Fund Your Account

- Ibkr Lite Ira Trading Fees

At this point, you only need to wait for IB to create and fund your account. After you have funded your account, there are still a few more things you can do. Another thing you need to configure when you create an IB account is the base currency of your account. I am going to make most of my payments in Swiss Francs . You can always convert money from your base currency to any other currency. On the second page, you will have to set your account type. You can check the kinds of accounts to make sure you choose the one according to your needs.

- Margin accounts on the contrary are riskier and should better be left for the experienced traders.

- The course includes over 48 unique courses for traders of varying skill levels.

- The Trader Workstation is robust and overwhelming for the new trader.

- It also is used for displaying combined margin requirements.

- TD Ameritrade $0 $49.99 $0 $0 $0 stock/ETF trades and transfer fee refund.

Desktop TWS designed for active traders with the most advanced forex trading tools and algos. The Trader Workstation includes news, risk analysis tools and technical analysis.

Best Brokers For Penny Stocks

Professional traders are brilliantly serviced with the trading tools, range of investments, and capabilities of Interactive Brokers. Meanwhile, less-experienced traders can still take advantage of the low commissions and excellent research through the web-based Client Portal platform. The disadvantages of IBKR platform is that that existing forex traders will need to learn the unique platform and that switching fx brokers later will be difficult with the need to switch platforms.

As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Perhaps 1 thing that raises the most red flags are those pesky commissions and margin fees. It might be reckless to choose a broker just because it’s the cheapest, but, boy, is it easy to overpay. It’s important to figure out on the front end exactly how much money will eke out during each trade. Lightspeed Trading offers volume discounts for frequent traders, low pay-per share commissions, direct access to ECNs and exchanges, and traders are also allowed a free practice account.

How We Make Money

You can download the demo without signing up for an account. All you have to supply is your email address and you can start executing pretend trades based on minute delayed data. You can try out different strategies and even test IB’s research tools within the demo. If you decide to open an account, you’ll use the same username and password to create the “real” account. If you have experience navigating complex platforms and enjoy transparent, low-cost trading, Interactive Brokers could be a great fit for you. On the plus side, IB has low fees, a vast range of available markets and products, anddiverse research tools. On the IBKR platform, you will have access to recommendations provided by third parties.

Everything must tick along as smoothly as a Rolex Cellini tracks the seconds in a day. Interactive Brokers provides one the most diverse offerings in the industry and leads by a wide margin in multiple areas, including international trading. Globally, customers can trade across more than 135 international markets in 33 countries. The flagship platform Interactive Brokers offers is Trader Workstation . TWS is a downloadable platform that is difficult to learn but comes packed with trading tools and features. Trader Workstation , Interactive Brokers’ downloadable platform, is packed with dozens of industry-leading tools professionals and institutions will appreciate. For inexperienced investors, the Client Portal web-based platform is straightforward and powerful enough to use as a trading platform, thanks to the Fundamentals Explorer tool.

Interactive Brokers Forex Review

The app works on all devices, including Apple and Android devices. You can execute basic stock trades or complex forex trades and everything in-between with the app. You can even access robust research right on the app, giving you flexibility while you are away from your computer.

The updates will be made each day following the market’s close in New York, and will be effective the next trading day. By regulation, brokers usually loan their clients 50% of the value of a new position, and 25% to maintain a current position. This will increase gradually to 67.5% for a new position and 33.75% for maintenance.

Buying Mutual Funds

Oh, and if you’re interested in seeing competing offers from other brokers, just check ourbroker comparison page. Interactive Brokers is unapologetic about catering to active traders, financial professionals, and sophisticated individual investors, which is reflected in its a la carte options for paid research. That its average client trades more than 300 times per year says a lot about the kinds of traders and investors who tend to gravitate to Interactive Brokers. Investors in the IBKR Pro plan who maintain a balance of $100,000 or more aren’t subject to minimum monthly commissions, thus avoiding Interactive Brokers’ minimum monthly fees of $10. Low commissions make IBKR Pro a compelling value for people who make frequent stock and options trades and want premium pro-oriented features. And the no-commission IBKR Lite plan is a great fit for less-active investors as well. As long-term buy and hold investors, we don’t necessarily make full use of all the bells and whistles of a fully-featured trading platform.

This means that losses can be substantial and traders should know the high risks of online trading and consider a demo account first. In regions such as America, Europe and Japan, leverage is heavily restricted. Traders looking for higher leverage should view the best forex broker table. This can include algorithmic traders who often require the highest leverage available. The two main trading fees for any forex broker are spreads and commissions.

Investment Research

Through AMP Global world , you can enter the world futures exchanges while trading forex and CFDs with your all-in-one Metatrader 5 account. This trading solution gives AMP Global an edge over rival firms. AMP Global is a CySEC-regulated forex, CFD and exchange-traded futures brokerage and brings the American trading experience to Europe. A futures demo account allows you to make trades and track how they would pan out without the risk of losing any real money. Day traders often buy large numbers of shares and wait for a small move before they sell.

However, the casual trader must consider inactivity fees, which can be as high as USD 20 per month, for not reaching the minimum monthly commission quota. Traders have a couple options at this broker, which has rolled out direct currency trading via TradeStation Crypto, with commission-based pricing for traders. Pricing is based on your account balance with the broker and whether your order is directly marketable. Normally pricing ranges from 0.25 percent of your order to 1 percent. Traders can also buy and sell bitcoin futures as well as take advantage of substantial volume trading discounts.

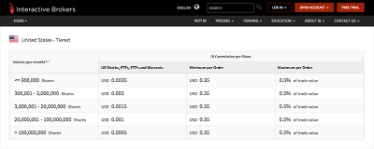

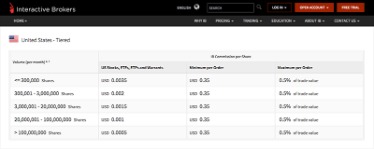

The variable commission schedule makes Interactive Brokers one of the cheapest brokers for small trades. Before we get into a discussion of Interactive Brokers’ pricing, it’s important to mention that there are two pricing plans customers can choose.

Fund Your Account

Interactive Brokers allows you set up your account, finish a current application, and view all the documents you’ll need for the process on this page. Once you start the application process, you’ll see an option on the right-hand side of the page to call the company if you have any questions throughout the process. Get your Interactive Brokers account up and running in just a few minutes.

The firm has recently done away with the $10,000 account minimum requirement, in a bid to attract more mass affluent customers. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Separate Trading Limit accounts are included in the consolidated calculation. Advisor and Broker Master accounts are not included in the consolidated calculation.

Interactive Brokers is also a great choice for options investors, traders, and those trading on margin. Interactive Brokers offers a robust selection of investments. You’ll find your standard stocks, bonds, and mutual funds. But you’ll also find ETFs, options, futures, and forex selections as well. Nevertheless, we recommend this broker mainly for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly.

NinjaTrader won the 2016 True Edge Futures Broker of the Year Gold Award and has the only platform powerful enough to run the Diversified Trading System. In addition, NinjaTrader offers extensive data feed options, flexible interface and free demonstration options. For professionals, Interactive Brokers offers a comprehensive selection of research tools. Alongside numerous screeners, traders can back-test strategies and conduct institutional grade portfolio analysis. Interactive Brokers allows you to buy bitcoin futures rather than owning the currency directly. And in this broker’s case, you can actually buy futures on the Chicago Mercantile Exchange, with all-in contracts costing $15.01 with five bitcoins per contract.

NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. A free version does exist without the extra goodies provided by Trader + and OrderFlow + but users can still break down charts, backtest strategies and trade without upfront payment.

Ibkr Lite Ira Trading Fees

And PayPal has also gotten in on the act, allowing U.S. users to buy and sell cryptocurrencies. It’s this kind of price movement that has attracted traders looking to ride the waves to profit. While some traders like to own the currency directly, others turn to the futures market. Futures may be an even more attractive way to play the volatility of digital currencies such as bitcoin, because they allow traders to use leverage to magnify their gains . All of the above stresses are applied and the worst case loss is the margin requirement for the class. Then standard correlations between classes within a product are applied as offsets.

Next, you’ll enter information about your net worth, liquid net worth, and annual net income, as well as your investment objectives and investing experience. Just answer these questions and head on to the next section. In this section, you’ll be asked whether you, or someone in your household, works for any major financial institutions or stock exchanges. You’ll also be asked whether you or an immediate family member is a director or 10% shareholder of a publicly held company. Lastly, you’ll enter some security questions for your account at the bottom of the page.

I do not think there is a way to transfer USD from a Swiss Bank account into their CH bank account. The only time I transferred USD is from an American bank account and this was free. I am trying to open an account from Switzerland and I got the same message. Exchange Traded Funds such as VT, which makes the most significant part of my portfolio.