Eu Inflation Rate

Table of Contents Heading

- Other Statistics On The Topiceuropean Union

- Inflation Returns To Positive Territory In January For The Eurozone

- Eurozone: Coronavirus Crisis Strikes Unprecedented Blow To Eurozone Economy In Q1

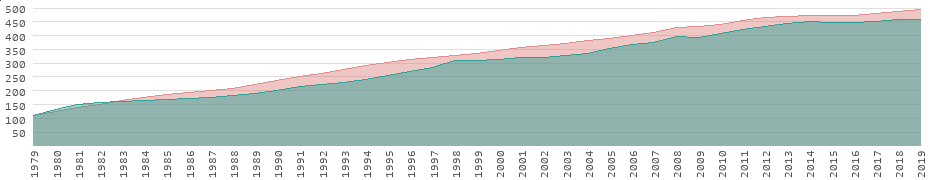

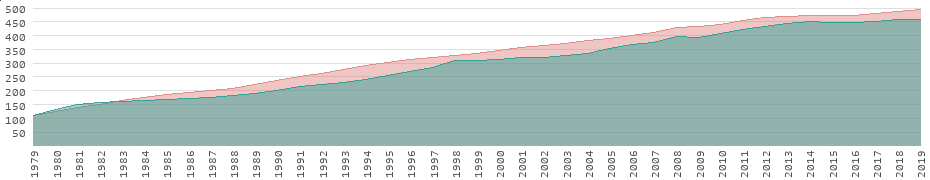

- Euro Area Inflation Chart

- Inflation In Eurozone

- The International Banker 2021 North & South American

- Historical Inflation Rates For Euro Area

Harmonized inflation fell to 0.4% in April from March’s 0.7%, marking the lowest reading since September 2016, according to a flash estimate released by Eurostat on 30 April. Inflation thus moved further below the European Central Bank’s target rate of near, but under, 2.0%. April’s further drop was again mainly due to a much sharper fall in energy prices, and to a lesser extent to slower price increases for services and non-energy industrial goods. On the other hand, prices for food, alcohol and tobacco rose at a much faster clip than in March, likely due to panic buying and slower deliveries. And having released the minutes of its January meeting a few days before the recent inflation data, the ECB made clear it expects higher inflation this year, especially in the short run on the back of higher energy prices. However, it also warned that “a temporary boost to inflation should not be mistaken for a sustained increase, which was still likely to emerge only slowly”. The general sentiment that inflation rates will continue registering increases during the coming months is growing.

The only exception was Lithuania where inflation edged down to 2.6% from 2.9% in May. In the Czech Republic (2.6%) and Hungary (3.1%), inflation came in above the Central Banks’ targets (2.0% and 3.0%, respectively) but remained within the ±1pp tolerance ranges around those targets, for now. In Romania, inflation remained elevated at 5.4% and has now exceeded the 3% ±1pp target range for six months in a row. Rising price pressures call for an end to the very loose monetary policy stance in the region in the next 12 months.

Recent monetary developments in the EMU are a reminder that it is simplistic and therefore risky to sum up the fuzzy concept of liquidity with QE as if it was the alpha and omega of monetary phenomena. The Covid-19 vaccine will supercharge global growth in 2021, but short-term headwinds, and a complete recovery only by 2022, will create transition risks. The Covid-19 crisis provides some leeway for policy support to absorb the negative impact from Brexit, but we expect UK GDP to remain -2% below pre-crisis levels at end-2022.

Other Statistics On The Topiceuropean Union

A simple answer may be that, in light of the Japanese experience, as long as inflation remains low, the central bank can continue to provide the necessary support by purchasing government bonds in the secondary market. In the case of the euro area, by allowing significant temporary deviations from its capital key in the allocation of purchases, the ECB may keep reducing cross-border fragmentation of sovereign debt markets, de facto helping troubled countries.

Central banks, and the ECB in particular, are likely to manage rate normalisation with a substantial dose of caution – again, while still supporting fiscal policy via market interventions. It is the job of central banks to keep rates as low as needed for as long as required to reach their objectives. With a two-year-out inflation forecast below 1.0%, the ECB has plenty of work to do. For as long as the ECB continues to perform quantitative easing , markets will stay calm. Evidence from the past 25 years shows that, if anything, inflation risk has hardly moved upward. There is an argument for central banks to err on the side of caution and/or aim for inflation overshooting , supporting fiscal policy along the way.

Inflation Returns To Positive Territory In January For The Eurozone

The ECB’S own forecasts, released after its monetary-policy meeting on September 10th, show that it is failing. Financial markets expect it will stay around that level for most of the next decade. The single currency has appreciated by 5.4% against the dollar this year. We assume a somewhat lagged policy reaction by the ECB, with a total of a 3.0 percentage point rise in short-term interest rates over (1.0 percentage points a year), with a parallel move in the yield curve. The increase in rates has a moderate and lagged negative effect on economic activity and the GDP deflator eventually returns to a value close to the ECB’s inflation target at close-but-below 2.0%.

Inflation returned to the euro area in January thanks to temporary shifts in prices, suggesting the European Central Bank won’t see any need to change its course in supporting the economy. BRUSSELS – Euro zone consumer inflation rebounded by much more than expected in January, a flash estimate showed on Wednesday, pushed up by a jump in prices in Germany and the Netherlands, and despite the continued downward pull from cheaper energy.

Eurozone: Coronavirus Crisis Strikes Unprecedented Blow To Eurozone Economy In Q1

Core inflation, which excludes volatile energy and unprocessed foods prices, soared to 1.4% from 0.4% in December. Harmonized inflation came in at 0.9% in January, swinging from December’s 0.3% year-on-year drop in prices and marking the strongest reading in close to one year. Inflation nonetheless remained below the European Central Bank’s target rate of near, but under, 2.0%. January’s jump was due a softer fall in prices for energy, a turnaround in prices for non-energy industrial goods, and faster increases in prices for services and for food, alcohol and tobacco.

Once the GDP deflator is close to 2%, real short-term interest rates will be close to 1% and long-term real interest rates to 2%. Market fragmentation within the euro area and different paces and magnitudes of economic recovery across member states present a further complication. If a large country like Italy remains a laggard , the recovery divide across borders would once again be a significant problem for the euro area as a whole. It would trigger calls for an early tightening of fiscal policy and possibly managed debt restructuring, both undesirable but eventually inevitable steps in the absence of effective correction. The vast literature on debt sustainability has recently been enriched by liquidity risk, contagion, implicit and contingent liabilities, tail risks and so on .

Euro Area Inflation Chart

The annual core inflation, which excludes volatile prices of energy, food, alcohol & tobacco and at which the ECB looks in its policy decisions, was unchanged at 0.2 percent in December, the lowest on record. But at present it partly reflects a suspicion that the ECB is willing to live with a lower rate of inflation than its official target demands. That risks damaging both the central bank’s credibility and also the euro zone’s recovery.

The conceptual and practical difficulties identified by the European Commission are not viable excuses for inaction, especially after 20 years. an assessment carried out by the European Commission published later in 2018 tells a somewhat different story. The document reveals there are strong conceptual disagreements over the statistical nature of housing prices and how to incorporate it into the HICP – which ultimately block the resolution of this issue. owner-occupied housing price index and it released its first data in 2006. But 20 years later, its inclusion into HICP has still not been achieved. including properly the cost of housing in HICP would likely make the ECB’s monetary policy more counter-cyclical, as the ECB would probably have to reduce significantly the size of its stimulus right now, while it would act more decisively if there was a crisis.

Inflation In Eurozone

Dutch inflation is the highest after Ireland’s, followed by Greece on 3.6 per cent and Portugal on 3.5 per cent. GDP rose 3.1% in seasonally-adjusted quarter-on-quarter terms in Q4, benefiting from the easing of trading and travel restrictions in Victoria, as well as strong fiscal and monetary stimulus. All data and calculations are based on the official Consumer Price Indexes published monthly by the Eurostat, statistical service of the European Commission.

Ireland was one of only three countries to report a monthly rate above 0 per cent. Annual inflation in the euro zone fell from 2 per cent in May to 1.8 per cent in June, the European Commission’s statistical office said yesterday. Ian Webster is an engineer and data expert based in San Mateo, California. He has worked for Google, NASA, and consulted for governments around the world on data pipelines and data analysis. Disappointed by the lack of clear resources on the impacts of inflation on economic indicators, Ian believes this website serves as a valuable public tool. A complete set of data for harmonized inflation will be released on 23 February. Consumer Prices are representing the prices that the end consumer has to pay for the product or service together with all taxes and fees and the indexes are calculated since 1996.

Biotech companies and Big Pharma are set to be the winners of the game at the expense of generic manufacturers. Our estimates show that an additional point in a country’s 2020 EDI score translated to +0.25pp GDP growth in Q y/y. We use cookies to help provide and enhance our service and tailor content and ads. The difference in CPI between the years is used by the European Central Bank to officially determine inflation. Early 2020, the ECB ‘s new president Christine Lagarde hinted that the cost of housing may finally be included in the HICP by the end of the ECB ‘strategic review. CPI, calculated an experimental index designed for direct comparison with the HICP. In addition, the Division of International Labor Comparisons at the Bureau of Labor Statistics compiles international comparisons of the HICP for different countries.

The International Banker 2021 North & South American

We assume that all the new resorces will be used for additional spending, although the RRF allows for a fraction of the money to be used in line with EU priorities on existing projects. Our news analysis and commentaries provide readers with insight essential to understanding the three Baltic countries and their neighbors. With offices in Tallinn and Vilnius and its headquarters in Riga, The Baltic Times remains the only pan-Baltic English language newspaper offering complete coverage of regional events.

From the vantage point of the EU and especially the euro area members, the policy response to the pandemic crisis adds a key novel dimension, i.e. an ex-post insurance to shocks, this time provided jointly by the ECB and the EU budget. Business Insider reports that the rising tensions over trade tariffs have stirred trade war concerns between the United States and China, EU, Canada and Mexico.

These figures are published by Eurostat, the statistical office of the European Union. In the Eurozone, 35% of commercial bank loans are granted for the purpose of house purchase. This means that housing prices are more likely to be affected directly by monetary policy changes than most other budget items. It is silly that the ECB does not closely look at one of its main transmission channels, that of mortgage lending.

This will be welcomed by the European Central Bank , which has struggled to lift inflation towards its target of just under but close to 2 percent over the medium term. Zooming back to , if the euro area had to face the current crisis with the institutions, governance, beliefs and politics prevailing then, there would be a severe threat to the survival of the euro. While imbalances remain and even grow in some cases, the monetary union is less incomplete and fragile than it was. Nominal GDP growth (as a result of real GDP growth but also the GDP deflator, i.e. inflation), the interest rate burden and the primary balance are closely interconnected. A return of real GDP growth, in the presence of an ultra-accommodative policy, would likely lift inflation, everything else equal. Monetary policy would have to react pre-emptively to reduce inflation risk, raising the cost of sovereign borrowing.

We show that in the euro area, the US, Canada, Japan and Australia, inflation rates have been substantially and persistently different in different regions. Inflation differences can reflect normal adjustment processes such as price convergence or the Balassa-Samuelson effect, or can reflect the different cyclical position of regions.

Annual inflation rate in the Euro Area jumped to 0.9 percent in January of 2021, the highest rate since February of 2020, and ending 5 months of deflation. Figures beat market forecasts of a 0.5 percent rise, preliminary estimates showed. The annual core inflation, which excludes volatile prices of energy, food, alcohol & tobacco and at which the ECB looks in its policy decisions, jumped to 1.4 percent in January from a record low of 0.2 percent in each of the previous four months. Thanks mainly to higher prices for services and industrial goods, inflation in the eurozone returned to positive territory. According to Eurostat, the statistics office for the European Union , the euro area’s annual inflation rate was 0.9 percent in January 2021, up from -0.3 percent in December. As such, it is the highest reading since February 2020 and is in line with Eurostat’s estimates for January, issued in early February.

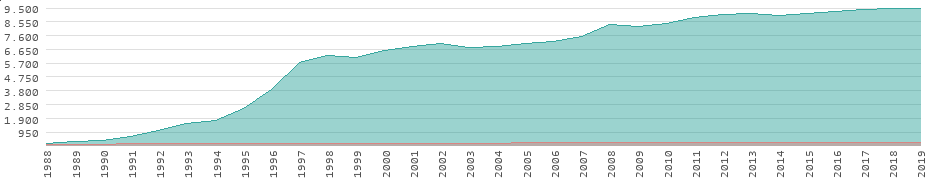

Historical Inflation Rates For Euro Area

The crisis primarily prevented many countries from refinancing their debt without help from a third party and slowed economic growth throughout the entire EU. As a result, general gross debt escalated annually in the euro area and more prominently in the EU. The collective sum of debt is most likely going to continue, given the current global economic situation as well as Europe’s recovering, however struggling economy.