Mutual Funds To Invest In

Table of Contents Heading

- Best Mutual Funds To Invest In 2020

- Stocks

- Mutual Fund Top Trending Terms

- Green Mutual Funds

- Do Any Mutual Funds Invest In Both Stocks And Bonds?

- Dodge & Cox Funds Rated 4 Stars Or Higher By Morningstar

- T Rowe Price Communications & Technology Fund

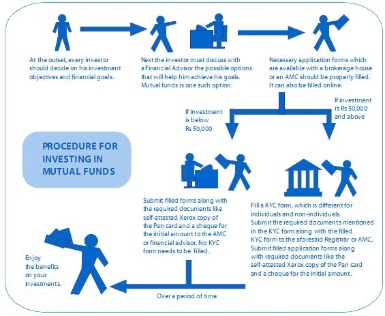

Once you have identified your goals and risk tolerance, proceed to choose the type of fund that suits your needs the best. Which one works for you will depend on the previously discussed goals and risk tolerance.

Now as a normal investor, how do you know when to pull your money out? One is the economic signals are there in terms of valuations, if valuations reach very high, that means that the market is over-promising the future. Today if you see the valuation chart, I believe we are still way off the peak valuations of the infra sector in 2008—which was the last very big peak, number one. Number two is with such an ambitious goal, normally you’d expect10-15% return from your normal diversified mutual fund. That’s what you expect, nominal GDP plus a little bit of alpha, plus 25% return per annum and let’s say you have a rule of 72, which is, at 25%, you will double your money in three years. No, I said if you take that kind of an approach, walk off with whatever you’ve made. After that, if you have lost, you have lost, but at least you have made money.

Best Mutual Funds To Invest In 2020

Can you talk a bit about this fund and if people have this fund what should they do and if they don’t have it, what should they do. Then, of course, if you can also give us a sense of the category. I will say that a lot of their most expensive funds are on that list like the Windsor II who’s fee is 0.34%. While this fund isn’t their best regarding the fee, it covers a much-needed gap in most people’s portfolios.

The other way to minimize your income tax bill is to invest in so-called tax-free mutual funds. These funds invest in government and municipal bonds, also called “munis,” that pay tax-free interest. This concept is pretty straightforward when it comes to investing in individual stocks. The world of mutual funds, however, is a little more complicated. Many investors have questions on the best way to calculate their taxes on mutual funds.

DODFX outdoes 93% of its peers, value-oriented foreign stock funds, over that time, too. But two additional things have been working against Dodge & Cox International Stock, which favors value-priced foreign shares, these days. Overseas stocks have lagged U.S. shares, and value-priced foreign stocks have lagged their growth counterparts for much of the past decade. As a result, some investments can take time to play out, which requires patience on the part of investors. These moves increased the fund’s corporate bond holdings to 45% of assets, paid for with proceeds from the sale of some holdings in mortgage bonds and Treasuries. But in the end, more than half of ANWPX’s assets are invested in U.S. firms. European firms comprise about a quarter of the fund’s assets; Asian companies in developed and emerging countries make up roughly 15%.

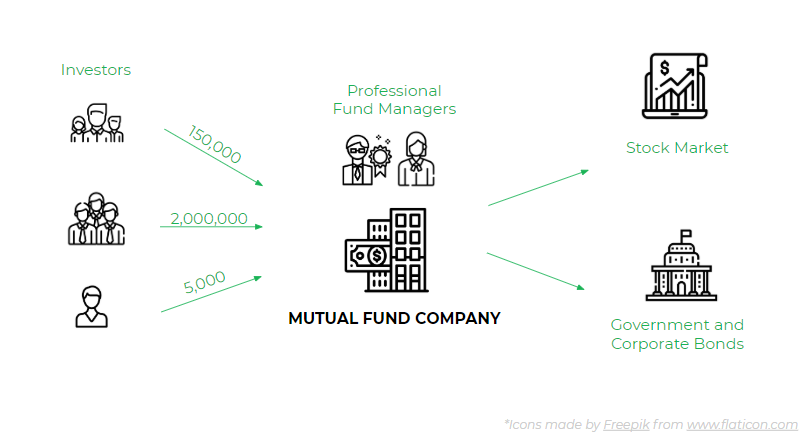

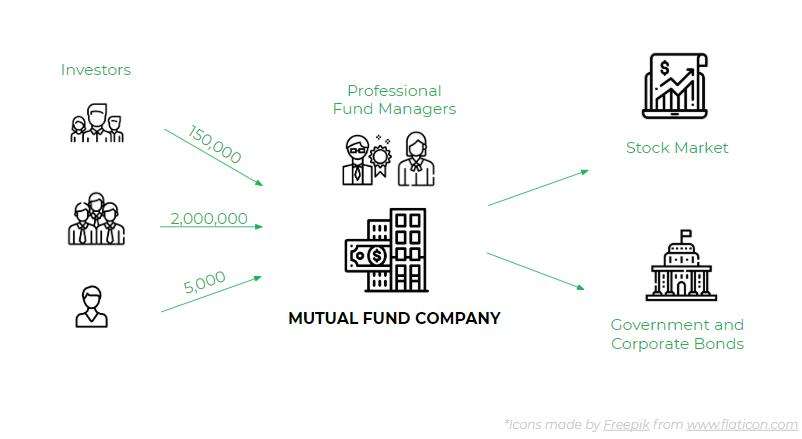

Mutual funds are actively managed by a professional money manager who constantly monitors the stocks and bonds in the fund’s portfolio. Because this is their primary occupation, they can devote considerably more time to selecting investments than an individual investor. It provides the peace of mind that comes with informed investing without the stress of analyzing financial statements or calculating financial ratios. Consider the risk factors – Remember that investing in mutual funds comes with a set of risks. Schemes that offer high returns is often accompanied with high risks. If you have a high appetite for risk and wish to accomplish high returns, you can invest in equity schemes. On the other hand, if you do not want to risk your investment and are okay with moderate returns, you can go for debt schemes.

Stocks

Tillinghast, a legend in the business, now manages 95% of the fund’s assets. Some focus on specific sectors; others are generalists who invest across the market. Market sentiment has worked against this value-minded fund for the past decade, as investors favored shares in fast-growing companies instead. But investors might finally be turning toward these bargain-priced stocks at last, if the last quarter of 2020 is any clue. As its name implies, American Balanced holds roughly 60% of its assets in stocks and 40% in bonds.

These value-focused mutual funds and ETFs all earn Morningstar Analyst Ratings of Silver or better. One mutual fund can invest in hundreds—sometimes thousands—of individual securities at once. So if any one security does poorly, the others are there to help offset that risk. Take some of the anxiety out of investing by letting a mutual fund do a little of the work for you. Supplement your core holdings with these funds to diversify more broadly and to tilt toward certain types of stocks and bonds. When a company declares a dividend, it also announces the ex-dividend date and date of record. The date of record is the date on which the company reviews its list of shareholders who will receive the dividend payment.

Mutual Fund Top Trending Terms

The top losers in the FMCG space were Hindustan Unilever, Britannia Industries, GSK Consumer, and United Spirits. Meanwhile, Tata Motors gained 7% and was the top performer in the Nifty index followed by Hindalco Industries, Wipro, and Maruti Suzuki. The stock prices of Godrej Properties hit a 52-week high after it gained 6% in the early trading hours on 5 April. Godrej Properties now owns 96.03% of Wonder Space Properties after it acquired its equity shares from Shubh Properties. Wonder Space Properties is involved in the construction and development of the areas in the National Capital Region . After the acquisition comes into effect, Wonder Space will become a subsidiary of Godrej Properties.

TheStreet Ratings uses multiple data points to rate mutual funds against their peers. Out of over 20,000 mutual funds that we rate, we consider these 20 funds to be the best.

Green Mutual Funds

You don’t have to keep track of every security your mutual fund owns. The fund is managed by experts who take care of that for you. With a no-load mutual fund, you pay one expense ratio—instead of racking up the commissions you’d pay when buying and selling individual securities yourself. If you want to invest for your future, you need to plan on investing consistently—no matter what the market is doing. Picking the right mutual fund is an important financial decision. In the long run, thousands or even tens of thousands of dollars could be riding on your call. But just because it’s important doesn’t mean it needs to be complicated or stressful.

Selecting a mutual fund may seem like a daunting task, but doing a little research and understanding your objectives makes it easier. If you carry out this due diligence before selecting a fund, you’ll increase your chances of success. Rather than looking at the recent past, investors are better off taking into account factors that influence future results. In this respect, it might help to learn a lesson from Morningstar, Inc., one of the country’s leading investment research firms. A study by investment firm Robert W. Baird & Co. looked into this phenomenon. The company found that even successful fund managers experienced periods of underperformance lasting two or three years. There are no benchmarks set in stone, but $100 billion in assets under management certainly makes it more difficult for a portfolio manager to efficiently run a fund.

The fund value is calculated as per the Net Asset Value , which is the value of the fund’s portfolio net of expenses. Diversification of your investments and follow-ups are important to ensure that you get the best out of your investment.

Do Any Mutual Funds Invest In Both Stocks And Bonds?

These generally come with lower fees than actively managed funds, with expense ratios started at 0.15%. Assets are not traded very often with passive funds, unless the benchmark index composition changes. The aim of an active fund is to outperform a benchmark index, and has higher fees than passive funds. Average fund performance measured against the S&P 500 throughout COVID-19. Instead of looking at the past to help make your decision, take into account the factors that will influence its results going forward. With this in mind, we can look to Morningstar.inc, a top investment research firm.

We want to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and safe by following our posting guidelines, and avoid disclosing personal or sensitive information such as bank account or phone numbers.

Dodge & Cox Funds Rated 4 Stars Or Higher By Morningstar

Similar to the majority of investment, there is risk involved with mutual funds in that you could lose money. The value of most mutual funds will change as your investments go up or down. Typically, the more the potential returns, the more risk will be involved. Mutual fund investors buy shares in a company that buys shares in other companies . Stay engaged with how your funds are performing and regularly rebalance your portfolio. Over time, certain mutual funds can start to take up more and more room in your investment portfolio, which can expose you to risk.

- He also decides on whether you should hold certain stocks or not, and for how long.

- Avoid rushing your dollars into any fund that was a top performer in the past year, too, because that reflects just a thin slice of time.

- If you know the price you paid for the shares you sold, then you can use the specific share identification cost basis method.

- If you are looking for broad exposure to the bond markets with a low annual fee, the Vanguard Total Bond Market Index Fund should be right up your alley.

- The best mutual funds will help you build wealth over years — and can help secure your financial future.

- Mutual funds is a cost-efficient investment vehicle where seasoned professionals research and find out investment opportunities for you at a very small ticket size.

If you would like current income, you should consider an income fund. The fees and performance of a mutual fund are the same across all mutual fund categories, and are dependent on whether it is actively or passively managed. The difference between stocks and bonds is usually met with “why choose? ” because of their conjoined benefit of creating a diverse portfolio.

T Rowe Price Communications & Technology Fund

The fund mainly invests 98% in equities and 2% in cash instruments. The fund was started in February 2003 and the fund size is Rs 2,207 crore. The cost of an equity fund is determined by subtracting the liabilities from its net asset value . An individual may invest in the best equity mutual funds available in India, with a relatively small pool of capital. Lower risk – Because they’re diversified, investing in an index fund is lower risk than owning a few individual stocks. That doesn’t mean you can’t lose money or that they’re as safe as a CD, for example, but the index will fluctuate a lot less than individual stocks.