Interactive Brokers Forex

Table of Contents Heading

- How This Broker Makes Money From You And For You

- Currency Trading

- Setting Your Base Currency

- Broker Reviews

- The Ibkr Mobile Platform

You enter your own price or volatility forecasts for an underlying and display a list of trading strategies. Then you can filter the results according to various criteria such as premium, delta, strike price, and/or expiry. The Options Analytics tool analyzes key options pricing criteria – price, time, and implied volatility – and visualizes the impact on premiums. It can also display the respective risk scenarios – Delta, Gamma, Theta, and Vega – for call and put options for the current time period through expiration.

Bottom line, with interest rates pegged at near zero, there is little to no yield to be captured in the US. For casual investors, sticking to Fundamentals Explorer within Client Portal is, hands down, the way to go. Meanwhile, for seasoned traders and professionals, TWS includes everything needed to be productive, e.g., scanning and back-testing. Despite clear progress made in simplifying its website for casual investors, including more robust fundamental research and education, Interactive Brokers underperforms the best brokers for beginners. That said, Interactive Broker still finished Best in Class across eight categories in 2021. All information on ForexBrokerz.com is only published for general information purposes.

How This Broker Makes Money From You And For You

Now, TWS users can watch video tutorials, browse some of Interactive Brokers’ most-requested FAQs, and keep abreast of the latest all without leaving TWS. The new Learn tab showcases all of the latest and all of the greatest features that TWS and IBKR have to offer. Sign up to our newsletter in order to receive our exclusive bonus offers and regular updates via email. Put your new knowledge to the test at HotForex and start trading smarter today. There is a 24 hour weekday service from IBs customer support. It comes via a series of regional customer service centers located in various places across America, Europe, and Asia.

However, unlike most brokers, it doesn’t inflate the spread or charge you more than the standard spread for the pair you’re trading. This charge comes in addition to a small commission of 0.08 to 0.20 base points, depending on the volume of currency you’re exchanging.

Currency Trading

This is a recommendable broker for professional forex traders. The individual account is the standard trading account that Interactive Brokers offers. It is suitable for both experienced professional traders and novice traders. The following are the many features of this account type. Owning a trading account with Interactive Brokers will allow you to execute trades on its many financial trading instruments as well as enjoy their unique trading conditions. To own an account you will need to sign up for one using your valid details. The Interactive Brokers video tutorials also offer various courses and tours.

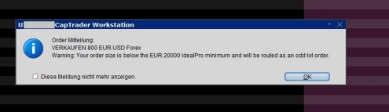

Interactive Brokers’ currency vendors provide more than 60%2 of global market share. You may remove a virtual forex position from display within the TWS Account Window. As the article says anyway, always use the preview function before placing the trade. If you sell USD for getting CAD, it is simple you just put the amount of USD to convert . If you choose Market as order type, the order is executed asap (slippage probably not considered!).

Setting Your Base Currency

With access to real-time options market data, the algorithm of the Options Portfolio finds the most cost-effective solution to achieve the desired objectives, taking both commissions and premium decay into account. To ensure the solution list remains relevant when the market changes, the algorithm constantly scans the market and presents the best solution list every 30 seconds. The solution list is then automatically updated with the revised constraints. Interactive Brokers offers tight spreads, good conditions, and substantial liquidity. Consequently, it can offer quotes with 1/10 pip precision. All client accounts are segregated accounts – that is, they are held separately from the broker’s accounts.

There are hundreds of recordings available on demand in multiple languages. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. The market scanner on Mosaic lets you specify ETFs as an asset class.

Broker Reviews

Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. If you’re outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. IBKR also offers trading in Forex futures and options as well as a number of currency related products listed on the US securities option markets. I have used the same approach to convert USD to CAD with Interactive Brokers, and I wanted to point out something that I found confusing and might confuse others as well. After performing this transaction (selling the USD.CAD currency pair), it will continue to show in your account as an open position.

IBKR offers an instant mobile check deposit that allows you to deposit your paper checks directly to your brokerage account. Just snap a photo, enter the amount on your check, verify that you’re the one making the deposit by completing 2-factor authentication and IBKR will finish the deposit for you. IBKR offers a massive range of options contracts for both the domestic and international markets.

The Ibkr Mobile Platform

It only lags behind its competitors in terms of its FX pair and CFD selection. Reportson the Interactive Brokers desktop platform arereally transparent, just like on the web platform. In this example, we searched for RWE stock, a German energy utility. However, when we typed in “rwe,” all the structured and derivative products were listed among the results as well, which made it harder to find the actual stock. Search results are not structured, and it is quite difficult to filter out the product you are looking for. In many respects, this is by far the most complex platform that we at BrokerChooser have ever reviewed. This platform is ideal for youif you consider yourself a professional user.If you are a beginner or someone who seeks long-term investments, though, you may have difficulty navigating all of TWS’s features.

And the third group developed for Other Services Accounts – compliance officers, administrators, educators, referrers. So you can trade with the courage and peace of mind that your funds are safe and well protected. Notwithstanding the long company history that built a reputation of the reputed and trusted financial service provider brings a stable base to trade.

If I was getting charged a fee you would at least think they would send you a statement. I started an application with Interactivebrokers.com, was told it was sent for review and waiting approval. Later I got a message saying I need to fund my account in order to be considered for approval.

In a margin account, you can do this without conversion; as soon as you buy the stock, you’ll have a negative account balance in USD, and your EUR will serve as collateral. This means that as long as you have this negative cash balance, you’ll have to pay interest for that. If you want to avoid this, you can convert your money at any time using the FXCONV function. Opening an account only takes a few minutes on your phone. The tieredprice plan charges fees based on your monthly trading volume. However, exchange, regulatory and clearing fees may be charged additionally. We selected Interactive Brokers as Best online broker and Best broker for day trading for 2021, based on an in-depth analysis of 70+ online brokers that included testing their live accounts.

The comprehensive proposals to the traders of every type, including various level traders or diverse institutions that bring the best possible technologies to the potential benefit of both parties. What we should strongly admit is the IB great offering of the broker is their technical development. Variety of platforms and tools are covering most demanding needs while bringing both performance and ease of use. InteractiveBrokers global presence delivers also multiple support to the traders benefit provided by professional and well established centers.

Our recommendations and rankings are based on our methodology, independent from partnerships we have. Please use our link to open your account so that we can continue to provide broker reviews for free. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. If you trade with stocks, bonds, funds or US stock index options, you are protected by the US investor protection, i.e. $500,000, with a cash limit of $250,000. TheShortable Instruments Search tool lists the available shortable securities within the web platform and the size borrowing volume that is provided for these securities. (SLB stands for Securities Lending/Borrowing.) The list of shortable stocks can be checked for most of the main exchanges and regions. Interactive Brokers offers an extensive selection of futures products and markets.

If the local margin rates are higher than the IB margin rates, then the margin rates required by local regulators will apply. Select one or more of these brokers to compare against Interactive Brokers.

- This is a hot button topic for anyone considering an online so-called “discount broker” because these platforms are ideally supposed to be cheaper to use in exchange for less hand-holding and professional guidance.

- Interactive Brokers has an alluring pricing system with low commissions overall and great bonuses for very active traders.

- I was paying them a fortune in commission and had to work that much harder to make my money.

- Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations.

Thanks to IB’s extremely conservative business policy, it was not directly impacted by the financial crisis. It systematically avoided risky exposure to subprime loans and CDOs. In 2011, Interactive Brokers became the largest U.S. online broker as measured by Daily Average Revenue Trades. Interactive Brokers Group, Inc. went public on May 3, 2007, selling 40,000,000 shares at a price of USD 30.01 per share. The free float represented an interest of roughly 10% in Interactive Brokers Group LLC. The stock is listed on the Nasdaq under the ticker symbol IBKR.