Forex Capital Markets San Francisco

Table of Contents Heading

- Introduction To Finance And Financial Markets

- The Only Investment Bankfocused Exclusively On Fintech

- Client Commission Management

- Products And Services

- 1 The Foreign Exchange Market

- Broad Global Capital Markets Experience

- Balanced Company And Underwriter

- The Currency Exchange Market In East Asia

Our team members include industry veterans with backgrounds in areas such as accounting, law, technology, operations, fund administration and property and infrastructure. Exactly one year ago when the S&P 500 fell 12% for its worst day since 1987, markets were busy pricing the COVID-19 recession. Nowadays the V-shaped recovery from that downturn is the main driving force behind price action. Housing finance company Freddie Mac on Tuesday named board member Mark Grier as its interim chief executive officer to succeed David Brickman, who resigned in November. John earned his Bachelor of Business Administration magna cum laude in finance and investment at Baruch College. The company, which has offices in Plano, New York and San Francisco, is also moving to rebrand, announcing on Tuesday it would change its name from FXCM Inc. to Global Brokerage Inc.

John began writing about forex trading strategies and analysis in 2005. Since that time, he has written 100s of daily and weekly articles and reports forecasting economic trends, analyzing currencies, equity indices, and commodities. During 2009, he contributed to the Daily FX Real-time News Feed, a 24/6 stream feed of strategy and trading recommendations. You will see his work on DailyFX; MoneyShow.com; The Australian, Currency Matters series; Currency Trader Magazine; Investopedia; SFO Magazine; and many other places.

Introduction To Finance And Financial Markets

Working seamlessly across our global network, our team can track, synthesize and utilize the information gained from our manager and investor relationships to make effective client introductions. Our team is committed to providing excellence in our service offerings, enhanced reporting and technologies as well as quality programs to assist clients with their independent research and brokerage payment needs. If you are interested in learning more, please contact the Client Commission Management Group. A cautious tone dominated currency markets on Tuesday, before the start of the U.S. Federal Reserve and other central banks meeting this week will keep policies accommodative to help drive a post-pandemic global economic recovery.

This research aims to provide the microfoundations of the exchange rate dynamics that have been missing in general equilibrium macro models. Foreign exchange is the action of converting one currency into another. The rate that is agreed upon by the two parties in the exchange is called exchange rate, which may fluctuate widely, creating the foreign exchange risk. As will be seen in the case of Japan Airlines below, the risk can be high. Thus, the rate of exchange in this market is referred to as the official exchange rate—ostensibly to distinguish it from that of the autonomous FX market. The official rate itself is the cost of one currency relative to another , as determined in an open market by demand and supply for them.

The Only Investment Bankfocused Exclusively On Fintech

Wells Fargo will consider qualified candidates with criminal histories in a manner consistent with the requirements of applicable local, state and Federal law, including Section 19 of the Federal Deposit Insurance Act. We use cookies to help provide and enhance our service and tailor content and ads.

The foreign exchange markets play a critical role in facilitating cross-border trade, investment, and financial transactions. These markets allow firms making transactions in foreign currencies to convert the currencies or deposits they have into the currencies or deposits they want. Most transactions are handled by foreign exchange dealers; on a typical day they handle over a trillion dollars in foreign currency exchanges involving U.S. dollars alone. The importance of foreign exchange markets has grown with increased global economic activity, trade, and investment, and with technology that makes real-time exchange of information and trading possible. DCS is designed to streamline the client clearing experience across products, asset classes and regions. In addition to credit default swaps and interest rate swaps, DCS will also support centralized clearing for foreign exchange, commodities and equity swaps as they become clearing-eligible.

Client Commission Management

As the premier global provider of securities lending services, we offer our clients industry-leading insights into securities lending flow and superior access to supply. The Prime Brokerage Group provides financing solutions and risk models that allow hedge fund managers to execute a wide range of investment strategies, while still providing a framework that is predictable and reliable across all market conditions. Goldman, Sachs & Co. is regularly listed among the largest FCMs with respect to the amount of segregated and secured funds held on behalf of customers according to data published by the CFTC. The size and diversification of our client base, along with the amount of Goldman Sachs capital committed to the business, provide our clients with added security.

Deteriorating economic conditions and inflation typically have an adverse affect on foreign exchange rates. Money markets, therefore, represent the short-term spectrum of the financial markets, where securities that mature in a year or less are traded.

Products And Services

Wilson Sonsini Goodrich & Rosati advised NightDragon Acquisition Corp. on the initial public offering. Over the past 20 years, the firm has represented some of the world’s most iconic companies in connection with high-value IPOs, including Google, LinkedIn, Twitter, and Lyft. It covers everything from real-time portfolio management applications to post-trade operations utilities and portfolio accounting reports.

Global stocks hit their highest levels in over three weeks on Tuesday, as investors bet the U.S. At Wells Fargo, we want to satisfy our customers’ financial needs and help them succeed financially.

1 The Foreign Exchange Market

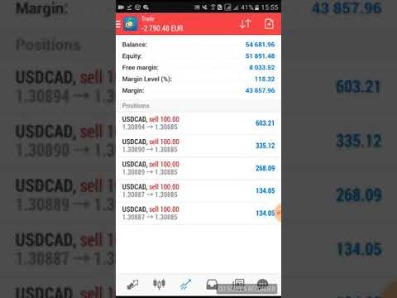

When FXCM made their Initial public offering in late 2010, they became the first forex broker ever to IPO in the United States. Note that the information provided will be posted publicly on this web page. It is important that you read and consider the relevant legal documents associated with your account, including the Terms of Business issued by FXCM Markets before you start trading. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. Relevant military experience is considered for veterans and transitioning service men and women. Wells Fargo is an Affirmative Action and Equal Opportunity Employer, Minority/Female/Disabled/Veteran/Gender Identity/Sexual Orientation.

Money markets are the financial markets where short-term financial assets are bought and sold. By definition, the financial assets, such as stocks and bonds, that are traded in these markets will mature in one year or less. Over a billion dollars in transactions take place in these markets on a daily basis. Treasury are active in the money markets as they adjust their short-term portfolios. Among the many companies situated in the heart of the Financial District are some of the nation’s most active and influential trading firms. These firms specialize in a variety of sectors and operate on a global scale.

Broad Global Capital Markets Experience

For eligible clients with particularly sophisticated needs, we can offerinstitutional levelsof access to the markets. Central banks may buy or sell currencies to influence the value of their currency. Considering San Francisco is the home of numerous world-class companies and countless other fast-growing startups, it’s no surprise that the city plays a major role on the nation’s financial stage. Known as “The Wall Street of the West Coast,” San Francisco’s Financial District boasts several of the city’s Fortune 500 companies including Wells Fargo and Charles Schwab. So while tourists flock to the district’s famous Transamerica Pyramid and Union Square, mathematicians and analysts are busy at work solving some of the world’s most complex financial problems. FXCM Markets Limited (“FXCM Markets”) is incorporated in Bermuda as an operating subsidiary within the FXCM group of companies (collectively, the “FXCM Group” or “FXCM”). FXCM Markets is not required to hold any financial services license or authorization in Bermuda to offer its products and services.

His work for DailyFX is in syndication on Yahoo Finance, and his Investopedia writing reposts on Nasdaq. Regulators alleged the company did not disclose this relationship to clients, who had been told their profits and losses on FXCM’s “No Dealing Desk” platform would not affect the company’s bottom line. In fact, regulators said, the market maker in question paid $77 million in rebates to FXCM from 2010 to 2014. Regulators also claimed the company made false statements to the National Futures Association about its relationship to the market maker. Forex Capital Markets, the U.S. subsidiary of FXCM Inc., will lay off 56 employees from its Plano office by mid-April as the company prepares to withdraw from business with all U.S. clients. Electronic Trading Services group is looking for a senior ALGO/Electronic Trading Developer to be part of an FX E-Trading development team building out its next generation, cross asset electronic trading platform. This individual will be a senior developer and technical expert in the development of very highly sophisticated and complex trading applications/modules for the FX D2D and FX D2C markets.

22 offices ProductsSoftwareCalypso (Calypso Technology, Inc.) is a software application provider specializing in Capital Markets, Investment Management, Central Banking, Risk Management, Clearing, Collateral and Treasury & Liquidity. Their integrated suite of trading and risk applications is used by banks and other financial companies. Expertise in asset-backed finance, capital markets, and mergers & acquisitions providing solutions and advice. With trading hubs in London, New York, Hong Kong, and Tokyo, our global team provides 24-hour access to over 50 developed and emerging markets. We have a strong reputation for significant and longstanding relationships built on the fundamentals of client service, borrow liquidity and borrow protection. We have business professionals and experienced prime brokerage technologists available to provide training and support, and our global Client Technology Services team responds to client inquiries 24 hours a day, seven days a week.

The major currency pairs that are traded include the EUR/USD, USD/JPY, GBP/USD, and USD/CHF. Seabury has increasingly broadened its global businesses to include structured finance products, enterprise software, and trade finance services. Seabury is a global leader in providing software tools and data products covering aviation, aerospace, cargo/global trade, FX trading and human capital. Seabury has developed world-class, enterprise-wide MIS systems that can extract information, manage contracts, and evaluate data across an array of IT systems delivering real-time analysis and executable information. Seabury professionals are a unique combination of top-tier bankers, consultants, software solutions experts, and former industry executives that provide in-depth advisory services to effectuate enterprise-wide change. Since 1995 Seabury’s professionals have advised on over 900 client engagements globally including assignments involving negotiating new or existing aircraft orders totalling over $250 billion and structuring over $80 billion of equity and debt capital transactions. Additionally Seabury served as investment banker and restructuring advisor for 10 of the 15 largest airline turnarounds, including restructuring over $100 billion of debt and lease transactions.

The Currency Exchange Market In East Asia

We provide insight and services to help institutional clients invest in a wide range of credit products, including bank loans, investment grade, high yield and municipal debt, in both cash and derivative form. The Client Commission Management Group is a global business responsible for serving the commission account management needs of our execution clients, including hedge funds, institutions and other financial service providers. Actively trading since he was a teenager, John Kicklighter’s experience ranges from currencies, financial futures, commodities, stocks, and options on all these instruments for his accounts.

Euromoney magazine provides some interesting insights into this market by publishing periodic surveys of information supplied by the treasurers of the major multinational firms. Citi Private Bank is a business of Citigroup Inc. (“Citigroup”), which provides its clients access to a broad array of products and services available through bank and non-bank afliates of Citigroup. Not all products and services are provided by all afliates or are available at all locations. In the U.S., investment products and services are provided by Citigroup Global Markets Inc. “CGMI”), member FINRA and SIPC, and also Citi Private Advisory, LLC (“Citi Advisory”), member of FINRA and SIPC. CGMI accounts are carried by Pershing LLC, member FINRA, NYSE, SIPC. CGMI, Citi Advisory and Citibank, N.A. The firm was founded by Steve McLaughlin, Managing Partner, formerly a senior investment banker in Goldman Sachs & Co.’s Financial Technology Group and Financial Institutions Group in New York and San Francisco.

- The platform allows for various structures and can be flexible according to clients’ preferences.

- Optimize leverage in line with our clients’ financing and asset protection needs.

- If you do not allow these cookies, you will experience less targeted advertising.

- We have a strong reputation for significant and longstanding relationships built on the fundamentals of client service, borrow liquidity and borrow protection.

Financial Technology Partners (aka “FT Partners”) is the only investment banking firm focused exclusively on the financial technology sector. We broadly define the sector as the dynamic convergence of technology-based solutions and financial services. FT Partners was recently recognized as “Dealmaker of the Year” and “Investment Banking Firm of the Year” by The M&A Advisor. Execute on complex capital markets and M&A financing transactions, including public debt issuance, bank financings, and interest rate hedges. Wilson Sonsini also advises companies with respect to commercial hedging arrangements, including foreign exchange (deliverable and non-deliverable), interest rate, and commodity derivative transactions. In addition, we assist enterprise clients with Dodd-Frank compliance issues. Mark Bass is a partner in the Washington, D.C., office of Wilson Sonsini Goodrich & Rosati, where he works with public and private technology companies at all stages of growth.

Capital Introduction

Under this system, the authorized dealers bid for FX under the auspices of the Central Bank every week. The Central Bank sells FX to only the banks with the winning bids at their bid rates.