The Foreign Exchange Matrix

Table of Contents Heading

- Forex Blog

- Foreign Exchange (forex)

- Buy The Ebook

- Example Of Foreign Exchange

- Ratings And Book Reviews (

- Options As A Strategic Investment

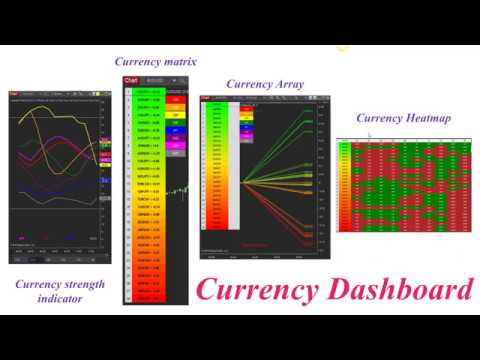

- Matrix Currency Converter

Finally, FX traded by institutions is not directly regulated by governments, although retail trading by individuals is usually regulated. FX escapes new efforts at regulation, as in exemption of FX derivatives in the US during 2010 and 2011, because self-regulation actually works, and works with impressive efficiency. This is in part because FX is a market on the leading edge of technology advances. We have not had a global problem due to FX since the Herstatt Bank failure in 1974, which was even then actually a credit risk issue and not strictly an FX issue.

Investors may experience jurisdiction risk in the form of foreign exchange risk. Movement in theshort termis dominated by technical trading, which focuses on direction and speed of movement. Long-term currency moves are driven by fundamental factors such as relative interest rates and economic growth. In the forex market currencies trade inlots, called micro, mini, and standard lots. A micro lot is 1,000 worth of a given currency, a mini lot is 10,000, and a standard lot is 100,000.

Agree or disagree with Churchill, forex traders must carry in their heads a mix of economic data if they want to truly follow forex and discover why prices are moving. Foreign exchange exposure to hedging is 80% whereas global equities markets hedge less than 20%. The authors delve into what traders pay attention to, including risk aversion, relative interest rates and relative inflation expectations, forex forecasting and the efforts of the U.S.

Forex Blog

Her education includes a BA in German from Clarion State University and the study abroad program with the Goethe Institut in Staufen, Germany. Barbara Rockefeller is an international economist and forecaster specialising in foreign exchange.

This risk originates when a contract between two parties specifies exact prices for goods or services, as well as delivery dates. If a currency’s value fluctuates between when the contract is signed and the delivery date, it could cause a loss for one of the parties. Foreign exchange risk arises when a company engages in financial transactions denominated in a currency other than the currency where that company is based. Any appreciation/depreciation of the base currency or the depreciation/appreciation of the denominated currency will affect the cash flows emanating from that transaction. Foreign exchange risk can also affect investors, who trade in international markets, and businesses engaged in the import/export of products or services to multiple countries.

In mathematics, especially linear algebra, the exchange matrix is a special case of a permutation matrix, where the 1 elements reside on the counterdiagonal and all other elements are zero. In other words, it is a ‘row-reversed’ or ‘column-reversed’ version of the identity matrix. An easy way to remember this is to multiple across left-to-right and divide across right-to-left, with the ending currency being the desired output of the calculation.

You will never discover how much profit Citibank, Deutsche Bank or Goldman Sachs made last quarter trading FX. And because FX traders are not burdened like equity and bond traders by having to meet a benchmark rate of return, relative performance among competitors is not in the public eye. FX traders have only cash profit targets and sometimes these are the bare minimum to justify the expense of the desk, quote terminal and telephone. ‘The Foreign Exchange Matrix’ is the go-to book for anyone seeking a deeper understanding of the world of foreign exchange. A lot of curious anecdotes from the history of world central banking and financial trading to learn from in anon-boring way. The single most important advantage of this book is that it offers a consolidated source of all the vital fundamental knowledge regarding the modern FX market.

FX is without clear supply and demand factors, so how do traders determine sentiment and price direction? Much is written in an effort to answer these questions, but a lot of it is just noise. In the 12 pieces here, Barbara Rockefeller and Vicki Schmelzer draw on their combined 50 years’ experience in foreign exchange to cut through the clutter and provide an elegant and razor-sharp look at this market. Their analysis is accurate, useful and enlivened by many anecdotes and examples from historic market events. The authors definitively explain the mechanics of the foreign exchange markets and confirmed my view that the field of economics has failed to provide a definitive formula for explaining exchange rate movements.

Risk appetite is the only explanation that bridges the tangle of contradictory facts and theories about FX. For example, how can a crisis in Europe trigger an already overvalued Japanese yen to become stronger, even in the face of Japanese economic data that dictates the yen should be weaker? The answer lies in risk aversion inspiring Japanese investors to repatriate funds into the safe-haven home currency, the yen. The explanatory value of risk appetite/risk aversion is powerful, and much needed. Before we go further it is important to understand what risk aversion is and how it came to be used in analysis of the FX markets. In contrast, the dollar can’t get a break and is sold heavily on the slightest pretext, with bad economic news exaggerated and good news dismissed or undervalued.

Foreign Exchange (forex)

The authors explain why the forex market exists and why this form of free-booting capitalism can operate independently from the political, economic and social zeitgeist of the day. In financial markets generally and the FX market in particular, we observe that players mostly act like the rich man – risk aversion starts out high and goes higher as a one-time specific threat to wealth appears. The Lehman Brothers bankruptcy was a spectacular example of a variable outside the usual scope of the FX market that became internal to the FX market through the transmission mechanism of short-term interest rates. The perception of excessive riskiness in the interbank lending market morphed in to a perception of excessive riskiness in the euro/dollar currency market. Risk aversion is what they have in common – it’s a force through which price actions are produced. Exchange rates also overshoot because we misinterpret economic data and do not have a universally accepted theory of how exchange rates should be determined.

Alternatives such as average absolute deviation and semivariance have been advanced for measuring financial risk. Calculating exchange rates may seem simple on the surface, but it can be confusing to those that don’t remember mathematics from school. While converting $100 to foreign currency when traveling isn’t a big deal, converting currencies when analyzing a foreign stock’s financial statements can mean big differences for international investors trying to make investment decisions. Currency converter is designed to compare the amounts in one currency with others, with the exchange rate for today and transferring from one currency to another online.

Buy The Ebook

As an example, trading in foreign exchange markets averaged $6.6 trillion per day in April 2019, according to the Bank for International Settlements, which is owned by 62central banks and is used to work in monetary and financial responsibility. The market determines the value, also known as an exchange rate, of the majority of currencies. Foreign exchange can be as simple as changing one currency for another at a local bank. For example, a trader is betting a central bank will ease or tighten monetary policy and that one currency will strengthen versus the other. A difficulty commentators and traders alike face is that the economics industry has failed to offer up a coherent theory of exchange rate determination . The FX industry has failed to give us basic information, so easily available in other asset classes, on positions and flows . Even the most accessible of explanations, relative interest rates , fails with great regularity.

Click Download or Read Online button to get The Foreign Exchange Matrix book now. This site is like a library, Use search box in the widget to get ebook that you want. It is one of those rare books that I can wholeheartedly recommend to every visitor of this blog. It does not explain any of the basic Forex orfinance-related concepts and terms, which it uses in abundance. A newbie trader without significant background in economics will struggle with some paragraphs.

Example Of Foreign Exchange

In a macroeconomic model, major risks include changes in GDP, exchange-rate fluctuations, and commodity-price and stock-market fluctuations. Before initiating an investment, a firm should consider the stability of the investing sector that influences the exchange-rate changes. For instance, a service sector is less likely to have inventory swings and exchange-rate changes as compared to a large consumer sector. Foreign exchange risk also exists when the foreign subsidiary of a firm maintains financial statements in a currency other than the domestic currency of the consolidated entity. Transaction risk refers to the adverse effect that foreign exchange rate fluctuations can have on a completed transaction prior to settlement. Three types of foreign exchange risk are transaction, translation, and economic risk. Companies that are subject to FX risk can implement hedging strategies to mitigate that risk.

As information for the converter used the average exchange rates on the market. The currency converter allows you to calculate the transfer amount of one currency to another when buying and selling currencies at today’s exchange rates . All currency converter conversions are performed on the basis of daily updated official data on international currencies. The authors also highlight why chart reading and technical analysis heavily influence Forex.

Ratings And Book Reviews (

This is different than when you go to a bank and want $450 exchanged for your trip. When trading in the electronic forex market, trades take place in set blocks of currency, but you can trade as many blocks as you like. For example, you can trade seven micro lots or three mini lots or 75 standard lots , for example. How, then, do we get FX prices that reflect all those high-level economic factors and links to governments and other markets?

Firms can manage translation exposure by performing a balance sheet hedge, since translation exposure arises from discrepancies between net assets and net liabilities solely from exchange rate differences. Following this logic, a firm could acquire an appropriate amount of exposed assets or liabilities to balance any outstanding discrepancy. Foreign exchange derivatives may also be used to hedge against translation exposure. Subsidiaries can be characterized as either an integrated or a self-sustaining foreign entity. An integrated foreign entity operates as an extension of the parent company, with cash flows and business operations that are highly interrelated with those of the parent.

- Foreign Exchange is a global market for exchanging national currencies with one another.

- It may, however, be noted that the guidance note is meant only for the purpose of broadly indicating the basis on which the amount to be imposed is derived by the compounding authorities in Reserve Bank of India.

- The KnowledgeLeader team will periodically update this RCM with new content.

- You will search in vain for a number representing the gross credit lines of any bank to other banks for the purpose of FX trading.

It is probably a bad book to try to learn technical analysis from, but Barbara gives a short overview of the TA techniques employed in FX and talks about how traders using those techniques may affect prices. You may well skip the technical analysis chapter if you are fluent in it. A lot of blog posts, analysis articles and journal issues are written about inter-market dependencies and correlations.

In the example above, we divided across right-to-left to determine how many Euros we could purchase with U.S. dollars and then multiplied across left-to-right to see how many U.S. dollars we’d receive from euros. “Anyone with bias against technical analysis will not fare well in forex,” they say.

In essence, Herstatt accepted FX payments due to it and then declared bankruptcy, avoiding paying out its side of the FX trades. Note that credit risk always starts with the character of the counterparty. Further, the FX market is so big also because FX is a market dominated almost entirely by private speculators, including banks and hedge funds, who are trading almost entirely on private credit. The positions are not reported, nor are the credit lines backing the trading. You will search in vain for a number representing the gross credit lines of any bank to other banks for the purpose of FX trading. The FX market is so big because accounting convention allows it to be largely hidden. FX is a contingent asset/liability on the balance sheet of both banks and corporations, and is reported only in the footnotes of financial statements.

For instance, what is the purpose of the $4 trillion per day trading volume? Does FX drive other financial markets, or is it the passive end-product of all the other markets?

She has appeared on ForexTV, FX Street and was in Alain Lasfargues’ 2009 documentary The Marvelous History of the Dollar. The currencies are moved by a variety of factors and their influence is not constant. In different conditions the same factors may demonstrate forces of opposite directions on the same currencies. The picture of all these numerous factors is multidimensional (hence the word Matrix in the book’s title) and relations between these factors are not linear.