Foreign Exchange Option Pricing

Table of Contents Heading

- Explaining Basic Currency Options For Foreign Exchange Risk Management

- In Our Markets

- Buying Or Selling Call Options

- Calculating Option Premiums

- What Is A Foreign Currency Option?

A strike price that is well away from the current spot price will cost less, since the likelihood of exercising the option is low. However, setting such a strike price means that the buyer is willing to absorb the loss associated with a significant change in the exchange rate before seeking cover behind an option. Foreign currency options are particularly valuable during periods of high currency price volatility. Unfortunately from the perspective of the buyer, high volatility equates to higher option prices, since there is a higher probability that the counterparty will have to make a payment to the option buyer.

Further information on each exchange’s rules and product listings can be found by clicking on the links to CME, CBOT, NYMEX and COMEX. CME Group is the world’s leading and most diverse derivatives marketplace. Sign up to receive product news, market trends, expert views, and statistics about our markets – from G10 to Emerging markets, across Futures, Options and FX Link. does not make any representations as to their accuracy or completeness. If you have questions about the matters discussed in those articles, please consult your own legal, tax and financial advisors. With 17 years experience in the financial industry, Frances is a highly regarded writer and speaker on banking, finance and economics.

Explaining Basic Currency Options For Foreign Exchange Risk Management

Get quick access to premium educational content, including expert-led webinars, a real-time trading simulator, and more. Receive exclusive insights on key FX macro themes, volatility trends, and market events through our bi-weekly report. Explore historical market data straight from the source to help refine your trading strategies. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Rather than determining the payout by the average price during the lifetime of the option, a lookback option determines payout by the peak average price reached by the currencies in the basket.

- Looking at the term structure of the implied volatility curve across many G10 pairs, not all parts of the curve moved in the same fashion.

- This reflects the unlimited profit potential of a long option position, since gains on a Call option position will increase in a linear way with the spot rate once it is above the strike price.

- It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

- Most FX derivatives trading is over the counter and is lightly regulated.

- Nevertheless, the most common style for options on currency futures, such as those traded on the Chicago IMM exchange, is known as American style.

Non-linear payoff – the payoff for a straightforward FX option is linear in the underlying currency, denominating the payout in a given numéraire. Notional – the amount of each currency that the option allows the investor to sell or buy. Put option – the right to sell an asset at a fixed date and price.

In Our Markets

In order to use post-trade option pricing, your Administrator must configure the Post-trade option pricing app and enable Kooltra Post-Trade Option Pricing. Once enabled, you can enter your options into the system as usual and the Post-Trade app will continue to update the price of all options in the selected entity’s portfolio. When the CAD/USD rate ends at 1.50 we would exercise the option and sell $1.45 CAD in exchange for $1 USD, and could immediately exchange that $1 USD for $1.50 CAD, for a profit of $0.05 CAD.

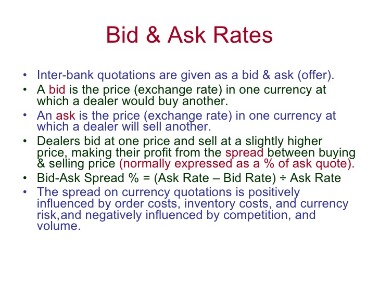

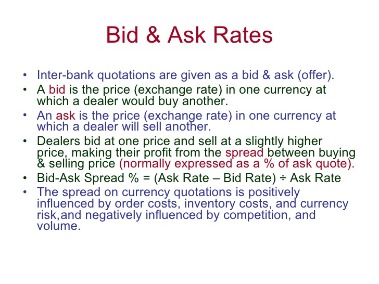

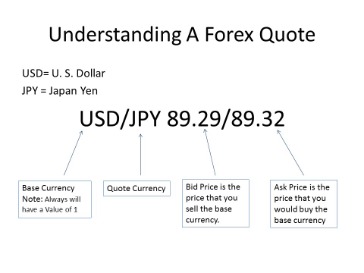

If the exchange rate is expressed as the number of US Dollar per Japanese Yen, the rates will need to be inverted before application in the formulae. If the exchange rate is expressed as the number of Japanese Yen per US Dollar, the rates will need to be used as is in the put formulae. If the exchange rate is expressed as the number of US Dollar per Japanese Yen, the rates can be used as is. If the exchange rate is expressed as the number of Japanese Yen per US Dollar, the rates will need to be inverted before application in the put formulae.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. 54814. FX Options traders need technology that will easily document events leading up to and including the trade. Most of all, traders need to ensure that their trades meet the requirements of any regulated environment. In the European Economic Area , trades need to comply with all stipulations of the Markets in Financial Instruments Directive and be transacted over a multi-lateral trading facility . Overall, FX Options traders want trade negotiation to be simplified and are turning more often to multi-dealer platforms.

Buying Or Selling Call Options

Similar to the call option, the longer the term of the insurance, the higher the put premium. Like the case of the call, the options are rarely exercised, but rather sold back to an option writer before expiration. However, what if the amount you are owed is “conditional”, that is, whether or not you get the Swissies depends on whether the Swiss customer decides to accept your bid to sell him a good or service.

To convert this value to JPY terms we divide Q by the initial spot rate, where the spot rate is expressed as the “the number of US Dollars per Japanese Yen”. If the currency convention used in the call or put option pricing formula is “the number of Japanese Yen per US Dollar” the result is a per unit value in Japanese Yen. Let’s call this value Y – A single 1USDxJPY contract results in an option value of Y in JPY. The total contract value in JPY terms will then be equal to the USD Notional times Y.

Calculating Option Premiums

The Garman-Kohlhagen model is similar to the model developed by Merton to price options on dividend-paying stocks, but allows borrowing and lending to occur at different rates. Additionally, the underlying exchange rate is assumed to follow Geometric Brownian Motion, and the option can only be exercised at maturity. The strike price is the price that the holder of an options contract can buy or sell the currency should they wish to exercise the option contract. With forex call and put options, the strike price is only valid until the expiration date. When determining the value of an option, the strike price is the single most important factor of an option’s value. Currency options are one of the most common ways for corporations, individuals or financial institutions to hedge against adverse movements in exchange rates. Corporations primarily use FX options to hedge uncertain future cash flows in a foreign currency.

First is the contract size for futures options, which will always equal the size of a futures contract. That the two equal is not surprising, as the buyer of a call option has the right to buy a futures contract at the agreed on strike price. The second piece of information is the unit of U.S. currency that the option premium is being quoted in.

A currency option or FX option gives the buyer an ‘option’ but not an obligation to buy or sell a foreign exchange currency at a certain exchange rate before or on a pre-determined date. A forex option is a derivative product that provides the feature of utilising leverage and dealing in currencies without having to purchase the tangible currency pair. The FX options market is the deepest, largest and most liquid market for options of any kind. Most FX derivatives trading is over the counter and is lightly regulated. The trade will still involve being long one currency and short another currency pair.

What Is A Foreign Currency Option?

To start with, FX Options incorporate elements of Forex and traditional options. The same example of a currency futures option tables using the Swiss Franc.

The option can only be exercised on certain predetermined dates. The option can only be exercised on the expiry date, which means that delivery will be two business days after the expiry date. The option can be exercised on any date within the option period, so that delivery is two business days after the exercise date. Certificate of Attendance for classes that you complete may be requested by sending an email to To allow us ample time to verify attendance, certificates will be issued every Thursday. The strata-measure module provides high-level risk measures for FX Vanilla Options. An FX Vanilla Option is represented in Strata using the FxVanillaOption class.

Myth Five Finessing Counterparty Risks.

In essence, the buyer will state how much they would like to buy, the price they want to buy at, and the date for expiration. Traditional options may have American or European style expirations. Both the put and call options give traders a right, but there is no obligation. If the current exchange rate puts the optionsout of the money, then they will expire worthlessly. When pricing foreign exchange options, the underlying is the spot or forward foreign exchange rate. A variation on the above could be one where the company’s profitability depends in some asymmetric fashion on a currency’s value, but in a more complex way than that described by conventional options. Anticipation of such an event could call for purchasing so-called Asian options, where the payoff depends not on the exchange rate in effect on the day of expiration, but on an average of rates over some period.

The purpose of the speculation is to make a profit if the option finishes in-the-money or letting it expire worthless otherwise. The best way to understand the table is to analyze some premium quotes.

A foreign exchange option can be used by a company looking to hedge or protect against a rise in the U.S. On the other hand, a speculator might purchase such an option if they wished to hold an extended long position in the U.S. Dollar against that currency because they believed that the U.S. The most common style traded in the Over-the-Counter or OTC forex market is the European-Style option. This style of option can only be exercised on its expiration date up to a certain specific cutoff time, usually 3pm Tokyo, London or New York time.

I also tried changing 0.75 and 0.5 into 0.0075 and 0.005, assuming that the interest rates are in percentages. The Odd-Even Binomial model is an extension of the Cox Ross Binomial model. Compared to Cox Ross Binomial model, the Odd-Even Binomial model provides better price accuracy. It was implemented by creating two tress, one with even number n of iterations and another with n+1 number of iterations, then taking the average of the two results. This method also helps to reduce the number of oscillations that can be observed with traditional Binomial models, where the option value depends quite heavily on the number of periods. FX Options are also useful tools which can be easily combined with Spot andcurrency Forward contracts to create bespoke hedging strategies. If the cash flow is uncertain, a forward FX contract exposes the firm to FX risk in the opposite direction, in the case that the expected USD cash is not received, typically making an option a better choice.

Deconstructing Myths About Foreign Exchange Options

With IG, you’ll be using spread bets and CFDs to speculate on the price of options contracts, rather than buying or selling the underlying contracts themselves. This means that you can go short as well as long on both call and put options – with zero overnight funding charges and no spread to pay on expiry. On the other hand, traders can also sell call options and put options – which obliges them to sell a currency pair in the case of a call, and to buy a currency pair in the case of a put. For taking on this obligation, the seller of a call or put option will receive a premium. Currency options – or forex options – give the holder the right, but not the obligation, to buy or sell a currency pair at a given price before or on a set expiry date.

But there are additional tools designed to help businesses manage the risks caused by fluctuating foreign currency exchange rates. Currency options, also known as forex options, are one of these tools. Traders like to use currency options trading for several reasons. They have a limit to their downside risk and may lose only the premium they paid to buy the options, but they have unlimited upside potential. Some traders will use FX options trading to hedge open positions they may hold in the forexcash market.

These cookies will be stored in your browser only with your consent. But opting out of some of these cookies may affect your browsing experience. This article introduces Foreign Exchange Options, and provides an Excel spreadsheet to calculate their price. Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. This website uses cookies to obtain information about your general internet usage.