Day Trading With Short Term Price Patterns

Table of Contents Heading

- About Toby Crabel

- Strategies

- What You Need To Know Before You Start Day Trading

- Patterns

- Day Trading Faqs

- Interpreting Price Action

- Price Gaps

You need a high trading probability to even out the low risk vs reward ratio. We highly recommend this book for the serious short-term trader. Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Controlling risk is one of the most important aspects of trading successfully.

This brings us to the next step of our short-term trading strategy. This brings us to step number 3 of the best short-term trading strategy. We turned it into the best short-term trading strategy with over 80% accuracy. With short-term trading tips, you can use this principle and reverse any losing strategy.

About Toby Crabel

Hence, what you’ll find here is a resource guide pointing to everything we have on price action trading. Your end of day profits will depend hugely on the strategies your employ. So, it’s worth keeping in mind that it’s often the straightforward strategy that proves successful, regardless of whether you’re interested in gold or the NSE. Also, check there is sufficient volume in the stock/asset to absorb the position size you use. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. It will also enable you to select the perfect position size. Position size is the number of shares taken on a single trade.

The information provided by StockCharts.com, Inc. is not investment advice. Chartists can also add other indicators to further qualify signals.

Seasoned traders understand the mechanics behind the patterns and will give the patterns some leeway in order to play out. The key is to recognize patterns quicker than the next guy in order to take a position before the full transparency is revealed. Chart patterns are linear throughout all time frames, which mean that a pattern that forms on a 5-minute chart performs the same way it would on a daily time frame chart. The only different is the range of prices being larger for wider time frames. For example, a wider time frame daily bull flag pattern may contain a 5-minute cup and handle breakout pattern that forms first.

Strategies

Time management – Don’t expect to make a fortune if you only allocate an hour or two a day to trading. You need to constantly monitor the markets and be on the lookout for trade opportunities. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Stock traders watch a so-called thrusting line as part of a pattern that indicates increasing demand for a particular stock. Short-term trading uses many methods and tools to make money. The catch is that you need to educate yourself on how to apply the tools to achieve success.

Consolidation, or a sideways market, occurs where price is oscillating between an upper and lower range, between two parallel and often horizontal trendlines. Technical analysts and chartists seek to identify patterns as a way to anticipate the future direction of a security’s price. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. Thank God I bookmarked your page for more trading strategies from you. Trading Strategy Guides, you have to use strict money management rules.

What You Need To Know Before You Start Day Trading

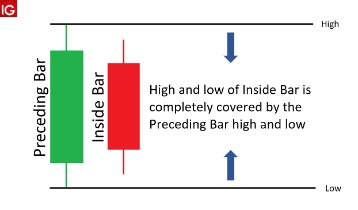

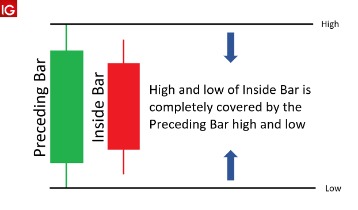

Day traders buy and sell multiple assets within the same day, or even multiple times within a day, to take advantage of small market movements. The NR7 day is based on the premise that range contractions are followed by range expansions. In this regard, the indicator is neutral when it comes to future price direction. As with Bollinger Bands, chartists must employ other tools for a directional bias.

Notice on the TNDM example below — the first few ‘steps’ in March, April, and May are small steps followed by long periods of sideways price action. Jump forward to June, July, August, and September and you see big steps with pullbacks. I’ll show you what each candlestick looks like in the context of a chart so you can see what I mean. The combination of the bullish hammer pattern along with the bullish divergence creates a solid condition for a long entry if and when price breaks the prior swing high at #1. Both of the bullish signals occur right as price is testing a break of the ascending triangle, giving us a very nice setup for a long entry. Where the bull flag is a rectangle, pennants are triangles.

- This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos.

- It could be giving you higher highs and an indication that it will become an uptrend.

- Implementing a combination of technical indicators is one way of filtering out bad trades and confirming good ones.

He has provided education to individual traders and investors for over 20 years. He formerly served as the Managing Director of the CMT® Program for the CMT Association. Customers who want to use their accounts for day trading must obtain the broker-dealer’s prior approval. Customers must also be aware of, and prepared to comply with, the margin rules applicable to day trading. The second part is composed of either a bull flag or bullish pennant on the pullback that forms the handle.

Utilizing the RSI and Composite Index to help us filter the appropriateness of a buy stop at #4 can help us be confident in our decision. Again, we look for any hints of bearish divergence that would indicate any move above the ascending triangle could be a bull trap. No bearish divergence exists between the RSI and Composite Index. We can further filter the appropriateness of the entry by using volume, the RSI, and the Composite Index. We can see volume rose after the break of the bull flag at #2, dropped a little, and then rose again before the conservative entry at #3. The bullish hammer is a candlestick where the wick is at least twice as long as the body.

Patterns

Toby’s returns are good, but his risk management is far better. Toby’s funds have grown primarily due to his excellent risk management skills as opposed to his returns. In layman’s terms this means that he hardly ever loses money but he doesn’t make much for his clients. This is actually fairly unique and he should be commended for finding this niche in the business.

The chapter of the theory with a link from someone called Marc Brown, who claims he found “holy grail” (e.g., term used in trading community). Further, found that Marc Brown had read this book back in 2005 with high praise. The U Turn Strategy is a short term deviation from the main trend. The set up occur quickly and disappear just as quick so you have to find them and take advantage of them as soon as they appear. The stop loss level is placed a few ticks below the signal day low price and the profit target is MOC or market on close. This way you get the most opportunity to profit from this position without having to hold it overnight. You need to move quickly when you see this type of pattern because they don’t last very long.

Eventually, the price will reach either the stop-loss or profit target. The problem is that sometimes the trade may show a nice profit, but not reach the profit target.

The blue arrows show the NR7 candlesticks and the thin blue lines mark the high-low of the range. A next day move above the high is bullish, while a next day move below the low is bearish.

Day Trading Faqs

Short-term trading involves risk, so it is essential to minimize risk and maximize return. This requires the use of sell stops or buy stops as protection from market reversals. A sell stop is an order to sell a stock once it reaches a predetermined price. Once this price is reached, it becomes an order to sell at the market price.

However, it is possible to scan for NR4 or NR7 days using the Advanced Scan Workbench to write the code, an example of which is provided in the next section. While this NATR7 will not produce the exact same signals, many will overlap with the basic NR7 readings. More importantly, the Average True Range does show when the range is contracting or expanding. This strategy starts with the day’s range, which is simply the difference between the high and the low. Crabel used the absolute range, as opposed to the percentage range, which would be the absolute range divided by the close or the midpoint. Because we are only dealing with four and seven days, the difference between the absolute range and percentage range is negligible.

This is an example of a brief pullback where the candlestick looked like a shooting star but was unconfirmed. A good reason to step back and wait for confirmation before making a play.

Interpreting Price Action

They form after a very strong initial parabolic price push higher or lower . The buy trigger forms above the horizontal upper trend line and the stop-loss is below the rising lower trend line. The profit target is usually the distance of the lower start of the lower trend line and upper trend line. The closer your entry towards the apex, the tighter your stop-loss will be and therefore represents the lowest risk.

While this short-term trading strategy can be used by only focusing on the price action short-term trading tips, you can modify it any time. The best short-term trading strategy is a pure price-action strategy. If you want to use indicators, you need to know how to pick the most accurate indicators for short-term trading. Our team at Trading Strategy Guides put together a step-by-step guide with the most popular Forex indicators here, The Big Three Trading Strategy. Market traders commonly use chart patterns to identify positive-expectation trading opportunities. When used in conjunction with other indicators, such as support and resistance levels, chart patterns can be powerful tools for generating profits.

Some traders find price action analysis to be too subjective. Here are the tools you can apply to build a systematic analytical framework. Before we dive in, let’s go through a few aspects of price action trading that makes it so appealing to both new and seasoned traders. Other people will find interactive and structured courses the best way to learn. Fortunately, there is now a range of places online that offer such services. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Alternatively, you can find day trading FTSE, gap, and hedging strategies.

Our team at Trading Strategy Guides enjoys keeping our trading strategies simple. In this article, we’ll demonstrate how to turn a simple trade principle into the best short-term trading approach. Below you can read our updated post for the best short-term trading strategy. Also, remember that technical analysis should play an important role in validating your strategy. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week.