A Three Dimensional Approach To Forex Trading Pdf

Table of Contents Heading

- Adventures Of A Currency Trader: A Fable About Trading, Courage And Doing The Right Thing

- Using Basic Analysis & Fundamental Trading Methods To Make The Most Of Your Profits By Dave Matias

- Books By Anna Coulling

- How To Make A Living Trading Foreign Exchange: A Guaranteed Income For Life

- Forex Library

Offering guidance on the pitfalls of trading to be avoided and rules to manage various kinds of risks. Providing an insider’s look at key characteristics of established and successful currency traders.

Instead, markets move in a series of steps, creating a series of higher highs in an uptrend, and a series of lower lows in a downtrend. From the example in Fig 19.18 here the market has been rising steadily and creating the classic pattern of series of higher highs, and higher lows, as the trend develops further. It is these price points which are then joined together to form the trend line. The trend line is now a channel with an upper and lower line, as with the support and resistance channel. Fig 19.16 Triple Top Pattern The triple top example in Fig 19.16 is a good example. A triple top occurs on a chart at the top of a rally, at a point when a market is beginning to struggle to move higher. In the price action associated with a triple top a market tries to break higher once, then a second time before trying for a third time.

Adventures Of A Currency Trader: A Fable About Trading, Courage And Doing The Right Thing

Here we now have the euro at just under 58% and with the UK pound, the two currencies constitute almost 70% of the weighting. Wholly unbalanced in my view, and the Australian dollar doesn’t even feature! So in my humble opinion, far from representative of today’s forex market. For me, there are far better choices which are simple to understand, and more importantly provide a realistic view of the US dollar against the major currencies. Once again, the US authorities are being pilloried by Europe for pursuing a policy which is seen as both self serving and protectionist. Whilst this is undoubtedly true, it is also the case that many other countries are also adopting the same policy, either overtly or covertly. For all countries, it is ultimately about survival and protection of their own fragile economies.

- To put this into context, an ounce of South African gold currently costs over $250 per ounce to extract, whilst the equivalent in the US is $190 per ounce and in Canada even lower at $170 per ounce.

- The place to start is with the powerhouse of Europe which is Germany.

- The IFO indicator is released monthly and the survey encompasses businesses across the entire market and business sector, including manufacturers, wholesalers and retailers, so is thoroughly representative.

- Here you will also find live futures prices, and charts for over 1000 currency pairs.

- Unemployment has been rising fast and consumer spending has all but stopped, other than for essential goods and services.

A chart is a chart, and provided there is volume displayed, then we have the ultimate in analytical techniques. I started my own trading journey using volume and it has shaped my trading career over the years. When combined with my three dimensional approach to trading, I truly believe this is the ONLY way to succeed as a forex trader. You may feel slightly overwhelmed, but trust me – learn a little every day, and you will slowly become that master forex trader that we all desire to become.

Using Basic Analysis & Fundamental Trading Methods To Make The Most Of Your Profits By Dave Matias

The first to fall was Hanbo Steel followed soon after by Sammi Steel, then Jinro Group and, in the summer of 1997, the Kia Group which collapsed with debts of almost $400 million. As panic ensued, international investors tried to move their money out fast, but with a currency that was collapsing, like many others in the region, this put an impossible strain on the banking system and bankruptcies followed. As a result, whilst other currencies weakened dramatically, the won only fell marginally and, in relative terms to others in the region, was in fact appreciating, and impacting exports. However, the won could not avoid the inevitable, and duly succumbed, falling heavily towards the end of 1997.

The size of the book is relatively less but the knowledge it imparts is significantly irreplaceable and can be adopted under complex situations for a long period of time. The contents of this edition are crafted after multiple years of testing and getting fingers burnt in the volatility of the financial market. One can follow the success stories of those who have made it big in the financial world, but few will understand the skills and swiftness one learns after going through failure, and this book highlights the same. Neither of the assumptions has been sufficiently supported by this book. However, it is written in simple language, and one can expand their financial understanding by linking the basic financial knowledge and the prevailing economic situation in the world.

Books By Anna Coulling

Once we see the index trading down to low levels, and into single figures, then this is the first warning of danger, of a potential change in longer term risk sentiment in the market. There is no guarantee that this will happen quickly, as markets can stay at these extremes for some time, but we know that it will, without a doubt, happen. Fig 11.25 Gold/Oil Ratio What does this chart and ratio reveal about risk and related markets? The associated fall in the price of gold, is suggesting an increase in bond yields as money flows from bonds and into equities. Therefore, if the Japanese stock markets are falling then investors will move from a risky asset class such as equities into a safe haven currency such as the Japanese yen. As the Nikkei 225 falls, then the USD/JPY pair are also likely to fall.

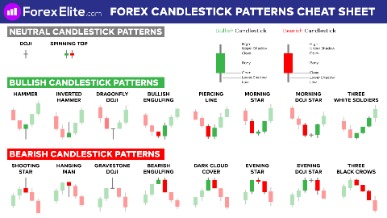

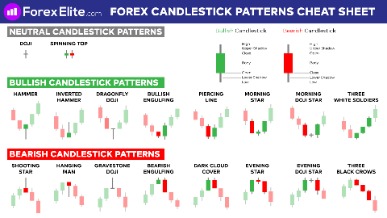

If you are only interested in basic analysis, then you will have problems reading this book. But if you are already in the business and you want to learn more about technical evaluations, then this book is perfect for you. At the end of the book, you will have the ability to use technical evaluations on your Forex trading. Steve Nison, who is the author of the publication, is not an ordinary trader and he is regarded as the father of candlestick charting.

Currency forwards are simply agreements to buy or sell an asset, in this case a currency contract, at a set price at an agreed future date. These are cash settled in dollars and are favoured by many investors as the funds don’t have to be deposited or registered locally. The Philippine central bank is not the only Asian country to impose these regulations with the Koreans also adopting a similar policy. And the principal reason for this is currency strength in the Philippine peso.

The trading range typically is between 70 and 100 pips per day, and this is the currency which tends to set the tone for the London session following the open in Europe and from the overnight in Asia. If you are a novice or inexperienced trader, I would urge you to consider starting with the GBP/USD.

How To Make A Living Trading Foreign Exchange: A Guaranteed Income For Life

And if you remember in the introduction to technical analysis, I mentioned Wyckoff’s third rule – that of cause and effect. In other words, the longer the market is in a congestion phase, then the longer the trend will last once the market breaks away. And of course, one of the key signals we use to validate any breakout is – volume. Now perhaps you can start to see how everything fits neatly into place in this three dimensional world. In Fig 19.10 I’ve highlighted what is referred to as the price ‘congestion area’ with two lines, one above and one below, which show how the market has remained contained within a narrow range for some time. Beginning with the lower or support line, what is happening here is that the market has been bullish for some time, but then starts to run out of steam, as all markets do.

Whilst the bond commodity linkage can be difficult to understand it is an important one as it reveals so much about future inflation expectations and interest rates. For forex traders it can provide valuable insights into central bank thinking and future exchange rate decisions. energy sources, Brazil is well placed to benefit from this increasing demand over the next few decades. Having considered oil producers and world oil reserves, we now need to consider the consumer end of the equation, and as you would expect, at the top of the list are the USA and China in that order. Between them they account for almost 35% of the world’s total consumption of oil.

Forex Library

The first of these issues concerns the way Japanese exporters invoice their goods, which is odd to say the least. Most large companies do not invoice in yen, as you might expect, but in fact in the currency of the country of delivery.

This is the world of global market cycles, interest rates, inflation and deflation, and is the business of forecasting and managing economies around the world. Its function is to create the perfect conditions for an economy to grow at a steady pace and, just like plants in a greenhouse, too much water or too little is equally bad. In addition, and also unlike our greenhouse, when the water is turned on, it may take months to appear. To use another analogy, the economy is like an oil tanker – once it is moving at full speed it takes many miles to slow down and stop. This is the ultimate problem all central banks face, so let’s start here, before moving on to consider the big picture of cycles, as well as examining individual economic releases in more detail. However, before moving forward I just want to explore further the role of the central banks, the tools they have available, how they communicate with the currency markets and their relationships with government.

In this section of this chapter I now want to move away from the ‘big’ economic numbers and look at those which look more closely at specific sectors of the market, which provide more of a ‘macro economic’ view of the economy as a whole. For example, the questionnaire asks the purchasing managers about new orders, output, hiring levels, exports and imports, prices for raw materials and supplies, supplier performance, and backlog of orders yet to be completed. In other words, all aspects of manufacturing from supplies and raw materials in, to finished goods out of the factory gate and onto customers. The index is then compiled from these responses and, of course, weighted. New orders carry the most weighting at 30%, down to inventories at 10%.

As I mentioned earlier, the key to trend lines is not that they necessarily reveal whether there is an up or down trend in place, but that the lines identify the potential areas of support and resistance in the trend as it moves higher or lower. Trend Lines The trend lines in this section refer to those which help to mark the price action as it moves higher or lower. However, the forex market, like all other markets and instruments, never moves in a straight line.

Despite the sharp fall in the commodity at the start of the financial crisis, growth has remained firmly positive. However, as with all commodity dependant countries, the volatility of the market and demand for base commodities remains the underlying problem. The close relationship between the currency and the commodity are never far away and below in Fig 13.17 is the monthly chart for the Peruvian New Sol against the US dollar.

In other words, whilst publicly stating that a strong US dollar was good for the America, privately they were taking a very different approach. And if you don’t believe that currency markets are subject to political manipulation, then please read the next section very carefully. With the US dollar hitting an all time high against every other currency, in the spring of 2002, President Bush launched a trade war against steel producers overseas with two objectives in mind. The reason here is that this is one currency that is directly manipulated by the Chinese, and therefore considered to be undervalued were it ever to become a free floating currency.

As always, it is the trend that matters and the CB index coupled with the UoM index, should correlate positively. So if the CB comes out first with a good number that sends the US dollar higher, then the UoM should confirm this view and reinforce this dollar strength provided there are no shocks or surprises. Once again, the index is viewed as a leading indicator of consumer sentiment, and therefore a guide to future interest rates, inflation and the broader economy as a result. If the number is better than expected then we should see the dollar strengthen on the news, provided this is in a rising trend and in line with the trend.

The principal reason why I do not advocate its use is that the FED also has two other books, one Green and one Blue. However, as neither is made public it does rather beg the question as to the validity of the information in the Beige book! In addition to the above orange group of releases in the US, the markets are also subjected to an endless round of statements and speeches from FOMC members.

This is the perennial problem for governments and central banks around the world, and one to which they have never really had an answer, as they only have limited tools with which to manage an economy. This is one of the reasons why an economy just moves from boom to bust because, just like an oil tanker, it can take a long time to get going, and an equally long time to stop. An economy usually hits the buffers and it is almost impossible for central banks to engineer a ‘soft landing’.

This is the first of our composite economic indicators and the reason I have chosen this one is that it is simply one of the most important of these types of indicators. Having said that, like all economic releases their impact will vary according to where we are in the broad economic cycle. Like the Australian data, the New Zealand number is released monthly, after month end, but takes between thirty and thirty five days to be appear. Nevertheless it is another excellent guide to the underlying economy and future outlook for growth and consumer spending. Once again the trend is everything, so provided the number is good and the trend is rising, then the New Zealand dollar should strengthen on the release. Equally, a weak number or shock in a falling trend is likely to weaken the New Zealand dollar on the prospect of a slowing economy and falling interest rates in due course.