Currency Trading For Dummies

Table of Contents Heading

- Speculating In The Currency Market

- Best Forex Trading Courses

- Forex For Dummies

- Great Book And A Promising Strategy!

- The Best Way To Learn Forex Trading

- Based On The Book ..

Foreign exchange, popularly known as ‘Forex’ or ‘FX’, is the trade of a single currency for another at a decided trade price on the over-the-counter marketplace. Forex is definitely the world’s most traded market, having an average turnover of more than US$4 trillion each day. After testing several Forex platforms we find this one to be the best. What made the difference is a unique feature that allow us to watch and copy the strategies and trades of the best performing traders on the platform. Since we started trading at this broker we noticed an increase of our successful trades and profits when compared to our former platforms.

Buy on AmazonThis financial market can accurately measure countries against each other. The book begins with a simple description of forex, which is helpful for beginners. Brian Dolan is the author of this edition and does a great job following the structural content of “For Dummies” books.

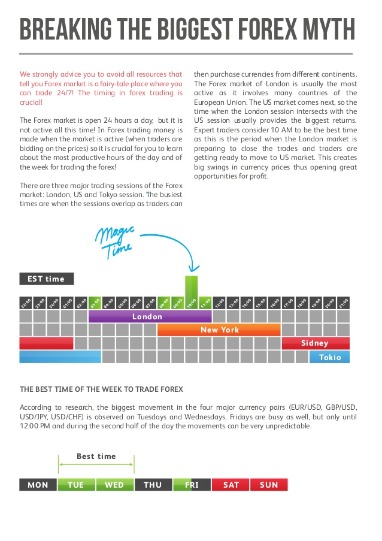

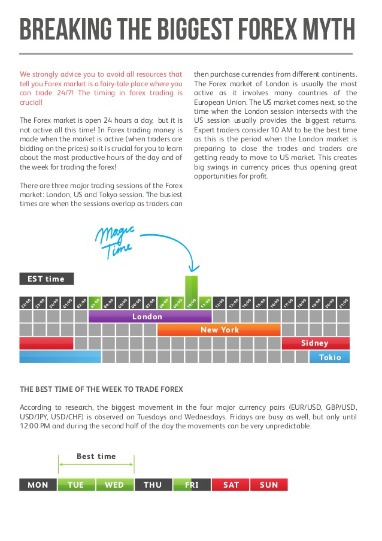

The forex market is open and active 24 hours a day from the start of business hours on Monday morning in the Asia-Pacific time zone straight through to the Friday close of business hours in New York. At any given moment, depending on the time zone, dozens of global financial centers — such as Sydney, Tokyo, or London — are open, and currency trading desks in those financial centers are active in the market. The forex markets have had a limited form of electronic trading since the mid-1980s.

It is like flipping a coin – only two possibilities exist; up or down. One of the functions of the foreign exchange market is to present the economic state of different countries or regions around the world. The rule of thumb goes that the stronger an economy is, the stronger the currency will be. For this reason, traders try to anticipate trends in the currency market based on how well an economy performs. In the forex market, currencies are paired together, so buying one means selling the other. One currency is worth a specific amount when compared with other currency. There always needs to be something else to set a currency against.

Speculating In The Currency Market

How about getting more favorable premiums costs for younger drivers? see car insurance for 17 year olds and motor car insurance for under 21 and vehicle insurance for male and female under 25 years old. Read the following informative article if you are looking for better rates for the young drivers in your family, cheaper vehicle insurance for young drivers. Now, for discovering new ways to get lower quotes go to general car insurance Read this article if your after high risk car insurance information. Forex transactions are quoted in pairs because you are buying one currency while selling another. The first currency is the base currency and the second currency is the quote currency.

Though, Forex participants were in a difficult position, the Forex market continues to function successfully, it is a stable and profitable as never before. The price, or rate, that is quoted is the amount of the second currency required to purchase one unit of the first currency. For example, if EUR/USD has an ask price of 1.2327, you can buy one Euro for 1.2327 US dollars. Compare this to the New York Stock Exchange, that has a daily turnover of about US$70 billion and it is very obvious how the Forex market is definitely the largest financial market on the globe. And you don’t need a large sum of money to start, you can trade initially with a minimal sum, or better off, you can start practicing with a demo account without the need to deposit any money.

And from the beginning of the year 1991, this caused bankruptcies of numerous financial organizations in Japan. As a consequence, the quotes on the Tokyo Stock Exchange collapsed, a Yen devaluation took place, thereafter, a new wave of bankruptcies among manufacturing companies began. In 1995 a historical low of the USD/JPY pair was recorded at -79.80.

Forex hours refers to the time when participants in the $5 trillion market are able to transact. If your account is funded in U.S. dollars, a micro lot represents $1,000 of your base currency, the dollar. A mini lot is 10,000 units of your base currency and a standard lot is 100,000 units. Currency trading is a 24-hour market that is only closed from Friday evening to Sunday evening, but the 24-hour trading sessions are misleading.

Best Forex Trading Courses

The truth is that for one person to make money, another person has to lose. Once you understand that, you can learn about money management, risk assessment, and position sizing. With the proper skills, you can be the one making money on currency, not losing it.

However, there’s also a way to profit when prices fall through a technique called “short selling”. We won’t get too technical in our Forex guide for dummies, we will explain short-selling in one of our next articles. Smith is also the chief investment officer of a money management firm. The title makes some lofty promises but the contents of the book deliver solid information. The book includes a thorough overview of the forex market and a ton of trading strategies, including a system of looking at the forex market from a day-to-week market perspective.

Her fifth book, Rising Storm, made the USA Today Bestseller List for all books on August 30th, 2012. Kathleen is an animal lover who supports rescue organizations and other non-profit organizations whose goals are to protect and save our four-legged family members. Kathleen lives in Central Kentucky with her husband, daughter, two dogs, and a cat who thinks he’s a dog. She loves to hear from readers and can be reached at -Brooks.com Check out the Kathleen Brooks’ Website, -Brooks.com for updates on in the Bluegrass Series. You can also “Like” Kathleen on Facebook and follow her on Twitter @BluegrassBrooks. However, certain market micro-structure details can’t be blindly applied like the pip value, the lot size, opening and closing hours, etc.

Forex For Dummies

And probably nothing is more frustrating as a trader than having pinpointed a trade opportunity, having it go the way you expected, but having nothing to show for it because you never put the trade on. Selling a currency pair short means you’re expecting the price to decline. Because of the way currencies are quoted and because currency rates move up and down all the time, going short is as common as being long. Above all, try not to take your trading results too personally. Financial markets are prone to seemingly irrational movements on a regular basis, and the market doesn’t know or care who you are and what your trade idea is. Get a comprehensive overview of the forex market and how it works. You could apply most of these concepts to the other markets, especially if those concepts involved technical analysis.

Other factors like interest rates, new economic data from the largest countries and geopolitical tensions, are just a few of the events that may affect currency prices. Transaction risk refers to the adverse effect that foreign exchange rate fluctuations can have on a completed transaction prior to settlement. A dual currency service allows investors to speculate on exchange rate movement between two currencies. Forex is the market where currencies are traded and is a portmanteau of “foreign” and “exchange.” Forex also refers to the currencies traded there. The foreign exchange is the conversion of one currency into another currency. Most retail investorsshould spend time investigating a forex dealer to find out whether it is regulated in the U.S. or the U.K. (dealers in the U.S. and U.K. have more oversight) or in a country with lax rules and oversight.

However, by choosing the reasonable leverage size, traders can minimize their risks. The Forex market is a highly speculative in nature and the ability to analyze price behavior becomes an invaluable asset for any trader or investor. Prior to reading this book, I had only read one other book on currency trading. The first book I read was unfortunately a sales pitch for the author’s retail software. After reading this book, I regained confidence in the idea that one could gain objective information from a beginners guide to FOREX. I highly recommend this book as a beginners guide to currency trading.

Great Book And A Promising Strategy!

Straight through processing and electronic communication networks are more for forex and CFDs. Welcome to video #12 of Currency Trading for Dummies — the different types of Forex analysis. Welcome to video #11 of Currency Trading for Dummies — the different types of Forex analysis. Welcome to video #10 of Currency Trading for Dummies — the different types of Forex analysis.

Currency trading is great because you can use leverage, and there are so many different currency pairs to trade. If you’re anxious to start trading right away, see our guide on how to pick the right forex broker.

The FX currency trading offers fantastic opportunity for wealth provided you know the basic rules and regulations of the market. Therefore, before starting FX currency trading, do your homework and read as much as to maximize your knowledge hence profits. Four “currency pairs” dominate the global forex currency trading market. Dollar, US Dollar versus Japanese Yen, US Dollar versus Swiss Franc, and US Dollar versus British Pound.

The Best Way To Learn Forex Trading

Currency trading has many benefits, but it also has fast- changing financial-trading avenues. Your plain-English guide to currency trading Currency Trading For Dummies is a hands-on, user-friendly guide that explains how the foreign exchange market works and how you can become a part of it. Plus, you’ll discover different types of trading styles and make a concrete strategy and game plan before you act on anything. Currency trading is a widely known and highly demanded concept into the international market. For any business person, the preferred place to make big money instantly is money market. Financial investors concentrate on the other aspects of the business like day trading, commodity trading and future trading apart from the currency trading. The term forex used to be widely observed into the multinational banks and corporate business houses since they deal across the country in various currencies.

- Investors usually focus on the fundamental approach to speculate and use technical analysis to reinforce their decisions.

- In 1995 a historical low of the USD/JPY pair was recorded at -79.80.

- Benzinga’s forex trading course teaches beginners to intermediates about forex basics.

- In addition to the major global financial centers, many financial institutions operate 24-hour-a-day currency trading desks, providing an ever-present source of market interest.

Regulated brokers cannot act on their own as they need to follow rules and guidelines set by the regulator. Regulated brokers protect their clients’ interest and offer greater confidence than unregulated firms. Investors usually focus on the fundamental approach to speculate and use technical analysis to reinforce their decisions. It is said that a good trade needs both fundamental and technical analysis, though the truth is that it depends very much on one’s trading style. Technical concepts have stood the test of time, and many of them have existed for over hundreds of years. The idea is not to forecast all future price action, but the next stage in the market. Depending on the volume traded, it is enough to speculate on the largest market in the world successfully.

Based On The Book ..

That payout is your original 100.00 investment along with an 81.00 profit. Be aware however different Forex traders will offer different payout amounts. With that in mind do shop around and compare the payouts you will be offered by several of our featured Brokers, as they can and do vary. When you take a look through the possible currency pairings available at any Forex Broker you will find a figure presented as a percentage.

Highly recommended read before any aspiring currency trader places their first trade in the markets. For individual traders, overall liquidity in the major currency pairs is more than sufficient, with generally orderly price movements. In some less liquid, non-regional currencies, like GBP/USD or USD/CAD, price movements may be more erratic or nonexistent, depending on the environment. With no Canadian news out for the next 12 hours, for example, there may be little reason or interest to move that pair. But if a large market participant needs to make a transaction in that pair, the price movement could be larger than normal.

Investing involves risk including the possible loss of principal. It’s better to pick a few that have no relation and focus on those. Having only a few will make it easy to keep up with economic news for the countries involved, and you’ll be able to get a sense of the rhythm of the currencies involved.

Currency Trading For Dummies #12: How To Choose A Forex Broker

We refer to liquidity, liquidity considerations, and market interest throughout this book because they’re among the most important factors affecting how prices move, or price action. Exiting each trade is the culmination of the entire process and you’re either going to be pleased with a profit or disappointed with a loss.