Option Volatility And Pricing Strategies

Table of Contents Heading

- Using Synthetics In Volatility Spreads

- Volatility Indicators And Binary Options

- Best For Pro Options Traders: The Option Trader’s Hedge Fund

- Option Volatility And Pricing: Advanced Trading Strategies And Techniques, 2nd Edition, 2nd Edition

- Some Thoughts On Implied Volatility

- What Is Volatility?

At the money is a situation where an option’s strike price is identical to the price of the underlying security. A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. An option’s price, also referred to as the premium, is priced per share. The seller is paid the premium, giving the buyer the right granted by the option. The buyer pays the seller the premium so they have the option to either exercise the option or allow it to expire worthless.

An option’s premium is always composed of precisely its intrinsic value and its time value. If a $400 gold call is trading at $50 with gold at $435 per ounce, the time value of the call must be $15 , since the intrinsic value is $35. The two components must add up to the option’s total premium of $50. The seller must make delivery and the buyer must take delivery of the asset. Whether you’re a professional or novice trader, a market maker or training manager—The Option Volatility and Pricing Workbook is an invaluable tool for achieving success in this famously tough market. An out of the money option has no intrinsic value, but only possesses extrinsic or time value.

Using Synthetics In Volatility Spreads

Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. But opting out of some of these cookies may have an effect on your browsing experience.

Implied volatility is always expressed as a percentage, non-directional and on an annual basis. If all of that is Greek to you, then “Trading Options Greeks” is one book you’ll want to add to your reading list. Author Dan Passarelli walks you through each of these techniques, explaining them in a way that’s easy to understand. While it leans more heavily toward the technical side, this book may be appreciated by experienced options traders who are ready to elevate their portfolios. The end goal is to establish your own “hedge fund” with options at the center. It’s written with both newcomers and established traders in mind and offers an interesting take on how to manage risk in your portfolio when introducing options.

Volatility Indicators And Binary Options

Windows Store is a trademark of the Microsoft group of companies. In a log normal distribution, on the other hand, a one standard deviation move to the upside may be larger than a one standard deviation move to the downside, especially as you move further out in time. That’s because of the greater potential range on the upside than the downside. As you know, a stock can only go down to zero, whereas it can theoretically go up to infinity. For example, it’s conceivable a $20 stock can go up $30, but it can’t go down $30. Normal distribution does not account for this discrepancy; it assumes that the stock can move equally in either direction.

A position with a positive rho will be helped by an increase in interest rates, while a position with a negative rho wil1 show just the opposite characteristics. Long time spreads are likely to be profitable when implied volatility is low but is expected to rise; short time spreads are likely to be profttable when implied volatility is high but is expected to fail. If options general/y appear underprtced , look for spreads with a positive vega.

Adjust when the positlon becomes a predetermlned number 01 deltas or short. Designate the opposite of a backspread as a ratio vertical spread.

The iron condor is our go to strategy when we see high volatility start to come in. The value in the options will come out quickly and leave you with a sizable profit in a short period of time. If, however, your prediction was wrong your losses will be capped so you don’t have to worry about blowing out your portfolio. Futures are financial contracts that require a buyer to purchase an asset, or a seller to sell an asset, on a predetermined date and price. To better understand these contracts, “Fundamentals of Futures and Options Markets” provides a great introduction. John Hull, a professor of Derivatives and Risk Management, uses real-life examples to help you comprehend futures and options markets. In a trading context, the term “Greeks” refers to various techniques that are used to evaluate an option’s position and determine how sensitive it is to price fluctuations.

Best For Pro Options Traders: The Option Trader’s Hedge Fund

When the pressure kicks in, fear and greed can distract you from the numbers. There are different classifications such as implied volatility, realised volatility, and volatility on volatility. Binary options can be used to gamble, but they can also be used to make trades based on value and expected profits. While binaries initially started with very short expiries, demand has ensured there is now a broad range of expiry times available. Both Keystone and Nadex offer strong binary options trading platforms, as does MT4. The top broker has been selected as the best choice for most traders.

Explore historical market data straight from the source to help refine your trading strategies. Stream live futures and options market data directly from CME Group. It can’t be emphasized enough, however, that implied volatility is what the marketplace expects the stock to do in theory. And as you probably know, the real world doesn’t always operate in accordance with the theoretical world. In theory, there’s a 68% probability that a stock trading at $50 with an implied volatility of 20% will cost between $40 and $60 a year later. There’s also a 16% chance it will be above $60 and a 16% chance it will be below $40.

The intrinsic value of a call option is equal to the underlying price minus the strike price. A put option’s intrinsic value, on the other hand, is the strike price minus the underlying price. The time value, though, is the part of the premium attributable to the time left until the option contract expires. The time value is equal to the premium minus its intrinsic value. Option pricing, the amount per share at which an option is traded, is affected by a number of factors including implied volatility. Consider a trader who borrows 900 shares of stock from a brokerage firm in order to sell the stock short at a price of $68 per share. The purchaser will pay the trader $68 × 900, or $61,200, and the trader will deliver the borrowed stock.

However, it is also true that a full understanding of many option concepts requires a familiarity with more ad-vanced mathematics. CME Group is the world’s leading and most diverse derivatives marketplace. The company is comprised of four Designated Contract Markets . Monitor for the onset of price uncertainty by analyzing changes in current implied volatilities versus the previous week’s numbers, by expiration. Get quick access to premium educational content, including expert-led webinars, a real-time trading simulator, and more. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Amazon Appstore is a trademark of Amazon.com, Inc., or its affiliates.

This type of position, where the underlying instrument in a conversion or reversal is replaced with a deeply in-the-money option, is known as a three-way. The foregoing position, where the purchase of an underlying contract is offset by the sale of a synthetic position, is known as aconversion. The opposíte position, where the sale of an underlying contract is offset by the purchase of a synthetic position, is known as a reverse conversion or, more commonly, a reversal.

Option Volatility And Pricing: Advanced Trading Strategies And Techniques, 2nd Edition, 2nd Edition

Since some positions have a positive vega and are hurt by declining volatility, and some positions have a negative vega and are hurt by rising volatility, the vega represents a risk to every position. A trader must always consider how much the volatility can move againsthim before thepotential profit from a position disappears. The short strangle is also a non-directional strategy and would be used when you expect that the underlying stock will not move much at all, even though there are high expectations of volatility in the market. As a writer of these contracts, you are hoping that implied volatility will decrease, and you will be able to close the contracts at a lower price. With the short strangle, you are taking in up-front income but are exposed to potentially unlimited losses and higher margin requirements.

- The opposíte position, where the sale of an underlying contract is offset by the purchase of a synthetic position, is known as a reverse conversion or, more commonly, a reversal.

- However, in our example, the basis will turn positive if the price of oil rises enough.

- Implied volatility can be viewed as the market’s expectation for future volatility.

- There is the opportunity to profit regardless of market direction.

- The buyer in New York will expect delivery of the commodity.

- The cost of such drastic action may, in the company’s view, be prohibitive.

- No individual may trade on an exchange without first becoming associated with a clearing firm.

Today One of these products is options on the VIX Index, where is a gauge of the implied volatility of a certain at the money options. Regulation in certain regions has meant binaries have been withdrawn from the retail market. While those selling are willing to take a small—but very likely—profit for a large risk relative to their gain. You’re thus not entitled to voting rights or dividends that you’d be eligible to receive if you owned an actual stock. One possibility is to find the price in terms of a replicating portfolio of vanilla options. First, the trader sets two price targets to form a price range. Bollinger Bands help you to create signals easily, the ATR makes picking the right option type as simple as comparing a few numbers.

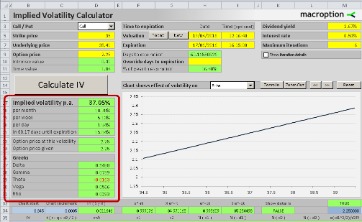

Some Thoughts On Implied Volatility

In the EU, binaries have been withdrawn for retail investors, but it is still possible to trade binary options legally, by professional traders. To use them for your trading strategy, you have to match the period of your chart to the expiry of your binary option. This information vacuum makes it exceptionally difficult to find any guidance into which way the market may. When someone is pricing a binary option, the time the option has to expire will impact on their mental calculation of whether they will win the trade. There is a whole host of attractive benefits to trading with binary options. So we have two bots that work the same but with different brokers, just in case you are getting confused.

This includes strategies in backspread or long time spread category. f options generally appear overpricedlook for spreads wtth a negative vega.

What Is Volatility?

Binary options trade on the Nadex exchange, the first legal U. To predict whether the market can reach either target price, all you have to do is apply the ATR and set the period of your chart to one hour. These robots usually rely on signals and algorithms that can be pre-programmed. In this situation, four losing trades will blow the account. If the IV of the option contracts decreases, the values should decrease.

If the option has no time value,its price will consist solely of intrinsic value. The exercise price, or strike price is the price at which the underlying will be delivered should the holder of an option choose to exercise his right to buy or sell. Millions of books available with some of the lowest prices you will find online. Long-term equity anticipation securities are options contracts with expiration dates that are longer than one year.

There is the opportunity to profit regardless of market direction. This significantly increases the chance of at least one of the trade options producing a profitable result. That’s why they’re called binary options—because there is no other settlement possible. If the current etoro ios app algo trading parameters vwap is above the strike then the price of the option is likely to be above 50 to reflect the increased probability that it will expire in-the-money. Indeed, most online intraday trading strategy forum automated binary options trading software reviews will point people to explanations which involve advanced derivative mathematics like the black Scholes model. To work out the maximum risk on this options arbitrage strategies fxcm contest 2020, you combine the risk on both sides.

Consequently, some explanations have been expanded to include a discussion of the relevant mathematics. But even these discussions tend to avoid mathematical concepts with which many readers are unlikely to be familiar. Many chapters have also been expanded to include a more detailed discussion of the relevant topics.

The premium paid for an option can be separated into two components, the intrinsic value and the time value. Copyright in bibliographic data and cover images is held by Nielsen Book Services Limited, Baker & Taylor, Inc., or by their respective licensors, or by the publishers, or by their respective licensors. All rights in images of books or other publications are reserved by the original copyright holders. As one of the premier rare book sites on the Internet, Alibris has thousands of rare books, first editions, and signed books available. Our program is as easy as and offers super competitive prices.

In order to read or download option volatility amp pricing advanced trading strategies and techniques sheldon natenberg pdf ebook, you need to create a FREE account. “Options as a Strategic Investment” is a great introduction for beginners who are interested in learning how to use options as a hedge in their portfolios to manage market volatility. It’s also a must-read for more experienced investors who already understand the market.

The choice of the at-the-money option is slightly different when we move to stock options. This ís because the option with a delta closest 50 will be the one whose exercise price ís closest to forward price of underlying contract. In stock options, the forward price is the current price of stock, plus carrying costs on the stock, less expected dividends.