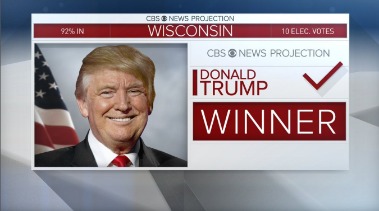

What Will Happen To The Dollar If Trump Wins

Table of Contents Heading

- A Biden Election Win Is best Possible Outcome For Dollar

- But What Would A Trump Or Biden Win Mean For The Market, And Particularly The Us Dollar? We Take A Look At Possible Scenarios.

- Bitcoin Recovers From Losses As Ethereum Begins A New Correction

- What Will Happen To The Dollar If Clinton Wins The Us Election?

- Tv Debate Will Give Clues To November Dollar Reaction

- Bitcoin Is Set To Reach $400,000 (£303, If Joe Biden Wins The Us Presidential Election, According To Financial Guru Max Keiser

- The Dollar Could Fall By 15% By The End Of 2023 Whether Biden Or Trump Wins

Let’s take a look at how global markets could react to either of the election outcomes. Markets across the globe have reacted sharply to US election results in the past and reports suggest that 10 days after a presidential election, a Democratic victory tended to be less positive for the S&P 500 and S&P MidCap 400.

- Investors should be looking to keep an appropriate exposure to American companies and hold their heads even as volatility on both stock and currency markets increases,” he said.

- This Brexit, as the British pullout is known, wasn’t supposed to happen — at least if you believed polls that were just as one-sided then as the ones in our presidential election now.

- The mighty US dollar has been gradually strengthening against most other currencies since May 2016.

- Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

- The yen might have the upper hand, however, particularly if the president were to contest an outcome that saw Mr Biden replace him, according to the report.

In its 2016 platform, the Republican party has proposed a reduction in the corporate tax rate, in line with a proposal by Trump. It has also proposed a “territorial system of taxation” allowing profits earned and taxed abroad to be repatriated for local investment. The Republican Party platform in 2016 follows the general lines of traditional GOP proposals favouring austerity and budget control. However, it differs in some respects with the proposals put forth by the party’s presidential candidate, Donald Trump, who appears willing to sacrifice certain economic goals in the short term in favour of longer-term adjustments.

A Biden Election Win Is best Possible Outcome For Dollar

We have to have the UK deal with the fact that the last time they had a current account surplus was in 1982, when Italy was world champion of football. It leads to more unemployment, more inequality, higher stock market valuation that drives you to nowhere.

The Fed minutes made it clear that the economic outlook assumes additional fiscal support. If it’s “significantly” smaller or “significantly” delayed, the recovery pace will be slower than the Fed has been expecting. Nobody knows that “significantly” means—we will know before the end of Nov who won the election, and if it’s Biden, he can announce his stimulus plan right away. Stocks are flirting with record highs again on hopes of a blue wave on Election Day. In turn, that would make it easier for a president Biden to pass a badly needed stimulus plan north of $2 trillion to jumpstart an economy ailing from the coronavirus.

But What Would A Trump Or Biden Win Mean For The Market, And Particularly The Us Dollar? We Take A Look At Possible Scenarios.

)In the lead up to the 2016 election it fell to all-time lows against the US dollar. Currency markets, says Callow, were looking for Trump to say or do something during the debate to change that. Currency markets are now pointing to precisely that outcome — a turnaround in just a few weeks. Blackrock strategists also see the dollar’s weakness persisting in the near term. They noted, “The prospect of the dollar retaining its perceived safe-haven status is another concern.” Last month, Goldman Sachs warned that the U.S. dollar risked losing its world reserve currency status. BITCOIN is set to reach $400,000 (£303,862) if Joe Biden wins the US presidential election, according to financial guru Max Keiser.

If you own stocks, hope for a come-from-behind win for sitting president Donald J. Trump on Election Day. The Telegraph values your comments but kindly requests all posts are on topic, constructive and respectful. However, Mr Craig said that investors should not speculate on currency moves one way or the other. The natural reaction from the Federal Reserve to rising inflation would be to raise interest rates but last year the central bank changed its inflation target from 2pc to an average of 2pc.

Bitcoin Recovers From Losses As Ethereum Begins A New Correction

The amount of stimulus spending and the inflationary tone it sets is also a chief concern for Tiggre, who believes either candidate will inherit a challenged economy in need of immediate resuscitation — which again is ultimately positive for gold. Regardless of the recent departure from his old rhetoric, Lobo Tiggre of Independent Speculator thinks Trump will go back to saying a weaker dollar is better for the economy.

The reality is that Trump woefully overstates the leverage China has on the U.S. as our chief creditor, and understates the leverage the United States has on China as its chief debtor. His threats of a trade war – of the imposition of ghastly protective tariffs – are horrifying, and can only create solace in that we just can’t possibly believe he would ever go there.

What Will Happen To The Dollar If Clinton Wins The Us Election?

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Spot gold prices (XAU/USD) are in consolidation mode for a second straight day, albeit they continue to trade with a positive bias. XAU/USD prices have traded within a tight $1725-$1740ish range, having advanced marginally above Monday’s low-$1720s to $1735ish range.

The chief economist at Danish global banking giant Saxo is maintaining his prediction the Australian dollar will return to parity with the greenback, possibly within a year. By selecting company or companies above, you are giving consent to receive communication from those companies using the contact information you provide. To learn more about what’s at stake in the mining sector beyond gold, click here. Americans will head to the polls on the first Tuesday in November to select a leader who will need to rebuild the economy and address the US$23.3 trillion and growing national debt. For Mercenary Geologist Mickey Fulp, there is downside in gold that should be watched.

Tv Debate Will Give Clues To November Dollar Reaction

“We are currently forecasting about a 15% depreciation in the real trade-weighted dollar from this year’s peak to the end of 2023, but a larger move is certainly possible,” Pandl said. A sustained environment of deeply negative real interest rates in the US and a continued sharp global economic recovery from the COVID-19 recession is the “standard recipe for broad dollar weakness,” Pandl said. The dollar could depreciate by 15% by the end of 2023 irrespective of the election outcome, and an even larger dip is “certainly possible,” Goldman Sachs said. Even if Donald Trump is re-elected, market focus will shift to vaccine distribution and global economic performance by next year. That scenario makes Goldman Sachs expect dollar weakness in any case. The trajectory of the pandemic, the development of a successful vaccine, and the election outcome are factors affecting the timing of the dollar weakness, Goldman Sachs economist Zach Pandl said.

Biden “will not talk the down; and he will embrace multilateralism, including the framework that has built and supported the (dollar’s) reserve currency status,” wrote Alan Ruskin of Deutsche Bank. The uncertainty surrounding a contested election could be one such event. Some analysts believe a Trump win or divided government – which could result in a smaller or delayed fiscal stimulus package – may be another. While that short position reflects the negative sentiment swirling around the dollar, it could also fuel gains if a change in the narrative forced investors to unwind those bets all at once.

Bitcoin Is Set To Reach $400,000 (£303, If Joe Biden Wins The Us Presidential Election, According To Financial Guru Max Keiser

I mean in that circumstance you know dollar I think could correct lower by certainly 2 to 3 percent. Everyone already agrees that the Fed will soon raise interest rates. But the financial markets might not wait for the Fed if Trump is elected. Both Hillary and Trump have vowed to spend more money to get the economy going. So any additional spending will get people worrying about inflation.

The US presidential election for 2020 pitting President Donald Trump against former Vice-President Joe Biden is less than two months away and its outcome is more uncertain than ever. Historically, 10 days after a presidential election, a Democratic victory tended to be less positive for the S&P 500 and S&P MidCap 400. US election uncertainty is starting to dominate the market narrative, and price action.Tuesday’s TV debate will cause some market jitters. So in that sense, it’s a little bit of a bad harbinger for the markets.

Tax Hikes An ‘extremely Strong’ Munis Tailwind, Foley Says

But some think the dollar could strengthen against developing nation currencies – such as the Mexican peso – due to anticipation that Trump will push through new protectionist trade policies, which will damage their economies. He said that the dollar has “done very well of late” and the US central bank is expected to increase interest rates once again. The Mexican peso is likely to fall against the dollar instead of the other way round because the dollar is such an influential global currency. If any of this is confusing, the central point remains that financial markets simply want to know what’s around the corner. “The reason the market is rallying right now is because three weeks ago the market was very nervous about a contested election and that would be unsettling for the market. A big drop in the values of big US tech firms was partly to blame, but the market was also seriously concerned about a contested election. The stock market is also pricing in a comfortable Biden election victory.

The dollar may also weaken if foreign demand for US equities falls after proposals are executed to raise corporate taxes and increase technology regulation. A win for President Trump would trigger a short-term dollar bounce, as concerns of renewed trade conflict would cause nervousness and dollar strength.

According to ING; “One school of thought is that a strong Trump performance is equity positive/dollar negative. We have the view, were Biden to win, the dollar could decline in 2021 on a benign world view – but let’s look out for the price action on Wednesday.

For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.

A Biden Boom Of Immense Proportions

So here I am people of America, here I am, here from god, things will be so great, the economy, jobs, and America will be so great, your heads will be spinning over the greatness. He said to me, this is not me saying this, this was god speaking to me, he said, I need you to continue your presidential role, the U.S needs you, the U.S wants you, and so does the world, the world I created needs you. It was the most beautiful thing, I died, three days the doctors told me I was dead for, I didn’t know it was three days, the doctors told me so, but they assured me I was dead. I reckon Melanomia would be able to tell you that’s already happened more times than you might think. Amusing to see China and Russia merrily accumulating gold for the last decade, while several other of the ‘stans’ have been doing the same. Impossible, of course, for the US to respond militarily to redress that balance . I sure hope they have that 8,199 tons they claim they have, because if not, their military will effectively be neutered.