Bond Yields

Table of Contents Heading

- Bonds And Securities

- Maturity, Maturity Date(s)

- The Influence Of Interest Rates

- Treasury Yields Predicted The 2008 Financial Crisis

- Moody’s Seasoned Aaa Corporate Bond Yield

- Yield To Worst

- Other Bonds & Rates Data

- Fire Up Your Portfolio With Transportadora De Gas Del Sur 11 75% High Yield Bonds!

When investors buy bonds, they essentially lend bond issuers money. In return, bond issuers agree to pay investors interest on bonds through the life of the bond and to repay the face value of bonds upon maturity. The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond.

These may make you reconsider whether to purchase a long-term bond. But the bond’s yield to maturity in this case is higher. It considers that you can achieve compounding interest by reinvesting the $1,200 you receive each year. It also considers that when the bond matures, you will receive $20,000, which is $2,000 more than what you paid.

The current yield is a function of the bond’s price and its coupon or interest payment, which will be more accurate than the coupon yield if the price of the bond is different than its face value. The face value, coupon, maturity, the issuer and yield are all factors that play a role in a bond’s price.

Bonds And Securities

If there is a lot of demand, the bond will go to the highest bidder at a price above the face value. The government will only pay back the face value plus the stated interest rate. Demand will rise when there is an economic crisis.

Treasurys to be an ultra-safe form of investment. As the price of bonds increase, returns decrease in the form of lower yields. This is because the coupon payment is fixed, but the cost to buy the asset goes up. For existing bondholders, this makes their bond to appreciate in price, as other investors are willing to pay more for a higher income stream.

Maturity, Maturity Date(s)

The riskier a borrower is, the more yield investors demand to hold their debts. Higher yields are also associated with longer maturity bonds. In general the bond market is volatile, and fixed income securities carry interest rate risk.

So even when investors don’t want to sell their bonds, they may have no choice if the bonds are callable. Even if bondholders don’t sell their bonds, they’ll face the same situation when reinvesting coupon payments. As the cost of borrowing gets cheaper, there’s less upside for debtholders. Some investors turn to riskier assets, like stocks, for growth. If an investor takes advantage of the price appreciation and sells their bond, they’ll be in the same position as everyone else when they want to reinvest the profits.

The Influence Of Interest Rates

The reason you should care is bond yields are a good indicator of how strong the stock market is and how much interest there is in the US Dollar. If bond yields are going down, it is because bond prices are going up. Now, the only reason bond prices go up is if there is an increase in demand for the bonds. Similarly, the creditworthiness of the issuer will affect the bond’s price on the secondary market. If the issuer is financially strong, investors are willing to pay more since they are confident that the issuer will be capable of paying the interest on the bond and pay off the bond at maturity. But if the issuer encounters financial problems—and especially if it’s downgraded by one of the ratings agencies —then investors may become less confident in the issuer. Buyers can get around 7% on new bonds, so they’ll only be willing to buy your bond at a discount.

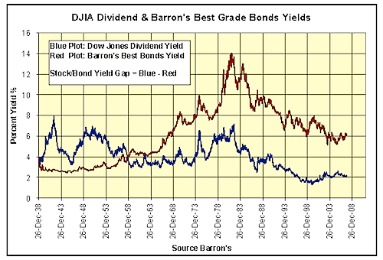

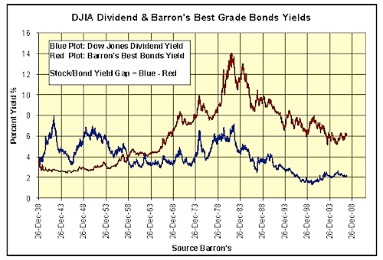

Use the yield curve as an indication of potential economic conditions to come. Inflation expectation is the primary variable that influences the discount rate investors use to calculate a bond’s price. But as you can see in Figure 1, each Treasury bond has a different yield, and the longer the maturity of the bond, the higher the yield. When inflation expectations rise, interest rates rise, so the discount rate used to calculate the bond’s price increases, and the bond’s price falls. Bond prices and bond yields are excellent indicators of the economy as a whole, and of inflation in particular.

Treasury Yields Predicted The 2008 Financial Crisis

The following examples can help you gain a sense of the relationship between prices and yields on bonds. This will usually cause the USD to rise against the majors. Coupon rate—The higher a bond’s coupon rate, or interest payment, the higher its yield. That’s because each year the bond will pay a higher percentage of its face value as interest.

A yield curve is a graph demonstrating the relationship between yield and maturity for a set of similar securities. Price—The higher a bond’s price, the lower its yield. That’s because an investor buying the bond has to pay more for the same return. The derived price takes into account factors such as coupon rate, maturity, and credit rating. But the price may not take into account every factor that can impact the actual price you would be offered if you actually attempted to sell the bond.

Moody’s Seasoned Aaa Corporate Bond Yield

After month 24, the yield curve is telling us that the economy should grow at a more normal pace. That’s why bond prices/yields, or the prices/yields of bonds with different maturities, are an excellent predictor of future economic activity.

Vanguard Total International Bond Index Fund holds about 3,000 non-U.S. In July 2000, the yield curve inverted and the 2001 recession followed. In 2013, yields rose 75% between May and August alone. China has threatened to purchase fewer Treasurys, even at higher interest rates. If this happens, it would indicate a loss of confidence in the strength of the U.S. economy. It would drive down the value of the dollar in the end. The inversion steadily worsened as the situation grew worse.

Yield To Worst

Aaa is the highest rating a corporate bond can get, and is considered investment grade. Another important way to analyze bond yields is spreads between different kinds of bonds. During the financial crisis in , the spread between Aaa and Baa bonds widened because of the unpredictability of bonds and increased default rates. When yields rise on the secondary market, the government must pay a higher interest rate to attract buyers in future auctions. Over time, these higher rates increase the demand for Treasurys. They must return higher yields in order to attract investors. To remain competitive, interest rates on other bonds and loans increase as Treasury yields rise.

In this example, the price rises to 104, meaning they are willing to pay you $20,800 (20,000 x 1.04). At a price of 104, the yield to maturity of this bond now matches the prevailing interest rate of 3%.

The risk that the financial health of the issuer will deteriorate, known as credit risk, increases the longer the bond’s maturity. To see the market’s prediction of future economic activity, all you have to do is look at the yield curve. The yield curve in Figure 1 predicts a slight economic slowdown and a slight drop in interest rates between months six and 24.

Diversification can help lower portfolio risk while boosting expected returns. When calculating a bond’s yield, the fractional periods can be dealt with simply; the accrued interest is more difficult. For example, imagine a bond has four years and eight months left to maturity. The exponent in the yield calculations can be turned into a decimal to adjust for the partial year.

When you buy a bond, you are entitled to the percentage of the coupon that is due from the date that the trade settles until the next coupon payment date. The previous owner of the bond is entitled to the percentage of that coupon payment from the last payment date to the trade settlement date. Note that Treasury bills, which mature in a year or less, are quoted differently from bonds. T-bills are quoted at a discount from face value, with the discount expressed as an annual rate based on a 360-day year. That is, if you buy a bond that pays 1% interest for 3 years, that’s exactly what you’ll get. And when the bond matures, its face value will be returned to you.

Because investors are nervous about bond yields in southern Europe, this has caused people to sell Spanish bonds and take the relative security of UK bonds. Japan has national debt of over 230% of GDP – yet, bond yields are very low. The high level of domestic savings means there is strong demand for Japanese government bonds. Firstly, bond yields have an inverse relationship with the price of bonds. The sharp drop in yields in 2020 have left some investors questioning their reasons for owning bonds.

I wouldn’t read too much into it, as none of this really matters as the markets are waiting on the FOMC statement tomorrow for direction. Therefore, I agree, the Fed is in no hurry to remove accommodation. The shift in investor positioning comes as interest rates begin to bounce off of historic lows seen amid the COVID-19 pandemic. Yield to worst is the worst yield you may experience assuming the issuer does not default. It is the lower of yield to call and yield to maturity. Yield to call is the yield calculated to the next call date, instead of to maturity, using the same formula. If the bid price is not listed, you must receive a quote from a bond trader.

But although the relationship has changed, there are still benefits to owning bonds as part of a diversified asset allocation. When the Federal Reserve cuts interest rates, the cost of borrowing usually decreases for companies, governments, and individuals, in the form of mortgages and other household debt. Issuers retire high-cost debt where possible using a call option while retail borrowers refinance mortgages and other consumer debt.

He has provided education to individual traders and investors for over 20 years. He formerly served as the Managing Director of the CMT® Program for the CMT Association. Security cookies should be enabled at all times so that we can secure our website and protect our services. This includes cookies used to enable you to log in and access our services, protect against fraudulent logins and help detect and prevent abuse or unauthorized use of your account. The information contained herein does not constitute the provision of investment advice. With or symbols, the countries where 10Y yield changed considerably in the last 3 months.

Fire Up Your Portfolio With Transportadora De Gas Del Sur 11 75% High Yield Bonds!

These funds, which invest in government bonds, are routinely adjusted for inflation. Most people ignored the inverted yield curve because the yields on the long-term notes were still low.