Strong Currency Vs Weak Currency

Table of Contents Heading

- See Current Exchange Rates Here

- On The Other Hand: When A Weaker Dollar Can Be A Good Thing

- Economic Issues That Increase Aggregate Demand

- Is There Anything That Farmers Could Do To Benefit From Exchange Rate Fluctuations?

- Trump Is Wrong: A Weak Dollar Is Bad For America

- Weak Dollar? Strong Dollar? Which Is Better For Stocks?

- How A Strong Dollar May Impact Investments

- But First Things First: What Is A Dollar?

EUR/USD wavers around the round-figure following its bounce off 1.1882. EUR/USD stays steady around 1.1900, after a three-day losing streak, during the initial Asian session trading. US stimulus, reflation fears highlight today’s Fed decision.

If a foreign investor wants to invest in the US and in US assets, they will often consider the value of the dollar. A foreign investor would typically want to see the value investment and the value of the dollar strengthen across the investment period. In this way, when the investment period comes to an end, the foreign investor would look to move back into their local currency at a more favorable exchange rate. A strong or weak dollar are terms used to describe the value of the US dollar relative to the value of other currencies. Here we will look in more detail at what a strong dollar is and what it means for the stock market, foreign investors, tourists and the US economy as a whole. Let’s have a quick primer on currency markets and why exchange rates matter to you, especially if you’re traveling abroad or thinking of buying a vacation home abroad.

See Current Exchange Rates Here

And if investors are leaving for other currencies, they’re likely investing or looking to invest somewhere other than the US. Furthermore, a weak dollar causes imports to be more expensive. The US generally imports more than they export, meaning more expensive imports could have an outsized effect, making products more expensive and slowing US growth.

When your currency is weaker, more people want to buy your country’s goods, which means that there will be more demand, which means that there will be more jobs. Because of Brexit, the pound – i.e., British currency – has just plunged to a thirty-year low against the dollar. The Japanese yen’s value has also gone up in value in comparison to the pound. But what does that mean for you – if you haven’t invested in currency?

After all, in that situation, the US currency is strong relative to other currencies. Or, alternatively, if you think the weak dollar helps out US stocks, for the same reasons you might think the weak dollar hurts global stocks.

On The Other Hand: When A Weaker Dollar Can Be A Good Thing

Exchange rate movements affect exporters, tourists, and international investors in different ways. Stability – A strong, well-established government is attractive to investors and promotes a strong currency because investors are more confident in the solidity of the currency. Economic policies – Fiscal discipline and anti-inflationary monetary policies help promote a strong currency because these policies can help keep inflation and debt in check. Higher inflation and government debt can be bad for a country’s currency. Currency depreciation is when a currency falls in value compared to other currencies.

Fundamentally weak currencies often share some common traits. This can include a high rate of inflation, chronic current account and budget deficits, and sluggish economic growth. Nations with weak currencies may also have much higher levels of imports compared to exports, resulting in more supply than demand for such currencies on international foreign exchange markets—if they are freely traded. While a temporary weak phase in a major currency provides a pricing advantage to its exporters, this advantage can be wiped out by other systematic issues. A high exchange rate does not necessarily indicate a strong currency.

Economic Issues That Increase Aggregate Demand

What we need to confirm is that our secondary close above these highs. I just wanted to reference this because obviously, we looked in the market outlook that the Dollar was weakening. We looked at this seasonal bias a few weeks before, when we were looking in September.

At the same time, the exporters will enjoy added real value to their nominal income. However, the effectiveness of the currency strength is based on the economic policy adopted by the country. However, continuous strengthening of the currency can inflate the cost of living above affordable levels. Salary demands will rise accordingly, and the companies won’t be able to sustain profitability with high wages and expansion costs at the same time. In the domestic economy, the strength of the national currency is calculated as the purchasing power when buying locally produced goods and services. It is based on income and wages reports which reveal the nominal earnings of the citizens.

Is There Anything That Farmers Could Do To Benefit From Exchange Rate Fluctuations?

For everyday items — think clothes, electronics and auto parts — if it’s cheaper to buy imports, people usually will. So, as you can guess, when the dollar weakens (that is, when American-made stuff gets relatively cheaper), American exports tend to increase. The opposite is also true — when the value of the dollar rises, American-made products are harder for U.S. exporters to sell overseas. A country with a strong economy tends to have a strong currency. IMHO, strength of your currency reflects the economic health of India. Hence, it is not a surprise that in last 10 years INR has become so weak compared to USD.

A self-perpetuating cycle of slowing economic activity begins and that will eventually impact the economic fundamentals supporting the stronger currency. For example, when a person exchanges dollars for yen, they are selling their dollars and buying yen. Because a currency’s value often fluctuates, a weak currency means more or fewer items may be bought at any given time. When an investor needs $100 for purchasing a gold coin one day and $110 for purchasing the same coin the next day, the dollar is a weakening currency. A direct quote is a foreign exchange rate quoted as the domestic currency per unit of the foreign currency.

Trump Is Wrong: A Weak Dollar Is Bad For America

In a free float rate scenario, influencing currency rate is difficult. May be it is possible for countries like China which has huge foreign reserves – Top 10 Forex reserve countries. Whether your favourite currencies rise or fall against others, you can use CFD trading to open Long or Short positions with lower margin requirements. Decreasing borrowing costs accelerates production, and the national Gross Domestic Product grows. Enhanced income and wages of the citizens translate into increased spending and consumer demand, leading to the inflation of consumer prices and allowing the businesses to enjoy higher corporate profits.

Currencies may become undervalued for natural reasons when political crises increase wariness about that country’s assets or currency, as happened in Brazil and Turkey since 2013. In other cases, governments deliberately keep the currency undervalued to encourage export sales. US and other officials allege that the People’s Bank of China has consistently undervalued the renminbi/yuan since the early 1990s. A currency that goes further allows all Americans, especially the poorest, to buy more essential goods and services than they could otherwise afford. He argues the case for USD but is applicable for most currencies.

Weak Dollar? Strong Dollar? Which Is Better For Stocks?

This document constitutes the general views of Fisher Investments and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration.

Eventually, the currency discount may spur more exports and improve the domestic economy, provided there are no systematic issues weakening the currency. A strong dollar means that the U.S. dollar has risen to a level that is near historically high exchange rates for the other currency relative to the dollar. The terms weak dollar and strong dollar are generalizations used in the foreign exchange market to describe the relative value and strength of the U.S. dollar against other currencies. The terms “strong,” “weak,” “strengthening,” and “weakening” are interchangeable for any currency. If the dollar falls in value against other currencies, exports from the USA become cheaper.This is good for the US economy as it can offer its products cheaper on the world markets. It is more worthwhile for companies to produce in the USA and sell the products all over the world.

How A Strong Dollar May Impact Investments

You may see headlines cautioning investors about the strength or weakness of the dollar, even foretelling doom if the dollar continues to strengthen—or weaken, depending on your assumptions. But now you know that the dollar’s weakness—or strength—does not dictate stocks’ direction. The US dollar’s relative strength is simply not inherently better or worse for stocks. Realizing the strength of the dollar does not predict market performance is a valuable insight.

The U.S. dollar is often the standard by which other currencies are measured. A strong dollar means that our currency’s exchange rate is favorable, and you can buy more of a foreign county’s goods. Currency exchange rates around the globe are constantly fluctuating, including our U.S. dollar. At present, the U.S. dollar is “strong.” And that’s good, right?

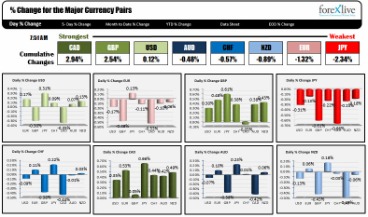

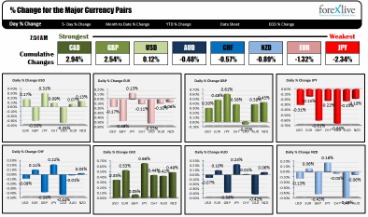

Yen is the strong currency, and the dollar is the weak currency. The USD Index compares the strength of the American Dollar against the currencies of the major trading partners of the U.S. It calculates a weighted average price of the USD currency pairs with Euro, British Pound, Japanese Yen, Canadian Dollar, Swedish Krona, and Swiss Franc.

A weak currency is one that loses its value faster than a strong currency. A currency loses its value due to inflation, which is when whoever issues the currency just prints more of the currency.

Currency Fluctuations: How They Affect The Economy

Currencies are always fluctuating relative to each other, and some investors trade currencies like others trade stocks. If you can figure out what will make the price of a particular currency weaken, you’re in a position to make a lot of money.

- For example, when a person exchanges dollars for yen, they are selling their dollars and buying yen.

- It can lead to manufacturers moving plants to foreign countries with lower costs to remain competitive.

- In this situation, locally-produced commodities stand a better chance of competing with foreign imports.

- Here’s one example of how a strong U.S. dollar can work in your favor.

- Yen is the strong currency, and the dollar is the weak currency.

Normally, increasing economic value of a currency will enable its spenders to purchase larger amounts of products, while its earners will enjoy further financial empowerment with more valuable income. In 1977 the Carter administration advocated and initiated the “locomotive theory”, which posits that big economies pull along their smaller brethren. Carter’s theory asked for concessions from the smaller countries to benefit the U.S. for the high price the U.S. has incurred for their benevolence after the recession.

But First Things First: What Is A Dollar?

The currency rises or falls freely, and is not significantly manipulated by the nation’s government. The strength or weakness of the U.S. dollar will impact FX traders and, in general, any international currency plays. On the other end of the spectrum, domestic companies will not be negatively impacted by the U.S. dollar. However, while the domestic economy is often advertised as strong, this is primarily based on the labor market. The labor force participation rate, not just the unemployment number, is often the best indicator of labor market strength. Even though market fluctuations could make you think otherwise, a strong U.S. dollar is not always tied to a strong U.S. economy.