Smccf

Table of Contents Heading

- Business Teams

- Program On Financial Stability

- Shafter Modified Community Correctional Facility

- Shafter Modified Community Correctional Facility (smccf)

- Faqs: Primary Market Corporate Credit Facility And Secondary Market Corporate Credit Facility

- Corporate Credit Facilities Under The Cares Act

- People Searching For Federal Reserve Bank Jobs Also Searched

If an issuer borrows under the PMCCF to repay debt maturing within three months, the debt being refinanced does not count towards the Eligible Issuer’s 130% issuer cap from the date of issuance under the PMCCF until the maturity date of the debt being refinanced. However, this exclusion from the 130% issuer cap will not prevent the cap from being exceeded if the issuer’s maximum debt outstanding exceeds the cap prior to giving effect to the transaction or after giving pro forma effect to the transaction and the assumed repayment of such maturing debt. Not purchasing bonds from these entities is consistent with the treatment of U.S. depository institution holding companies, depository institutions, and subsidiaries of depository institution holding companies.

The SMCCF can purchase up to 20% of the assets of any one ETF as of March 22, 2020. A bond is a security that a company or organization uses to borrow money from investors. For more information on the legal and business implications of COVID-19, visit the Reed Smith Coronavirus (COVID-19) Resource Center or contact us at [email protected]. Issuers should analyze their current debt agreements to determine available capacity to issue additional debt and whether any consents are needed to participate in the PMCCF.

Business Teams

In order to borrow under the PMCCF, Eligible Issuers must complete several forms, including CARES Act certifications, a Regulation A certification, and the PMCCF’s program-specific authorization form. Additional information may be required and collected throughout the process of borrowing under the PMCCF. Fifth, the issuer must satisfy the conflicts-of-interest requirements of section 4019 of the CARES Act. Third, the issuer is not an insured depository institution, depository institution holding company, or subsidiary of a depository institution holding company, as such terms are defined in the Dodd-Frank Act.

In addition, seasoned bonds compete against newly issued bonds for private investors’ funds, so lower secondary market yields will decrease borrowing costs for businesses. On April 9, the Federal Reserve announced that it would take additional actions to provide up to $2.3 trillion in loans to support the economy in response to the coronavirus pandemic.

Program On Financial Stability

When the PMCCF is participating in a transaction alongside other investors, the Facility may purchase no more than 25% of the par amount of the issue. However, the total amount of the transaction (i.e., 100%) counts toward the 130% issuer cap. Scenario 3 – Issuer proposes to refinance existing debt with no additional borrowing. Scenario 2 – Issuer proposes to refinance existing debt with no additional borrowing.

- If companies are unable to issue corporate bonds, they may be unable to invest in inventory and equipment, meet current liabilities, or pay employees.

- For example, in a syndicated bond issuance of $1 billion in which the PMCCF purchases 25 percent ($250 million), the issuer must pay a facility fee of $2.5 million at closing.

- The Reserve Bank will continue to fund each Facility after such date until such Facility’s underlying assets either mature or are sold.

- However, the SMCCF may occasionally sell bonds to resolve trading or settlement issues in connection with transactions into which it has entered.

- The SMCCF didn’t hold more than 10% of the bonds issued by a given corporation or 20% of an ETF’s assets.

The CARES Act certifications, along with all other forms required for participating in the PMCCF, are available on the New York Fed’s PMCCFwebsite. SMCCF requirements and processes for issuer certification will be provided before the SMCCF begins eligible individual corporate bond purchases. Issuer certifications are not required in connection with the SMCCF broad market index purchase program.

Shafter Modified Community Correctional Facility

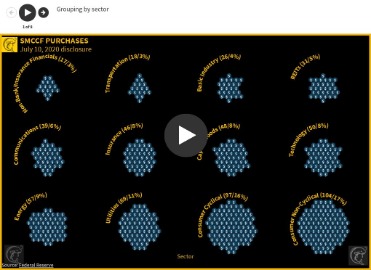

It will not be possible for the SMCCF’s purchases to exactly replicate the index at all times. As a result, the primary focus of the SMCCF’s Eligible Broad Market Index Bond purchases will be to track as closely as possible the sectoral weights of the index. Eligible Broad Market Index Bond purchases will also generally track the ratings and maturity profile of the index.

A significant expansion is still to come, with a Main Street Business Lending Program to support lending to small-to-mid-sized borrowers facing temporary financial difficulties, but this program raises new challenges. The Secondary Market Corporate Credit Facility was a Fed program to support the corporate bond market during the COVID-19 coronavirus crisis. Subject to approval by the Fed, an issuer could choose to delay all or part of a scheduled interest payment, instead having the amount added to the principal value of the bond or loan. The PMCCF limited its holdings from a given issuer to 130% of the maximum amount of bonds and loans that were outstanding from that issuer on any day between March 22, 2019 and March 22, 2020.

The Primary Market Corporate Credit Facility was a Fed program to extend credit to large employers during the COVID-19 coronavirus crisis. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Shafter Modified Community Correctional Facility (smccf)

Still, it is unclear how that intended purpose will translate into a strategy for what to purchase, and when and whether it will also be a seller. On April 9, the Federal Reserve Board announced updated terms for two facilities to support corporate debt markets. The Primary Market Corporate Credit Facility (“PMCCF”) will serve as a funding backstop for corporate debt issued by eligible issuers. The PMCCF will purchase qualifying bonds directly from issuers; and purchase portions of syndicated loans or bond offerings.

A full description of eligibility and program requirements for firms interested in participating as Eligible Sellers in the SMCCF can be found in theExpression of Interest materials andFrequently Asked Questions for the Section 13 facility counterparty and agent expansion. First, the issuer must be a business that is created or organized in the United States or under the laws of the United States with significant operations in and a majority of its employees based in the United States. Initially, BlackRock Financial Markets Advisory will be the investment manager, acting at the sole direction of the New York Fed on behalf of the facilities.

Faqs: Primary Market Corporate Credit Facility And Secondary Market Corporate Credit Facility

SMCCCD are a three College District located between San Francisco and the Silicon Valley. Our Colleges serve more than 40,000 students each year and offer the first two years of instruction in a wide variety of transfer programs as well as more than 90 vocational-technical programs. If you are having trouble with logging in, visit mySMCCD Login Support page for more support contact information.

The SMCCF will initially have $250 billion in capital available to purchase in the secondary market portions of bonds or exchange-traded funds whose investment objective is to provide broad exposure to the market for U.S. corporate bonds. The preponderance of ETF holdings will be of ETFs whose primary investment objective is exposure to U.S. investment-grade corporate bonds, and the remainder will be in ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds.

Corporate Credit Facilities Under The Cares Act

An issuer must be domiciled and incorporated in the United States to be included in the Broad Market Index. The Federal Reserve will publicly disclose information regarding the CCFs during the operation of the facilities, including information regarding participants, transaction amounts, costs, revenues and other fees. The Department of the Treasury, using funding from the Coronavirus Aid, Relief, and Economic Security Act , has committed to make $75 billion in equity investment in the SPV for both of the CCFs. Pursuant to section 13 of the Federal Reserve Act, and with prior approval of the Secretary of the Treasury, the Board of Governors of the Federal Reserve System authorized the Federal Reserve Bank of New York to establish the PMCCF and SMCCF. The New York Fed is lending to a special purpose vehicle through which the CCFs operate. The financing provided by the New York Fed to the SPV is with full recourse to the SPV and secured by all the assets of the SPV. Detailed Monthly Reporting Reports filed by the Federal Reserve with Congress pursuant to section 13 of the Federal Reserve Act concerning the lending facilities.

A third issue is balancing the incentives provided to lenders to quickly get funds to businesses, while at the same time protecting banks from possible future risks of many costly loan workouts if many borrowers cannot make their payments or repay their loans. The Fed also has broadened its reach to short-term high-grade municipal securities in the Commercial Paper Funding Facility and the Money Market Mutual Fund Liquidity Facility . Municipalities that had issued commercial paper or other short-term notes prior to the onset of the pandemic will be allowed to issue three-month paper to the CPFF at a spread to the overnight index swap of 110 basis points. In addition, state and local governments will benefit from the Fed’s offer to lend to banks that purchase short-term debt or variable-rate demand notes (essentially long-term municipal bonds that reprice at short-term intervals) from tax-exempt money market mutual funds . These MMFs have been facing significant withdrawals as investors have fled to the safety of banks or to funds that invest primarily in Treasury securities. The Federal Reserve Bank of New York managed the PMCCF and lent to it on a recourse basis.

However, note that if issuers take advantage of the option to defer any scheduled payments on the debt placed with the SPV pursuant to the terms of the PMCCF program, such issuers would not be permitted to use the funds for stock buybacks or dividends for certain periods of time. Corporate bonds purchased by SMCCF must have a remaining maturity of five years or less at the time of purchase. The SMCCF may purchase no more than 10% of an issuer’s maximum bonds outstanding on any date between March 22, 2019 and March 22, 2020, and will not purchase shares of a particular ETF if after such purchase it would hold more than 20% of such ETF’s outstanding shares. It will avoid purchasing shares of ETFs which trade at prices that materially exceed the estimated net asset value of the underlying portfolio. Interest rates of bonds issued solely to the PMCCF will be informed by market conditions, plus a facility fee of 100 basis points. With respect to syndicated bonds and loans, the PMCCF will receive the same pricing terms as other syndicate members, plus a facility fee of 100 basis points on its share of the syndication.

The U.S. Department of the Treasury provided $50 billion from its Exchange Stabilization Fund to the PMCCF. The bonds purchased were the collateral for the loans that the Fed gave the PMCCF. Indeed, banks make up 21% of the investment-grade credit market, based on the industry-standard ICE/BofA corporate credit indexes. It should be expected that ETFs designed to broadly track that market would include some bank debt. By helping to keep investment-grade corporate bond issuers in the investment-grade category, the SMCCF should help reduce the risk that life insurers will end up with a much higher level of junk bonds, and help reduce the risk that life insurers will face higher risk-based capital charges, the analysts write. For the avoidance of doubt, eligible assets shall not include any investment-grade senior secured bonds that are issued by a non-investment-grade issuer.

While details have yet to be released, the Main Street Lending Facility and the Main Street Expanded Lending Facility have been established to provide financing to lenders that make direct loans to U.S. business with up to 10,000 employees or up to $2.5 billion in 2019 annual revenues. Treasury Secretary Steven Mnuchin estimates that there are 40,000 mid-sized companies that fall in this category. These businesses are typically too small to access the capital markets and thus receive funding directly from lenders. Unlike the PMCCF and SMCCF, the Main Street facilities will purchase 95% participation in loans extended to middle market borrowers; 5% will be required to be retained by the lender. Eligible borrowers may be rated investment grade or non-investment grade and must attest financing is required due to the exigent circumstances presented by the coronavirus disease 2019 (“COVID-19”) pandemic. The facilities, with a combined size of $600 billion, will provide loans on a recourse basis. While, to date, no firms have issued bonds to the PMCCF, the SMCCF has purchased securities on the open market.

The SMCCF will not purchase bonds of issuers that have filed for bankruptcy protection or bonds of issuers that no longer meet the facility’s minimum rating or other requirements. Such bonds also will be removed from the Broad Market Index and excluded from consideration in the calculation and tracking of the index when it is next recalculated.

Section authorizes the Department of the Treasury to make loans, loan guarantees, and other investments in support of certain eligible businesses. An issuer will not be eligible for the PMCCF or SMCCF if it has received a loan, loan guarantee, or other investment from the Treasury Department under section 4003-. On April 9, 2020, the Federal Reserve issued a term sheet for each of the Primary Market Corporate Credit Facility (“PMCCF”) and the Secondary Market Corporate Credit Facility (the “SMCCF”). Under the PMCCF and the SMCCF, the Federal Reserve Bank of New York (“Reserve Bank”) will commit to lend to a special purpose vehicle (“SPV”) on a recourse basis. Under the PMCCF, the SPV will purchase qualifying bonds as the sole investor in a bond issuance; and purchase portions of syndicated loans or bonds at issuance. Under the SMCCF, the SPV will purchase in the secondary market eligible individual corporate bonds as well as eligible corporate bond portfolios in the form of exchange-traded funds (“ETFs”).

The Weekly Economic Index provides an informative signal of the state of the U.S. economy based on high-frequency data reported daily or weekly. The Center for Microeconomic Data offers wide-ranging data and analysis on the finances and economic expectations of U.S. households. Our model produces a “nowcast” of GDP growth, incorporating a wide range of macroeconomic data as it becomes available. Working within the Federal Reserve System, the New York Fed implements monetary policy, supervises and regulates financial institutions and helps maintain the nation’s payment systems.