Weekly Gas Storage Report

Table of Contents Heading

- Weekly Gas Storage: Inventories Increase By 43 Bcf

- Connecting You To The Energy News You Need

- Texas Senate Passes Bill To Authorize Reversal Of $16 Billion In Charges During Winter Storm

- U S. Energy Information Administration

- A Natural Gas Primer

- Weekly Gas Storage: Inventories Decrease By 114 Bcf

- More News In Energy News

- Weekly Gas Storage: Inventories Decrease By 187 Bcf

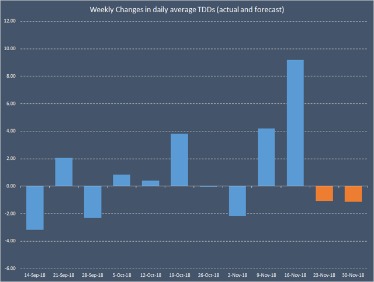

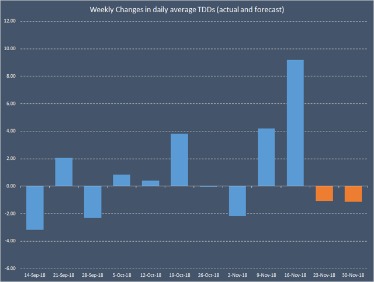

Energy Market Intel Webinar Invitations — During our webinars, energy market analysts provide listeners with updates on factors affecting energy prices, such as weather, gas storage and production. This week’s 100 Bcf injection came up slightly short of market expectations, but managed to exceed last year’s value of 93 Bcf and the five-year average of 88 Bcf. Little has changed fundamentally despite slightly warmer changes in the East along with cooler shifts in the West. With any major heat expected to be pushed later into June, the last two trading days have tumbled back under the $2.60/MMBtu mark.

The decline, combined with growth in natural gas exports, is expected to contribute to smaller net injections in working gas storage through the refill season. The heating season ran from Nov. 1, 2019, to March 31 and ended with the most working natural gas storage since the winter, with 1,718 billion cubic feet in net withdrawals, the least in four winters. Working natural gas storage in the lower 48 states has risen 19% to 2,008 billion cubic feet as of March 31, from the previous five-year ( ) average for the end of the heating season, according to the U.S.

- Working gas in storage was 1,793 Bcf as of Friday, March 5, 2021, according to EIA estimates.

- Prices at Dawn in Ontario, a major natural gas storage hub for the Great Lakes region, decreased 25¢ from $2.75/MMBtu last Wednesday to its weekly low of $2.51/MMBtu yesterday.

- Existing home sales reports U.S. data on the sale of existing single-family dwellings, co-ops, and condominiums.

- The EIA has released its natural gas inventory report, showing a net decrease of 130 Bcf as of January 1, 2021.

- We want to help you take a more informed approach to your energy management strategy.

The EIA has released its natural gas inventory report, showing a net decrease of 114 Bcf as of December 25, 2020. The EIA has released its natural gas inventory report, showing a net decrease of 130 Bcf as of January 1, 2021. The EIA has released its natural gas inventory report, showing a net decrease of 134 Bcf as of January 8, 2021.

Weekly Gas Storage: Inventories Increase By 43 Bcf

Stocks were 357 Bcf higher than last year at this time and 111 Bcf below the five-year average of 2,849 Bcf. The EIA has released its natural gas inventory report, showing a net increase of 26 Bcf as of July 24, 2020. The EIA has released its natural gas inventory report, showing a net increase of 33 Bcf as of July 31, 2020. The EIA has released its natural gas inventory report, showing a net increase of 43 Bcf as of August 14, 2020. The EIA has released its natural gas inventory report, showing a net increase of 45 Bcf as of August 21, 2020.

Hydraulic fracturing, commonly called frac’ing, is a completion technique in oil and gas operations that uses a high-pressure mixture of water, sand and chemical additives to unlock hydrocarbon resources such as oil and gas. The frac’ing process is mainly used in shale formations, where tight underground rock structures make traditional methods of producing oil and gas uneconomic. Frac’ing can be defined as a well stimulation process designed to maximize underground resource extraction. The process typically includes drilling a particular formation, casing the formation, completion or stimulating the well using water from the surface, producing the well, and disposing of waste from its operation. It is commonly used in conjunction with horizontal drilling to reach energy deposits that could not be accessed via traditional vertical drilling methods. Total working gas in storage as of Feb. 19 was 1,943 Bcf, 298 Bcf less than last year at this time and 161 Bcf below the five-year average of 2,104 Bcf, according to EIA.

Connecting You To The Energy News You Need

By the week of August 7, inventories exceeded the upper bound of the previous five-year range for that time of year. Since then, the pace of weekly injections has slowed because of slowing natural gas production throughout 2020 and relatively steady natural gas demand.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below. Tools to customize searches, view specific data sets, study detailed documentation, and access time-series data.

Texas Senate Passes Bill To Authorize Reversal Of $16 Billion In Charges During Winter Storm

The information above is an excerpt from the applicable report referenced above. For a full and complete copy of this report please complete the form below, sign up for our newsletters or schedule a virtual meeting at your convenience. Last week, Gov. Greg Abbott declared correcting billing errors during the state’s power failures an emergency item for the legislative session, which ends in May. Public Utility Commission chairman Arthur D’Andrea apologized to Bank of America last week for the “uncertainty” around its profits. The Senate confirmed Michael Regan to be administrator of the EPA on a vote Mar. 10.

Please Select less than more than 500 Submit By submitting this form you agree to let NUS follow up with you related to your inquiry. Your information will be used for these purposes alone, we never buy, sell, or trade your personal data.

U S. Energy Information Administration

The Energy Information Administration provides weekly reports with estimates of working gas volumes held in underground storage facilities at the national and regional levels. Net additions to working natural gas inventories totaled 1,914 Bcf during the injection season, about 2% less than the five-year average and 23% less than the near-record net injections of 2,571 Bcf reported during the 2019 injection season. The amount of working natural gas in storage in the United States ended the natural gas injection, or refill, season (April 1–October 31) at 3,920 billion cubic feet , according to interpolated data from the U.S. Energy Information Administration’s Weekly Natural Gas Storage Report released on November 13. The amount of natural gas held in underground storage in the Lower 48 states is now near the record-high value, 4,047 Bcf, reached in mid-November 2016. The Energy Information Administration reported a monstrous 338 Bcf withdrawal from natural gas storage for the historically cold week ending Feb. 19, falling short of the all-time high but easily taking the second spot. The analysis showed weekly stocks fell by 338 billion cubic feet in the week ending Feb. 19, 2021.

A single frac’d well, on average, can use from 500,000 to 700,000 barrels of water – equal to more than 21 million gallons. As production continues to expand in the Basin, operators tend to use larger drilling pads to serve multiple wells, as well as extend lateral lengths to improve well yields. These tactics increase the demand for supplying, transferring, storing, and maintaining water at the location of each pad. Criterion Research LLC analyst James Bevan noted that South Central supply was actually higher last week despite the massive production freeze-offs. “When you add up the weekly pipeline exports, decreased liquefied natural gas export deliveries, Mexican exports and production freeze-offs, supply actually gained 1.5 Bcf/d,” he said on Enelyst.

A Natural Gas Primer

The information is pertinent to mineral rights and royalty owners as the value of their assets and expected cash flow unequivocally correlate with the price of natural gas. April natural gas futures prices briefly bounced on the EIA figure, but anyone who blinked may have missed it. The prompt Nymex contract was trading relatively flat day/day at around $2.805/MMBtu in the minutes leading up to the report. As the data crossed trading desks, the April contract jumped to $2.819, but by 11 a.m. The EIA noted estimated domestic natural gas demand on Feb. 14, 2021, reached 148.3 Bcf, surpassing the previous single-day record set in January 2019, per IHS Markit. During the week ending Feb. 19, average domestic weekly dry natural gas production fell by 13.8 billion cubic feet per day (Bcf/d).

Nonetheless, much of the over-production and surplus inventory accumulated in the first half of 2020 has been eliminated by the long period of low prices last year. At one point in October, hedge funds increased their position to almost 3,500 bcf, putting it in the 96th percentile since 2010, but mild weather subsequently foiled expectations for such a rapid tightening of gas supplies. Tightening inventories have already drawn the attention of hedge funds and other money managers, who have boosted their net position in futures and options from 1,500 bcf at the end of June to more than 2,700 bcf last week. In November, as gas prices fell, gas and coal-fired generation declined compared with the same month a year earlier, because of warm weather, but gas generation was down 8% while coal fell 17%. At the same time, low prices have ensured gas-fired generators remain the primary choice for power companies at the expense of running coal-fired units, ensuring gas consumption has remained high. The number of gas rigs has increased by 18 since the middle of August compared with an increase of 117 extra rigs for oil, oilfield services company Baker Hughes says. The Energy Information Administration is a government agency that collects, analyzes, and publicizes independent and impartial energy information.

Weekly Gas Storage: Inventories Decrease By 114 Bcf

Please login to your account to post your comment, or enter a different email address to continue with your comment & account creation. Also on the podcast, a manufacturer burns down in Iowa, disturbing deep fakes, banning gas stations and the all peanut butter cup. The Wall Street Journal says OSHA took little action as infections increased at certain locations. America’s biggest motorcycle company is getting clobbered by the pre-owned market. The Paris Agreement is an agreement among more than 180 countries to significantly reduce the emission of greenhouse gases by the year 2100. A Tier 2 spill is the second of three levels of response capability appropriate to an oil spill emergency. Contact the team at NUS to learn more about how our expertise and insights can transform your energy management and sustainability programs.

According to the EIA, upon release of the report, the natural gas market reacts to the derived net change in inventory levels from the prior week. This information on the nature of the net changes between weekly inventory data reports is helpful in informing trading decisions that often move natural gas prices 3 cents to 5 cents per million British thermal units each week upon release. Demand declines as residential/commercial consumption falls to lowest level for the same week since 2016. Total U.S. consumption of natural gas fell by 4.8% compared with the previous report week, according to data from IHS Markit. In the residential and commercial sectors, consumption declined by 9.0% as warmer-than-average temperatures across most of the country depressed space heating demand. Natural gas deliveries to U.S. liquefied natural gas export facilities averaged 10.6 Bcf/d, or 0.87 Bcf/d higher than last week.

More News In Energy News

Gas demand from the industrial sector demand set a new all-time high of 28 Bcf/d. The extreme winter weather last week resulted in the second-largest withdrawal of natural gas from storage in the U.S. as demand spiked, the Energy Information Administration said on Friday. On a regional basis, the largest decline in natural gas storage was in the South Central region, where inventories fell by 153 Bcf.

These data are used to prepare regional and national estimates for all underground storage. This data is used to prepare regional and national estimates for all underground storage. In 20 of the 29 weeks since the end of June, weekly inventory builds have been smaller, and draws have been larger, than the five-year average, confirming that the market is tightening. The Permian Basin in West Texas and New Mexico has rapidly become the largest source of new oil reserves in the United States. Drilling activity in the region is dominated by hydraulic fracturing, or frac’ing, which enables operators to access previously unreachable hydrocarbon resources located in tight shale rock formations. Frac’ing involves injecting large amounts of water, along with proppants such as sand and some chemical additives, into shale rock formations, opening up fractures to release the trapped oil and gas found there.

The two most common space heating fuels in Texas are electricity and natural gas. Increases in electricity demand also impact natural gas demand because natural gas is the most prevalent electricity generation source in Texas and much of the South. EIA recorded a pull of 187 Bcf from storage for the week ended Jan. 15, the largest decrease of the season.

Please confirm you understand and are happy with this and our privacy policy by ticking this box. You can withdraw your consent, or ask us to give you a copy of the information we have stored, at any time by contacting us. Please understand that, by submitting this form, you will be creating a free OilPrice.com account, and therefore agree to abide by our Terms of Use. Your details will be stored in our database and shared with our third party mailing list provider. You will be sent an email containing a link that will ask you to generate a new password – please follow the link to complete your OilPrice account activation.

What Is Natural Gas Storage?

If you’re interested in receiving additional resources to help you manage your energy strategy, complete the form below. You may adjust your subscription preferences by returning to this page at any time.

In its March Short-Term Energy Outlook, the US EIA forecast Brent crude oil prices will average $61/bbl in 2021 and $58.5/bbl in 2022, compared to previous forecasts of $53/bbl and $55/bbl, respectively, in last month’s outlook. The last AGA report will be Jan. 2 and cover estimating working gas in storage for the week ending Dec. 28.

Weekly Gas Storage: Inventories Decrease By 187 Bcf

The total volume of natural gas in underground storage reservoirs is classified as either base gas or working gas. Underground storage facilities may be reservoirs in depleted oil and gas fields, aquifers, or salt caverns. Weekly estimates of working gas in storage were first provided by the American Gas Association in 1994, however, by 2001, the AGA decided that it would discontinue its survey due to resource considerations. The EIA stepped in to fill the information gap to the natural gas market and released its first estimates of underground U.S. natural gas storage for the week ending May 3, 2002. With the coldest air being seen over the weekend and into early next week, the withdrawal figure for the week ending 2/19 could be a MONSTER! With storage inventories already shrinking the surplus against the five-year average and now already behind a year ago levels, traders are starting to speculate about how the end of season inventories will look by 3/31.