Reversal Candlestick Patterns

Table of Contents Heading

- Confirming The Trend Change

- Candlestick Reversal Patterns: 5 Of The Most Important Types

- Understanding A Candlestick Chart

- One Response To 6 Reversal Candlestick Patterns For Explosive Gains In Forex

- What Is A Candlestick Pattern?

- Bullish Harami

- What Are Forex Reversal Patterns

Customers are solely responsible for determining whether any particular transaction, security or strategy is right for them. Note that, as with all technical analysis, indicators that a reversal pattern will occur or continue are not guarantees. Always be careful to place stop losses or limits when trading reversal patterns to protect your positions in the event that a reversal does not develop or continue as anticipated. As the bearish harami candlestick closes, the next candle closes lower which starts to concern the longs. When the low of the preceding engulfing candle broken, it triggers a panic sell-off as longs run for the exits to curtail further losses.

Learn how to identify trend reversal patterns using candlestick charts. Combine the Japanese candlestick patterns with advanced instruments of the technical and volume analysis. Modern achievements in the field of technical analysis and computing equipment allow finding confirmation for the candlestick patterns, which age is calculated in centuries. As well as in the previous example, if Doji emerges below a long black candle during a bearish trend, according to Bulkowski there is 68% probability of continuation of the price decrease. Look for one black candle without the upper shadow with the closing nearly on the low at the top of a bullish trend. Look for one white candle without a lower shadow with the closing nearly on the high at the bottom of a bearish trend.

Confirming The Trend Change

I first discovered the One-White Soldier by a bit of a mistake and luck. This is not a popular pattern, yet it is an extremely predictive one. It started when I noticed the cousin to this pattern, the One-Black Crow pattern a few years ago. Be prepared for confirmation that the bull trend is setting up. When you find this formation at support, it is a very good reason to expect an imminent bullish swing. Unfortunately, many of those formations above will not play out well. If someone takes the literal definition and looks at any of the formations above as though it is a tweezer bottom about to reverse, the results will not be good and that trader will be very frustrated.

Often it simply leads to a sideways move rather than a bullish reversal, and many times there is no change in the previous trend at all. The Bullish Counter Attack pattern is very similar to the Bullish Piercing Pattern, so much so that many people confuse the two. While they are technically different patterns, they are similar enough that confusing them would have minimal impact on the trade performance after the fact. This pattern is a very consistent pattern which often leads to a bullish swing or a full-on reversal. The second candle gaps down to start the day, appearing as though the bears are going to continue destroying everything in their path. But then, in a move that shocks most, the bulls return and not just push the bears back, but actually, force the bears to retreat.

Candlestick Reversal Patterns: 5 Of The Most Important Types

Harness the market intelligence you need to build your trading strategies. Harness past market data to forecast price direction and anticipate market moves. From beginners to experts, all traders need to know a wide range of technical terms. Deepen your knowledge of technical analysis indicators and hone your skills as a trader.

Usually happens following an unexpected and unscheduled significant news event. Most if the move happens in the initial spike in the few minutes following the news.

Understanding A Candlestick Chart

A hammer candlestick forms at the end of a downtrend and indicates a near-term price bottom. The hammer candle has a lower shadow that makes a new low in the downtrend sequence and then closes back up near or above the open.

Engulfing – It consists of two candles – a small candle and another candle, whose body fully engulfs the body of the first candle. Doji – The price closes wherever it has opened and creates a candle with no body. Every chart pattern has a mass sentiment component that can help a trader in gauging potential price swings. The price action reverses afterwards and starts a bearish move. However, the next candle after the Hammer is bearish, which does not confirm the validity of the pattern. The price then consolidates and creates a Double Bottom pattern – another wonderful trading opportunity. You can buy the USD/JPY when the price breaks the magenta horizontal trigger line.

One Response To 6 Reversal Candlestick Patterns For Explosive Gains In Forex

The key element of an engulfing pattern is that the second candle’s body encapsulates the entire first candle. This illustrates an initial test of an extreme and strong reversal against the established high or low value of the trading range. Engulfing patterns are two-candle formations that act as strong evidence that a market reversal may be forthcoming. They are found near the upper and lower extremes of a price range and illustrate that the prevailing trend has been contested and is becoming exhausted. Reversal patterns mark the turning point of an existing trend and are good indicators for taking profit or reversing your position. Generally, trend reversal patterns indicate that a support level in a downtrend or a resistance level in an uptrend will hold and that the pre-existing trend will start to reverse.

The Bearish Abandoned Baby is a less common reversal signal that occurs over two days. A Doji candlestick, in which the opening and closing prices are equal, gaps up above the closing price after a large bullish candlestick. The Doji candle should gap up enough that it does not overlap at all with the previous bullish candlestick’s body or upper wick. On the next day, the opening price should gap down below the Doji candlestick’s lower wick and the price should drop sharply by market close. The Bearish Abandoned Baby pattern leaves little time to exit at the uptrend’s high but is relatively reliable at signaling a reversal even in the absence of other indicators.

What Is A Candlestick Pattern?

There are often times where a new high or the prior price range extreme is exceeded only to see a new relative low develop a few short days after. For this reason, these should be combined with the prior articles on price range extremes to find when they have expired and when a trading opportunity is present.

The image above is the H4 chart of the USD/JPY Forex pair for Sep, 2016. The chart shows 5 potential trades based on a reversal trading strategy using candlestick and chart patterns. Each of the trades is marked with a black number at the opening of the trade. There are two types of Engulfing patterns – bullish and bearish. The bullish Engulfing appears at the end of a bearish trend and it signals that the trend might get reversed to the upside. The second candle, the engulfing candle, should be bullish and it should fully contain the body of the first candle. The Doji candle is one of the most popular candlestick reversal patterns and it’s structure is very easy to recognize.

I highly doubt this pattern had any influence on the breakdown. What goes up, must come down and that is where we will look for bearish patterns. I wanted to show this pattern where it fails to produce a reversal even when it coincides with a complex correction and a support zone. The difference between the opening white marubozu and the white marubozu is the close is the high of the day or time period.

Bullish Harami

The harami pattern consists of two candlesticks with the first candlestick being the mother that completely encloses the second, smaller candlestick. It is a reversal candlestick pattern that can appear in either an uptrend or a downtrend.

A doji candlestick usually signals indecision for a direction in a chart. A doji candle can signal a pause in the current trend and a higher probability that the trend is about to end or go sideways. A dragonfly doji can signal the end of a downtrend and a gravestone doji can signal the end of an uptrend.

The doji is a reversal pattern that can be either bullish or bearish depending on the context of the preceding candles. The candle has the same open and closing price with long shadows. A doji is a sign of indecision but also a proverbial line in the sand. Since the doji is typically a reversal candle, the direction of the preceding candles can give an early indication of which way the reversal will go.

What Are Forex Reversal Patterns

In this blog, we are going to see how we can use several candlestick patterns to spot key reversal zone in the chart. Like the majority of early reversal patterns, this pattern consists of two candle lines. The first candle is usually a small black bearish candle , and the second candle is a large bullish white candle. Candlestick patterns are predictive in nature, and they can predict moves in the market, bullish and bearish. The vast majority of the technical analysis tools we use require several days of data to calculate their signal.

It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. When using a Forex reversal strategy you would want to open a trade when you get a pattern confirmation and to hold for at least the minimum price projection based on the structure of the pattern.

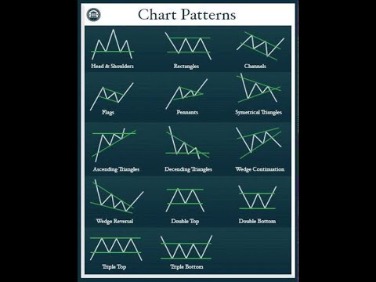

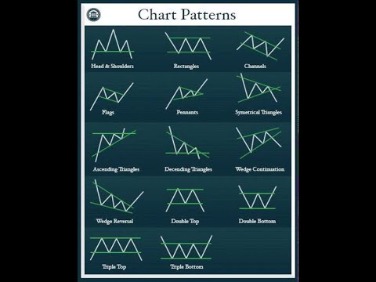

Candlestick Patterns

The large sell-off is often seen as an indication that the bulls are losing control of the market. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down.

It means the uptrend may be over and the stock could reverse to the downside. There are still some candlestick patterns that can indicate a change in trend. But if the pattern doesn’t work, remember to cut losses quickly. © 2020 Millionaire Media, LLCThere are a few different candlestick patterns. They can indicate that the stock may change — or reverse — direction.

The Piercing Pattern requires that the current day’s opening price gaps down below the previous day’s low, only to then rise throughout the day. However, consider looking for a further price rise on the following day or increased trading volume before buying. It is used to determine capitulation bottoms followed by a price bounce that traders use to enter long positions. The creation of candlestick charts is widely credited to an 18th century Japanese rice trader Munehisa Homma. It is believed his candlestick methods were further modified and adjusted through the ages to become more applicable to current financial markets.

First is a large white body candlestick followed by a Doji that gaps above the white body. The third candlestick is a black body that closes well into the white body. When it appears at the top it is considered a reversal signal. It signals a more bearish trend than the evening star pattern because of the Doji that has appeared between the two bodies. An engulfing pattern is a pattern of two candlesticks and can be a bullish or bearish candlestick pattern. If it appears at the top of a trend, it signals the start of a bearish trend. And if it’s at the bottom of a downtrend, it signals a reversal to the upside.

The chart above shows you a Shooting Star candle, which is part of the Hammer reversal family described earlier. The shooting star candle comes after a bullish trend and the long shadow is located at the upper end. The shooting star pattern would signal the reversal of an existing bullish trend. In the case above, you see the Doji candle acting as a bearish reversal signal. Notice that the price action leading to the Doji candle is bullish but the upside pressure begins to stall as evidenced by the Doji candle and the two candles just prior to the Doji candle. After the appearance of the Doji, the trend reverses and the price action starts a bearish decent. A harami two-candle pattern signals prices could begin to stop trending in the previous direction, which could lead to a trading range first before a big reversal in the opposite direction.