Cftc Commitments Of Traders

Table of Contents Heading

- The Cot Dashboard: A Must

- Commitments Of Traders

- What Type Of Forex Trader Are You?

- Supplemental Report

- Risk

- What Separates Beginners From Professionals In Forex Trading?

The computed amount of spreading is calculated as the amount of offsetting futures indifferent calendar months or offsetting futures and options in the same or different calendar months. Any residual long or short position is reported in the long or short column.

The term commercial trader refers to any trader who trades on behalf of a business or institution. A small trader has buying or trading activities that are below the required reporting thresholds specified by the relevant exchange or commission. Department of Agriculture’s Grain Futures Administration issued an annual report outlining hedging and speculation activities in the futures market. In the 1990s, the report moved to a bi-weekly publication before going weekly in 2000. The Commitment of Traders report is a weekly publication that shows the aggregate holdings of different participants in the U.S. futures market. Investors and traders spend an enormous amount of time forming their own thesis about what to buy or sell.

The Cot Dashboard: A Must

This report shows a break down of open interest positions in three different categories. These categories include noncommercial, commercial, and index traders. For example, traders are classified as non-commercial or commercial, and that holds for every position they have within that particular commodity. This means that an oil company with a small hedge and a much larger speculative trade on crude will have both positions show up on the commercial category. Simply put, even the disaggregated data is too aggregated to be said to accurately represent the market.

Staff use Form 40 data5 and, where appropriate, conversations with a trader and other data available to the Commission regarding a trader’s market activities to make a judgment on each trader’s appropriate classification. Every other reportable trader that is not placed into one of the other three categories is placed into the “other reportables” category. The legacy COT report separates reportable traders only into “commercial” and “non-commercial” categories. In a December 5, 2006 press release, the CFTC announced that, in addition to the existing weekly Commitments of Traders reports, a supplemental report would be published beginning January 5, 2007. The Legacy and Disaggregated reports are available in both a short and long format.

Some traders being classified in the “swap dealers” category engage in some commercial activities in the physical commodity or have counterparties that do so. Likewise, some traders classified in the “producer/merchant/processor/user” category engage in some swaps activity. Moreover, it has always been true that the staff classifies traders not their trading activity. Staff will generally know, for example, that a trader is a “producer/merchant/processor/user” but we cannot know with certainty that all of that trader’s activity is hedging. Staff is working on improvements to the Form 40 and other methodologies in order to improve the accuracy of the trader classifications. When large reporting or classification issues are found, an announcement is made and corrections are published as quickly as possible. The Commodity Futures Trading Commission publishes the Commitments of Traders reports to help the public understand market dynamics.

Commitments Of Traders

These include large banks (U.S. and non-U.S.) and dealers in securities, swaps and other derivatives. The long and short open interest shown as “Nonreportable Positions” is derived by subtracting total long and short “Reportable Positions” from the total open interest. Accordingly, for “Nonreportable Positions,” the number of traders involved and the commercial/non-commercial classification of each trader are unknown. Open interest held or controlled by a trader is referred to as that trader’s position. For the COT Futures-and-Options-Combined report, option open interest and traders’ option positions are computed on a futures-equivalent basis using delta factors supplied by the exchanges. Long-call and short-put open interest are converted to long futures-equivalent open interest. Likewise, short-call and long-put open interest are converted to short futures-equivalent open interest.

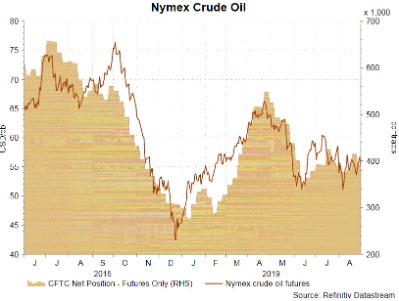

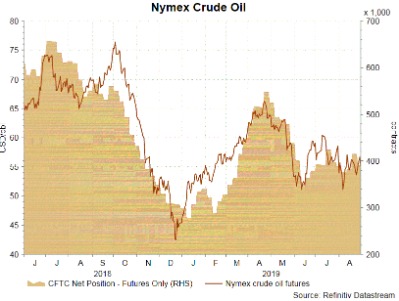

By looking at which direction their positioning is heading, this information can be used as not only a gauge of direction but trend strength as well. 7 An unregistered fund may have a Part 4 exclusion from CTA/CPO registration or be a non-U.S. So called “hedge funds” are included in this category, regardless of whether they are registered. The Disaggregated COT report is being published side-by-side with the legacy COT formats at least through the end of 2009. The Commission is soliciting comment on the new report and will review whether to continue to publish both side-by-side or to replace the legacy report with the new report. The COT data is from Tuesday, and is released Friday by the CFTC.

What Type Of Forex Trader Are You?

In the graph below, in the gold market you can see a nearly 100% inverse correlation between the activity by hedgers and large speculators. The tendency for large specs to use trend-following strategies can also be observed, as the general direction of their trading activity and the price of gold move relatively in-line.

Dealer/Intermediary – typically ‘sell-side’ and include large banks and dealers in swaps, securities and other derivatives. The Disaggregated – [] COT report provide a breakdown of each Tuesday’s open interest, updated Friday at 3pm CT. gives you the Overall Picture of what is happening behind the scenes of each Futures market. The Legacy Commitment of Trader – [] COT report provide a breakdown of each Tuesday’s open interest, updated Friday at 3pm CT. The database was corrupted with missing data between March 2018 and 2019. Due to data corruption of our COT files posted on 1 February 2020, all data downloaders are advised to download new COT history files to replace existing data.

Supplemental Report

Commercial traders are thought of as the “smart money”, since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, is composed of hedge funds, mutual funds, and commodity trading advisors. These are speculative traders who have no interest in the underlying physical commodity business. CFTC will make available more than three years of history of disaggregated data included in the weekly Commitments of Traders reports. History for the 22 commodity futures markets currently contained in the weekly disaggregated COT reports, first published on September 4, 2009, will be available starting Tuesday, October 20, 2009.

For refined oil products, NET LENGTH for gasoline plunged contracts to , while heating oil’s NET LENGTH increased +983 contracts to . On safe-haven currencies, NET LENGTH on CHF futures declined contracts to 8 371.

Risk

The practical application of this comprehensive market law can be extremely useful for anyone who has ever dared to predict future prices. They are of the opinion that the data reported lags five days hence is invalid. Free CoT Data should not be construed by any consumer as a solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice over the internet. This website and information are provided for guidance and information purposes only. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice. All graphs provided on this website should not be reproduced, copied, redistributed, transferred, or sold without the prior written consent of the site owner.

You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Advanced indicators covering the CoT Index, CoT Positions and the open interest for 45 future markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. During this time there were numerous attempts by the commodity to rally, but within the context of a clear downtrend those only proved to be temporary before sellers took over again.

What Separates Beginners From Professionals In Forex Trading?

Receive exclusive insights on key FX macro themes, volatility trends, and market events through our bi-weekly report. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider.

The sudden change, in only four weeks, saw their position-size move from the lower one-third of the range over the prior year to net-long for the first time in several years. We can safely take the commercial traders out of the equation since we already have a good idea of what they are doing by just looking at what large speculators are doing. We won’t focus on small speculators, as they tend to exhibit more erratic behavior, but loosely follow the positioning of the large speculators. It’s just not with the same degree of negative correlation observed between large speculators and hedgers.

Less time is focused on examining how other market participants are positioned, and if their personal idea is already widely held or not. CoT data lets you see if you’re running with the herd and how “smart money” traders are positioned. Click on “How To Use” at the top to understand how this site analyzes CoT data to make it actionable information.

On safe-haven currencies, NET LENGTH on CHF futures dropped contracts to 9 372. By contrast, NET LENGTH on JPY futures rose +2 840 contracts to .

The short format shows reportable open interest and week-to-week open interest changes separately by reportable and non-reportable positions. For reportable positions, additional data is provided for commercial and non-commercial holdings, spreading , changes from the previous report, percent of open interest by category, and numbers of traders.

Commodities traded lower and despite current strong fundamentals, the market worried rising bond yields could trigger a reduction in the near record speculative long held by funds. On safe-haven currencies, NET LENGTH on CHF futures increased +2 132 contracts to while NET LENGTH on JPY futures plunged contracts to 6 514. Concerning commodity currencies, NET SHORT for AUD futures increased +2 034 contracts to 8 075. Separately, NZD futures’ NET LENGTH added +718 contracts to during the week.

There are many ways to measure supply and demand in the market. It might be partly driven by emotions or rationale but after all – the volume of orders will decide which way the price will go. Fundamental and technical conditions create supply and demand. I truly believe there is enough evidence for you to change your mind and once you get to the bottom of this page, you will be a much better trader. An exempt commodity is any commodity other than an excluded or agricultural commodity.

Also, the “index trader” category of the CIT supplement includes pension and other investment funds that place their index investment directly into the futures markets rather than going through a swap dealer. Those traders are classified as “managed money” or “other reportables” in the Disaggregated COT, depending on the specific details of their business and trading. Commission staff reviews the reasonableness of a trader’s classification for many of the largest traders in the markets based upon Form 40 disclosures and other information available to the Commission. As described above, the actual placement of a trader in a particular classification based upon their predominant business activity may involve some exercise of judgment on the part of Commission staff.

Concerning commodity currencies, NET SHORT of AUD futures fell contracts to 3 907. Separately, NZD futures’ NET LENGTH decreased -538 contracts to during the week. Meanwhile, NET LENGTH for CAD futures decreased -844 contracts to contracts. A futures exchange is a central marketplace, physical or electronic, where futures contracts and options on futures contracts are traded.

We previously looked at using the COT report in FX trading, in this article, we take more of a big-picture perspective on this very important sentiment report. Some parent organizations set up separately reportable trading entities to handle their different businesses or locations. In such cases, each of these entities files a separate Form 40 and is analyzed separately for determining that entity’s proper Disaggregated COT classification. When graphically shown on charts, you actually see what is referred to as the Net Traders Positions which is the actual difference between the number of long positions held by each group minus the number of short positions. Thus a positive number means they hold more long positions than short and vice versa. The report was first published in June 1962, but versions of the report can be traced back to as early as 1924 when the U.S. Department of Agriculture’s Grain Futures Administration started regularly publishing a Commitments of Traders report.

The Disaggregated Commitment Of Traders (disaggregated Cot) Report

Meanwhile, NET LENGTH for CAD futures decreased contracts to contracts. , also known as ‘small speculators’, are the smallest traders in the marketplace. These can be individuals, proprietary trading firms, small hedge funds, and anyone who establishes small position sizes for speculative purposes.