Canadian Dollar Drops

Table of Contents Heading

- Sterling Is Active And Steady; Canadian Dollar Drops 4 Points

- Canadian Recession Fears Grow As Interest Rate Drops To Another Record Low

- Earlier News About The Canadian Dollar:

- Reserve Currency

- Be The First To Know About Great Rates

- More In Canadian Dollar

- The Fallout For Agricultural Prices

- Pound To Euro Retreats After Brexit Strength

The US dollar Canadian dollar exchange rate broke above the 1.30 mark during the US session on Wednesday and continued pushing higher to reach a peak of 1.3044. However, the biggest driver for the move in USD/CAD is the massive flight to safety that is happening in all world markets right now. The U.S. dollar is the primary recipient of investor money – other safe haven currencies like Swiss frank or Japanese yen are losing ground against the dollar.

Indeed, the credit crunch was taking over global economy and there very few good alternatives out there. Yet, in the first five months of 2009, like in 2006 and 2007, the greenback depreciated sharply due to spending spree of U.S. government. Looking ahead, we see a potential for gradual Dollar recovery as the US economy starts rebounding and the current account deficit improves. The dollar dropped to the lowest level this year against the euro as prospects for economic recovery spurred a rally in global stocks, helping to push gold above $1,000 an ounce and oil to more than $71 a barrel. The combination of a weak economy with quantitative easing and a rising appetite for risk has brought the US dollar to its lowest level against the euro since the begging of the year. Moreover, although the recent data suggests that the pace of U.S. contraction may be slowing, the biggest economy in the world is far from a sustainable recovery.

Sterling Is Active And Steady; Canadian Dollar Drops 4 Points

The coronavirus situation gets tougher day by day, and various countries implement tough measures to stop the spread of the disease. Four months ago, in October, the Canadian dollar was worth about US$.97, not quite at parity, but not so far from it either. Today, it is worth about US$.90, a drop of over 7%, and many economists and pundits are saying that it has further to fall.

Canadian dollar banknotes were later issued by the chartered banks starting in the 1830s, by several pre-Confederation colonial governments , and after confederation, by the Canadian government starting in 1870. Some municipalities also issued notes, most notably depression scrip during the 1930s.

Canadian Recession Fears Grow As Interest Rate Drops To Another Record Low

Canada produced its first gold dollar coins in 1912 in the form of $5 and $10. The obverse carries an image of King George V and on the reverse is a shield with the arms of the Dominion of Canada. Gold from the Klondike River valley in the Yukon accounts for much of the gold in the coins. Canadian English, like American English, used the slang term “buck” for a former paper dollar.

She is regularly quoted by international news organisations including Financial Times, Reuters and Bloomberg. Fiona is a familiar face after years of appearances on BBC, Sky News and Fox Business News. Inventories unexpectedly rose by 1.2 million barrels from the previous week. Given the oil is Canada’s largest export, the Canadian dollar is closely correlated to the price of crude oil.

Earlier News About The Canadian Dollar:

The tech sector tends to have the greatest exposure when the dollar is strong. For example, more than 95% of chip maker Qualcomm’s sales are outside the U.S. If the exchange rate changes to 1/1.40 USD/CAD, that means the U.S. dollar has strengthened and the U.S. dollar can buy more Canadian currency.

This article looks at the general trend in the US dollar forecast and how it might impact your home currency. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

Reserve Currency

Expert opinions on foreign exchange from the team at Foreign Currency Direct. If you would like updates for GBP/CAD rates or have an upcoming currency transfer, please contact me directly, Lauren Buckner, using the form below. The total sum is 200% because each currency trade always involves a currency pair; one currency is sold (e.g. US$) and another bought (€). Therefore each trade is counted twice, once under the sold currency ($) and once under the bought currency (€).

- Even if companies have as much as $2.6 trillion stashed abroad, the majority of this money seems to already be in dollar-denominated assets.

- However, the downside is that U.S. companies that sell goods to foreign customers suffer because, relative to a weaker currency, our goods and services cost more.

- At this point, the fundamental outlook for the Canadian economy is rather grim, which contributes to the weakness of the Canadian dollar.

- However, when the exchange rate goes to par, $20 American is the same as $20 Canadian.

- The Canadian dollar returned to a fixed exchange rate regime in 1962 when its value was set at US$0.925, where it remained until 1970.

Since 76.7% of Canada’s exports go to the U.S., and 53.3% of imports into Canada come from the U.S., Canadians are interested in the value of their currency mainly against the U.S. dollar. Although domestic concerns arise when the dollar trades much lower than its U.S. counterpart, there is also concern among exporters when the dollar appreciates quickly.

Be The First To Know About Great Rates

If the cows are particularly productive and a surplus of butter is produced, the price tends to go down. On the other hand, if short term interest rates in Canada were higher than those in the US, there would be a demand for Canadian dollars for investment, and the value of the loonie would rise. The Canadian dollar is still suffering at the hands of the Coronavirus outbreak which has captivated headlines for the past couple of weeks.

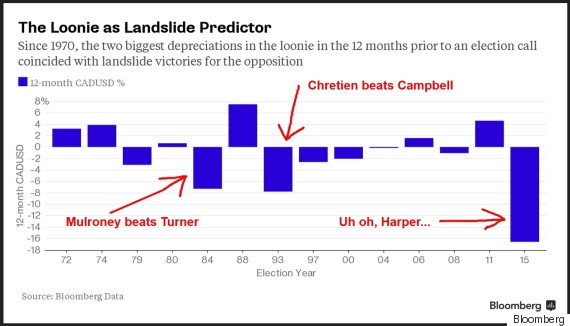

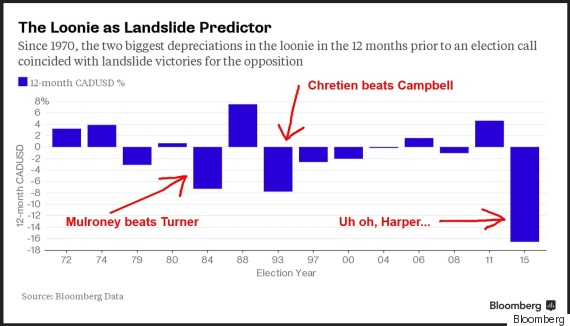

Although the Canadian dollar is now trading below 80 cents USD, exports have yet to recover – a finding Poloz described as “puzzling”. Anticipating the news last week, Harper blamed falling oil prices and other outside factors for the persistent weakness of the Canadian economy, an excuse at least partially endorsed by the central banker today. The prime minister vowed to respond with “strong fiscal discipline” that would not “spiral ourselves into deficit”. The U.S. dollar turned around in early 2016 as the economies of other major trading currencies improved.

More In Canadian Dollar

It is entirely possible that the Canadian dollar has been oversold at its recent low of $.893 US. However, there is no denying that the major forces that move currencies are all trending against our currency. We have purchased a lot of American stocks in the past two years, and our clients have benefitted from the change in the currency. We are still buying U.S. names, but cautiously, and with an eye towards the value of our dollar. We don’t think we are taking too much risk as we would be very surprised to see a sudden return to parity, or indeed, to a value over USD.096, anytime in the next six to twelve months. The US is about to become the world’s largest oil producer, and Canadian exports are threatened by environmental protests, leading to the cancellation or delay of major projects such as the Keystone pipeline. Currency traders sense coming weakness, and are moving funds out of Canada.

This year there is a Presidential election in the US, which will create more uncertainty. Greater uncertainty from politics means investors will sell the US dollar, because there is a greater chance of it getting weaker.

Cad

Most bank analysts are expecting the EURUSD currency pair to gradually rise towards 1.2200. If you want to see why the Australian dollar fell or what will happen to your home currency next year, check out ourguides for 2020 currency forecasts.

Suppose a Canadian manufacturer sells hockey sticks to retailers for the price of $10 Canadian each. The value of the U.S. dollar impacts the economy of Canada through a number of means, including its imports, exports, and local and foreign businesses, which in turn affects average Canadian citizens and their spending habits. The dollar dropped as low as 1.0001 Canadian dollars Tuesday, just above parity. In later morning trading in New York, the dollar fetched 1.0005 Canadian dollars, down from 1.0031 Canadian dollars late Monday.

The Fallout For Agricultural Prices

Some economists have attributed the rise of importance of the Canadian dollar to the long-term effects of the Nixon Shock that effectively ended the Bretton Woods system of global finance. Canada is a major exporter of oil, and crude prices are circling 18-month highs. Canada also has one of the smallest budget deficits of the major economies.

dollar exchange rate and oil prices is due, in large part, to the amount of the nation’s total foreign exchange earnings that are garnered through crude oil sales. In 2019, Canada was the fifth-largest producer and exporter of crude oil in the world. Crude oil is the largest single contributor of foreign exchange to Canada, and its share has been increasing.

Pound To Euro Retreats After Brexit Strength

Meanwhile, commodity currencies such as the AUD, NZD, CAD and ZAR exchange rates fall. Since then, its value against all major currencies rose until 2013, due in part to high prices for commodities that Canada exports.