Deutsche Bank Federal Reserve

Table of Contents Heading

- Presidents Of The Bundesbank

- Deutsche Banks Us Operations Criticised By New York Fed

- Van Hollen Calls On Federal Reserve To Investigate Deutsche Banks Conflicts Of Interest With Trump

- Wall Street Journal

- Going Forward, Federal Regulators Should Announce When They Are Not Probing Deutsche Bank

- The Timing Of The Fed’s New Warning

- Deutsche Bank’s U S. Ops Deemed “troubled” By Fed A Year Ago: Wsj

Since the early 2000s, regulators at the central bank have repeatedly criticized Deutsche Bank for a range of problems, including inadequate risk management and sloppy financial accounting. Most recently, in May 2017, the Fed ordered Deutsche Bank to fix anti-money-laundering systems that had failed to stop billions of dollars of illicit transactions by wealthy Russians. Add in the derivatives exposure to these foreign banks by Citigroup, JPMorgan Chase, Morgan Stanley, Merrill Lynch and one can begin to understand why the Federal Reserve wanted to keep its $16.1 trillion in revolving loans to both domestic and foreign banks a big secret from the American people. That’s because the Federal Reserve is not just the U.S. central bank but it is also a regulator of bank holding companies, which includes the largest banks on Wall Street.

Since 1 January 1999, one of the principal aims of the ECB has been to maintain price stability by means of its monetary strategy. Commercial banks can deposit money that is temporarily surplus to requirements with the Bundesbank/ECB . The Bundesbank supports cross-border payments between domestic and foreign commercial banks, for instance by means of the German real time gross transfer system RTGSplus and TARGET2.

Presidents Of The Bundesbank

I have been dedicated to providing clients high quality financial consulting, research, and training services on Basel III, risk management, risk-based supervision, capital markets, financial derivatives and Dodd-Frank for over 25 years. I have extensive global expertise and have led projects in the financial and energy sectors in over 30 countries in English, Russian, and Spanish. Mr. Trump has sued to block Deutsche Bank and another bank, Capital One, from complying with the congressional subpoenas. The letter, sent by Senator Chris Van Hollen of Maryland, also asks the Fed officials for information about their interactions with Deutsche Bank, including whether they have investigated the issues that several former bank employees raised in the Times article.

In 2011 the Financial Services Authority fined Deutsche Bank’s DB Mortgages unit £840,000 for “irresponsible lending practices and unfair treatment of customers in arrears”; the agency also secured redress of approximately £1.5 million for DB Mortgages’ customers. That same year, a German appeals court ruled that Deutsche Bank had to compensate a small-business customer for losses incurred as the result of an interest-rate swap. The court concluded that the bank had a “grave conflict of interest” in its dealings with the customer. Also in 2011, the Federal Housing Finance Agency sued Deutsche Bank and other firms for abuses in the sale of mortgage-backed securities to Fannie Mae and Freddie Mac (the case was settled for $1.9 billion in late 2013). Senate Permanent Subcommittee on Investigations accused Deutsche Bank and Barclays of helping hedge funds use dubious financial products to avoid paying more than $6 billion in taxes. In 2007 Deutsche Bank agreed to pay $25 million (and give up $416 million in unsecured claims) to settle litigation relating to its dealings with bankrupt energy trader Enron Corporation. During this period, Deutsche Bank chief executive Jose Ackermann personally paid 3.2 million Euros to settle criminal charges that he and other directors of the German telecommunications company Mannesmann awarded excessive bonuses to Mannesmann executives.

Deutsche Banks Us Operations Criticised By New York Fed

It was among a handful of banks that settled with Brazil’s antitrust watchdog Cade in December. The Fed also said it found gaps in Deutsche Bank compliance with the Volcker Rule, which prohibits government-protected banks from engaging in proprietary trading. Seven years after regulators issued guidance to financial institutions, a small Michigan credit union was ordered to stop opening new accounts for marijuana businesses. M&F Bancorp in North Carolina plans to use some of the $18 million it received from big banks to make overdue improvements to its commercial lending platform.

They are designed to avoid a repeat of the taxpayer bailouts of the financial crisis. We know that AIG is back in the game of derivatives again after being seized by the U.S. government over its derivative losses in September of 2008. As insane as it sounds that federal regulators would allow this to happen, the Office of Financial Research, a unit of the U.S. Treasury, reported in its 2017 Financial Stability Report that the mega banks on Wall Street were once again interconnected through derivatives to insurance companies that included AIG, Lincoln National Corp., Ameriprise Financial, Prudential Financial, and Voya Financial. “There’s no doubt stock markets and currency markets are being hugely manipulated by central bankers,” said financial author and trading veteran Glen Goodman, who made a name for himself by successfully navigating stock markets during the 2008 global financial crisis.

Van Hollen Calls On Federal Reserve To Investigate Deutsche Banks Conflicts Of Interest With Trump

Deutsche is expected to pass that section comfortably, as it did last year, the sources said. Even if the bank passes the stress tests, executives expect the Fed to continue to bar it from making payments to its German parent without the Fed’s approval, the sources said. They also anticipate Deutsche will be told to continue improving the systems it uses to monitor its business and risks, the sources said. Executives hope improvements the bank has made to its risk management and capital planning processes since failing last year’s test will enable it to achieve a conditional pass this year, the sources said. The Fed’s letter, dated March 31, “casts doubt on the German lender’s ability to rehabilitate its business in the world’s largest and most profitable banking market,” the Financial Times said.

It also faces investigations by the Federal Bureau of Investigation and Department of Justice into possible money-laundering lapses. The Federal Reserve implemented annual tests of lenders after the 2008 financial crisis to check whether they have sufficient capital to weather a major economic downturn. Seven banks have paid authorities in the United States and Europe a total of more than $10 billion, and some pleaded guilty to criminal charges.

Wall Street Journal

Payments involving sanctioned entities were subject to additional scrutiny and might be delayed, rejected, or frozen in the United States. In order to facilitate what it saw as “lucrative” U.S. dollar business for sanctioned customers, Bank employees developed and employed several processes to handle dollar payments in non-transparent ways that circumvented the controls designed to detect potentially-problematic payments. Deutsche Bank has joined an ever-growing list of global financial institutions that have been found guilty and fined for breaking US sanctions on a variety of unsavory regimes. is investigating how Deutsche Bank handled billions suspicious payments from Danske Bank, as regulators try to unravel who was involved in one of the largest financial scandals in history.

The Federal Reserve has issued a cease & desist order which requires Deutsche Bank to clean up its act and bans it from having any further dealings with the people involved in these activities, most of whom have already left the bank. In addition, the NYDFS has insisted on the sacking of six current senior managers and significant restrictions on the activities of three more. It all adds up to deliberate, systematic evasion of US sanctions as a matter of bank policy.

Going Forward, Federal Regulators Should Announce When They Are Not Probing Deutsche Bank

Congress has turned a close eye to the bank’s longstanding relationship with Mr. Trump and his family. Deutsche Bank has dispensed a total of about $2.5 billion in loans to Mr. Trump’s companies, and more than $300 million was outstanding when he was sworn in as president, making it by far his largest creditor. The letter to the Fed chairman, Jerome H. Powell, and John C. Williams, the president of the Federal Reserve Bank of New York, called on the Fed to look into the transactions and whether the bank’s handling of the matter adhered to anti-money-laundering laws. The Fed is one of the main regulators of Deutsche Bank’s American operations.

- The bank posted a huge loss in 2019 but reported better-than-expected results in the first quarter, sticking to cost-cutting goals and a plan to streamline its businesses.

- You will also benefit from our innovative communication systems so you can access all the information you need.

- In 2004 investors who purchased what turned out to be abusive tax shelters from Deutsche Bank sued the company in U.S. federal court, alleging that they had been misled .

- Deutsche Reserve Kb, Stockholm, Sweden, is a leader in the banking services and financial industry worldwide.

All such accounts are required to have a positive balance, i.e. the Bundesbank is not allowed to grant credits to the public sector. This is due to negative historical precedents in connection with the financing of two world wars by the Deutsche Reichsbank.

The Timing Of The Fed’s New Warning

Have you found that you mispriced any loan or financial transaction to Trump? If so, did you recalculate your loan loss reserve, risk weights, and/or regulatory capital? Mispriced loans lead to an inaccurate loan loss reserve and also the incorrect level of regulatory capital to sustain unexpected losses. These figures appear in disclosed financials and Basel’s Pillar III risk disclosures, . Both financial and risk disclosures are utilized by bond and stock investors and by any counterparty engaging in a derivative, loan or any other financial transaction with a bank. Fraud is an important element of operational risk, which under the Basel Committee for Banking Supervision’s Basel Accord is defined as a breach in the day-to-day running of a business due to a failure in or of people, processes, technology or external events. Fraud can be external, that is, someone outside of a bank lies to the bank to obtain approval for a transaction.

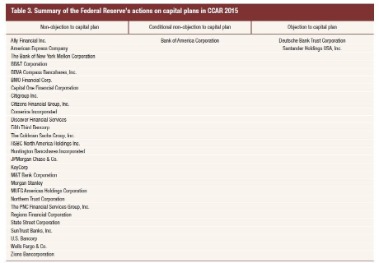

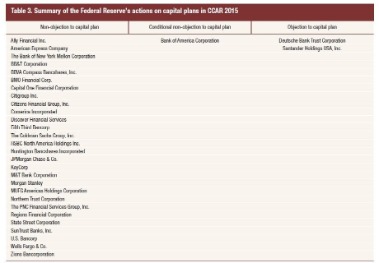

These liabilities are separate from the conflicts of interest and liabilities of the President’s family, which are extensive. For example, the President’s son-in-law, Jared Kushner, holds a multi-million dollar line of credit at Deutsche Bank. One of these loans, totaling $285 million, was finalized a month before Election Day. Mr. Kushner is now a federal employee who serves as Senior Advisor to President Trump, with a portfolio that includes tax and banking policy. The tests assess whether it is safe for banks to implement their capital plans, including using extra capital for stock buybacks, dividends and other purposes beyond providing a cushion against losses.

Deutsche Bank’s U S. Ops Deemed “troubled” By Fed A Year Ago: Wsj

Given Deutsche Bank’s size, complexity, and interconnections with the residential, financial, and corporate sectors, here are just a few questions I urge legislators, regulators, and the media on both sides of the Atlantic Ocean to pose and to obtain documentation with proof of the responses. In the meantime, congressional investigators are preparing to interview former Deutsche Bank employees, including some who have voiced concerns about the bank’s anti-money-laundering practices. In the House of Representatives, the Financial Services and Intelligence Committees have issued subpoenas to Deutsche Bank, demanding its records about the Trump family.

This year’s tests are likely to be the last for Deutsche’s U.S. business under current Americas head, Tom Patrick, the sources said. Patrick is expected to leave in the coming months as the bank’s U.S. restructuring progresses, they said. The tests this week and next come amid uncertainty over the bank’s U.S. operations. Deutsche plans cutbacks to appease investors unhappy about its stock market underperformance.

The news was reported by multiple outlets, which say the Fed delivered its displeasure at the bank’s progress in a letter to Deutsche Bank. The rebuke continues long-standing issues that have been piling up at the German bank in recent years. Bram Berkowitz mainly writes in the financials bureau covering the banking sector.

The U.S. Justice Department has also been looking into the bank’s money-laundering controls and longtime links with Russian companies and oligarchs. Deutsche Bank is also under scrutiny over its ties with Russia and business with President Trump. The British Crown donated the company to the Vatican, which gave the exploitation rights back to the Crown. The US Presidents are appointed CEOs and their business is to make money for the British Crown and the Vatican, who take their share of the profits every year.