Stash Invest Review

Table of Contents Heading

- What Is Stash App?

- Stash Stock

- Who Is Stash Invest Best For?

- Stash App Pros And Cons

- Best Investment Apps

- Stash Alternatives

- Thoughts On stash App Review: Is This Investment App Safe Or A Scam?

Amazon and Walmart are two examples of stocks that Stash customers can trade. Another advantage the website has over its mobile cousin is the portfolio builder tool. It recommends a portfolio of ETFs based on a short questionnaire. Stash doesn’t offer the full suite of different account types that you’ll find with the larger brokers, like TD Ameritrade, but they do offer the most popular accounts. These include your standard taxable account, Traditional and Roth IRAs, and custodial accounts. There are more options and slightly more transparency available with Stash than is available with Acorns.

With all that in mind, there is no reason for investors not to trust Stash with managing their money. However, investors should be wary of Stash’s high expense ratios – and may need to keep an eye on whether these expense ratios creep even higher after their initial investment. Stash was founded in 2015 as a mobile investment app by Brandon Krieg and Ed Robinson. The app has expanded into an online desktop platform and has attracted more than two million users in the years since. While Stash does not disclose its total portfolio value, the company was named as a “Tech Company to Watch” by the Wall Street Journal in 2018. Robinhood and Stash Invest are both good picks for new investors or individuals looking for a solid low-cost broker.

You can choose to invest as little as $5 at a time on a weekly, bi-weekly, or monthly schedule. While Stash Invest is not the only low fee, easy to use investment app on the market, they educate their customers and show them how to invest and save money. There’s a lot of jargon out there, and many people don’t know the difference between a stock and a bond, let alone how to read a stock ticker. The Stash app aims to solve both of these issues by making investing both affordable and accessible. This is to help you invest in companies whose ideologies you support, or voting with your money in other words.

What Is Stash App?

Some features, such as debit card use, are available on the mobile app only. For example, reading the advisory agreement requires slogging through 40 pages of small print, with over 19,000 words and no table of contents. A new client, unsure of how investing works, is unlikely to make the effort. These four categories are U.S. companies, foreign companies, up and coming markets, and bonds. The categories will remain the same for everyone, but the allocation will change based on your risk profile. The screen will then highlight which categories need attention, but the action is left up to you. Trades are queued up and executed during four trading windows when markets are open.

- Once a bank account is linked, it cannot be changed until 60 days after the first deposit has been made.

- I then called my bank and disputed the charge and blocked their access to my account.

- Stash Coachis your personalized, financial, digital advice engine.

- I just visited the BBB site and this company now has a B+ rating, not a D+ rating.

- It’s Stash investing’s personalized financial coaching tool that sets challenges, teaches you how to diversify your account, how to set long-term investing goals, and more.

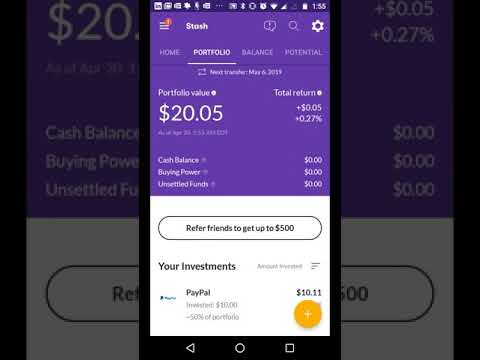

The fee structure is uncomfortably high on small accounts. For example, on an account balance of $100, a $1 per month fee–$12 per year–is steep. But that should motivate you to build up your account balance as quickly as possible. Once you reach $10,000, the fees are competitive with robo-advisors. Based in New York City, and founded only in 2015, Stash Invest already has 3.5 million users. The service is an app designed to help people save and invest money. In the company’s short history, they’ve moved from basic investment accounts to adding retirement and custodial accounts.

Stash Stock

If you have never invested before or you only have a little money to invest, Stash Invest will guide you, turning you into a seasoned investor one dollar at a time. Fractional Shares – You can buy parts of a share or fractional shares starting at just $5. Stash suggests that you auto-invest small amounts of money.

Apex charges $75 to transfer the account to another broker. Stash’s security is sufficient and comparable with peers. Stash uses 256-bit SSL encryption and follows industry standards for data security and access control. Apex Clearing holds your funds, providing access to Securities Investor Protection Corporation insurance and excess insurance. Green Dot Bank, which provides banking services, has FDIC insurance on the cash held in accounts. Stash offers its educational materials for free through the Stash Learn section.

This ETF has an expense ratio of 0.54% – which is pretty high for a domestic ETF. Of course, the banking aspect connects seamlessly to Stash Invest, to allow you to manage all your money in one place. Over time, you can check in your home screen and see how your portfolio is doing overall. You just click on the “Add To Portfolio” button and enter how much you want to invest.

Stash offers themed ETFs, so you can invest in areas and companies with goals and ideals that match your own. The biggest thing that is different with Acorns is that instead of offering stock back, it has round-ups. You have the option of rounding up each purchase you make to an even dollar amount and adding the rest to your Acorns account.

Who Is Stash Invest Best For?

Similarly, you could invest in “Companies”. For example, you could want to invest in a piece of Warren Buffett through his company, Berkshire Hathaway. Click here to get Stash for free on the App Store, you’ll be directed to the app store and you can download the app to your phone. Click here to check out Stash Investonline and get started on your desktop. These options compare to Acorns, but are slightly more expensive in some regards, although you do get banking at every price point.

When you join Stash and add at least $5 to your investment account, you can receive a $5 sign up bonus to invest in your Stash portfolio. If you’d like to try out the Stash app, feel free to join here and enjoy your free $5 sign up bonus today. However, if you’re looking to have access to investing in thousands of individual stocks and ETFs you may want to compare Stash with some of today’s other top investing apps here. automate your contributions into your Stash personal portfolio on a weekly, bi-weekly, or monthly basis. This encourages consistent contributions to your Stash investments without having to think about it. Robo-AdvisorAssets Under Management Annual FeeAccount MinimumBonusesReviewBetterment$15 billion0.25% of account balance.

The information contained in BibleMoneyMatters.com is for general information or entertainment purposes only and does not constitute professional financial advice. Please contact an independent financial professional for advice regarding your specific situation. 5 Early access to your direct deposit depends on deposit verification and when Green Dot Bank gets notice from your employer, and may vary from pay period to pay period. 4 Stash does not monitor whether a customer is eligible for a particular type of IRA, or a tax deduction, or if a reduced contribution limit applies to a customer. Here are some other important features and functionality of the app that are important to know about. Based on your level of acceptable risk you’ll be given recommendations for portfolios. Anyone can open an account, you just have to be 18 years old, and live in the United States.

Stash App Pros And Cons

Reinvesting dividends is the best way to maximize your dividend yields and Stash will handle it automatically. Dividend reinvesting also lowers the amount of commissions and fees you have to pay. The Stash Coach program is designed to help you plan and improve your portfolio. Stash is directed at beginner investors so this feature is a way to get newbies portfolio’s in fighting shape.

For example, you get a quick synopsis of any investment that you click on. This includes a bar visualization that shows the level of risk for any stock, and you can check out the last price and expense ratios. Investors may choose that portfolio, or they can customize their own based on what they want to invest in.

Best Investment Apps

Stash Invest is an investment app that enables you to get started investing. You can open an account and begin investing with no minimum deposit. Because the app enables you to invest in fractional shares, you don’t need to have a large initial deposit to begin building your investment portfolio. The company provides comprehensive help and guidance for first-time investors. If you want to start investing but don’t know where to start, it teaches you how to choose investments, manage your portfolio and when to trade. This involved experience gives you a practical education in investing.

This includes explainers on investment jargon, and how to build a risk-averse portfolio of assets. Outside of the investment space, Stash also offers guides on everything from personal finance, credit cards, debt, insurance, and income. This includes investment guidance, which gives you suggestions on where your money should go.

Instead of choosing a stock or ticker symbol to invest in, you choose from themed investments. Stash is great because the app allows users – who perhaps don’t have a ton of money – to buy fractional shares of a stock.

Even if I put that money in my high-yield savings account, which earns 1.45 percent a year, I would only have earned about $4. Here’s an interesting quote from the article titledI used an investing app for the first time and it made for the easiest $300 I ever saved .

Stash App services cost $1 a month for accounts with balances below $5000 and $2 per month for IRA accounts with balances less than $5000. Stash charges 0.25% for both general investment accounts and IRAs above $5000. Since the platform’s main target is new investors, most people are likely to be in the $1 per month range.

With that said, if you simply want to take advantage of the app’s commission-free offering, you’ll pay just $1 per month. Additionally, Stash offers a fully-fledged education department that is packed with free blogs and guides. Not only does this include investment-based material, but also content surrounding personal finance, credit, and saving for your retirement. Stash is a new-age broker that aims to challenge the ‘status quo’ of retail stock investing. It does so through its super-simple online and mobile investment app that allows you to buy stocks at the click of a button.

When you first join, you’ll be asked some questions about your financial goals and other information. Then, you’ll choose one of three account types and add cash to your Stash account. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy. Day Trading is a high risk activity and can result in the loss of your entire investment. Stash is a new brokerage firm on the scene trying to provide a modern way to invest and trade.

You don’t have to understand anything about stocks to know that you are investing in the right causes or industries that pertain to your interests. As Stash CEO Brandon Krieg has said, he wanted to help investors learn more about why they should invest and how they can do that even if they have barely any funds to work with.

Un-invested funds are also insured up to $250,000 by FDIC insurance. It uses Quovo and Plaid to authenticate your account before any transfers are made. All information between the three services are encrypted over a 256-bit SSL. Yes, investments you make with the platform are taxed as any other investment.