A 30-year-old investing for retirement might have 80% of his or her portfolio in stock funds; the rest would be in bond funds. A general rule of thumb is to keep these to a small portion of your investment portfolio.

This is the opportune time to take notice of our financial habits. Designed for recent graduates, our guide walks through budgeting, setting goals, investing a 401, and the importance of investing early. Maps to follow no matter where you are in your investing life. We explore the perils of holding too much in stocks for goals that are within reach. Here are a couple of fund ideas in case your portfolio is light on that side of the style box.

They can also help people develop retirement plans and manage trusts and other retirement accounts, such as 401s. This is a catch-all category that includes hedge funds and private equity. Hedge funds are so-called because they can hedge their investment bets by going long and short on stocks and other investments. Private equity enables companies to raise capital without going public.

You also have access to more than 160 no-transaction-fee mutual funds from Vanguard and more than 3,000 funds from other companies. That’s because there are plenty of tools available to help you. One of the best is stock mutual funds, which are an easy and low-cost way for beginners to invest in the stock market. These funds are available within your 401, IRA or any taxable brokerage account. An S&P 500 fund, which effectively buys you small pieces of ownership in 500 of the largest U.S. companies, is a good place to start. If your portfolio is too heavily weighted in one sector or industry, consider buying stocks or funds in a different sector to build more diversification.

Best Place to learn Investing for begginers

For beginner investors, especially, short-term trading comes down almost entirely to luck, and you can easily lose as much or more than you profit. Even forex currency pairs can be accessed with ETFs, as can other alternative investments such as hedge fund or private equity investments. ETFs also offer investors the ability to invest in portfolios that reflect popular stock indexes.

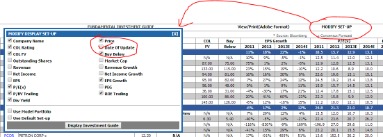

At Schwab, you have access to a wide range of investment management services to help you reach your goals. And you’ll have access to a variety of investment strategies, investment advice, and the ability to regularly monitor and rebalance your portfolio. Take advantage of our online tools, extensive research, expert insights, education opportunities, and dedicated support to help you make informed and timely decisions about your investments.

Read an article of 25 things to know about investing and categorize the items based on their prior knowledge. This fun and easy-to-implement game elicits various emotions we feel when we gain, lose, or miss out on investment opportunities and brings to light the psychology behind some of the investment decisions we make. Determine what features they value in a brokerage account and then conduct online research to determine which accounts best meet their needs. A recent research study found that of stock day traders made money over a 12 month period. Best robo-advisors for March 2021 Is 2021 the year you start investing? Try it out with one of the best robo-advisors available right now. Lawmakers, regulators and Reddit aren’t happy with the popular investing app.

These are the top books we recommend all our students read to learn more about investing, finance, financial modeling and valuation. The habit of regularly investing even small amounts of money is definitely a habit worth cultivating, a habit that will pay off handsomely for you. But now assume that you make one very small adjustment – contribute just an additional $50 every month to the account. Figuring in $50 monthly contributions, in 10 years your investment account will have grown to $27,300 – almost double the account size that you’d have hadwithoutmaking any additional contributions.