How To Invest In Index Funds

Table of Contents Heading

- Index Funds Are Not Very Flexible

- Here’s How Schwab Market Cap Index Fund Costs Compare ³

- Schwab Market Cap Index Etfs Have Among The Lowest Expenses In The Industry

- Choosing Index Fundsdownload Article

- What Exactly Are Stocks?

- Best Index Funds For March 2021

- Investing Principles

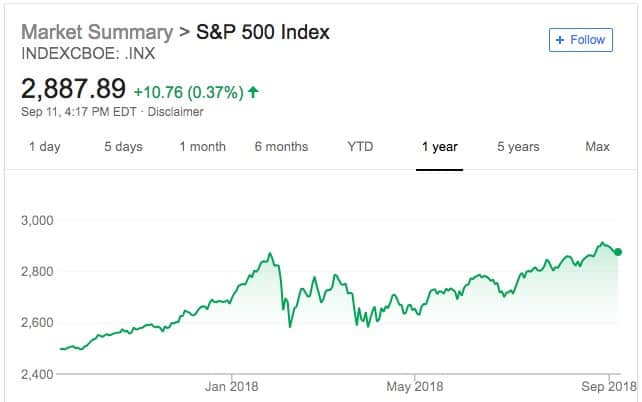

Index funds can put your investments on auto-pilot and build an impressive nest egg. U.S. mutual funds are required by law to distribute realized capital gains to their shareholders. If a mutual fund sells a security for a gain, the capital gain is taxable for that year; similarly a realized capital loss can offset any other realized capital gains. Some common indices include the S&P 500, the Nikkei 225, and the FTSE 100.

This fee goes to the managers of the fund who are making the buy and sell decisions on your behalf. There is usually a team of analysts who make buy and sell recommendations to the manager or managers. The fees for this vary, but in the neighborhood of 1% is common. Two main benefits make index investing a better alternative to analyzing and purchasing specific companies in the hopes that you are picking only the “best” stocks. Indexes are also built to track different slices of the market too. The Russell 2000 index is comprised of 2000 stocks and measures the performance of small US companies.

Investors who believe in passive investing prefer index funds because they’re designed to simply match the market. This school of thought believes it’s not worth it to try to “beat the market.” They believe stock prices are generally “correct” based on the information available to investors. So why would you spend mental energy trying to pick stocks? If every stock is correctly priced, then it’s a waste to try to beat the market. In fact, you’ll probably lose — your returns will be worse than the market — if you try to pick stocks.

Index Funds Are Not Very Flexible

BlackRock’s UK Equity Tracker costs 0.06%, while HSBC’s FTSE All Share Index is 0.07%. Fidelity’s Index UK costs 0.08% a year, but 0.06% if you buy directly from Fidelity. Which one you choose comes down to price, which vary according to which market you are tracking. On 24 June, Brexit result day, active funds fell 8%, but UK index funds were down just 6%. Since then the latter have maintained a 2% lead over the former. Over one year the average UK active fund is up 10.6%, but the typical UK index fund is up 17%. In the US, active funds are up 24.8% over the year, while Fidelity’s US index fund is up 31.2%.

Learn exactly what does a portfolio manager do in this guide. Portfolio managers are professionals who manage investment portfolios, with the goal of achieving their clients’ investment objectives. These funds track the price of a particular commodity instead of an index. To do so, some exchange-traded products, such as iShares Gold Trust , buy and store the actual material.

Here’s How Schwab Market Cap Index Fund Costs Compare ³

Using an index fund will make it easy for you to start an investment without having to pick and choose individual stocks on your own. Actively managed funds provide an investor with the opportunity to beat the market. The funds may deliver a greater return over a short investment horizon. Investors in such funds should possess some investment experience and knowledge to be able to understand the strategy employed by the fund. Traditional benchmarks, such as the S&P 500 and Russell 3000, weight companies according to their stock-market value. In a designer index, market capitalization takes a back seat to other measures.

You’ll want to closely review expense ratios and tax-cost ratios. It’s relatively easy to find the expense ratio in the fund’s prospectus or when you type in the ticker symbol on a financial website. In addition to paying fees, owning the fund may trigger capital gains taxes if held outside of tax-advantaged accounts like a 401 or an IRA. You’ll typically pay approximately 0.3% of returns when you invest in an index fund. They tend to have fewer fees than other actively managed funds, as the cost of commissions and management of the account, known as expense ratios, are usually lower. While index funds aren’t immune to short-term market ups and downs, indexes in general also tend to rise over time. You may not get high returns during a bear market , but it’s unlikely you’d lose your entire investment in one day during a bear market.

- Remember, more aggressive investments—like equity index funds—offer greater potential returns in exchange for more risk.

- Setting an ongoing strategy and maintenance plan is important for all investors.

- Make sure you can afford the index fund’s minimum investment.

- Schwab operating expense ratios and Vanguard net OERs represent the lowest OERs reported from prospectuses as reflected on December 2020.

- If you’re interested in growing your money but aren’t excited about doing a lot of research, then index funds can be a great solution to achieve your financial goals.

- The Office of Investor Education and Advocacy has provided this information as a service to investors.

Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market or economic developments, all of which are magnified in emerging markets. System availability and response times may be subject to market conditions. Expense ratio is the total annual fund operating expense ratio as of 07/16/19. Index funds keep costs low because they’re designed to be passive, so they don’t require much attention from fund managers (and even less if you’re using a robo-adviser). You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free) or through another broker . See the Vanguard Brokerage Services commission and fee schedules for full details. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars.

When you buy a share of a mutual fund, you’re actually buying little pieces of hundred of underlying individual securities. The other way that stock investors make money is by receiving investor dividends. A dividend is a regular payment that a company will pay its stockholders. Many investors prefer dividend-paying stocks because they can provide a steady stream of passive income, separate from the stock’s overall price performance.

Schwab Market Cap Index Etfs Have Among The Lowest Expenses In The Industry

We understand why you’re buying index funds—you want an investment that performs as closely to its benchmark as possible. Over time we seek to minimize tracking error — the amount an index fund’s performance deviates from its target index. We offer index funds that attempt to track the performance of a range of the most widely followed equity and fixed income indexes. You’ll find funds that seek to track U.S. stock market indexes of all market caps, as well as several international equity index funds, including an index fund dedicated to emerging markets. You’ll also find bond index funds, including a fund that seeks to track the Bloomberg Barclays Indices. If you’d rather not build your own portfolio of index funds, you can buy a diversified portfolio containing a combination of four Fidelity stock and bond index funds. Your company will likely offer a limited selection of safe-bet mutual funds to choose from.

Because future stock price movements depend on unknown information that can’t be predicted, they are said to follow a random walk. Even if you thought you could predict the future, you would have to think everyone else could too. They would then have the same future expectations you do, and it would be reflected in stock prices.

Choosing Index Fundsdownload Article

Governments and corporations issue bonds when they want to raise money. When you buy a bond, you give the issuer a loan and they agree to pay you back in a specific amount of time, with interest. One share of stock represents a partial stake of ownership in a company. You buy stock in companies where you expect the stock price to rise so you can eventually sell your shares and make a profit. Index funds offer a plethora of other advantages too, but before you jump on the bandwagon, read on to explore the pluses, minuses, and reasons they’re so popular. I reveal EVERYTHING I know through 4+ years of experience in investing, coaching and researching on the subject. I will continue to add extra content to the course at NO cost to you at all.

Do you want to purchase index funds from various fund families? The big mutual fund companies carry some of their competitors’ funds, but the selection may be more limited than what’s available in a discount broker’s lineup. Even though they’re not actively managed by a team of well-paid analysts, they carry administrative costs. These costs are subtracted from each fund shareholder’s returns as a percentage of their overall investment.

Index fund investing is one of the most popular forms of investing these days, and with good reason. It’s an easy to set up, low cost, and effective investment strategy for beginners and experts alike. Learning how to invest in index funds is simple too, especially when you have the right guidance on how to get started. This can make ETFs the best choice for beginning investors. With ETFs, investors can literally enjoy the diversification of an index fund with an investment amount of less than $100.

In other cases, however, ETFs can’t buy the actual stuff. United States Oil Fund , for instance, tries to track the spot price of light, sweet crude oil by buying oil-futures contracts. But because of quirks in the trading of futures contracts, USO has done a poor job of achieving its goal. For starters, be sure you understand what kind of index fund you’re buying, the rules that govern its underlying holdings and how it has behaved in past markets.

What Exactly Are Stocks?

“It’s a very simple decision; ‘Do I have enough money each month to put aside and where should I put it?’ My recommendation is to put it in index funds, particularly as a younger starting investor. Most index funds require a minimum investment to buy into, typically anywhere from $1 to $3,000. If you have less cash on hand to invest than is required for a particular index fund, you can eliminate it from your list of options for now. If you’re wondering how to invest in an index fund, you can start through your 401, IRA, or a brokerage account. A strategy intended to lower your chances of losing money on your investments. We launched the first index fund for individual investors in 1976.

The S&P 500 Index, for example, is the one most experts use as a benchmark for the overall U.S. stock market. Standard & Poor (S&P) is a ratings agency that identifies the top 500 largest companies on the New York Stock Exchange to include in its index. In a very real way, they use it to measure the overall performance of the stock market. Index funds get a lot of talk on the cable news shows and all over message boards, but are they really the best option when it comes to investing for retirement? Well, I’m here to break down index funds for you so that you can decide whether or not they have a place in your investment plan.

Transactions in shares of ETFs may result in brokerage commissions and will generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders.

And we’ve been perfecting our benchmark selection and tracking skills every day since. We’re never distracted by the demands of private owners or other outside interests.

This book explains the essential concepts and steps for starting with passive investing while living in Europe. “Throughout your blog I have learnt much more about passive investment than patreon subscriptions, books and other sources in the vast “ocean” of the net. “The course taught me a lot and gave me the confidence to actually start investing. The recommendations for specific ETFs and reasoning why were the most helpful things for me. It was just enough for me to make an informed decision I could act on immediately” – Jiri K. “I have read some materials in the past regarding investing in ETFs but usually all was ending in confusion.