Top 5g Companies To Invest In

Table of Contents Heading

- How To Make The Best Investment In 5g Technology?

- A Guide To Investing In 5g Stocks

- Is Investing In 5g Technology A Good Decision?

- Ase Technology Holding Co , Ltd.

- My Top 5g Asx Share To Buy Right Now

- Bull Market Confidential: Matt Mccalls Keys To Major Profit In 2020

The company makes its 5G money by selling chips to device makers and by making money from licensing its IP to other companies. The new cellular technology is very promising for Qualcomm because the company already has more than 110 5G agreements with smartphone makers and all major handset manufacturers are under license with the company. And investing before the 5G rollout is complete could position investors in front of incredible growth rates.

- People may receive compensation for some links to products and services on this website.

- It is also getting into small cell antenna space, partnering with Qualcomm, which we covered in the first part of this blog.

- Verizon plans to increase its number of 5G cell sites by 500% in 2020 and deploy its 5G network in 30 new cities by the end of the year.

- BlackBerry is an ideal stock for growth investors, as 5G technology will create tonnes of innovation in the tech sector, especially with the Internet of Things.

- these stocks are all good investments but not cheap… beginners and small investors wont get much out of them.

Verizon is best-known among 5G analysts for its fiber deployment. Verizon has also announced plans to have 5G coverage in 30 cities by the end of the year. Revenue is expected to grow well for Ciena over the coming months as Ciena continues to be involved with some of the largest tier one companies in the United States. The stock dropped to lows of around $33 in December 2019 but has been growing steadily into 2020. NXP Semiconductors has maintained strong 5G deployment over the last few quarters, making it a strong player in the 5G space.

How To Make The Best Investment In 5g Technology?

It provides infrastructure platforms, including networking technologies of switching, routing, wireless, and data center products that are designed to work together to deliver networking capabilities, and transport and/or store data. But, like other communications infrastructure companies, the next few months should see a return to previous levels of growth, and its stock currently sits at $204.42. The stock market saw big dips at the end of March 2020, and 5G stocks were amongst those affected. However, since then the market has started its recovery, and the picture for 5G stocks in 2021 still looks attractive to investors.

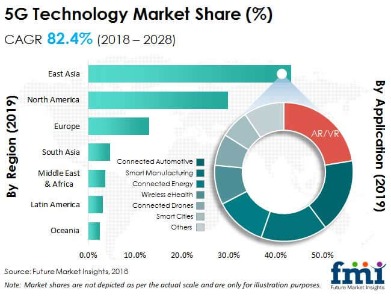

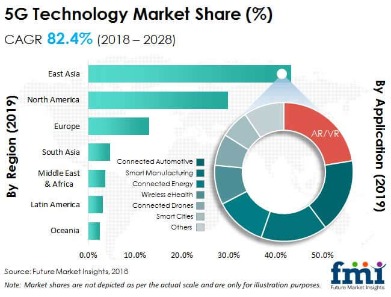

Cybersecurity firm Palo Alto Networks in November unveiled new security tools to secure 5G infrastructure and web-connected industrial devices. Palo Alto’s product offerings enable end-to-end protection of 5G networks. The future of 5G wireless lies in the industrial Internet of Things, remote health care, drones and robotics, autonomous driving, smart cities and more. In addition, 5G enterprise applications in smart factories and other business uses are expected to come into view in 2021. Analysts say it make take a few years for 5G broadband services to homes to pose a threat to cable TV companies. In the December quarter, demand for 5G iPhones came in strongest in China.

They work closely with community members, government officials, and their customers to design and build solutions that meet their unique connectivity needs—from wireless coverage to smart city solutions to custom fiber optic networks. They play an important role in tomorrow’s smarter, better-connected communities, while paving the way for new innovations in the way they live, work, and stay safe. Crown Castle owns, operates, and leases towers and other infrastructure for wireless communications. Crown Castle offers significant wireless communications coverage to 92 of the top 100 US markets and to substantially all of the Australian population. Their smartphones and tablets are connected, of course, but soon things like traffic lights, machines, appliances, and autonomous cars will all be online. Nokia Corporation engages in the network and technology businesses worldwide.

A Guide To Investing In 5g Stocks

At a forward price-to-earnings ratio of 13, Nokia is not valued as a strong 5G player for the future. Markets are making a mistake ignoring this company’s strong prospects. Not only that, but NOK is building its 5G business by converting all of its 4G LTE customers — it has over 300 commercial 4G customers who need help transitioning to 5G over the next years.

The relatively high margin on those customers has enabled the company to offset its video subscriber losses and still grow EBITDA at a strong rate. Comcast is the largest pay-TV and home internet service provider in the United States. While it also owns NBCUniversal, a giant in the media industry, Comcast’s biggest source of revenue and profits is its cable communications business. Another tech trend that will be accelerated by 5G will be telemedicine. While telemedicine already exists, 5G will make it possible for people in more remote locations and in rural areas to have better online medical services. Reliable connections, improved video calling, and a more expansive cellular network will make telemedicine more prevalent.

Is Investing In 5g Technology A Good Decision?

Marvell’s chipsets will eventually replace the field programmable gate arrays that Nokia originally chose for its 5G products. These were an expensive option that doesn’t appear to have paid off. As more networks make the move to 5G standalone, and upgrade networking infrastructure accordingly, Ciena will be well placed to handle installation, configuration, and management of fiber optic backhaul within 5G networks. And whilst Ciena doesn’t have the heady market cap of many companies operating in and around the 5G market, it is a traditionally strong performer, with year-on-year growth over the last five years.

And October through November has seen 5G stocks continuing to increase in value, which will be further buoyed by the recent launch of the 5G iPhone. As a real estate investment trust, American Tower pays out at least 90% of its taxable income to shareholders every quarter. The sector is often attractive to more conservative investors looking for dividend-yielding stocks, but it’s also full of companies with good potential for capital appreciation. Here’s how to find top telecommunications stocks for your portfolio. Telecom companies provide the technology that ties together our increasingly connected world. Companies in this sector provide phone, internet, and television services and the infrastructure to support them. Spending on 5G network infrastructure still falls behind 4G/LTE spending, but it’s catching up quickly.

Ase Technology Holding Co , Ltd.

They’re attributing revenue growth for various segments to 5G testing. Bezos has his own company Blue Origen that makes his rocket engines in Huntsville, AL. I am not sure whether satellite or towers is where to invest. I am looking to see which smaller companies may profit from assisting in these projects. From my reading Teradyne has a unique ability to robotically test circuits for quality. If their product is unique and the best way of getting the job done it seems like a food place to invest. Find out which tech stocks we love, like, and avoid in this special report, now available for all Nanalyze Premiumannual subscribers. Shipped over 100 million 5G wireless infrastructure components since January 2018.

Lina is also currently undertaking a Masters of Teaching in secondary education, specialising in the Economics and Accounting curriculum. As an aspiring educator, she wants to model by example and to show her students the ropes of the sharemarket. The 5G Networks share price ran more than 60% between 21 July and 28 July. Following the run up, the share price has consolidated around the sub $2 level. This ASX stock is in a compelling space and certainly one to watch for growth-orientated investors. Another attractive feature of the software security business is that almost all of the revenue is recurring.

Personally, I am currently making moves in the Renewable Energy space, it’s hotter than 5G stocks atm. However, I’m keeping a close eyes on developments in the 5G space, paying attention to trends and waiting patiently to make the big move. I had a price target of $450 for Broadcom back in November, but it’s currently at $445, so I will have to re-evaluate the stock. As of December 31, 2019, the company served approximately 21,922,000 mobile subscribers and 8.4 million IPTV subscribers. VEON’s stock price trades under $5 and is up 15% YTD, it sees an average daily trading volume of 3,502,458 and has a market cap of $3.2 billion. VEON is currently developing its 5G ecosystem in partnership with Nokia. The company provides these services through five of its brands Beeline, Kyivstar, Jazz, Djezzy, and banglalink.

However, the company is yet to realize this potential, failing so far to serious capitalize on the non-participation of Huawei in the 5g infrastructure market and has even lost 5G contract bids to the likes of Samsung. The first beneficiaries of the 5G wave are most likely 5G infrastructure stocks and at the other end are companies that will use 5G to massively improve their offerings technologically. You can capitalize on this projected growth by investing in 5G stocks.

My Top 5g Asx Share To Buy Right Now

Investing in pure plays levered to a growth theme is tricky, though, due to execution and valuation risk. “The 5G buildout has arrived and there are a host of semiconductor companies that are poised to benefit,” he said. “At the moment, Skyworks is my favorite because it’s so darned cheap and Liam is such a good manager they’ve finally got investors focused on the 5G future, but you can make the case for all five.” Third up is communications technology giant Qualcomm, whose president believes that “virtually all 5G mobile devices launched in 2019” will be embedded with Qualcomm’s 5G tech. “With its 2.5 percent yield new CEO who is very energized, I think you could do a lot worse than Intel as a slow-and-steady way to play the 5G buildout.” Five semiconductor companies are in a prime position to benefit from the rollout of 5G, the fifth generation of wireless communication that telecom companies are racing to implement, CNBC’s Jim Cramer said Wednesday. The company also reported Q3 revenue of $62.7 million, which beat forecasts by 5.4%, and revealed that its 5G revenue could exceed US$10 million for 2019.

Most investors don’t prefer the OTC (over-the-counter) route for it isn’t regulated. So the easiest way to get your hands on the Samsung stock is through an ETF, which we’ll talk about in the third part of this blog in greater detail. Individual shares of Samsung must be purchased either over-the-counter as a pink sheet stock, which means your purchase isn’t regulated, or on the Korean exchange, which will require you a South Korean brokerage account. Most phone makers, along with Apple, have already released their 5G smartphones, but that only can’t be the basis of our investment strategy. The only issue apart from living in a compatible location is that you also need a 5G-enabled phone.

Real Estate Stocks

In early September, Samsung won a $6.65 billion 5G contract from Verizon. The global 5G radio access market will jump to $21 billion in 2024, up from less than $4 billion in 2019, research firm Omdia forecasts. At Jefferies, chip analyst Mark Lipacis expects augmented reality apps, higher resolution video and cloud gaming to drive early 5G consumer demand. 5G will contribute $1.9 billion in revenue to cloud gaming by 2024, estimates ABI Research. “Enterprise solutions could be the largest 5G revenue drivers, including factory and manufacturing, with telemedicine and health monitoring also new drivers,” Raymond James analyst Ric Prentiss said in a note. Verizon’s 5G network uses both lower-band and high-frequency “mmWave” airwaves. In a boost for Verizon, Apple’s new 5G iPhones utilize mmWave spectrum.

I consider a stock’s growth to be explosive if it grows over 100% but if a 30% growth is explosive for you, check out the list of 5G stocks mentioned above. The year is just beginning to unfold, and there are several factors that will determine if this year is going to be really explosive, in terms of growth, for 5G stocks. Nonetheless, none of these publicly traded companies are specifically building private 5G network as thier primary business. And Ericsson recently announced its acquisition of Cradlepoint, a major Enterprise 5G company, making a big move for the private network market. Wipro’s stock that trades in the New York Stock Exchange as WIT, has a stock price under $10, with its exposure to 5G and the IT space in general, it is expected to benefit directly and indirectly from the 5G boom. The company has a market cap of over $35 billion and its stock is currently up over 14% YTD.

Bull Market Confidential: Matt Mccalls Keys To Major Profit In 2020

The last leg of 5G transmission, unlike 4G, will require antennas within several hundred yards of the connected device to ensure signal strength and speed; previously, towers could beam connectivity over much longer distances. This will require tens of thousands of smaller cell towers — the type in which real estate investment trust Crown Castle specializes. CCI boasts more than 70,000 small cell nodes that are either operational or under contract. Carriers often opt to rent instead of build tower space, so CCI’s steady expansion will translate into vast recurring revenue streams in upcoming years. As demand for data and wireless communications has spiked in 2020, so too has CCI stock — up about 15% through late April and within reach of recent all-time highs.

For those questioning why this happened, it looks like Qualcomm’s strong 2020 may not have been strong enough for some investors. So rather than Qualcomm being a busted flush, it could well be a good time to buy. However, the latest financial results from Nokia show a €193m ($227m) net profit for the three months up to September, which is an €82m increase over the same period in 2019. But a fall in sales of 7% had an instant reaction on the stock-market, where the share price dropped from €3.45 at the close of play on the 28th October, to a low of €2.84 – an 18% drop.

Without the technology developed at ADI, the 5G communications industry structure that exists today would not be possible. 5th on this list is Qualcomm, an American public multinational corporation headquartered in San Diego, California, and incorporated in Delaware. It creates an intellectual property, semiconductors, software, and services related to wireless technology. Qualcomm harnesses the power of 5G with comprehensive modem-to-antenna solutions for smartphones. Qualcomm generated USD 24.27 billion in revenue last year, with a current market cap of USD 81 billion — making it one of the top 5G technology companies in the world to invest in. Ranking 3rd on this list of biggest 5g companies to invest in 2020 is Nokia, a Finnish multinational telecommunications, information technology, and consumer electronics company, founded in 1865 and an early adopter of 5G technology. Currently, Nokia has 18 live networks and over 152 5G agreements.