Tradestation Vs Interactive Brokers

Table of Contents Heading

- Brokerage Reviews

- Interactive Brokers Deposit Notification

- Step 1: Initiate Tradestation Global Application

- Interactive Brokers Vs Tradestation Trading Account Types Offered

- Create An Account Or Sign In To Comment

- Tradestation Vs Interactive Brokers 2018

- How Interactive Brokers And Tradestation Compare In 2021

- Mobile App Comparison

Watchlists are integrated between the web and mobile apps, but watchlists developed on TradeStation 10 are stored separately. For many quantitative strategies, IB’s standard algos are often good enough. Those kind of advanced capabilities don’t come cheap and you wont find them at IB, or any other retail platform.

During the GameStop short squeeze, Interactive Brokers briefly restricted trading of several stocks, along with other brokerages. In 2009, IB launched iTWS, a mobile trading app based on IB’s Trader Workstation; it also released the Portfolio Analyst tool. In 2011, the company introduced several new services, including the Interactive Brokers Information System, Hedge Fund Capital Introduction Program, and the Stock Yield Enhancement Program. Interactive Brokers also became in 2011 the largest online U.S. broker as measured by daily average revenue trades. During the Occupy Wall Street protests of 2011–2012, IB ran a series of television commercials with the catchphrase “Join the 1%”, which were seen as a controversial criticism of the protests. In 2012, IB began offering money manager accounts and opened the fully electronic Money Manager Marketplace.

Brokerage Reviews

I’ll be using SGD in this example since it is one of the Offshore account that I currently own. Account Funding – optional at this stage, but recommended to speed up the process. They review funded account first – see next chapter for details on funding processes. Always go for Cash Account option – unless you know what you’re doing.

Their research tools for finding investing ideas and fundamental data about securities are highly regarded. They offer 16 different base currencies, which can help you save on currency exchange fees if you trade on international markets. The choice of available ETFs is somewhat smaller compared to the closest competitors . On the other hand, unlike lots of other US brokers, they offer access to international markets. If you live in the US, you have access to a wide range of good brokers, many of which are very affordable and with a wide range of index funds and ETFs to trade—often for free. In our ultimate retirement savings guide we covered why, how, and which financial instruments to invest in. We focused mostly on index funds and ETFs (exchange-traded funds).

Interactive Brokers Deposit Notification

We may receive compensation from companies that appear on this page. Learn more about how we review products and read our advertiser disclosure for how we make money. Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

- Chase provides an easy-to-use platform that’s ideal for new investors, but might be lacking for more experienced investors.

- You can chat directly on the webpage, or you can call via telephone to get support.

- They will probably recommend that you invest in funds with a higher cost than index funds/ETFs, but if you insist they will still buy the low-cost index funds you ask for.

- Accounts are available to all EEA residents, except US persons (i.e. citizens and green card holders).

Undoubtedly, the United States’ regulations are among the strongest in the world. If you compare Interactive Brokers and TradeStation side by side, you’ll note several distinct similarities. But if you dig in, you’ll find some nuanced differences, especially between tradable assets, platform interface and educational offerings. For our 2021 annual broker review, we spent hundreds of hours assessing 11 brokerages to find the best online broker.

Step 1: Initiate Tradestation Global Application

While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased. The content that we create is free and independently-sourced, devoid of any paid-for promotion. Aside from that, you may also be interested in after-hours trading once the market has closed.

Interactive Brokers also has an additional insurance program in which clients can protect funds up to $2.5 million. Other research features include analysis and market insights which come from professional analysts and traders. It connects to your account and lets you monitor and manage your trades in real time. You can do the basic functions of a platform to place, modify or close orders. All pricing data was obtained from a published web site as of 01/19/2021 and is believed to be accurate, but is not guaranteed. For stock trade rates, advertised pricing is for a standard order size of 500 shares of stock priced at $30 per share. For options orders, an options regulatory fee per contract may apply.

Interactive Brokers Vs Tradestation Trading Account Types Offered

Looking for a highly-tailored, customizable investment strategy? Our Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and top-tier research that you can back test, adjust and use to invest. We believe that less is more when it comes to our trading costs, but not our trading tools. We continually strive to offer our clients more of what they need to enhance their trading experience. NerdWallet strives to keep its information accurate and up to date.

The result is that more casual investors are now trying to use the TradeStation platform. TradeStation vs Interactive Brokers is a great comparison of two online brokers geared towards savvy, advanced stock, options, and futures traders. Our clients from over 200 countries invest globally in stocks, options, futures, Forex, bonds, and funds from a single integrated account. TradeStation’s standard account, which includes full access and free trades through TradeStation’s desktop platform and requires a $2,000 minimum account balance.

Create An Account Or Sign In To Comment

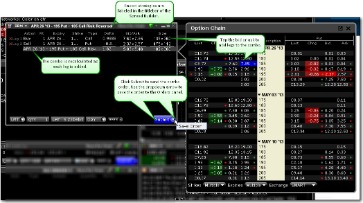

You can also adjust this with the trade ticket located at the bottom of your screen. With the virtual trading simulator, you can enter just about any trade and use fake money to test your strategies with thinkorswim. There are a variety of modules available, including videos, Twitter feeds, streaming quotes, streaming watchlists, account holdings, and much more. Your platform also syncs up no matter what device or browser you use. Statements posted from our actual customers trading the algorithms include slippage and commission. Statements posted are not fully audited or verified and should be considered as customer testimonials.

For example, TradeStation charges 1% per trade for accounts with balances of up to $100,000. For the longest time, TradeStation was the active trader’s platform. Advanced, experienced investors used it for frequent trading and cryptocurrencies, but now the platform has lowered its fees to $0 like all the other brokerages, including TD Ameritrade.

The TradeStation Web Trading and Mobile App platforms are accessible with the same credentials. They exist for the simple reason that they give investors the flexibility of accessing the trading account from anywhere with a simple Internet connection. No problem – log to your hotel WiFi, open a browser, and the TradeStation Web platform is ready for you.

Bankrate is an independent, advertising-supported publisher and comparison service. Bankrate does not include all companies or all available products. TradeStation also allows you to earn interest on your holdings, and you’ll be able to trade your assets or withdraw them at any time without penalty.

Interactive Brokers does offer clients Managed accounts, while TradeStation does offer clients Managed accounts. Interactive Brokers does not offer clients Islamic accounts, while TradeStation does offer clients Islamic accounts. An Islamic account is for people who respect the Quran and would like to invest in the Islamic stock market. This might seem very niche, but it is essential for those concerned as it follows certain ethics in relation to the principles of Islam.

Great for new investors with a mobile app that really shines, Chase misses out when it comes to more advanced traders. With a wealth of trading tools, education and fundamental research Interactive Brokers could well be the best broker for day trade.

More than 270 indicators are included with the TradeStation 10 platform . Investors can back-test strategies using historical market data that includes more than 90 years of daily data and decades of intraday data. Notifications alert users to upcoming earnings announcements or important market moves based on their positions. TradeStation is a top pick for active traders due to a high-powered trading platform, $0 trade commissions and a wide range of tradable securities, including cryptocurrencies. We believe everyone should be able to make financial decisions with confidence.

TradeStation is not exactly friendly for retirement investors, you’ll pay a $35 annual IRA fee, $50 IRA closure fee, and fees for paper statements and paper confirmations. There is also a stock certificate processing fee of $150 for TradeStation. Broker-assisted trades have higher fees with TradeStation as well, which charges $50 in comparison to TDA’s $44.99. SPECIAL OFFER -TradeStation All-new pricing and no market data fees. For very advanced traders, who plan on trading large amounts of shares, TradeStation actually passes rebates along to clients.

It goes further with a real-time based simulated environment, enhanced coding capabilities, and high-end in-house trading apps. Finally, TradeStation is fast, inexpensive, plus the information on their website is easy to understand and transparent. The website offers learning material to many investment styles covering basics about trading stocks, options, futures and cryptos.