Icm Capital Reviews

Table of Contents Heading

- How To Leave A Review About Icm Capital On The Traders Union Website?

- Is Icm Capital Legit?

- Ready To Find Your Broker?

- Icm Capital Review Conclusion

- Icm Capital Trading Tools

- Professional Clients

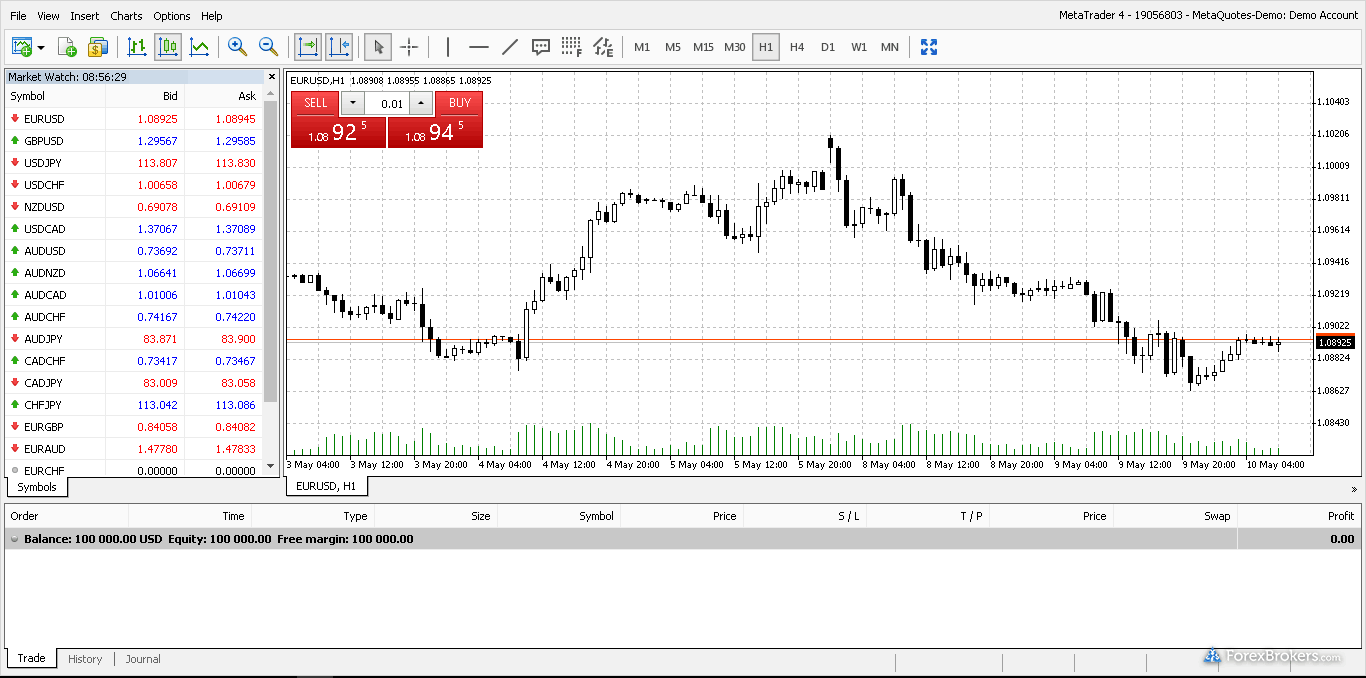

You can sign up for a demo account to acquaint yourself with ICM Capital platform. learn more 67% of retail investor accounts lose money when trading CFDs with this provider. It is a fact that MetaTrader 4 is a highly professional platform that not only allows you to actively trade, it also has powerful technical analysis, charting and modeling tools. Also, all clients can benefit from auto trading by the use of Expert advisor in the terminal. ICM Capital’s trading platforms have been selected according to importance within the industry offering and the most balanced trading parameters like speed, reliability and security.

When you request a withdrawal, the money will be in your bank account within 5 days, but ICM Capital has a special treat for their traders when it comes to deposit. Every trader can request their own ICM Capital prepaid MasterCard card which is directly connected to your live trading account. So if you have money in your trading account you can use this card for payments in stores or money withdrawal at an ATM. We have tested all available transfer method and saw no problems, whatsoever. As far as we are concerned, this broker’s transfer methods check out.

How To Leave A Review About Icm Capital On The Traders Union Website?

ICM Capital offer an their own custom trading platform developed and tested in house. The ICM Capital trading platform allows traders to track their portfolios, track the current markets, locate trade ideas and place trades. That said, please note that you can lose funds when trading in financial assets. Accounts can lose money due to either not putting enough effort into researching the markets, lack of experience or not using the tools provided by the brokerage platform. Often you have to visit and read many broker websites all of which have different uses of language. For a beginner, the first few hurdles can come in the form of what appears to be a complex mobile or online trading platform, hard to understand investment terminology and confusing fee structures.

CFD’s are complex instruments, and there is a high risk of losing money. ICM Capital is a well-regulated forex & CFD broker with a Market Maker/STP model. The one thing you should keep in mind is ICM Capital keeps its spread a bit high. Clients of ICM Capital can make deposits to their accounts via bank wire and debit/credit card , e-wallets Skrill & Neteller + ICM Capital Prepaid MasterCard®. Micro lots are available for trade on both account types and besides, swap-free service is provided on the ICM Standard account, which is Sharia-compliant and suitable for clients of Islamic belief. Trading FX or CFDs on leverage is high risk and your losses could exceed deposits.

Is Icm Capital Legit?

Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with ICM Capital vs. similar brokers. To open a live account, you’ll need a minimum deposit of at least €200. Alternatively, ICM Capital offers a demo account that you can use to practice and familiarise yourself with their platform.

The bonus is just a reward for the trader’s choice that gives some of these expenses back to the trader, once proving himself as an active trader. Traders in a standard account feature should keep in mind the rollover rates in case you hold a long position. For instance, the EUR/USD long buying position will impose -$ 7.86 while selling will gain $ 2.68 per lot. The spread of a currency pair is the difference between the bid and the asking rate.

Ready To Find Your Broker?

Among other categories the company has been awarded for its excellence in providing the best execution, customer service, and rebates for its traders. This2021 Forex Broker Reviewhas been conducted though thorough research and assessment of rating and ranking among almost 300 international forex brokers. The final grade is given based on ICM Capital FX broker performance and features. A few days later, I decided to open an account and made a Webmoney deposit of $ 61.00.

On social media, they are on Facebook, Twitter, YouTube and LinkedIn. The education centre also has a glossary of about 517 trading terms and their meanings. It has the customizable ‘Market Watch’ window which displays all the instruments’ quotes in real time.

79% of retail investor accounts lose money when trading CFDs with this provider. If you are no longer using your trading account close it with the brokers customer support. And make sure you have a confirmation that any remaining fees are not due. When trading in the financial markets it can be very time consuming to find a broker that meets your needs. For the Clients benefit, the company offers smart spreads calculation through ECN deep liquidity providers starting from 0 pips. In fact, ICM trading technology demonstrates great trade execution and allow all trading styles.

Icm Capital Review Conclusion

The forex trading software provided by a broker company to its clients is called the platform and is used to carry out their trades. Forex brokers tend to lure new traders with offers of attractive deposit bonuses. This can be useful, but it is essential to discern what a proper bonus is. ICM’s trading technology demonstrates great trade execution and allows all trading styles. For the client’s benefit, the company offers smart spreads calculation through ECN deep liquidity providers starting from 0 pips. ICM Capital uses market execution with liquidity accumulated via major Tier 1 global banks. The brokers keep the spreads for all markets consistently lower among the offering, as data show that the spread for EUR/USD during peak times averages at 1.3 pips.

You should consider whether you understand how CFDs and Spot FX work, and whether you can afford to take the high risk of losing your money, according to research done. Expert Advisors can be installed and run without interruption 24 hours a day whenever the markets are open. Virtual Private Server is available for existing and new clients who maintain a balance of 4,000 USD or equivalent in EUR, GBP, or SGD in their account. ICM Capital enhanced this with the additional protection of up to £ backed by substantial global capital and available to all live account clients with no additional cost. One of the first things a potential trader needs to establish is whether a broker like ICM Capital is safe to trade with.

Icm Capital Trading Tools

It can be downloaded from the respective app stores for Android and iOS devices. ICM Capital is committed to its AML and KYC policy document which is found on its websites. The company is against using its services to launder money or fund terrorist activities.

- Mark was previously of the Kiel Insitute and has worked with financial organisations across Europe, Australia, South East Asia, South Africa and the Middle East.

- Please follow the links to each of our affiliated broker’s websites.

- Be well informed that trading on high leverage level margins can so easily drain your wallet of funds.

- The standard methods are accepted by this broker which include the traditional wire transfer, credit cards and e-wallets .

- For instance, the EURUSD long buying position will impose -7.86$ while selling will gain 2.68$ per lot.

According to research in South Africa,ICM Capital is a UK broker headquartered in London and operates as a wholly owned subsidiary of ICM Holding SARL . Support and operation offices have been established in Dubai and Shanghai and subsidiary offices in 10 locations across Africa, South America and Asia. ICM Capital accepts clients from all over the world, excluding USA and some countries where restrictions apply. We take them seriously because we respect your privacy and rights in this digital era and we respect the integrity of our advertisers and partners. Due to the complex structure of the group of companies, it’s hard to evaluate the advantages and disadvantages of trading with ICM Capital. It would require a vast amount of analysis to compare and evaluate each entity to produce any meaningful conclusion. Put your new knowledge to the test at HotForex and start trading smarter today.

The leverage for ICMCapital accounts can vary depending on the price volatility of the underlying asset. ICM capital forex broker guarantees the protection of client investments under the FSCS scheme in the amount of up to £ 1,000,000 and up to £ 50,000 in case of insolvency of the company. VIP customers are provided with additional guarantees of up to £ 1,000,000 under the insurance system from Lloyd’s of London. ICM Capital is an award-winning broker that has been operating for more than a decade.

Write A Review About Your Broker Icm Capital

The company offers negative balance protection, safeguarding clients from losing more money than deposited. Although ICM Capital does not offer its own app, customers can trade from anywhere using the MT4 app, which is available for iOS and Android users.

If you are a novice trader, ICM Capital offers opening a demo account. CFDs and Spot FX are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.31% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Forexscambuster.com has taken reasonable measures to ensure the accuracy of the information in the website, however, does not guarantee it. The data exhibited in this website is not necessarily always real-time or completely accurate; this includes market analysis, forecasts, signals, assets’ price quotes and charts. The risks involved in trading binary options are high and may not be suitable for all traders. Forexscambuster.com doesn’t retain responsibility for any losses readers might face as a result of using the information presented in this website. In accordance with FTC guidelines, Forexscambuster.com has financial relationships with some of the products and services mentioned on this website.

ICM Capital have a good track record of offering Forex trading, Spread Betting, Share Dealing. You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 3 minutes or so to complete the account opening process. ICM Capital safeguards the personal information of its clients through SSL encryption in its PC and mobile platforms. ICM Capital also urges its clients through its web platform to always look for the SSL security sign o the browser while operating ICM Capital.

Trading Environment

The maximum trade requirements vary depending on the trader and the instrument. As ICM Capital offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades. As you can see, ICM Capital’s minimum spread for trading EUR/USD is pips – which is relatively low compared to average EUR/USD spread of 0.70 pips.

Brokers may have certain trading activity requirements that under the terms and conditions of the accounts, clients may have to fulfill. Brokers that do not charge minimum deposits do so usually to attract new customers. They have to make some way, so transaction commissions and other trading fees may be higher with a low minimum deposit account.

Professional Clients

ICM Capital support a wide range of languages including English, Arabic, Chinese, and Spanish. The ICM Capital customer support team is multilingual and available from 6am to 6pm from Monday to Friday. ‘Request a call back’ form is available on the website if you to schedule a call with a support representative.