Stock Chart Books

Table of Contents Heading

- Breakthroughs In Technical Analysis

- List Of The 5 Best Day Trading Books For Beginners

- Momentum, Direction, And Divergence: One Of The Best Day Trading Books On Trading Concepts

- Swing And Day Trading Table Of Contents

- Free Trading & Investing Ebook

What distinguishes Charting & Technical Analysis from many other technical analysis books is the in-depth focus on who is buying and who is selling. Technical Analysis of the Financial Markets is the gold standard of technical analysis books. Among the very best technical analysis books is John Murphy’s classic, called Technical Analysis of the Financial Markets. Once you understand those concepts, you’ll be ready to spot — and profit from — chart patterns like the cup with handle, double bottom and flat base. As IBD founder William J. O’Neil says, “Fortunes are made every year by people who learn to properly read charts.” But it’s only by using charts that you can keep those fluctuations in perspective and understand whether it’s time to buy, sell or hold.

- Don Worden defines the essential attributes of an effective trader and shares the Seven Uses of Technical Analysis – only one of which, he argues, is prediction.

- Do you apply stock technical analysis when making investment decisions?

- Novice traders may want to check out this book before diving into more complex topics.

- Your knowledge of charts and analytic techniques can shipwreck you if you don’t have the right mindset.

- We strive to maintain the highest levels of editorial integrity by rigorous research and independent analysis.

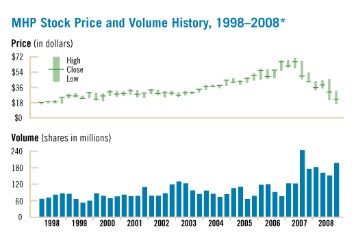

My learning curve consisted of reviewing literally thousands of charts in the early years, drawing multiple trend lines, and then observing what happened. , SRC is highly regarded as the “keeper of the data” and America’s most trusted stock-charting company. SRC charts use a semi-logarithmic scale to plot earnings and dividends, as well as price, moving average, trading volume, and relative performance-to-market index. This signature product offering allows investment professionals and individual investors to instantly and accurately assess the performance of selected stocks or groups of stocks in a visually compelling and easy-to-read manner.

The upward target is 183.39 with a 61% probability of reaching 191.33 . A downward target is 139.84 with a 53% probability of reaching 130.28. After a bumpy start, the stock moved up in a straight-line run to 187.70 on November 30, 2007 before pausing for a few days. Research is used to prove the ideas discussed, but is presented in an easy to understand and light-hearted manner. You will find the books to be as entertaining as they are informative and packed with moneymaking tips and ideas. Use the ideas presented here to hone your trading style and improve your success.

This book is going to help you understand how to trim the fat so to speak and dial down the stress. Help you build momentum and to have a better work life and a better life in general. It encourages adventure in both experiences and investment opportunities – so much so that Rogers has been heralded as the ‘Indiana Jones of finance’ by Time magazine. ‘One Up On Wall Street’ was written by Peter Lynch, one of America’s most famous fund managers and investors. In an easy-to-read guide, he explains how the average investor can become an expert in their field and outperform even Wall Street experts, simply by doing their research. Weigh the pros and cons of each broker to make an informed decision.

Breakthroughs In Technical Analysis

Find the best stock screener based on data, platform, and more. Segment the stocks you’re watching with these exceptional stock screeners. Access all the information you need to know about stocks in one place. Find the best stock research tools for you with our comprehensive selection. Research and compare the best online stock trading brokers of 2021.

These past studies had not taken the human trader into consideration as no real-world trader would mechanically adopt signals from any technical analysis method. Therefore, to unveil the truth of technical analysis, we should get back to understand the performance between experienced and novice traders. If the market really walks randomly, there will be no difference between these two kinds of traders. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable.

List Of The 5 Best Day Trading Books For Beginners

The book is based on interviews with former LTCM employees, the Federal Reserve, banks involved in the rescue and one of the firm’s founding partners. First published in 2000, it foreshadowed the 2008 financial crash and continues to serve as a reminder of what can happen when complacency enters a trader’s mindset. The second part, of course, charts its downfall as the models developed by the ‘geniuses’ fail to keep pace with the ever-changing markets. Although it is an entertaining tale, at its heart is an exploration of what it takes to be a successful trader. The book delves into the behaviour of a group of short-sellers and explains why they choose to pursue their strategy. But more importantly, it explores the intricacies of the financial system and the ways in which its weaknesses were exploited when no one else was paying attention.

Upon the book’s arrival in 1991, it served the purpose of introducing the technique to the west. The vast popularity of the book brought the technique mainstream attention to the extent that it has today become the most popular of all charting techniques used for Technical Analysis.

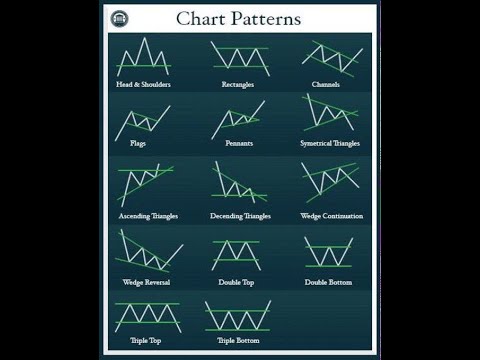

Those new to technical analysis may want to check out these books to fine-tune their strategies and maximize their odds of success. This book has a wide appeal for technical traders because it can be helpful to traders regardless of the strategy that they use. The book highlights the value of applying technical analysis across multiple timeframes to identify trades with the highest probability of success. It also goes well beyond what its title implies and covers subjects including short selling, stop-loss order placement, price target identification, and related topics. This book is truly an encyclopedia that contains an exhaustive list of chart patterns a statistical overview of how they have performed in predicting future price movements. Mr. Bulkowski is a well-known chartist and technical analyst and his statistical analysis set the book apart from others that simply show chart patterns and how to spot them.

Momentum, Direction, And Divergence: One Of The Best Day Trading Books On Trading Concepts

For the more complicated stuff, there are technical indicators. On a stock chart, the x-axis represents time and runs left to right. One of my all-time favorite books is “Reminiscences of a Stock Operator,” by Edwin Lefèvre . It’s a biographical novel based on the life of legendary trader Jesse Livermore. In this book, Douglas focuses on the psychology of trading, and the steps you need to take to think like a great trader. Trading requires mental toughness, and in this book, Douglas delves into the mindset of a trader, teaches you how to gain confidence, and shares how you can take responsibility for your failures. If you are looking for a book that provides you with a get-rich scheme, then keep on browsing.

All charting software and apps allow you to choose from several time periods. Use hours, a single day, multiple days, weeks, months, or years. In Japanese Candlestick Charting Techniques, he walks readers step by step through the theory and practice of this eastern method of investment analysis.

Swing And Day Trading Table Of Contents

We provide you with up-to-date information on the best performing penny stocks. Livermore examines the psychology behind trading and mastering the art of risk-taking, obsession with speculation and the private downfall of a man who was so successful in the markets.

While it may not give you a “Holy Grail” for trading, it will give you the basics you need to construct a winning system. This book sheds insight into the ways and means of the Oracle of Omaha. Warren Buffett’s thoughts are insightful and his methods may yield fruitful rewards for investors with enough patience to learn them, understand them and apply them correctly. Our team spends hundreds of hours testing financial products and services each year. If you use the links on this page to open an account, we may be compensated. Investopedia requires writers to use primary sources to support their work.

In the late 1980s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis. In a 2000 paper, Andrew Lo back-analyzed data from the U.S. from 1962 to 1996 and found that “several technical indicators do provide incremental information and may have some practical value”. Burton Malkiel dismissed the irregularities mentioned by Lo and McKinlay as being too small to profit from. An influential 1992 study by Brock et al. which appeared to find support for technical trading rules was tested for data snooping and other problems in 1999; the sample covered by Brock et al. was robust to data snooping.

Free Trading & Investing Ebook

Identification guidelines help even beginners recognize common patterns, and expert analysis sheds light on the period of the stock’s behavior that actually affects your investment. You’ll discover ideal buy and sell setups, how to set price targets, and more, with almost 370 charts and illustrations to guide you each step of the way. Coverage includes the most common and popular patterns, but also the lesser-known ones like bad earnings surprises, price mirrors, price mountains, and straight-line runs. Whether you’re new to chart patterns or an experienced professional, this book provides the insight you need to select better trades. Many trading and technical analysis books focus on how to use charts to make stock trading decisions, but what about how to actuallybuilda chart? Stock Charts For Dummiesreveals the important stories charts tell, and how different parameters can impact what you see on the screen.

The moving average lines simply track the share price movement over a set period of time. But they are absolutely crucial to understanding if a stock is being enthusiastically supported — or aggressively sold — by large investors.

105 Books Bar Chart Stock Photos And Photography Are Available Royalty

Livermore’s system was determining market phases (trend, correction etc.) via past price data. He also made use of volume data (which he estimated from how stocks behaved and via ‘market testing’, a process of testing market liquidity via sending in small market orders), as described in his 1940s book. The book includes sections to help the reader put what they’ve learnt into practice, including a technical checklist and guide to coordinating technical and fundamental forms of analysis.

But they can also be quite volatile, as many big-buzz IPO stocks have shown. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. Caginalp and Laurent were the first to perform a successful large scale test of patterns. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend.

A masterpiece on technical analysis is nothing less than an in-depth exposition on chart pattern analysis along with a detailed discussion on the evolution of the dow theory and how it can be replaced with a viable alternative. Originally published in 1948, this work continues to be an important resource for chartists, focusing on vertical bar charts and stressing their utility for market analysis. The latest edition of the work includes a great deal of updated information on the subject, including an expanded version of pragmatic portfolio theory and Leverage Space Portfolio Model, among other concepts. In short, a true classic for technical analysts and chartists.

In addition to covering chart patterns and technical indicators, the book takes a look at how to choose entry and exit points, developing trading systems, and developing a plan for successful trading. These are all key elements to becoming a successful trader and there aren’t many books that combine all of this advice into a single book.

An entire chapter discusses the opening gap setup and why fading the gap is the best way to trade it. Another chapter discusses the opening range breakout setup and questions whether it works. If you have to guess at the answers, then you need to buy this book. If you get some of them wrong, then imagine what you are missing. Heartfelt thank you for all you’ve added to the trading community.

If I Have Your Other Courses, Should I Still Get This Book?

It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. Hence technical analysis focuses on identifiable price trends and conditions.