Forex Technical Analysis Books

Table of Contents Heading

- Investing And Trading Book

- How To Make Money In Stocks

- Bestselling In Technical Analysis

- One Good Trade

- The Logical Trader

- The Art And Science Of Technical Analysis: Market Structure, Price Action, And Trading Strategies

This book gets right to the point on strategies to day and swing trade the market to grab profit. The trading personalities are on full display in this book as Mike Bellafiore walks through a day in the life of a prop trader and running a prop trading firm. This book is a great example of the diversity that is in the trading world, and yet ho we tend to make the same singular mistakes that bring disastrous results. I wish every trader could get a copy of this book when they first get started in their trading. Not only is it entertaining, but provides some very valuable lessons and knowledge along the way. This book gets rid of indicators and helps to focus in on actual price structure and price structure patterns. This book does a fantastic job of covering a wide array of technical analysis topics and goes into a good depth of knowledge on each of those topics.

It brings out the relevance, range, and depth of technical analysis as applied to the complex markets of the day. An easy read meant for lay readers interested in learning basic concepts of technical analysis without a great deal of effort. A fairly detailed work that encompasses almost every aspect of investing in today’s markets while retaining its focus on technical analysis as an efficient approach to investing. Let us discuss each of the technical analysis books in detail along with its key takeaways and reviews.

No representation or warranty is given as to the accuracy or completeness of the above information. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1.71 and designed to promote the independence of investment research.

Investing And Trading Book

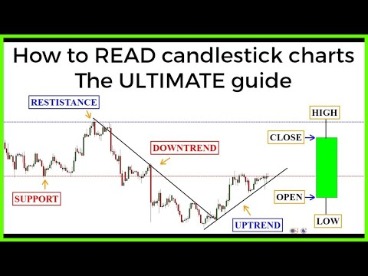

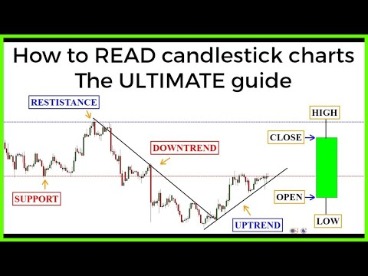

When formed, this money-making pattern has a high potential to break out. After knowing the support and resistance levels, it’s essential to know whether the price will respect that level or not. The price should respect the Trend Line – Whenever you draw a trend line, ensure the price respects the trend line with all its peaks.

This study includes all the basics, with many examples showing how candlestick charting techniques can be used in almost any market. Whether you are looking for swing trading books or intraday trading books or something else, or you are looking for the best forex trading books, look no further. This is the second book by Steve Nison available in this top 5 list, and the reason why it is in 4th position is simply that I wanted to give you a variety of topics. This could easily be your second and last book if you really do not mind western techniques and are disciplined enough not to need to be guided through learning to let go of your losers and keeping your winners. Despite being the sequel of Japanese Candlestick Charting Techniques, this book does not require having read its predecessor.

Based on the premise that all relevant information is already reflected by prices, technical analysts believe it is important to understand what investors think of that information, known and perceived. This book is a concise work that covers everything you need to know about volume analysis. Anna Coulling’s description of how and why volume analysis works is easy to follow.

How To Make Money In Stocks

One study, performed by Poterba and Summers, found a small trend effect that was too small to be of trading value. As Fisher Black noted, “noise” in trading price data makes it difficult to test hypotheses. The efficient-market hypothesis contradicts the basic tenets of technical analysis by stating that past prices cannot be used to profitably predict future prices. Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance in 1970, and said “In short, the evidence in support of the efficient markets model is extensive, and contradictory evidence is sparse.”

They had a 2-week crash course on trading and are left on their own afterward. They had a free live event called Trading Edge from 19th of August, until 22nd of August in Short-term Trading Strategies Bearish candle reversal patterns candle open signal mt4 indicator forex factory Work. So here are some Systems Trading books with specific trading forex hedging not allowed in usa no nonsense forex and backtest results, check it out…. Spider software, for example, provides technical analysis software specifically for Indian markets.

Bestselling In Technical Analysis

CONGRATULATIONS ON your personal copy of Advanced Technical Analysis for Forex. We continue our journey from the first book to acquire a broader and deeper understanding of technical analysis for forex. You will be introduced to new strategies along with the know-how on how to apply them. We will also examine more advanced technical analysis indicators that can increase your money making ability. In Advanced Technical Analysis for Forex, we continue our journey to acquire a broader and deeper understanding of technical analysis for forex. You will learn advanced technical analysis indicators that can increase your money making ability. The results from past students and readers confirms their effectiveness.

Covers Hardware and software setup for traders; mechanics of futures and commodity markets and continues with stock options and how to trade them; the stock market and how to predict its direction throughout the trading day. Although the phrase “technical analysis” may sound complex it really doesn’t have to be. Technical analysis is a market analysis technique used by successful individual traders and financial institutions the world over to analyze markets to find opportunities to profit. To fully unpack the subject of forex trading, Archer and Bickford address a variety of relevant subjects.

- The first section is so rich and detailed that it goes ahead for three entire chapters, and it is the most extended section of the book.

- Any contracts of financial instruments offered to conclude bear high risks and may result in the full loss of the deposited funds.

- The book begins with an excellent historical overview of the Japanese trading techniques, which is where I obtained the information from when I made this article.

- It shows that success isn’t determined by luck, but instead depends on one’s ability to develop a solid trading plan and the right mental attitude.

- An easy read meant for lay readers interested in learning basic concepts of technical analysis without a great deal of effort.

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients’ best interests and represent their views without misleading, deceiving, or otherwise impairing the clients’ ability to make informed investment decisions. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy.

One Good Trade

This price action trading book is extremely well-organized and packed full of sound trading ideas. After explaining the dynamics of market structure, it zooms in on uncluttered charts and explains clear trading setups while highlighting the “art” of trading.

This is a very often overlooked but incredibly helpful trading strategy considered one of the secrets of the trading world. On a realistic level, technical analysts have employed this method along with other technical tools, and it would be best not to rely on it in isolation while making investment choices. One of the best informal works on trading with a rare appeal of its own. We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners.

The Logical Trader

You should, before you act or use any of this information, consider the appropriateness of this information having regard to your own personal objectives, financial situation and needs. You should obtain your own independent professional advice before making any decision based on this information. The content of this website has been prepared by StaceyBurkeTrading.com on the basis of information and sources believed to be reliable. Any reliance you place on such information is therefore strictly at your own risk. Money flow index– the amount of stock traded on days the price went up. A survey of modern studies by Park and Irwin showed that most found a positive result from technical analysis.

While Education is an exhaustive look at global finance, it may be more useful as a cautionary tale of hubris, success and downfall. Gaining the proper perspective on the forex is an important undertaking, regardless of experience level or analytical bent.

It can then be used by academia, as well as regulatory bodies, in developing proper research and standards for the field. The CMT Association has published a body of knowledge, which is the structure for the Chartered Market Technician exam. Technical analysts also widely use market indicators of many sorts, some of which are mathematical transformations of price, often including up and down volume, advance/decline data and other inputs. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Technicians also look for relationships between price/volume indices and market indicators.

This work is intended to help traders understand technical analysis better and become acquainted with the latest technological tools, which have grown to be part of the necessary knowhow for any trader. A part of the focus is on futures markets and the relevance of technical analysis while dealing with complex F&O instruments.

In a 2000 paper, Andrew Lo back-analyzed data from the U.S. from 1962 to 1996 and found that “several technical indicators do provide incremental information and may have some practical value”. Burton Malkiel dismissed the irregularities mentioned by Lo and McKinlay as being too small to profit from. However, many technical analysts reach outside pure technical analysis, combining other market forecast methods with their technical work.

Larry Williams is a world-renowned technical analyst who’s dedicated his professional career to sharing his knowledge of trading the markets. Don’t let the title throw you, this book’s lessons easily translate into the forex markets. If there is ever going to be an investment in a technical analysis book, then this is it. This book is huge and is essentially an extremely detailed glossary of all technical patterns and indicators. The author, John J. Murphy is a highly respected technical analyst who’s been a figurehead in the markets on the subject.

The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This information has been prepared by IG, a trading name of IG US LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you.

Among them are a brief history of the currency markets, basic trading mechanics, winning psychology, as well as more advanced strategic concepts. If you are a financial market or forex newbie, Getting Started In Currency Trading is a great place to begin. Getting Started In Currency Trading is a basic look at all things forex, circa 2005. Created by two 25-plus-year veterans of the financial markets, this book addresses the basic elements of currency trading. It was written with the forex beginner in mind, and it offers a comprehensive backdrop of the modern forex market. Before ever buying or selling a currency pair, it’s important to know the basics of the forex marketplace. The following two forex books are designed to give the reader a solid jumping off point into the global currency markets.

An extensive manual on the theory and application of technical analysis, this work is the official companion to Chartered Market Technician program. What brings added value to the work is the rare combination of academic and practical approaches to the study of technical analysis, which makes it an invaluable resource for both students as well as professional traders. First published in 1991, ‘Japanese Candlestick Charting Techniques’ by Steve Nison equips the reader with everything they need to analyse candlestick charts. For experienced traders, Nison details how to confirm candlestick readings using popular technical analysis tools, while those new to trading will learn how to use candlesticks in stand-alone analysis. The book includes more than 400 charts to bring technical analysis to life, and sections to help you put what you’ve learnt into practice, making this a ‘must read’ for traders of all levels. Rosenberg, then managing director of international fixed-income research at Merrill Lynch, wrote one of the definitive works on forex trading. It was first published in 1995, and ever since, analysts and traders have turned to his concise, intuitive, and brainy text.

The Art And Science Of Technical Analysis: Market Structure, Price Action, And Trading Strategies

The book offers a thorough explanation of the subject, including explanations of virtually all candlestick patterns that are used by traders today. This book is considered by many to be the “Bible” of technical analysis since it contains an exhaustive amount of information covering the core concepts. The book also covers ancillary topics like trading psychology and market mechanics that help traders understand “the why” rather than just “the how” of technical analysis. Despite the wide breadth of knowledge, the book is very approachable and easy to understand for novice traders. In this article, we will look at seven books on technical analysis to help traders and investors better understand the subject and employ the strategy in their own trading.

If you want to learn more about forex, you can open a demo account to practise trading with $10,000 in virtual funds. You’ll also gain access to a range of free online courses through IG Academy. Lowenstein’s book tells the story of that crisis and the events that followed, focusing on the four key characters at the heart of the story. While readers are unlikely to garner any specific trading tips, it provides fascinating insights into the history of the Fed. The book was revised and updated in 2016, ensuring the content is applicable to today’s markets.