Stan Weinstein’s Secrets For Profiting In Bull And Bear Markets

Table of Contents Heading

- Secrets For Profiting In Bull And Bear Markets

- Stan Weinstein’s Secrets For Profiting In Bull And Bear Markets (paperback)

- Reader Q&a

- Optimal Buy And Sell Areas

- Can Anyone Vouch For Stan Weinsteins secrets For Profiting In Bull And Bear Markets?

The method teaches how to view price, volume and trend data so that stock picks yield winners 60 to 80% of the time and with gains 2x to 10x! It also provides lessons on the how to cut losses and how to learn the discipline of selling for maximum profit. This is a book which can be reread over and over as one gains expertise at Technical Analysis. The methods learned provide logical procedures which eliminate the hype of the stock market and turns the hype into profits. Weinstein’s motto of the “Tape Tells All” is the foundation for success because it places stock action as the primary source of information over OPINION.

Bootstrapped by a small team with a big passion for books. Earn money by sharing your favorite books through our Affiliate program. If you like books and love to build cool products, we may be looking for you. Most of the concepts are better for use at the start of new bull markets.

Goodreads helps you keep track of books you want to read. The go-to guide for launching a lucrative career in trading – fully updated for today’s turbulent markets. One of today’s most successful traders, John F. Carter has made his popular guide more relevant and effective than ever. In The Battle for Investment Survival, the turf is Wall Street, the goal is to preserve your capital at all costs, and to win is to “make a killing without being killed”. This memorable classic, originally written in 1935, offers a fresh perspective on investing from times past.

If this were the first book I ever purchased I would not have needed to purchase another. This is the only investing book you will ever need, but you will need to subscribe to a decent charting service like tele-chart 2000 to get the full advantages of the book. The Triple Confirmation Patterns are a surge in trading volume, breakout past major resistance zones and RSI neutrality/crossovers. This book is decent for someone who is interested in understanding the financial market with little or no prior knowledge about technical trading. However, it is less useful for others and many of the things said are outdated but the psychology of trading and investing remains the same.

Secrets For Profiting In Bull And Bear Markets

Buy a call option only on a stock that is in Stage 2 or is moving into Stage 2. Buy a put option only a stock that is in Stage 4 or is moving into Stage 4. Track the number of new highs and new lows of common stock on a weekly basis. The near-term target price will be A – (B – A), i.e. height from A to B is projected downwards from A. If there is a prior peak very close to the breakdown level, use that as the initial buy-stop. Else, set the initial buy-stop 4-6% above the breakdown level. For InvestorsFirst buy-stop set above the top of the trading range , should not be too far (30-40% is no-no) away.

The sell-stop for the other half of your position remains at the sell-stop set at the previous support. When the next support is found, raise the sell-stop for the full position to just below the support found. When the next support level is determined, raise sell-stop to just below the support level. Choose those few stocks with the most potentially profitable formations within those favourable groups. Stocks that have steadily risen 40-50% before breaking out do the best, rather than stocks having wide swings in Stage 1. Meeting of the excited herd buyers vs. the aggressive sellers that bought at much lower prices. One problem with implementing exactly the system in the book is that a number of indicators may not be readily available on the mainstream websites or the data may not be tracked publicly.

Stan Weinstein’s Secrets For Profiting In Bull And Bear Markets (paperback)

As you will read later below, Sam Weinstein uses the following 5 basic tools to analyze the individual stock. It presents the key concepts for trading without cluttering the material with lots of nitty gritty patterns which typically just confuse readers. ‘Stan Weinstein has put his technical wisdom about markets into terms that every one can profit from ‘ – Peter Kangas, financial commentator. Easy-to-understand, concise and hands-on methods for technical market analysis. To anyone who wants to beat the market and improve their success rate by learning and using Technical Analysis this book is a gauranteed way to get started. Its written in simple terms, has excelent examples and offers advice based on time-proven methods. Compared to other similar tomes on this subject it uses no math or formulas but relies on actual charts of stocks.

The first quarter of the book is probably the most useful but there are many more out there that are more pertinent. There never has been and there never will be; what was before, is now, and will be again. Fear and Hope are the two driving factors behind the psychology of all traders and investors. Edwin Lefevre said it in The Reminisciences of A Stock Operator, and Weinstein says it in this book. Whether you’re beginner or advanced in stock market investing, you’re bound to learn something new from this book. This book is a series of interviews of trading legend Jesse Livermore conducted by financial writer Richard D. Wyckoff.

The rating is more of an indicator of the fact that it would be more beneficial to pick up the hard copy and read it. I am always looking for the next book on trading/investing, and I especially like seeing high ratings with ample reviews. That interview was in Nov of 2015 and he said this book was one of the best he had ever read on technical analysis. This book certainly opened my eyes to the world of technical analysis more than any other book I have read. I highly recommended it as it’s easy to read and has fantastic case examples.

Reader Q&a

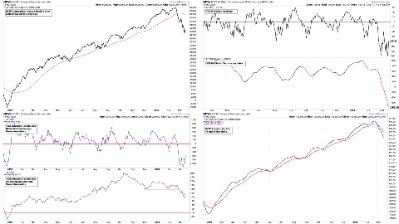

All of the books are extremely well written and have tons of investment nuggets of wisdom. Technical charts are a bit old and outdated compared to other technical analysis books since this is first published in 1988. Key concepts still apply but the charts are sometimes hard to read.

Breakdowns do not require volume to be significant, although a volume increase makes it even more significant. A significant trendline will be touched at least 3 times. The more times a support/resistance zone is tested, AND the longer the time period during which the testing takes place, the more important the signal when the zone is violated. AAII formulaAAII has a Relative Strength formula that gives a value of 0 when they are of equal strength, a positive value if the stock is stronger, and a negative value if the stock is weaker.

I read on another stock forum one time years ago that you can post a simple filter with a simple strategy . Use a very tight protective stop that is tighter than for stocks.

Optimal Buy And Sell Areas

This is probably the best longer term trading method I have seen. It is so basic you may already know most of it , but this book puts chart reading into a simple, practical method that can be mastered. One of the problems I had with CANSLIM was when to sell. Reading this book will give what I consider a good answer on when to take profits. And, like the book says, go short.I wouldn’t say Weinstein’s methods are “secrets,” they are just 100% common sense, and very effective. CANSLIM investors may find this a very useful book on expanding charting knowledge.

If volume is not significant on breakout, sell the stock on the first rally, or sell when it breaks below the breakout level. Thomas Bulkowski did some very interesting research on relative strength.

Can Anyone Vouch For Stan Weinsteins secrets For Profiting In Bull And Bear Markets?

For options, you need to swing only at the best pitches. To move from Stage 1 to Stage 2, the price should go down with a spike in volume to show final panic dumping, followed by a shrinking of volume to show lessening selling pressure. Use a buy-stop good-’til-cancelled order if trading on a liquid exchange / stock. to just below the trendline during the period before the next support level has been determined (hence the sell-stop can change day-to-day following the trendline). Nonetheless, the ideas in the book remain valuable and the book is definitely recommended reading for the trader starting out. For example, the Mansfield 30-week MA uses a proprietary formula , the Momentum Index defined here is not plotted in any chart service, etc.

Stan explains things from the base, and in a very interactive way. The book also has quizzes at the end of each chapter which help us rate ourselves. Round numbers – psychology plays a very big part in market moves, and this is another example of herd instinct.” Trying to guess the bottom in a weak stock is like fishing in the ocean with your fingers. Fear causes you to panic and sell at the bottom, while greed motivates you to buy right near the top. “Don’t fret missing an advancing stock – it is similar to hailing a taxi; if you miss the first one, another one will soon come along.

The optimal buy area is obviously on the left side of the stage where the price breaks out of the 30-MA line (Investor’s way). The optimal sell point is the area where the price breaks out of the support trendline. The longer the duration the price spends on the trading range, the more significant the breakout of the channel will be. In a previous blog post on Price Trends, we discussed the 4 Price Action Stages that happens for most of the stocks. The cycles or stages mentioned in the blog is heavily inspired and made popular by Stan Weinstein. ‘Stan Weinstein has put his technical wisdom about markets into terms that every one can profit from ‘ – Peter Kangas, financial commentator. Here are the same techniques that have made Weinstein’s own highly successful market forecasts.

While it is quite simple the messages are vitally important and I still find myself periodically referring to it. I have it in front of me now and it reminded me that I should write a review. I can’t believe that I’d started trading without this book. First published in 1988, analysis in this book is still valid in 2020. What differentiates the highly successful market practitioners – the Market Wizards – from ordinary traders? What lessons can the average trader learn from those who achieved superior returns for decades while still maintaining strict risk control?

Trading For A Living

This is an excellent book that really helped me refine and tighten up my technical analysis. Though some parts of the outbook are outdated, his advice and concepts still hold up well. Good book that’s almost completely related to explaining the four cycles of a stock trend. As I write this review we are in the midst of the Corona Virus stock market meltdown. As the first book in my journey to the market, I’m pretty happy. It is simple, concise, well-written and just as applicable today as it was 25 years ago.

- When the next resistance level is determined, lower the buy-stop to just below the MA point that was above the new resistance level.

- For stocks, you can be right must less than 50% of the time and still make money.

- Every time he deviated from his core strategy of price action he incurred big losses and he went broke multiple times.

- A significant trendline will be touched at least 3 times.

- the round number, because people like to put sell orders at round numbers.

- When the next resistance level is determined, lower buy-stop to just above the resistance level.

He reveals the exact methods and insights that Jessie Livermore used to make millions in the stock market. From best-selling author, investment expert, and Wall Street theoretician Jack Schwager comes a behind-the-scenes look at the world of hedge funds, from 15 traders who’ve consistently beaten the markets. Stan actually had a fundamental background when he first got into the markets but says in the book once he discovered that wasn’t working well shifted to the technical approach. This same theme I’ve seen with other famous traders like Nicholas Darvas and Jesse Livermore.

Book Overview

Ignore oversold rallies of less than 7% when determining resistance. When the MA stops declining and flattens out (i.e. Stage 1 base is forming), lower the buy-stop to just above the most recent resistance level. When the next resistance level is determined, lower the buy-stop to just below the MA point that was above the new resistance level. If the resistance level is above the MA, set the buy-stop just above that resistance level. the round number, because people like to put sell orders at round numbers. This works for halves as well, especially for prices under $20 (e.g. $16.50).

You can find the general results here, including results for industry relative strength here. His research basically supports buying stocks with rising relative strength, and industries with high relative strength. They lead both on the upside in a bull market, and on the downside in a bear market, so they are prime candidates for both the bull and bear positions. Very wise words, some of them very helpful and a lot of them food for thought. However, being written in the 1990s, a lot of the information was woefully out of date and completely irrelevant. If you have read lots of investing books and want something else to read, it might be worth your time .

When the next resistance level is determined, lower buy-stop to just above the resistance level. This is the first book I’ve read that explained technical analysis and likely the best one I’ve read – and I have read a ton of them. Weinstein knows how to not get caught up in the minutiae and provides a straight-forward way to invest and still have a life. I cannot guess how many times I’ve come back to read this book or parts therein since my first reading of it in the mid-1990’s. I have the hard copy, but wanted to get through it since I can never seem to make the time to read it. The only reason for the 4 star rating is the fact that there are a lot of visuals (charts, etc.) that supplement the reading and that the author refers to that help develop understanding.