The Livermore Formula For Combining Time Element And Price

Table of Contents Heading

- Jesse Livermore’s Stock Market Games And Tricks For Maximal Stock Market Profits: Www Chegg.com

- Jesse Livermore: Newspaper Cuttings

- Wall Street Success

- Subscribe Now And Take My Free Trend Following Ecourse

- Trend Following Podcast

- Market Forecasting And Technical Analysis

Livermore noticed that emotions were high and seemed to guide investor’s decisions not only in that office, but surely around the country. He observed that human emotions collectively had major impacts on the on stock prices and the patterns seen in the Stock Markets, in general. He watched the fluctuations occur as news events were reported in the office. The second and possibly most important observation that Livermore had was the reaction of the people themselves.

- Early on, Jesse Livermore learned that in order to succeed in life, one needs to put in a great deal of time and effort to an endeavor that one enjoys doing.

- All data on this site is direct from the CFTC, SEC, Yahoo Finance, Google and disclosure documents by managers mentioned herein.

- Widely regarded as a leading stock market theorist, Dr. Flumiani has infused the study of stock market motions and their anticipation with new challenging dimensions rich with significant historical psychological and philosophical ramifications.

- We want a buffer between actual breakout and entry that allows us to get into the move early but will result in fewer false breakouts.

- From 24/7 financial television to 3-second guaranteed executions on Internet trades to after-hours trading, our modern market environment is cunningly designed to nurture a culture of continuous frantic trading.

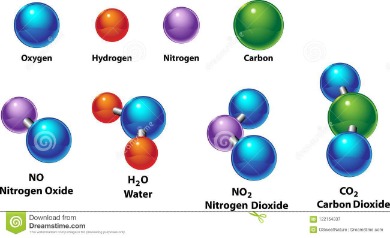

- A “scientific study” of the technical and fundamental factors affecting stock prices.

Accordingly, he predicted that there would be a sharp drop in prices when many speculators were simultaneously forced to sell by margin calls and a lack of credit. With the lack of capital, there would be no buyers in sight to absorb the sold stock, further driving down prices. After the crash and its aftermath, he was worth $3 million. Written around 1920 and published in1923 when Livermore was in his early 40’s Reminiscences of a Stock Operator is one of the three most important trading books ever written according to Dan Zanger. However, there is a much rarer book that offers even more detailed insights into how Livermore traded.

It is too much bother to have to count the money that he picks up from the ground. We love volatility and days like the one in which the stock market took a big plunge, for being on the right side of moving markets is what makes us money. A stagnant market in any commodity, such as grain has experienced recently, means there’s no opportunity for us to make money. While his tape-reading skills were still important, they were not as important as studying the fundamentals of each company and the credit conditions of the stock market and the economy. His first successful “raid” on the stock market based on his sound, fundamental studies occurred during the Panic of 1907. As credit conditions tightened and as a number of businesses and Wall Street brokerages went bankrupt during the summer, Livermore could sense that something was wrong – despite the hopes of the public as evident in the still-rising stock market. Sooner or later, Livermore concluded, there will be a huge break of epic proportions.

Jesse Livermore’s Stock Market Games And Tricks For Maximal Stock Market Profits: Www Chegg.com

Please note that I am not going to list them in any particular order. Each trader/speculator has to deal with their own trading flaws – some lessons may be more applicable than others to one trader but the same lessons may not apply to another type of trader – especially so if he has conquered them. Early on, Jesse Livermore learned that in order to succeed in life, one needs to put in a great deal of time and effort to an endeavor that one enjoys doing. Of course, it didn’t hurt that Livermore also had a great genius with crunching numbers and a great discipline for keeping records.

He also shared what he learned, with his Sons, Jesse Jr. and Paul Livermore. Both of his sons were interviewed closely by author Richard Smitten, who published a Book about the Life of Jesse called, The World’s Greatest Stock Trader that also has some of the writings of the Trading Legend included in the book. In 1940 Livermore Published, a Book Sharing his Trading & Market Genius a lot of key trading wisdom can be found in this Investing Classic, seen as Livermore’s blueprint for trading the Stock Market. This Trading Master made his share of mistakes, during his early days of Trading Stocks. He carefully examined all his trades at the end of each year, learning from his successful and unsuccessful trades. Secretive and he left plenty of his Market Insights and Stock Trading Advice based on personal experiences and acquired knowledge.

Jesse Livermore: Newspaper Cuttings

Jesse Livermore traded heavily in the early decades of the 1900s, an amazing era to speculate in stocks. His lofty speculation wisdom will stand tall for ages to come.

Did investors just say they liked a stock or were they actually buying it – this is what Livermore wanted to know? His records “spoke to him” as he put it, allowing him to profit immensely. Being right because of your work and trading execution, is a very rewarding feeling. The ability to repeat it with a high probability of success was even more rewarding. Livermore was on his way to beginning a life, where he could pursue his love of numbers, reading, and continue his learning. He would not return home, until years later after making millions in the Stock Markets. His father could not believe how much money his son had.

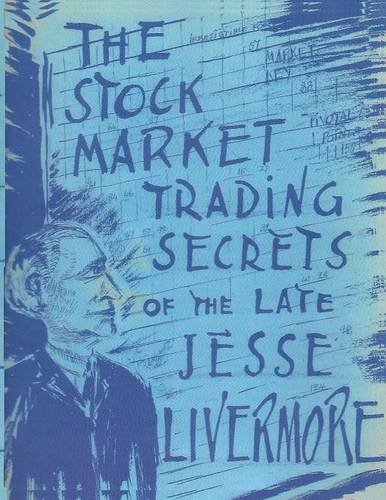

One of 500 special copies printed on all rag paper. Pages contain sixteen charts printed in red, blue, and black. Title with the Livermore crest, showing the ticker tape, market key, and chart sheets, printed in red, blue, and black. Goodreads helps you keep track of books you want to read.

In 1929, he noticed market conditions similar to that of the 1907 market. He began shorting various stocks and adding to his positions, and they kept declining in price. When just about everyone in the markets lost money in the Wall Street crash of 1929, Livermore was worth $100 million after his short-selling profits. By the age of fifteen, he had earned profits of over $1,000 (which equates to about $23,000 today). In the next several years, he continued betting at the bucket shops. He was eventually banned from most bucket shops for winning too much money from them.

Every once in a while you must go to cash, take a break, take a vacation. The average man doesn’t wish to be told that it is a bull or a bear market. There are times when you should be completely out of the market, for emotional as well as economic reasons. Wall Street never changes, the pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes. Greed, Fear, Impatience, Ignorance, and Hope will all fight for mental dominance over the speculator.

As the normal reaction ends, volume increases once again in the direction of the trend. It isn’t as important to buy as cheap as possible as it is to buy at the right time.

Wall Street Success

In the tape, there are three columns, execution price, number of shares sold a time the execution was made . The green means the price was higher or the same as the last execution price, whereas the red means the execution price was lower than the previous one. When institutional buying occurs, big orders can be seen coming across the Tape and likewise when they are selling. Livermore began keeping a notebook and always carried it with him. It was filled with stock quotes that he had seen or written earlier in the day.

Written just before his death in 1940; this book is more contemplative and revealing. The following passage succinctly sums up Jesse Livermore’s trading approach. The Herrick Payoff Index tracks price, volume, and open interest to identify potential trends and reversals in futures and options contracts. Wait for the market to confirm the opinion before entering.

Subscribe Now And Take My Free Trend Following Ecourse

Kerr writes, “Stock speculation is a science as truly as is economics itself,” responding with consistent rules of probability to certain recurring causes. The methods outlined in this book are precise, but complicated. Kerr assigns each of many probable events a value; when particular combinations of these events occur, he maintains, there is a high probability that a corresponding effect is sure to follow. Matt Blackman is a technical trader, author, reviewer, keynote speaker and regular contributor to a number of trading publications and investment/trading websites in North America and Europe. Dan Zanger focuses the majority of his attention on market leading stocks, much like Jesse Livermore did, as summarized on page 33 of How To Trade In Stocks.

Printer’s error in pagination, typically skipping, transposing or repeating page numbers. Not uncommon in older, larger books, it is not considered a defect, so long as all integral leaves are present. Typically early printed books and especially manuscripts. Leaf preceding the title page that bears the book’s title, originally used to identify the unbound text block.

Trend Following Podcast

He watched how those price movements moved in conjunction with other stocks or another company in the same industry. Speculation was Mr. Livermore’s game from his first teenage gamble in the dubious bucket shops of Boston in the early 1890’s. His precocious success there caused traders to label him the ”Boy Plunger,” a nickname that stuck long after his sleek blond hair was frosted with gray. First edition, first printing, hardbound with dust jacket.

Livermore did not get upset or emotional, but after this incident, he swore that he will never listen to insider information again and that he will only trust his tape-watching skills and instincts from now on. Livermore had a significant execution disadvantage by taking his actual business to the NYSE. Not only does he have go pay a high commission , there was also a significant delay between the time he places his order to when the order was actually executed. This disadvantage is severely magnified when one traded as often as Livermore did in his early days as a trader on the NYSE. Livermore was handed down the ultimate lesson in the art of execution during the final day of the Northern Pacific Corner on May 9, 1901. Livermore had anticipated a huge downside move in the morning and a subsequent one-day upside reversal.

This disappointed the young Jesse Livermore, who found a deep interest in numbers, math, writing, reading, and other subjects school had opened his eyes too. Robert Rhea began studying The Wall Street Journal founder, Charles Dow’s, theories of investment when he was “confined to a bed for a great number of years.” He later emerged as one of the most prominent proponents of Dow Theory.

His Book

In his lifetime of trading, he learned what moved people; it was Emotions! Feelings like fear and greed that could be amplified when felt by many could cause major bull or bear markets. He was able to master the movement of stock and commodity prices and with this unique and gifted ability; he made millions in the Stock Market. At the height of his Trading Career, Jesse Livermore was a Billionaire when measured in today’s dollars.

He ran away from home with his mother’s blessing to escape a life of farming that his father wished him to have. Born in Shrewsbury, Massachusetts, on July 26, 1877 Jesse Livermore started his trading career at the age of fourteen, when his father demanded he work on the small family farm rather than continue going to school.

Let price confirm the trade before entering large positions. The second lesson that was handed down to Livermore did not strictly involve insider information, although it was pretty darn close to it. It also taught Livermore a little about himself – his gullibility and his succumbing to another man’s sale skills even though he practically knew all the facts of a product . This happened soon after the Panic of when Livermore was trading successfully at a peak level and soon after he made a small fortune by nearly cornering the cotton market. Some weeks before, a man named Percy Thomas (who was also know as the “Cotton King”) had gone bankrupt in trying to corner the Cotton market, and hearing Livermore’s exploits, Thomas would seek him out and ask Livermore to be his partner. Livermore refused to be Thomas’ partner since he had always played a lone hand. However, Thomas was a man of knowledge (particularly in the cotton market, of course – where he supposedly had “spies” that would report crop conditions and the like to him as soon as they could) and a great charmer, and Livermore was soon put under his spell.

Market Forecasting And Technical Analysis

Other trademarks and service marks appearing on the Trend Following network of sites may be owned by Trend Following or by other parties including third parties not affiliated with Trend Following. Small town guy starts at a 1970s gas station and becomes a trading legend worth $100 million. To see what your friends thought of this book,please sign up.