Forex Trading For Dummies

Table of Contents Heading

- How Can You Trade Forex?

- Like Us On Facebook!

- Book Preview

- Find The Book To Satisfy Your Book Cravings

- What Is A Pip In Forex Trading?

- Trading Forex For Beginners 2020

An even better motivation personally is the fact that some of the biggest shorted trades in history have been those of currencies. Obviously, the one that immediately comes to mind is the iconic shorting of British Pound by the legendary investor Soros netting almost three billion pound. Cornwall Capital of The Big Short fame also profited immensely with shorting Australian Dollar before it killed it with the subprime mortgage CDOs. The point being that despite the fact that volatility in the forex market is barely observable, some of the most lucrative trades of Wall Street hedge funds have been that of forex. Thirdly, the forex market is barely moved by global economic downturns. Even during the Great Recession of 2008, forex barely moved. This makes it an amazing hedging tool for your investments.

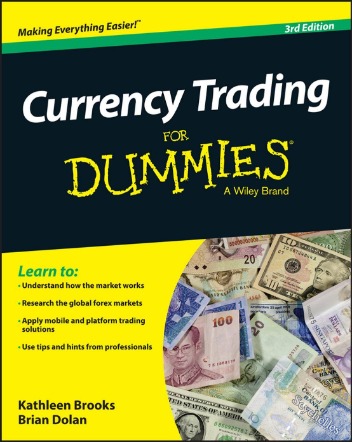

This book is jam packed with information on a complex subject but delivered in an accessible style. Highly recommended read before any aspiring currency trader places their first trade in the markets. An illiquid, or thin, market will tend to see prices move more rapidly on relatively lower trading volumes.

How Can You Trade Forex?

One or the other choices include up or down, or touch and no/touch. We’re having technical issues, but we’ll be back in a flash. If you’re buying at multiple price levels, you’re adding to longs and getting longer. Currency Trading For Dummies, Getting Started Edition The answer is another currency. In relative terms, if the dollar goes up against another currency, that other currency also has gone down against the dollar. To think of it in stockmarket terms, when you buy a stock, you’re selling cash, and when you sell a stock, you’re buying cash. Getting liquid without getting soaked Liquidity refers to the level of market interest — the level of buying and selling volume — available at any given moment for a particular asset or security.

- His long hours of research paid off and he was able to discover a method of making money that would change his life.

- About the only holiday in common around the world is New Year’s Day, and even that depends on what day of the week it falls on.

- If 117.50 is hit first, then your position is stopped out at a loss.

- So, if EUR/JPY moves from ¥172.119 to ¥172.129, it has moved a single pip.

It provides a glossary of forex markets, strategies, psychology, trading pairs, and even tips on how to choose the right broker to best suit your personal needs. Author Courtney Smith explains how markets work in easy to understand terminology, and provides six unique strategies to generate regular income from trading forex markets. The book contains a detailed breakdown of each of the major currencies along with tons of tips and tricks on how to trade fx markets. In addition, there’s information on what factors drive the various economies these currencies power. It’s perfect for beginners or those looking for an in-depth refresher. However, to be a long term winner you have to develop a method and strategy that works for you. You have to consistently profit by winning more trades than you lose.

News and data reports from New Zealand, Australia, and Japan are going to be hitting the market during this session. New Zealand and Australian data reports are typically released in the early morning local time, which corresponds to early evening hours in North America. Some Japanese data reports and events also take place in the Tokyo afternoon, which equates to roughly midnight to 4 a.m. Currency trading volumes in the Asia-Pacific session account for about 21 percent of total daily global volume, according to the 2004 BIS survey. The principal financial trading centers are Wellington, New Zealand; Sydney, Australia; Tokyo, Japan; Hong Kong, and Singapore.

Like Us On Facebook!

Holding positions for that long necessarily involves being exposed to significant short-term volatility that can quickly overwhelm margin trading accounts. With proper risk management, individual margin traders can seek to capture longer-term trends. The key is to hold a small enough position relative to your margin balance that you can withstand volatility of as much as 5 percent or more. Currency Trading For Dummies, Getting Started Edition European time zones — about 2 a.m. Trading in other sessions can leave you with far fewer and less predictable short-term price movements to take advantage of. If you’re aiming to capture second-by-second or minute-by-minute price movements, you’ll need to fully concentrate on one pair at a time.

Look at the spread as the compensation the broker receives for being the market-maker and executing your trade. Spreads vary from broker to broker and by currency pairs at each broker as well. Generally, the more liquid the currency pair, the narrower the spread; the less liquid the currency pair, the wider the spread.

Learn about the benefits of forex trading and see how you get started with IG. You can see sentiment from IG clients – as well as live prices and fundamentals – on our market data pages for each market. Unless there is a parallel increase in supply for the currency, the disparity between supply and demand will cause its price to increase. Similarly, a piece of negative news can cause investment to decrease and lower a currency’s price. As a result, currencies tend to reflect the reported economic health of the country or region that they represent. Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. So, if a positive piece of news hits the markets about a certain region, it will encourage investment and increase demand for that region’s currency.

Book Preview

Trading in the currencies of smaller, less-developed economies, such as Thailand or Chile, is often referred to as emerging market or exotic currency trading. Although trading in emerging markets has grown significantly in recent years, in terms of volume it remains some way behind the developed currencies. Due to some internal factors , and some external factors , the emerging-market forex space can be illiquid, which can be a turnoff for a small investor. Spot refers to the price where you can buy or sell currencies now, as in on the spot. If you’re familiar with stock trading, the price you can trade at is essentially a spot price. The term is primarily meant to differentiate spot, or cash, trading from futures trading, or trading for some future delivery date. The spot currency market is normally traded for settlement in two business days.

That is why there are several Forex trading for beginners and dummies course available that can help the newcomers in getting all the basic details before starting trading in the Forex. It is true and also suggested by the experts that before starting investing in the Forex market it is important for the individual to have a lot of practice and patience. The main reason behind this is that Forex is the largest and the huge liquid market having a daily turnover of around 4 trillion dollars. Even if a risky attempt got taken by someone then also the market can easily resist it. This legislation includes limits on available leverage, volatility protection, negative balance protection and more. Traders can also make short trades , where they sell a Forex CFD at the ask price and, once the price drops, buy it at a lower bid price, and profit on the difference.

The authors also include a basic primer on technical analysis as it pertains to currency trading. However, what may be most benificial is the discussions on developing and executing a trading plan. It’s important to understand that, although the forex market offers exceptionally high liquidity on an overall basis, liquidity levels vary throughout the trading day and across various currency pairs. For individual traders, though, variations in liquidity are more of a strategic consideration rather than a tactical issue. For individuals, who generally trade in smaller sizes, the amounts are not an issue, but the strategic levels of liquidity are an important factor in the timing of when and how prices are likely to move. While commercial and financial transactions in the currency markets represent huge nominal sums, they still pale in comparison to amounts based on speculation. By far the vast majority of currency trading volume is based on speculation — traders buying and selling for short-term gains based on minute-to-minute, hour-to-hour, and day-to-day price fluctuations.

Find The Book To Satisfy Your Book Cravings

This is the point when the actual price of the underlying asset is determined and you find out if you finish the trade ‘in the money’ with a win, or ‘out of the money’ with a loss. Your return is clearly stated before hitting the ‘apply’ button.

A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate. Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

What Is A Pip In Forex Trading?

The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated. As an active trader of options, futures, stocks, and crypto, I have been meaning to foray into forex trading for a while now. Besides, most of us have been unintentionally following the growth or decline of at least two currencies, some even more, and noticed how they could be a viable investment vehicle. For example, INR was at 40 units per dollar ten years ago, and now stands around 75. That’s a bit shy of 100% returns in ten years, almost as much as real estate. And if you track the currencies of weaker economies, you see the returns of even better.

It also teaches you the process on how to become an affiliate marketer and how to make your business a success. News and data events from the Eurozone , Switzerland, and the United Kingdom are typically released in the early-morning hours of the European session. As a result, some of the biggest moves and most active trading takes place in the European currencies and the euro cross-currency pairs (EUR/CHF and EUR/GBP).

Trading Forex For Beginners 2020

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were largemultinational corporations,hedge fundsor high-net-worth individuals because forex trading required a lot of capital. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance. This book, written by one of the most well-known currency market analysts teaches aspiring forex traders the ins and outs of the forex market. The author has appeared on CNBC, and Bloomberg to offer her insight and market analysis, and now it is available to forex traders who can learn from the best. Currency Trading For Dummies, Getting Started Edition price movements. The longer you hold a position, the more risk you’re exposed to.

With that noted, extreme movements in gold prices tend to attract currency traders’ attention and usually influence the dollar in a mostly inverse fashion. This is an excellent first book for those interested in currency trading. This was my first foray into the subject and the authors do a great job with explaining the fundamentals of the forex market and trading currencies. What I particularly found helpful was the explanation of the major currency pairs and the particular intricacies of trading each.

The rest of the time they’re bouncing around in ranges, consolidating, and trading sideways. Although medium-term traders are normally looking to capture larger relative price movements — say, 50 to 100 pips or more — they’re also quick to take smaller profits on the basis of short-term price behavior. They’re not going to hold on to the position looking for the exact price target to be hit. Gold Gold is commonly viewed as a hedge against inflation, an alternative to the U.S. dollar, and as a store of value in times of economic or political uncertainty. Over the long term, the relationship is mostly inverse, with a weaker USD generally accompanying a higher gold price, and a stronger USD coming with a lower gold price.

Book Actions

A spot exchange rate is the rate of a foreign-exchange contract for immediate delivery. A currency pair is the quotation of one currency against another. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The blender costs $100 to manufacture, and the U.S. firm plans to sell it for €150—which is competitive with other blenders that were made in Europe.