Learn To Trade Forex Pdf

Table of Contents Heading

- A Comprehensive Guide To Profiting From The Global Currency Markets

- Learn About The Currencies You Trade

- How Does Forex Trading Work?

- What Does Forex Mean?

- Popular Currency Pairs

- Explore, Learn, Grow

- The Best Forex Trading Strategies That Work

A swing trader is looking to enter trades on the 4 hour or daily charts and then hold those trades for hours or days. When scalping you are generally holding your trades for minutes at a time, depending on how small the time frame. Whilst this book will not teach you how to trade the markets, it sure is a great book that has been read by millions of traders. Where swing traders are holding for longer periods of time and for the next swing higher or lower, scalp traders are jumping in and out of trades quickly. The two trading strategies discussed below are swing trading and scalping.

For example, if your account is worth $30,000, you should risk up to $300 on a single trade if the risk limit is set at 1%. Depending on your risk sentiment, you can move this limit to 0.5% or 2%. Varying time periods (long, medium, and short-term) correspond to different trading strategies. Before we proceed to discussing the most popular Forex trading strategies, it’s important that we understand the best methods of choosing a trading strategy. There are three main elements that should be taken into consideration in this process. Harness the market intelligence you need to build your trading strategies.

A Comprehensive Guide To Profiting From The Global Currency Markets

I studied a bit of market theory in college and learned about channel trading. I always thought that would be a good fit for algo trading since the strategy is recursive.

- Trade up today – join thousands of traders who choose a mobile-first broker.

- As a result, scalpers work to generate larger profits by generating a large number of smaller gains.

- Write them via their email above and you will surely give testimonies as well get good service from them.

This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. They watch various economic calendars and trade voraciously on every release of data, viewing the hours-a-day, five-days-a-week foreign exchange market as a convenient way to trade all day long.

Learn About The Currencies You Trade

Think of drawing key support and resistance levels as building the foundation for your house. It’s impossible to identify favorable swing trades without them.

Learn as much as you can about the ins and outs of FX trading so, you’ll always be prepared to safely navigate the Forex market. As a novice Forex trader, you have a wide variety of Forex trading strategies so you can take advantage of the currency price fluctuations. Since the market conditions are constantly changing, make sure you get familiarized with different types of Forex trading strategies. This Forex Trading for Beginner’s Guide will give you all the information you need so you can start trading Forex. You’ll learn what forex trading is, how to trade forex, how to make your first trade, plus our best forex trading strategies. By the end of this guide, you’ll be equipped with the right knowledge to tackle the world’s largest capital market. As a bonus, we’re also going to reveal the best forex trading platforms.

The decision making of the wonderful brain is not independent of time. That’s why we put most of the efforts of brain in developing and back testing strategies that normally we would use our brain for. No doubt there will be situations where manual approach might prove to be better than a machine decision. But its as likely as emotions making an impact on the decision making. With machines, the problem of emotions, and feelings do not hinder in making a rational decision.

How Does Forex Trading Work?

While it can take some time to get your head around heading in the forex markets, the overarching concept is that it presents both outcomes. That is to say, irrespective of which way the markets move, you will remain at the break-even point . In order for you to lower your risk of exposure and offset your balance, you might consider hedging. This is a procedure which involves traders selling and buying financial instruments.

Each currency in the pair is listed as a three-letter code, which tends to be formed of two letters that stand for the region, and one standing for the currency itself. For example, USD stands for the US dollar and JPY for the Japanese yen. In the USD/JPY pair, you are buying the US dollar by selling the Japanese yen. any of their charts and will see that this pattern repeats time and time again on all time frames.

What Does Forex Mean?

MetaTrader 4 is — without a doubt — one of the most complete and useful forex trading tools available, and it can be obtained online as a free download from its developer’s website. One of the most important elements that spread sensitive traders tend to examine before selecting a forex broker is their typical dealing spreads. Some of the most useful and popular tools for traders are fundamental analysis tools that can be accessed by anyone online, such as economic news calendars. Trading in the foreign exchange market can be quite challenging for both novice and seasoned traders. This is why all forex traders with any level of success will augment their decision-making skills by using a number of FX trading tools. These tools can help traders facilitate and determine profitable entry and exit points. There are many brokers and for new trader it may be hard to choose the best one.

Leverage facilities are also on offer – fully in-line with ESMA limits. eToro is an online stock, CFD, and forex broker that appeals to newbie investors. While spreads a slightly higher on minor and exotic pairs. The risk here is that if a country’s interest rate falls, the currency of that country will probably be weaker. This generally leads to investors withdrawing investments, and as a result, your return will be lower. A good indication that the latest price is higher than the older price is when the long-term moving average is below the short-term moving average.

During the course you will not only learn about CFD trading but also check your knowledge with tests at the end of each module. Benzinga provides the essential research to determine the best trading software for you in 2021. There are no slides, no screenshots, no fluffs but real strategies and actual scenarios that work in the live market. Raghee Horner loves trading the $5 TRILLION Forex market because there’s always a bull market somewhere. Over 3 decades ago Raghee cracked the code for finding the strongest trends.

Popular Currency Pairs

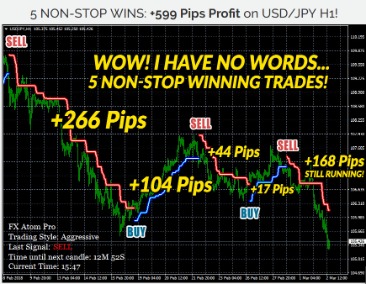

However, profit targets in these trades are likely to be at least a couple of hundreds pips per each trade. Take profit is also 5 pips as we focus on achieving a large number of successful trades with smaller profits.

During active markets, there may be numerous ticks per second. During slow markets, there can be minutes without a tick.

Money management strategy based on stop loss and take profit ratio. Even if you lose 20 times and then win once you will still make money. This strategy will show you how to make money not thinking about where the market will go. You have shared a informative information about forex algorithm.

This could be considered a buy signal due to an upward trend in the market. Supported payment methods typically include a debit/credit card or bank account. Some brokers even support e-wallets like Paypal and Skrill. Now you need to select your payment method of choice (usually from a drop-down list). Bear in mind that how long this takes to go into your trading account will largely depend on the payment method – so always check this before parting with your cash. Known as KYC in the industry , this simply means that the forex broker is going to need you to prove who you are. Some brokers will verify this using scanned copies of documentation.

As long as your trade is active, your FX broker will lock up the required margin and only free it back to you once the position is closed. This enables traders to execute much larger trades than they could otherwise afford. If you don’t want to wait for a particular exchange rate to be reached to open your first trade you can instruct your trading platform to open the trade at the current price level. Forex traders trade with one another through a structured group of dealers and computer networks that act as market makers for their own customers.

The Best Forex Trading Strategies That Work

Trading may not be suitable for you and you must therefore ensure you understand the risks and seek independent advice. We’re going to show you how Forex traders go about developing strategies.